Situational analysis: What it is, frameworks, and how to do one

- What is a situational analysis?

- Why situational analysis matters for strategic planning

- Situational analysis key benefits

- Situational analysis frameworks

- Situational analysis: Step-by-step process

- Practical examples and templates

- Common mistakes to avoid

- Perform a situational analysis with Ramp

A situational analysis is a structured way to understand where your business stands by evaluating internal performance and external market forces before you commit to a strategy.

It matters because strategic planning gets expensive fast when it’s built on assumptions. Taking time to assess what’s working, what’s not, and what’s changing around you helps you make decisions with less guesswork and fewer surprises.

What is a situational analysis?

A situational analysis is a comprehensive evaluation of the internal and external factors that affect your organization, used to understand your current position and inform strategic decisions. Internally, it looks at things like financial performance, resources, capabilities, and constraints. Externally, it examines market conditions, competitors, customers, and broader forces that shape demand and risk.

The goal isn’t just to collect information. It’s to translate what’s true today into implications for growth, risk, positioning, pricing, hiring, and resource allocation so you can plan financially with more confidence.

Situational analysis vs. SWOT analysis

A SWOT analysis is one tool within a situational analysis, not a replacement for it. While SWOT helps summarize strengths, weaknesses, opportunities, and threats, a situational analysis takes a broader view of your current environment.

Situational analysis typically combines multiple frameworks to understand internal performance and external forces in more detail. SWOT is often used to synthesize findings, but other tools are needed to surface root causes, competitive dynamics, and structural risks.

Here’s how the two compare:

| Aspect | Situational analysis | SWOT analysis |

|---|---|---|

| Scope | Internal and external factors across multiple frameworks | Internal strengths and weaknesses, external opportunities and threats |

| Purpose | Understand current position to inform strategic decisions | Summarize key findings for prioritization and alignment |

| Level of detail | High, with supporting data and analysis | High-level, summary-oriented |

| Typical use | Strategic planning, market entry, major decisions | Leadership alignment, quick assessments |

Why situational analysis matters for strategic planning

Situational analysis improves decision-making by forcing you to test strategic assumptions against reality. When you document what’s true about your business and market today, you can see the gap between where you are and where you want to go, then plan the most realistic path forward.

It also helps you manage risk more deliberately. By examining internal constraints and external forces together, you can identify issues that could derail execution before they become expensive problems, which supports stronger risk mitigation.

Just as important, situational analysis clarifies tradeoffs. Strategy isn’t only about choosing what to pursue, it’s about deciding what not to do. A structured review helps you avoid spreading resources across initiatives that don’t fit your capacity, timing, or competitive position.

A 2025 report from Public Administration Review found that formal strategic planning, which typically includes evaluating internal and external factors before setting goals, has a positive, moderate, and statistically significant impact on organizational performance across industries and contexts.

Situational analysis key benefits

Situational analysis isn’t busywork. It’s how you build confidence in your strategy, reduce avoidable risk, and make sure your plans match what your team and budget can realistically support.

Key benefits include:

- Sharper market understanding and positioning

- More disciplined resource allocation

- Earlier risk identification and mitigation

- Clearer sources of competitive advantage

Improved market understanding

Situational analysis forces you to define your market with precision. That sharper definition affects your competitor set, pricing anchors, channel mix, messaging, and product roadmap.

It also helps you catch early signals that are easy to miss day to day. Macro shifts like interest rate changes, new regulations, or changes in buyer behavior can quickly alter demand and sales cycles. If those forces aren’t part of your planning process, your strategy may assume a market environment that no longer exists.

Better resource allocation

Strategic plans often fail at execution, not intent. Situational analysis ties goals to real constraints, including headcount, cash runway, tooling, and operational maturity, so priorities are grounded in what your organization can actually deliver.

It also helps surface where resources are leaking. For many companies, spend is fragmented across vendors, subscriptions, and ad hoc purchases, making it difficult to fund the initiatives that matter most without clearer visibility into costs and tradeoffs.

Risk identification and mitigation

A strong situational analysis goes beyond listing risks. It clarifies which risks are most likely, which would have the biggest impact, and which warning signs to monitor.

Common areas to pressure-test include operational dependencies, vendor and partner concentration, regulatory exposure, and potential competitive responses. Addressing these risks early supports stronger risk mitigation and lowers the cost of corrective action.

Competitive advantage identification

Situational analysis helps you answer a hard question honestly: why your business is positioned to win.

Sometimes the advantage is product differentiation. Other times it’s distribution, switching costs, operational efficiency, or pricing power. A structured review makes those advantages explicit and measurable, so you can invest in strengthening them rather than relying on assumptions.

Situational analysis frameworks

Situational analysis usually relies on a small set of proven frameworks because each one highlights a different dimension of your business environment. The goal isn’t to use every framework available, but to choose the combination that best fits the decision you’re trying to make.

SWOT analysis

SWOT analysis organizes findings into four categories: strengths, weaknesses, opportunities, and threats. It’s most useful as a synthesis tool after you’ve gathered data, rather than as a starting point.

Use SWOT when you need a clear summary to align stakeholders or prioritize initiatives.

| Category | What it captures | Example inputs |

|---|---|---|

| Strengths | Internal advantages | Strong retention, proprietary technology, efficient processes |

| Weaknesses | Internal limitations | Skill gaps, high costs, operational bottlenecks |

| Opportunities | External upside | New markets, shifting demand, regulatory changes |

| Threats | External risks | Competitor moves, economic pressure, substitutes |

PESTEL analysis

PESTEL analysis examines macro-level forces that shape your operating environment: political, economic, social, technological, environmental, and legal factors. It’s especially valuable for long-term planning or market entry decisions. Use PESTEL when external forces, regulation, or economic conditions could materially affect your strategy.

| Factor | Questions to ask |

|---|---|

| Political | Are policy changes or government priorities affecting your market? |

| Economic | How are inflation, interest rates, or budgets shifting demand? |

| Social | Are customer expectations or behaviors changing? |

| Technological | Are new technologies enabling substitutes or efficiencies? |

| Environmental | Do sustainability or climate factors affect costs or compliance? |

| Legal | Are new laws or regulations altering risk or feasibility? |

Porter’s Five Forces

Porter’s Five Forces focuses on industry structure and competitive pressure. It helps explain why some markets are more profitable than others and where pricing power comes from. Use Porter’s when evaluating competitive intensity, margins, or long-term industry attractiveness.

| Force | What it assesses |

|---|---|

| Competitive rivalry | Intensity of competition among existing players |

| Threat of new entrants | How easily new competitors can enter the market |

| Threat of substitutes | Availability of alternative solutions |

| Buyer power | Customers’ ability to influence pricing and terms |

| Supplier power | Vendors’ ability to raise prices or limit supply |

5C analysis

The 5C framework looks at company, customers, competitors, collaborators, and climate. It’s particularly useful for go-to-market and positioning decisions. Use 5C when you need to connect internal capabilities with customer behavior and channel dynamics.

| Component | Focus |

|---|---|

| Company | Capabilities, costs, constraints, and differentiation |

| Customers | Needs, buying behavior, and decision criteria |

| Competitors | Alternatives and relative positioning |

| Collaborators | Partners, suppliers, and distribution channels |

| Climate | Broader trends affecting demand and execution |

Situational analysis: Step-by-step process

A situational analysis works best when it’s repeatable. You can use the same process for annual budget planning, market entry decisions, quarterly resets, or major product launches, adjusting depth based on the size of the decision.

Step 1: Define your objectives and scope

Start with the decision you need to make. A situational analysis should be anchored to a concrete question, not a vague goal like “understand the business.”

Define what you’re deciding, the timeframe you’re planning for, and the constraints you need to work within. For example, “Should we enter a new vertical next year?” or “Which product line should we invest in or sunset?”

Also identify who needs to be involved. Finance, sales, marketing, product, and operations often see different risks and constraints. Bringing those perspectives in early improves both accuracy and buy-in.

Step 2: Gather internal data

Collect data that reflects how the business actually operates, not how it’s supposed to operate.

Common internal inputs include financial performance, operational metrics, headcount and capacity, sales and marketing efficiency, and customer retention or support data. The goal is to understand what’s funding your strategy, what’s constraining it, and where execution breaks down.

Standardize definitions and timeframes so datasets can be compared cleanly. Where possible, assign ownership to each dataset so assumptions and gaps are explicit rather than implied.

Step 3: Analyze the external environment

Next, assess forces outside your control that affect demand, competition, and risk.

This typically includes competitor behavior, customer needs and buying patterns, industry trends, and macro factors like regulation or economic conditions. Use a mix of qualitative inputs, such as interviews and win-loss reviews, and quantitative inputs, such as market data or pricing benchmarks.

If you operate in a regulated or fast-changing space, prioritize primary sources over summaries so you’re working from the most accurate information available.

Step 4: Select and apply frameworks

Choose frameworks that match your decision and apply them with evidence, not intuition.

For example, PESTEL helps surface macro forces, Porter’s Five Forces explains industry pressure and profitability, and 5C connects internal capabilities to customers and channels. SWOT works best at this stage as a synthesis tool that summarizes what matters most.

When combining frameworks, keep the order simple. Start with external forces, connect them to your market and go-to-market reality, then use SWOT to distill the implications that are most relevant to the decision at hand.

Step 5: Synthesize findings

Raw analysis only becomes useful when it’s reduced to a small set of insights.

Organize findings in one place, tag them as internal or external, and note confidence levels where evidence is thin. Look for patterns that repeat across teams or data sources, since those usually signal real constraints or opportunities.

Then translate insights into priorities by weighing impact against effort. If an initiative can’t be staffed, funded, or owned, it isn’t a priority yet.

Step 6: Develop strategic recommendations

Turn insights into decisions with clear constraints.

Strong recommendations specify what to do, why it makes sense given the analysis, and what needs to be true for execution to succeed. They should also include owners, dependencies, and timelines so they can be acted on, not just agreed with.

Define a small set of metrics to track whether the strategy is working. Leading indicators help you course-correct early, while outcome metrics confirm whether the strategy delivered the results you expected.

Practical examples and templates

Situational analysis becomes easier when you can see what a complete output looks like. The example below shows how the frameworks work together, followed by templates you can reuse for your own planning.

Situational analysis example for a SaaS company

Scenario: You run a mid-market B2B software company offering subscription management tools for finance teams. Growth has slowed, and leadership is deciding whether to expand into enterprise or focus on strengthening the mid-market.

Internal signals show that annual recurring revenue growth has slowed, customer acquisition cost payback is longer for enterprise prospects, and implementation effort increases sharply with complex integrations. External signals show buyers are scrutinizing budgets, competitors are bundling adjacent workflows, and security and compliance requirements are rising.

Applying the frameworks clarifies the decision. PESTEL highlights economic pressure and regulatory complexity as meaningful constraints. Porter’s Five Forces shows intense rivalry and high buyer power, which puts pressure on pricing. The 5C analysis reveals stronger time-to-value and onboarding efficiency in the mid-market, while SWOT synthesizes the findings into a clear tradeoff between faster execution and higher-risk expansion.

The analysis points toward doubling down on the mid-market in the near term, while treating enterprise expansion as a gated initiative tied to specific readiness criteria.

Common mistakes to avoid

Situational analysis tends to fail in predictable ways. The issues below don’t usually come from a lack of intelligence or effort, but from how the analysis is scoped, executed, or used.

Analysis paralysis and over-complication

Running every framework in full detail often creates more noise than insight. The goal isn’t to analyze everything, it’s to reduce uncertainty around a specific decision.

Common signs include:

- Filling out frameworks for completeness rather than relevance

- Producing large slide decks without clear conclusions

- Delaying decisions while waiting for “one more data point”

Keep the output tight by limiting results to a short set of decision-relevant insights, a prioritized initiative list, and clear next steps.

Ignoring internal biases

Teams often enter the process with a preferred outcome already in mind. That leads to cherry-picked data and overlooked risks.

Watch for:

- Evidence that supports a conclusion while contradictory signals are dismissed

- Overreliance on anecdotal input from a single team

- Lack of documented assumptions

Counter this by labeling assumptions explicitly and comparing inputs across functions before drawing conclusions.

Focusing only on the current state

Current performance explains where you are, not where the market is going. A situational analysis that ignores emerging trends can lock you into decisions that age quickly.

This shows up as:

- Plans built entirely on historical metrics

- No monitoring of regulatory, economic, or technology shifts

- Surprises that could have been anticipated with basic trend tracking

Use PESTEL or a lightweight trend scan to identify a small number of forces to monitor regularly.

Insufficient stakeholder involvement

If key teams aren’t involved, the analysis will miss operational constraints and struggle to gain traction.

Red flags include:

- Findings that surprise teams responsible for execution

- Pushback late in the process

- Lack of clear owners for recommendations

Involving stakeholders early improves accuracy and makes execution more likely.

Poor documentation and follow-through

A situational analysis only matters if it informs action. Without documentation and ownership, insights fade quickly.

Common breakdowns include:

- Decisions scattered across slides, emails, and notes

- No link between analysis, budgets, and roadmaps

- No cadence for reviewing progress

Centralize findings in a single source of truth and tie recommendations to owners, timelines, and metrics so the work translates into execution.

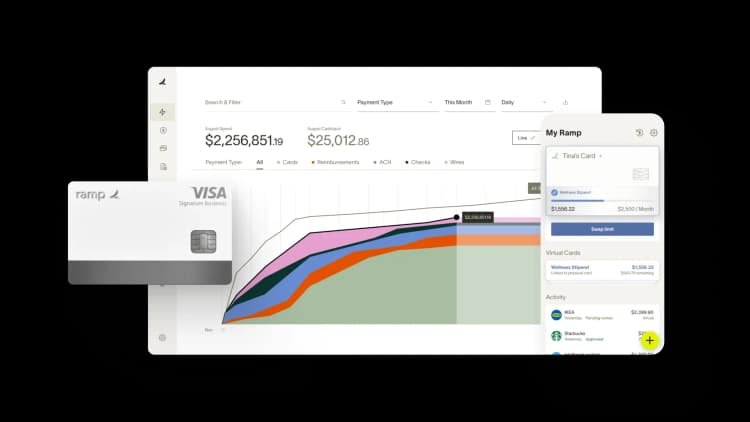

Perform a situational analysis with Ramp

A situational analysis depends on the quality of your inputs. If you don’t have a clear view of where money is going, which vendors you’re committed to, or how spend maps to strategic initiatives, even strong analysis can drift from reality.

Ramp helps you ground situational analysis in accurate, real-time data. With real-time spend reporting, you can see how costs break down by category, vendor, or initiative, making it easier to assess current performance and constraints before setting priorities.

Ramp also gives you visibility into vendor and subscription commitments, including renewal timing and duplicated tools. That clarity supports more informed decisions about consolidation, renegotiation, and reallocating budget toward higher-impact initiatives.

Once decisions are made, Ramp’s controls and workflows help translate strategy into execution. You can align budgets, approvals, and purchasing behavior with the priorities identified in your situational analysis so plans don’t remain theoretical.

If you’re building or refreshing a strategic plan, Ramp can help you run situational analysis with cleaner inputs, tighter controls, and clearer follow-through across finance and operations.

FAQs

Situational analysis assesses the internal factors, such as strengths and weaknesses, and external factors, such as market trends, impacting your company.

There are five main tools to run a situational analysis:

- SWOT analysis is a framework for identifying the internal (strengths and weaknesses) and external (opportunities and threats) factors impacting your company.

- PESTEL analysis assesses the external factors impacting your company: political, economic, social, technological, environmental, and legal.

- Porter’s Five Forces analyzes competition from the perspective of the threat of substitutes and new and established competitors and the bargaining power of suppliers and customers.

- 5C analysis assesses your company and its competitors, customers, collaborators, and (business) climate to support the development of a marketing plan.

- VRIO analysis identifies your company’s competitive advantage by assessing the value, rarity, and imitability of its resources, such as raw materials, and the organization’s ability to leverage them.

The main reason your company runs a situational analysis is to support strategic planning, like launching a new product. The information gathered informs decision-making.

You can use the information collected during a situation analysis to assess your company’s current strategy or guide upcoming strategic decisions. You can also use it to address weaknesses.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits