- What is break-even analysis?

- Break-even formula and calculation

- How to do a break-even analysis

- How managers use the break-even analysis

- Why break-even analysis is important for startups

- What a break-even analysis doesn't tell you

- Track your break-even point in real time with Ramp's spend visibility and reporting

Many tools are available for forecasting and cost evaluation, but few are as important as a break-even analysis.

The break-even point is the moment your business covers all its costs. It’s when total revenue equals total expenses. At this point, you're not making a profit, but you're not losing money either. It’s the baseline every business needs to understand.

Knowing your break-even point helps you price products, control spending, and make confident financial decisions.

What is break-even analysis?

Break-Even Analysis

Break-even analysis is a financial calculation that shows how many units you need to sell or how much revenue you need to generate to cover your fixed and variable costs. It helps identify the point where your business moves from a loss to making a profit.

Break-even analysis helps owners and managers to determine the target to hit before turning a profit.

Break-even analysis considers various factors to determine how many units a company needs to sell or how much money it must earn to cover its costs. When conducting a break-even analysis, managers should consider sales price, variable and fixed costs, and the contribution margin per sales unit.

An organization that doesn't break even will result in losses, while a business that exceeds the break-even point will produce a profit.

Business owners and managers use the results from break-even analysis to determine the potential profitability of a product line or service. Using the details obtained from the report, business owners can evaluate the feasibility of the organization to generate a return through product sales.

Break-even formula and calculation

Business owners can calculate a company's break-even point in units sold or in the amount of earned revenue. If you're looking to learn how to calculate your break-even point, you can use one of the two formulas below.

Break-even quantity

The break-even quantity determines how many units a business must sell before it becomes profitable. If you want to calculate the break-even points in units, use the following formula:

Break-even quantity = Fixed costs / (Sales price per unit – Variable cost per unit)

Total fixed costs represent overhead and administrative expenses that remain the same no matter how many units the company sells. Typical fixed costs include rent, executive salaries, and ERP software expenses.

Variable costs are the direct expenses of producing a unit, such as raw materials and hourly labor costs. Total variable costs go up and down depending on how many units the business creates.

Consider an example. An entrepreneur plans to open a restaurant that sells only one product: the Vegetarian Deluxe pizza. The variable costs associated with preparing a single Vegetarian Deluxe pizza are $4. The sales price for the pizza is $12. The restaurant has monthly fixed costs of $1,500 for rent, $2,000 for salaries, and $100 for software. The number of sales to break even for this restaurant is 450 pizzas, as calculated below:

Break-even quantity = ($1,500 + $2,000 + $100) / ($12 – $4) = 450

So, if the restaurant has a sales volume of 450 Vegetarian Deluxe pizzas per month, it will make enough revenue to cover its costs. If the restaurant sells more pizzas, it will earn a profit. If it sells fewer pizzas, it will lose money.

Break-even point in dollars

Managers can also calculate the break-even point in total revenue. The formula for calculating the break-even point by the amount of sales revenue is:

Break-even point = Sales price per unit * Break-even quantity

Using the previous example, the break-even point in revenue is $5,400:

Break-even point = $12 * 450 = $5,400

How to do a break-even analysis

Break-even analysis is typically handled by anyone who is responsible for setting budgets, pricing, or forecasting revenue. For smaller businesses, it’s often the founder or general manager. In larger companies, FP&A teams run break-even models to guide product launches, market expansion, or cost reviews.

Step 1: Identify your fixed costs

Fixed costs are expenses that stay the same no matter how much you sell. These can include rent, salaries, insurance, business licenses, software subscriptions, and equipment leases. For example, if you pay $2,000 in rent, $6,000 in salaries, and $2,000 for other overhead each month, your total fixed costs are $10,000. This is the baseline amount your revenue needs to cover before you can earn a profit.

Step 2: Calculate your variable cost per unit

Variable costs change depending on how many units you produce or sell. These might include raw materials, packaging, shipping, manufacturing labor, or credit card processing fees. If it costs $15 to produce and deliver one unit of your product, that’s your variable cost per unit.

Step 3: Define your selling price per unit

This is how much you charge customers for each unit you sell. It should reflect the market rate, your costs, and your desired margin. For instance, if you charge $30 for each product sold, use that number as your unit price. If you sell multiple products or offer services, use the average selling price or run separate analyses for each.

Step 4: Apply the break-even formula

To calculate your break-even point, divide your total fixed costs by the difference between your selling price and your variable cost per unit. This difference is called your contribution margin, which is the amount each sale contributes toward covering fixed costs. Using our example, the break-even point comes to 667 units. This means you need to sell 667 units to cover all of your expenses. Every unit sold beyond that adds directly to your profit.

Step 5: Review and interpret your results

This number gives you a concrete sales goal. If 667 units seems out of reach, you may need to raise your prices, reduce fixed costs, or lower your variable costs. For example, switching to a more efficient supplier or reducing software subscriptions could move your break-even point closer.

How managers use the break-even analysis

Managers revisit break-even analysis regularly. Many run the numbers during quarterly planning, before launching a new product, or when costs or pricing change.

- Understand and manage costs: Managers use break-even analysis to break down fixed and variable costs. This helps them see how many units need to be sold to cover expenses and start generating profit. If the break-even point is too high, it signals a need to cut unnecessary costs or find operational efficiencies.

- Set budgets and sales targets: Once the break-even point is clear, managers can set more accurate revenue goals and spending limits. It creates a financial baseline that supports planning, especially during forecasting or when launching new products. This insight is essential for department heads building quarterly budgets or sales managers creating performance targets tied to profitability.

- Improve team alignment and accountability: Managers often share break-even data with their teams to reinforce goals. Sales managers can focus efforts on reaching the required unit volume, while operations leads can explore ways to reduce production costs. This creates cross-functional alignment and ensures every team works toward improving the bottom line.

- Refine pricing strategy: Break-even analysis helps them test how different pricing scenarios affect profit thresholds. Even small changes to pricing can shift the balance between healthy margins and customer demand, making it essential to evaluate pricing decisions carefully. Managers also use this analysis to avoid pricing missteps, like raising prices too high can reduce sales volume, while lowering them too far can strain capacity and resources.

Why break-even analysis is important for startups

A new business must find its footing before it's able to grow its customer base. A break-even analysis calculation forces small business owners to examine the components of their business plan and business idea, including pricing strategy and startup costs. Using the information from the analysis, managers can determine if the company is likely to make enough sales to cover its monthly business expenses.

Break-even analysis isn't just appropriate for pricing and cost analysis—it can also help businesses to attract potential capital. Many startups need funding from investors or banks to scale the company for growth. To attract investors, the company will need a comprehensive set of financials and a complete break-even analysis to help lenders understand the challenges that the business faces and determine if they can help.

Commonly, startups seek financial assistance from lenders and investors through business loans, programmatic funding, and venture capital. Alternative funding sources such as startup corporate cards, inventory financing, and accounts receivable financing are also viable options.

Ramp can strengthen investor confidence by streamlining how startups track and report financial data. With automated transaction coding and real-time reporting, founders can present accurate break-even models and forecasts during fundraising.

What a break-even analysis doesn't tell you

Break-even analysis doesn’t reveal whether your target market is large enough to reach that point. When used alone, it can give a false sense of security. That’s why break-even analysis should be one of several tools used to guide financial decisions, not the only one.

Garbage in, garbage out

Like any mathematical formula, the break-even analysis is only as accurate as the details used to calculate it. Inaccurate variable and fixed costs will leave managers with an incorrect break-even quantity that doesn't accurately reflect the company's need to turn a profit.

Your accounting team needs to maintain accurate records of each period and ensure the proper recording of all expenses. Without meticulous bookkeeping, break-even analyses are useless.

Long-term analysis

Remember that a break-even analysis is fixed and relies on cost and sales price details that may change in the future. It's vital for businesses to regularly update the factors used in break-even analysis as circumstances change. Hiring new employees, purchasing new technology, and changing the sales price for a product all impact the results of break-even reporting.

Sales price changes and discounts

It's not uncommon for organizations to provide discounts to their customers if they purchase products in bulk. For instance, a company may decide to offer clients a deal if they buy a certain quantity of the product at once. Break-even analysis does not account for selling price modifications.

Companies that use discounts to attract more customers must consider how the markdown impacts their break-even unit point.

Track your break-even point in real time with Ramp's spend visibility and reporting

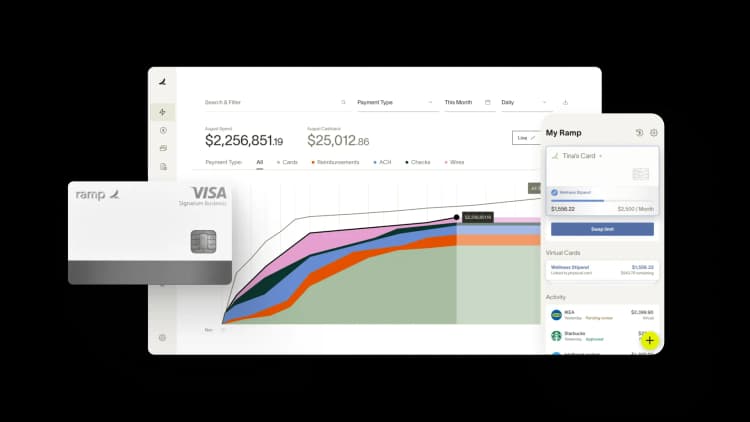

Calculating your break-even point is straightforward in theory, but keeping it accurate as costs shift is where most businesses struggle. Without real-time visibility into spending patterns and expense categories, you're working with outdated data that makes break-even analysis more guesswork than strategy.

Ramp's accounting automation software gives you the spend visibility and reporting tools you need to monitor your break-even point with confidence. Every transaction is categorized automatically, synced to your ERP in real time, and available in customizable reports that show exactly where your money goes.

Here's how Ramp helps you track break-even accurately:

- Real-time spend visibility: See all company spending as it happens across cards, reimbursements, and bill pay, so your fixed and variable cost calculations reflect current reality

- Automated categorization: Ramp's AI codes transactions to the right GL accounts and cost centers automatically, eliminating manual errors that throw off your break-even calculations

- Custom reporting: Build reports that break down spending by department, vendor, category, or project to identify which costs are fixed versus variable and spot trends that impact your break-even threshold

- Audit-ready records: Every transaction includes receipts, approvals, and context automatically, so you can verify cost assumptions and defend your break-even analysis with complete documentation

Try a demo to see how Ramp gives you the real-time data you need for accurate break-even monitoring.

FAQs

Break-even analysis helps determine the sales quantity required to cover the company's expenses. Information obtained from a break-even analysis allows the business to set sales targets and decide when cost-cutting measures are necessary. New organizations that need funding assistance benefit from having detailed break-even reporting that investors can use to determine if the company warrants a loan or capital.

There are two main break-even analysis formulas: break-even quantity and break-even revenue. Calculate the break-even quantity using the following formula:

Fixed Costs / (Sales Price per Unit - Variable Cost per Unit) = Break-even Quantity

Once the break-even quantity is known, managers can calculate break-even revenue using the formula below:

Sales Price per Unit x Break-even Quantity Units = Break-even Point in Revenue

Break-even analysis is a comprehensive tool that allows organizations to consider the impact that changes in unit sales, sales price, and costs will have on the company's profitability. The break-even point is a simple calculation that indicates the number of units that the organization must sell before it's able to cover its total expenses. Once sales quantity exceeds the break-even point, the company will begin to yield a profit.

Service-based businesses can run break-even analysis by using average revenue per client and tracking direct costs like labor, software, or subcontractors. Instead of units sold, they may measure billable hours or projects completed to find the break-even point.

Seasonal businesses should calculate break-even points for peak and off-peak periods separately. Costs and demand can fluctuate throughout the year, and using a single average can lead to inaccurate projections and poor inventory or staffing decisions.

Typically, taxes are not included in basic break-even calculations since they are applied after profit is earned. However, for more advanced planning, factoring in estimated tax obligations can give you a more complete picture of the true profit threshold.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits