Ramp Rewind: Speeding up finance with travel spend controls, receipt matching integrations, and more

- Freedom to book travel on your preferred platform with spend controls and real-time visibility

- Ramp automatically matches spend to receipts through our effortless integrations.

- Sync cashback and statement payments to your ERP

- Leverage the success of your sales to attain higher card limits

- All your transaction questions answered, all in one view

Editor’s note: We publish quarterly Ramp Rewind posts to get you up to speed on the latest product features and updates.

We pride ourselves on moving fast—it’s built into our company DNA. We’ve moved with lightning speed on shipping features that can improve your user experience and help take your business to the next level.

But one thing we’ll never sacrifice for speed is accuracy. It’s important to move quickly, but only if that speed helps guide your business toward superior results.

That’s why we’re focused on features that are fast but also incredibly accurate. Powerful integrations, automated receipts, and enhanced visibility in the audit process are all here to help you gain the insights you need to drive better business outcomes.

Freedom to book travel on your preferred platform with spend controls and real-time visibility

Your expense policy should move at the pace of your fastest employee. Ramp’s open travel solution is designed for speed and accuracy, while still providing spend controls and visibility.

Employees can book their flight or hotel with your expense policy requirements built into the transaction—and since speed alone isn’t worth the pain of inaccurate reporting, automatic receipt integrations with companies like Lyft allow for an even more seamless experience.

Ramp automatically matches spend to receipts through our effortless integrations.

Chasing down employees for receipts can be a time-consuming and frustrating experience. But Ramp streamlines this process via automatic receipt matching for the platforms you use most, such as Gmail, Amazon Business, and Lyft.

Never dig through your overflowing inbox for a receipt again. Ramp seamlessly matches the spend so you can allocate your valuable time toward more strategic activities.

Sync cashback and statement payments to your ERP

Rewards should never create more work for you. Keep track of all your earned cash back by automatically and accurately syncing it to your ERP. Ramp does all the heavy lifting by accurately syncing card payments and cashback.

Leverage the success of your sales to attain higher card limits

Traditional corporate cards have limits that may not work for every business. For example, businesses like e-commerce, which rely on inventory, may require more flexibility to run efficiently. Ramp solves this issue by increasing the credit limit up to 30x those of legacy cards. We’ll underwrite based on your sales when you connect your commerce platform to Ramp, eliminating the need for large bank balances and years of financial statement history.

View your spend in real time across your business either with a macro view of all spend or by drilling down deeper into specific categories like advertising or shipping. You’ll feel empowered to make more informed business decisions that can provide your business with a competitive advantage.

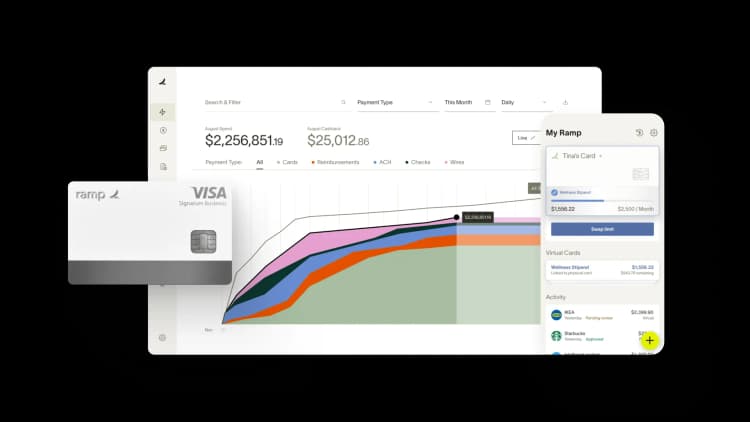

All your transaction questions answered, all in one view

Who, what, when, where, and why are all questions you probably ask yourself when it comes to employee spend. Ramp’s event history provides a clear snapshot that allows you to answer these questions at a glance.

We’ve eliminated manual detective work by consolidating spend history and providing an audit trail on both the card and transaction level.

Cardholders and managers can also use this view to quickly answer their own questions about transactions such as why something was out of policy and whether a reimbursement has been completed. Say goodbye to email trails and follow up reminders with transaction histories, approvals, and memos all in one place.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits