Companies go all in on AI—5 charts show how

- Chart 1: More customers are using AI vendors for 12 months and longer

- Chart 2: Mean AP spend with AI vendors has nearly 3xed since the start of the year

- Chart 3: Card spend with AI vendors doubled year over year, a sign of further experimentation

- Chart 4: Anthropic is gaining ground in the battle of the AI models

- Chart 5: AI productivity tools and OpenAI alternatives are growing fast

- Who were the top AI vendors in Q2? Coming tomorrow

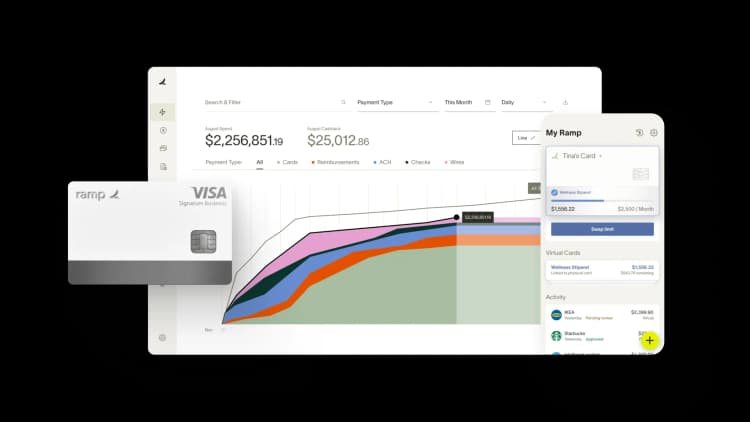

Ramp processes billions of dollars each month, giving us a front-row seat for spotting new tools that companies are testing, as well as vendors that are becoming mainstream. We’ve grown our database of AI vendors to over 1,500 vendors, including long-time tools that may not have started as AI-focused but have since incorporated cutting-edge AI capabilities. Our latest analysis of Ramp customers’ aggregated and anonymized transactions shows AI was the fastest-growing expense in Q2 as more companies lean on the technology to unlock efficiency gains and new product capabilities.

> Download our Summer 2024 Business Spending report now

What does this mean for your company's AI strategy? Here are five charts that can help inform your organization’s budget discussions and vendor experimentations. Check out our new spending microsite for more insights on companies’ top expenses.

Chart 1: More customers are using AI vendors for 12 months and longer

Last year, AI was still an experimental area for many organizations as teams started to explore the world of AI models and how they could be applied to different products and workflows. Very few companies spent on a recurring basis with vendors we categorized as AI; the amount they spent with these vendors on Ramp cards and Ramp Bill Pay was also nominal.

Now, businesses are going all in. Our data show customers who started spending with top AI vendors in 2023 are likelier to stick with these vendors than those who started spending in 2022 or 2021—a signal that companies are increasingly convinced of AI's value. Of businesses that started transacting with top AI vendors in 2023, 70% still spend with the same vendors after 12 months, compared to just 42% of businesses that started spending in 2022.

AI vendor stickiness

Note: Top AI vendors are defined as the vendors with the most businesses transacting with them on Ramp cards in Q2.

Chart 2: Mean AP spend with AI vendors has nearly 3xed since the start of the year

The trend of longer-duration AI engagements is also evident if we look at AP spending trends for AI vendors. In Q2, mean AP spend with AI vendors rose 375% year over year. As expected, these AP expenditures were dominated by OpenAI, with companies spending $181K on average.

Mean AP spend with AI vendors

Chart 3: Card spend with AI vendors doubled year over year, a sign of further experimentation

If AP spend represents companies making significant vendor commitments, then card spend indicates companies’ willingness to explore different vendors or increase usage of less expensive tools. Typically, companies pay for new tools month-to-month via credit whenever possible and only shift to AP for annual subscriptions. Mean card spend with AI vendors increased 104% year over year, suggesting companies continue to experiment even as they start to lock in their favorite tools. OpenAI leads the list of top AI vendors that businesses pay for with Ramp cards, followed by Grammarly and Anthropic.

Mean card spend with AI vendors

Chart 4: Anthropic is gaining ground in the battle of the AI models

This quarter, we used internal mapping data and third-party sources like NFX's Generative Tech Open Source Market Map to get a better understanding of the types of AI vendors that Ramp customers are purchasing. Machine learning (ML) operations and platforms are the clear winners, with nearly 80% of customers using AI transacting in this category.

Anthropic is seeing particularly rapid adoption when we look at the percentage of businesses purchasing AI models on Ramp cards. After hovering at 4% at the start of the year, its market share jumped to 17% in Q2. In July alone, the number of transacting businesses soared 22% month over month, and total card spend nearly doubled. New features like projects and artifacts in June may have propelled its ease of use and subsequent growth.

Anthropic market share on Ramp cards

Chart 5: AI productivity tools and OpenAI alternatives are growing fast

We can also see clear evidence of Anthropic’s growth when we look at the fastest-growing AI vendors in Q2 2024. It ranks high for companies of all sizes, alongside Perplexity, suggesting that companies are putting models to the test.

Vendors that offer novel approaches to everyday work are becoming commonplace, as companies turn to AI to boost employee productivity. Suno AI, for instance, lets anyone generate music using simple text prompts. Limitless runs in the background to capture your audio and screen automatically so you can generate meeting summaries, emails, and more at a later time. Instantly offers AI for sales engagement and lead intelligence AI. Cursor makes an elegant AI code editor. All of these vendors are popular with small and large businesses alike.

Who were the top AI vendors in Q2? Coming tomorrow

These charts are just the first of many we’re sharing this week to unpack the latest corporate spending trends. Tomorrow, we’ll reveal the top AI vendors that companies are purchasing and software vendors that are seeing the most first-time purchases. The data signals where companies are pushing for greater efficiency.

Methodology: Data come from millions of aggregated, anonymized transactions on Ramp cards and invoices paid through Ramp Bill Pay, as well as trusted third-party sources. For year-over-year comparisons, our sample comprises customers who have been active with Ramp over that entire 12-month period. Quarter-over-quarter comparisons comprise customers who have been active with Ramp over the two quarters analyzed. Small SMBs represent companies with 1-24 employees. Large SMBs represent companies with 25-99 employees. Mid-market companies range from 100 to 999 employees.

Aug 12 correction: An earlier version of this article incorrectly identified Cursor as Instill AI. Instill AI is an old domain name for the company.

“We’ve simplified our workflows while improving accuracy, and we are faster in closing with the help of automation. We could not have achieved this without the solutions Ramp brought to the table.”

Kaustubh Khandelwal

VP of Finance, Poshmark

“Our previous bill pay process probably took a good 10 hours per AP batch. Now it just takes a couple of minutes between getting an invoice entered, approved, and processed.”

Jason Hershey

VP of Finance and Accounting, Hospital Association of Oregon

“When looking for a procure-to-pay solution we wanted to make everyone’s life easier. We wanted a one-click type of solution, and that’s what we’ve achieved with Ramp.”

Mandy Mobley

Finance Invoice & Expense Coordinator, Crossings Community Church

“We no longer have to comb through expense records for the whole month — having everything in one spot has been really convenient. Ramp's made things more streamlined and easy for us to stay on top of. It's been a night and day difference.”

Fahem Islam

Accounting Associate, Snapdocs

“It's great to be able to park our operating cash in the Ramp Business Account where it earns an actual return and then also pay the bills from that account to maximize float.”

Mike Rizzo

Accounting Manager, MakeStickers

“The practice managers love Ramp, it allows them to keep some agency for paying practice expenses. They like that they can instantaneously attach receipts at the time of transaction, and that they can text back-and-forth with the automated system. We've gotten a lot of good feedback from users.”

Greg Finn

Director of FP&A, Align ENTA

“The reason I've been such a super fan of Ramp is the product velocity. Not only is it incredibly beneficial to the user, it’s also something that gives me confidence in your ability to continue to pull away from other products.”

Tyler Bliha

CEO, Abode