- Where single-use cards fit into vendor payments

- How to pay a vendor via card if they only accept ACH?

- What happens if a vendor charges a one-time card twice?

- How are recurring vendor subscriptions flagged in accounting?

- Can vendor payments automatically map to vendor-specific GL codes?

- How do I reconcile prepaid vendor deposits?

- What happens if a vendor charges a terminated employee's card?

- Closing the loop on vendor payments

A single-use card is a virtual card number created for a single transaction. Once that transaction is complete, the card automatically expires. This prevents vendors from charging the card again, blocks unauthorized use, and ensures every payment has a clean audit trail.

You can set exact amounts, link payments to specific invoices, and avoid the risk of duplicate or recurring charges. Each card maps back to a single transaction, which makes reconciliation faster and more reliable.

Where single-use cards fit into vendor payments

Vendor payments often involve multiple methods such as ACH, checks, and wires. Each comes with trade-offs around speed, cost, and risk. One-time use cards sit alongside these options and are designed for control and precision. This setup protects you from duplicate charges and provides a direct link between the vendor, the invoice, and the transaction.

The role of single-use cards in vendor payments can be understood in a few clear ways:

- Control over spend: You decide the transaction amount and the vendor. This keeps unauthorized or mistaken charges from slipping through.

- Cleaner reconciliation: Each card is tied to a single invoice. Month-end close involves fewer mismatches and less manual research.

- Reduced exposure to fraud: Expiring card numbers cut off the risk of repeat charges or account information leaks.

- Faster processing: Virtual card payments settle faster than checks and often quicker than ACH, which helps vendors receive funds without delay.

- Audit readiness: Every transaction has its own trail, making compliance reviews smoother and less time-consuming.

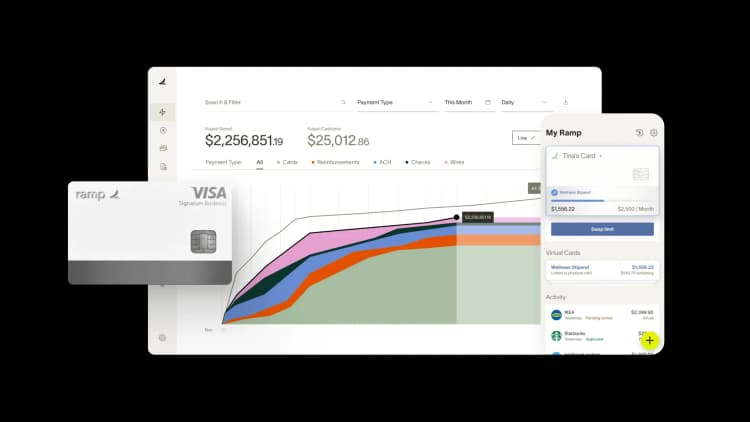

Ramp’s single-use virtual cards feature built-in merchant restrictions and expiration rules, ensuring each card is directly mapped to a specific vendor payment.

How to pay a vendor via card if they only accept ACH?

Some vendors accept only ACH for payments, which can be limiting if you prefer using cards for control or tracking. In these cases, card-to-ACH conversion tools bridge the gap. This approach allows you to use the visibility and controls of card payments while still meeting the vendor’s ACH requirement.

How card-to-ACH conversion works

Card-to-ACH conversion enables you to pay vendors using your business card, while they receive funds in ACH format. It bridges two payment systems without adding manual work for either side.

Here’s how the process works in practice:

- Step 1: You initiate payment with your card. You start by entering a payment with your business card. The payment goes through card networks as it normally would. This gives you the ability to use card controls and reporting from the start.

- Step 2: The provider intercepts the card payment. A payment processor or integrated payables platform captures your card payment and prepares to convert it. You see the charge appear on your card statement, while the vendor does not interact with card rails at all.

- Step 3: Conversion into ACH instructions. The processor creates an ACH instruction using the vendor’s banking details that you or your ERP system already stores. The dollar amount matches your card authorization. This step ensures the vendor only ever sees an ACH transfer into their account.

- Step 4: Funds settle into the vendor account. The ACH transaction moves through the banking system and arrives as a deposit in the vendor’s bank account, typically within 1 to 2 business days. From the vendor’s perspective, the payment looks like any other ACH settlement.

- Step 5: Your records and controls stay intact. On your side, the payment remains logged as a card charge with all the usual benefits, including transaction-level data, category tagging, and spend controls. For accounting, the payment can be matched against the vendor invoice while still meeting the vendor’s ACH requirement.

Costs and timing differences to consider

Paying a vendor through card-to-ACH conversion involves trade-offs in both cost and timing. While the method offers flexibility, it is essential to understand the impact on your payment process.

- Transaction costs: ACH transfers are among the lowest-cost options, often under $1 per payment. Card-to-ACH routes can include processing fees ranging from 2% to 3% of the transaction value. For a $50,000 vendor payment, that difference can mean $1,500 in additional costs.

- Settlement speed: Standard ACH transfers settle within 1 to 2 business days. Same-day or instant ACH is available but requires cutoff times and added fees. Card-to-ACH settlements depend on the processor but often match standard ACH timing. Some platforms provide faster settlement to vendors while still charging your card immediately.

- Cash flow effects: Paying by card can extend your float by up to 30 days, depending on your billing cycle. This gives you more flexibility to manage working capital, even though the vendor sees funds through ACH on their usual timeline.

- Market scale: In 2023, the ACH network processed 33.56 billion payments, showing how deeply embedded ACH is in vendor transactions. The scale explains why most vendors continue to rely on it as their primary settlement method.

The choice between direct ACH and card-to-ACH depends on how much value you place on extended float, card-level controls, and vendor relationships compared to the higher fees.

What happens if a vendor charges a one-time card twice?

A one-time use card is designed to stop duplicate charges. Once the card processes a transaction, it becomes inactive. If a vendor attempts to charge the same card again, the transaction is automatically declined by the payment network.

The decline also protects against unintentional errors. If a vendor splits an invoice into multiple charges by mistake, only the first attempt succeeds. The result is a clear match between your invoice and your payment, with no excess activity left to investigate.

With Ramp, refunds remain valid even if a one-time card has expired or is locked, preventing stranded credits and ensuring accurate reconciliations.

Impact on your reconciliation process

When a vendor attempts to charge a one-time card twice, the failed transaction never enters your books. This prevents duplicate entries that would otherwise slow down your close. You see only the original approved payment, which keeps the link between the invoice and the transaction intact.

This structure reduces manual intervention. Without duplicate charges, you avoid time spent matching extra entries or reversing incorrect payments. Around 50% of finance leaders identified reconciliation delays as one of their top challenges during the month-end close. One-time card controls remove a common source of those delays.

Reconciliation also becomes more accurate. Each one-time card is tied to a specific vendor and invoice, so the payment record is easy to trace. If a vendor mistakenly retries a charge, the decline keeps your system aligned without creating exceptions to investigate.

Vendor side outcomes

When a vendor tries to charge a one-time card a second time, the network blocks the payment instantly. The vendor sees a decline code and no funds move. This response signals that the card cannot be reused, giving the vendor immediate clarity.

For vendors, the outcome matters because it shapes how their billing and collections teams handle the situation. Instead of dealing with pending transactions or lengthy reversals, they know right away that a new payment method is required.

Here’s a breakdown of what vendors experience in different situations:

Scenario | What the vendor sees | Impact on vendor operations | Outcome for vendor relationship |

|---|---|---|---|

First charge attempt | Authorization accepted and settled | Payment posts to vendor account | Invoice marked as paid with no delay |

Second charge attempt | Decline code at authorization stage | Billing system flags failure and stops retry | Vendor knows card is invalid and must request a new method |

Multiple split attempts | Only the first partial charge clears | Subsequent attempts fail with decline codes | Vendor avoids duplicate funds but must reissue consolidated invoice |

System error or accidental retry | No funds transferred and error logged | Vendor accounts receivable notes mismatch | Clear audit trail prevents disputes with your finance team |

Subscription or recurring setup attempt | Recurring charge blocked after initial use | Vendor subscription system records payment failure | Vendor prompted to collect a new card or switch to ACH |

For vendors, the clear signals reduce confusion and help them maintain accurate records. They avoid holding funds that may later be reversed and gain faster visibility into failed payments.

How are recurring vendor subscriptions flagged in accounting?

Recurring vendor subscriptions are charges that repeat on a fixed schedule, such as monthly software licenses, cloud storage, or industry memberships. These payments often run in the background and can continue indefinitely unless actively reviewed.

How recurring charges appear in transaction data

Recurring vendor charges create patterns that are easy to spot in your transaction data. These payments follow predictable cycles, usually monthly or annually, and appear with the same vendor name and a consistent dollar amount.

Accounting platforms use these signals to flag recurring activity. A subscription to a software provider, for example, appears on the same day each month with no variation in the amount. This repetition helps your system recognize the charge as ongoing rather than one-time.

Some subscriptions shift slightly in value due to usage tiers or tax adjustments. Even then, the vendor name and frequency of the charge make the pattern visible.

The average business manages more than 87 SaaS applications, resulting in hundreds of recurring charges flowing through their ledgers each month. Without clear flagging, these entries can easily become hidden or misclassified.

Recurring charges also carry merchant category codes that reinforce their identity. A cloud storage payment, for instance, will consistently appear under software or IT services. These codes add another layer of reliability when your system flags subscription spend.

Rules that map recurring spend to the right accounts

Recurring vendor charges are assigned to the right accounts through predefined rules. These rules let you automate classification and reduce the need for manual coding.

Common rules include:

- Vendor-based mapping: Each recurring vendor is linked to a default account code, such as SaaS subscriptions, which posts directly to software expenses.

- Merchant category code mapping: Charges from the same merchant category route to a shared account, like utilities or IT services.

- Frequency-based mapping: Monthly or annual charges that follow consistent billing cycles are flagged as recurring operating expenses.

- Department or cost center mapping: Recurring spend tied to a department is directed to the correct cost center for reporting.

These rules provide consistency in reporting and ensure recurring subscriptions land in the correct accounts every cycle. The result is fewer errors, faster closings, and clearer financial visibility.

Linking recurring charges to contracts and approvals

Recurring vendor charges only make sense when they align with approved contracts. Accounting systems flag these payments by verifying whether the recurring transaction aligns with an active agreement on file. If the charge appears without a contract, it signals a need for review.

Linking charges to contracts ensures that spend is not only categorized correctly but also supported by documentation. Connecting recurring spend to contracts helps manage vendor payments.

Approvals play a key role as well. When a recurring payment is tied to an approval workflow, each renewal reflects authorization from the right budget owner. This prevents outdated or duplicate subscriptions from flowing through unnoticed.

The benefit is twofold. You maintain vendor compliance by keeping payments tied to valid agreements, and you improve visibility by confirming that recurring spend continues to have business value. This connection between contracts, approvals, and recurring charges gives you a more reliable view of vendor commitments.

Can vendor payments automatically map to vendor-specific GL codes?

Vendor payments can be automatically mapped to general ledger codes when accounting systems utilize rules tied to vendor information. This means that every time you pay a specific vendor, the expense is assigned to the correct account without manual coding.

For example, if you always pay a software subscription to a cloud provider, those charges can be routed directly to your software expense account. A logistics vendor can be linked to freight expense, and a legal partner can be mapped to professional services. By setting these rules, the system eliminates guesswork and ensures your chart of accounts remains consistent.

How vendor-level coding works

Vendor-level coding links each vendor in your system to a predefined general ledger account. This allows your accounting platform to classify payments automatically, creating consistency and reducing errors.

The process typically works like this:

- Step 1: The vendor is added to your system. When a new vendor is created, details such as name, category, and contract type are stored in your vendor master file.

- Step 2: GL code is assigned to the vendor profile. Each vendor is linked to a default GL account. For example, a law firm may be assigned to professional services expenses, while a delivery partner is tied to transportation expenses.

- Step 3: Payment is processed. When you make a payment to that vendor, the system automatically pulls the default GL code from the vendor profile and applies it to the transaction.

- Step 4: Transaction flows to the ledger. The payment is posted to the correct account without manual coding. This keeps expense classifications consistent across periods.

- Step 5: Review and adjust as needed. Finance teams periodically review vendor mappings to confirm they remain accurate. If a vendor relationship changes, the GL code is updated at the vendor level, and all future payments follow the new rule.

By linking payments to vendors in this way, you keep reporting aligned, reduce reconciliation issues, and maintain cleaner books.

How do I reconcile prepaid vendor deposits?

Prepaid vendor deposits are payments you make before receiving goods or services. They are common with vendors that require upfront commitments for materials, long-term contracts, or high-value services.

Reconciliation begins when the vendor issues an invoice. The deposit is applied against the invoice, reducing the outstanding balance.

How prepaid vendor deposits are recorded

When you make a deposit to a vendor before receiving goods or services, the payment is recorded as a prepaid asset rather than an expense. This reflects the fact that value has not yet been delivered. Prepaid deposits sit on your balance sheet as current assets until the vendor fulfills the order or provides the service.

For example, a $15,000 advance to a supplier for raw materials is classified as a prepaid expense. Once the materials arrive, the amount is moved from the asset account to the cost of goods sold. This shift ensures that your expenses align with the period when the benefit is received.

You benefit from tracking these deposits carefully. Each entry creates a clear link between the upfront payment and the future expense, making it easier to reconcile invoices and maintain a precise ledger.

Tracking deposits against vendor invoices

Once a vendor deposit is recorded as a prepaid asset, the next step is tracking how it offsets future invoices. Each time an invoice arrives, the deposit is applied until the balance is fully used. This creates a direct link between the initial payment and the expenses recognized over time.

For instance, if you place a $12,000 deposit for equipment, a $3,000 vendor invoice reduces the prepaid balance to $9,000. The expense portion is transferred from the asset account into the corresponding expense category. This cycle continues until the full deposit is cleared.

You also gain clearer visibility into vendor relationships. Tracking deposits against invoices reveals the amount of value you have already received and the amount that remains outstanding. This transparency supports both cash flow planning and audit readiness.

Accounting treatment during reconciliation

Reconciling prepaid vendor deposits requires moving amounts from assets to expenses as the vendor delivers goods or services. Until delivery, the deposit remains on your balance sheet as a prepaid asset. Once the obligation is met, the prepaid amount is released into the income statement as an expense.

Here's how different deposit scenarios flow through the books:

Scenario | Accounting Entry | Impact on Financials | Example |

|---|---|---|---|

Deposit made | Debit Prepaid Expense (Asset), Credit Cash | Assets increase, cash decreases | $20,000 deposit for raw materials recorded as prepaid asset |

Partial invoice applied | Debit Expense, Credit Prepaid Expense | Asset reduces, expense recognized | $5,000 invoice offsets part of $20,000 deposit |

Multiple invoices applied | Debit Expense, Credit Prepaid Expense (repeated) | Gradual shift from asset to expense | Deposit cleared across four $5,000 invoices |

Full invoice matched | Debit Expense, Credit Prepaid Expense | Prepaid asset fully cleared | Entire $20,000 deposit consumed by one invoice |

Vendor cancellation with refund | Debit Cash, Credit Prepaid Expense | Cash restored, asset removed | Vendor cancels order, refunds $20,000 deposit |

Vendor cancellation without refund | Debit Expense, Credit Prepaid Expense | Asset converted to expense | $20,000 deposit lost due to non-refundable contract |

Aged or unused deposit | Remains in Prepaid Expense until resolved | Overstates assets if not reconciled | Deposit sits unresolved for more than 12 months |

Ramp’s automation can collapse hours of reconciliation work into minutes. Snapdocs previously spent 5 to 6 hours each month reconciling expenses across Brex, Expensify, and Bill.com. After consolidating everything into Ramp, the same process takes under 30 minutes.

What happens if a vendor charges a terminated employee's card?

When an employee leaves, their card is deactivated in your system. Any attempt by a vendor to charge that card fails at the authorization stage. No funds are released, and the charge does not post to your books.

What the vendor sees after a failed charge

When a vendor tries to bill a terminated card, the payment request is immediately declined by the network. The vendor receives an error code that identifies the card as inactive or closed. No pending transaction is created, so there is no temporary hold on funds.

Most payment processors deliver specific decline codes, such as “lost or stolen card” or “account closed,” which help vendors understand that the charge cannot be retried. This allows them to contact you for an updated payment method rather than submitting repeated requests.

Decline events are common in vendor billing. About 15% of recurring transactions fail due to invalid or expired cards. In the case of a terminated employee’s card, the decline prevents unauthorized spending and ensures the vendor is aware that a valid replacement is needed.

Impact on your accounting records

When a terminated card is charged, the transaction never posts to your ledger. Because the authorization fails, no expense is recorded, and your books stay aligned with actual spend. This prevents reconciliation errors that would otherwise occur from charges associated with inactive employees.

The benefit is clear in audit preparation. Each declined charge ensures that no unapproved vendor payments slip into your expense accounts. Blocking these transactions keeps your documentation clean and reduces the chance of audit adjustments.

Reassigning payments to active cards

When a vendor attempts to charge a terminated card, recurring payments need to be linked to an active account so services continue without interruption. Reassignment ensures that vendor relationships remain intact while spend is tracked under the right employee or department.

The process generally follows these steps:

- Identify recurring charges tied to the inactive card. Review past statements to spot subscriptions or vendor payments linked to the terminated employee’s card.

- Select a valid replacement card. Assign the payment to a department card or to another employee who now manages the vendor relationship.

- Update payment details with the vendor. Provide the new card details to the vendor to ensure billing resumes smoothly on the correct account.

- Verify the reassignment in your system. Confirm that the payment method has been updated in both the vendor’s billing portal and your accounting platform.

- Monitor the first billing cycle after reassignment. Check that the charge posts to the correct GL code and that no duplicate payments occur during the transition.

A structured reassignment process minimizes that risk and ensures your financial records remain accurate.

Closing the loop on vendor payments

Managing vendor payments requires ensuring that one-time cards block duplicate charges, prepaid deposits are shifted into expenses at the right time, and recurring subscriptions are mapped cleanly to the correct accounts. Each piece contributes to financial records that reflect reality, not just activity.

Strong reconciliation practices protect you from the gaps that often cause month-end delays. Closing gaps through clear rules and automated processes keeps vendor spend aligned with both contracts and budgets.

This is where automation makes the difference. By linking vendor payments to unique identifiers, mapping spend to the right GL codes, and syncing directly with your accounting system, you remove the manual work that creates errors.

Ramp’s platform adds another layer of control with single-use cards, automated categorization, and real-time reconciliation. Features like these move reconciliation from a time-intensive review into a streamlined process that consistently produces clean records.

You also gain transparency that extends beyond accounting. Clean records provide a clearer view of vendor relationships, payment history, and unused deposits. That clarity reduces disputes, shortens audits, and builds trust across both internal teams and external partners.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°