4 ways to jumpstart your SMB finance function

- 1. Decide on the best option to get your team up and running

- 2. If hiring a VP/head of finance, look for investment experience

- 3. Ask incisive interview questions

- 4. Avoid overhiring with a smart finance tech stack

- Automate your way to a scalable finance function

If you’re a startup founder or small business CEO, you may be starting your finance function from scratch. One crucial area to focus on is your hiring plan. In this article, we’ll share some insights on key attributes for new hires, which we touched on in our guide in partnership with Stripe. Here are 4 tips that can help you set the right foundation for your growing team.

1. Decide on the best option to get your team up and running

TL;DR: There isn’t a one-size fits all approach for starting your team. Pick the option that’s the best fit for your business.

Outsource your finance

You can outsource finance functions such as accounting, finance, and tax. You often don’t need a full-time accounting or finance hire until about 25 hires, so this might be the best selection if you’re in the nascent stages. It’s best to wait until you have enough volume in your customer base, rather than bringing on a full-time hire too early. If you do decide to go the outsourcing route, consider assigning a team member with leading your outsourced functions as they can help the fractional team better understand the needs of your business.

Have other team members take it on

As a temporary solution, you might be able to have a senior executive who has financial management experience handle it until a fractional or full-time hire is onboarded.

Hire a controller

Bringing on a controller to bring your accounting needs in-house can help guarantee that your data and accounting are strong and accurate, and can also help support your FP&A.

Hire a VP or head of finance

Lastly, you could bring on a VP or head of finance. We’ll go into more detail on best practices for sourcing the right candidate below.

2. If hiring a VP/head of finance, look for investment experience

TL;DR: Your ideal candidate combines the internal (accounting expertise to provide a strong foundation) with the external (fundraising experience to secure capital).

With the rise of venture capital, more and more companies are looking for candidates with skills such as investor relations. This is a departure from the previous emphasis on a strong accounting background, with employers now more focused on the quality of their books than strategic finance and fundraising. As a result of this, plus the rise of finance operations and gains in operating leverage, there is a wider pool of talent to pick from. Individuals coming from private equity, hedge funds, or Wall Street are now rubbing elbows with more traditional candidates.

Why a hire with these skills is important for your team: A hire with prior experience in venture capital or investment banking, who is adept at external-facing tasks such as building models, can be an asset in securing capital. This is especially relevant in today’s uncertain economy, with businesses vying to secure assets that are significantly more scarce than they were a year ago. Bringing on a candidate with this experience could mean the difference between your business scaling up or winding down. After all, your model is a numeric representation of your overall strategy. A hire who’s familiar with your industry’s KPIs and can put a compelling model together is worth their weight in gold.

3. Ask incisive interview questions

TL;DR: The right questions can make or break your team.

The right interview questions can help you hire candidates, no matter which option you select, who will yield the most ROI for your finance team. Here are some of the most important questions to ask:

- What would you want to see from this company to understand its past?

This question helps you understand how they see the business’s financial characteristics. - What’s the bull case for this company?

This question asks the candidate to forecast the future as well as their rationale, thereby assessing reasoning skills and financial knowledge. - Tell me about a recent time that you’ve driven either turnout or improvement to a company’s top line, bottom line, etc.

This question examines their possible impact to the company by looking at their past success, e.g. how were they able to affect change? Are they focused exclusively on themselves or are they a true team player? - What attributes do you view as critical to a successful company culture?

This helps assess whether a candidate fits the overall culture of the org. Culture is paramount to the success of your business, so be sure to keep it a key hiring consideration.

4. Avoid overhiring with a smart finance tech stack

Overhiring can drain your resources and create long-term challenges for your finance team. In today's uncertain economy, you need to be strategic about every new hire.

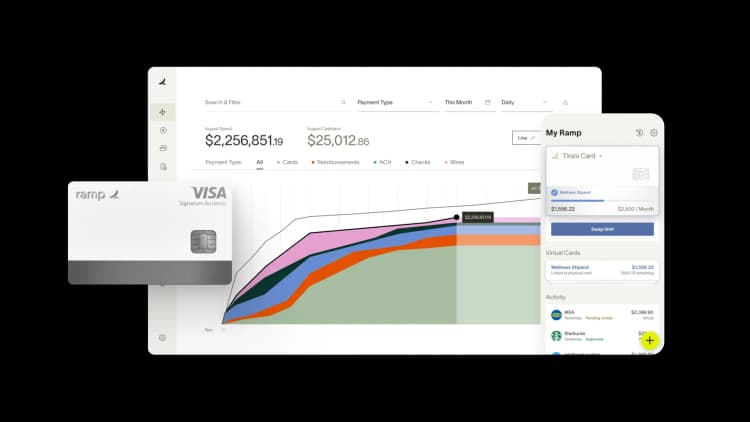

The right tech stack helps you stay lean without sacrificing capabilities. When you equip employees with virtual cards and give them clear spending guidelines, you eliminate hours of manual expense tracking while empowering your team to move faster.

Smart automation tools do more than save time—they fundamentally change what roles you need to hire for. Instead of bringing on staff to handle routine tasks, you can focus on recruiting strategic thinkers who drive real business value.

For more insights on building an efficient finance function, check out the full guide from Ramp CEO Eric Glyman, covering everything from fractional CFOs to remote team payroll strategies.

Automate your way to a scalable finance function

Building a finance function from scratch feels overwhelming when you're juggling vendor payments, expense tracking, and financial reporting with limited resources. As your SMB grows, manual processes that worked for five employees quickly break down at fifty, leaving your finance team drowning in receipts, spreadsheets, and approval bottlenecks.

Ramp's expense management platform eliminates these growing pains by automating the tedious work that typically requires hiring additional staff. Instead of chasing employees for receipts, Ramp's corporate cards capture transaction data in real-time and automatically match receipts through OCR technology. When your sales team travels to close deals, they simply snap photos of receipts through the mobile app, and Ramp instantly categorizes expenses according to your chart of accounts. This means your finance team spends minutes, not hours, closing the books each month.

The platform's automated approval workflows scale effortlessly with your headcount. You can set spending limits by department, require manager approval for expenses over certain thresholds, and create custom policies that enforce your expense guidelines automatically. For instance, if marketing tries to expense a client dinner exceeding your $200 per-person limit, Ramp flags it before reimbursement, preventing policy violations without manual review.

Ready to learn more? Try an interactive demo and see how Ramp can kickstart your SMB finance function out of the box.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits