Startup valuation guide: 6 methods for valuing a startup during a market downturn

- What is a startup valuation?

- What determines a startup’s valuation?

- 6 startup valuation methods to consider for your startup

Startup valuation can be a complex undertaking for first-time founders. Even the best valuations are mere estimates of your company’s value, especially when you account for fluctuating markets and the uncertain nature of startups themselves.

Take, for example, the stark difference between last year’s venture capital (VC) funding efforts and this year’s. Due to the current market downturn, average startup valuations have decreased across the board. In a recent Crunchbase article, Mark Sherman, Telstra Ventures’ managing director, noted:

“If you are a special company, you are still getting the valuation you want. But I would say the more ‘meat and potato’ companies are probably down 20% in January-February in relation to November-December—some more, some less.”

Despite these reductions in VC funding, it’s still important for entrepreneurs to understand how valuations work if you want to be prepared for future fundraising talks. Here, we offer a high-level overview of 6 of the most popular startup valuation methods and how to use them to value your startup.

What is a startup valuation?

Startup valuation is the calculation of a startup’s value based on factors like the company’s industry and sector, development stage, customer base, and founding team.

Although some traditional business valuation methods can be used to appraise these companies, startup valuation methods were developed for the unique needs and constraints that these businesses face. For instance, in pre-revenue startups where the company has made little to no revenue yet, traditional valuation methods relying on revenue to estimate value don’t apply.

What determines a startup’s valuation?

The value of a startup company depends on many factors, but the following are some of the most important ones for investors and venture capital firms.

Revenue

A company that’s already earning revenue is easier for investors to value, while proof of financial growth is crucial for any startup seeking a high valuation.

Some investors will also prioritize revenue numbers over overall profits, especially if your company has high margins, as they expect the money will be reinvested into the business. As a result, they may invest in these startups with the expectation that they won't make a profit in their first few years.

User or customer base

Having a strong customer base or loyal network of users shows that people are willing to pay for your offering and stay with your company long-term. Even if you aren’t making money yet, investors know that it’s much easier to monetize existing offerings when you have a large number of users already supporting and using your product.

Growth potential

Investors want to know you have a strategy in place that addresses any obstacles, risks, and competition that could affect the success of your startup. A well thought-out business plan that shows the short-term and long-term goals for your company—and how you intend to reach them—can instill confidence in potential investors.

Founding team

The reputation of a startup’s founders and team should not be overlooked either. Investors may see founders with a good track record as less risky, since they’ll bring their past experiences and network with them to support this new venture. They’ll also scrutinize the rest of the founding team to ensure each person has the skills, experience, commitment, and culture fit to build a successful startup.

6 startup valuation methods to consider for your startup

Scorecard valuation method

This valuation model is especially useful for pre-revenue startups having trouble getting an accurate valuation. Use the average pre-money valuation (the value of a company before it receives any investments) of similar startups in your area and industry as your baseline. Then, score your company against the following criteria:

Adjust the percentages in the chart based on how important each factor is to the startup’s value. Then, compare your startup to your competitors on each of the factors. If your company ranks the same for a given factor, multiply the percentage by 100%. If it ranks above or below average, give it a proportional score above or below 100%.

Add all the factors together, and multiply the resulting sum by your initial average valuation to get your startup’s valuation.

Berkus method

Created by venture capitalist Dave Berkus, the method named after him is used to estimate valuations for pre-revenue startups by assigning dollar amounts to every milestone a founder reaches.

To use this method, take note of every milestone below that your company has hit, then add up the dollar amounts to get your startup’s estimated value.

Although this approach sets a limit on your valuation, it offers a simple way for entrepreneurs to estimate the value of their venture when they’re just starting out.

Risk factor summation method

Similar to the previous two methods, this one compares a startup against a list of characteristics. In comparison to the previous methods, though, this one assesses how various risks can affect a company’s success. It’s a great approach for newer startups that may not have all of the information they need to execute a more sophisticated valuation of their business.

You’ll need an initial valuation of your company to start (perhaps calculated through one of the other methods listed here). Then, increase or decrease that number by multiples of $250,000 based on whether the the following risks affect your business, and to what extent:

- Management

- Stage of the business

- Legislation / political risk

- Manufacturing risk

- Sales and marketing risk

- Funding / capital raising risk

- Competition risk

- Technology risk

- Litigation risk

- International risk

- Reputation risk

- Potential lucrative exit

If your company is negatively impacted by one of the above elements, subtract $250,000 from your initial valuation. Subtract $500,000 for elements that pose an even greater risk. If your company sees a positive impact from one of these elements, add $250,000 or $500,000 accordingly.

Comparable transactions method

In a process similar to the one used by homebuyers, this approach takes data from similar and recently-acquired startups to set the value of your company.

Start by comparing transaction data from similar companies in the same industry or sector as you, then adjust the estimate based on any differentiating factors that impact the value of your business. For instance, if your startup has a significantly smaller customer base than the company you’re using as a comparison, then you’ll need to lower your estimate to account for that.

This method can be used by any startup. However, it may be difficult to find comparable data for similar acquired startups, as many of them don’t publicize the details of these transactions.

Cost-to-duplicate approach

This simple method looks at how much it would cost to replicate your business idea elsewhere from scratch, as savvy investors won’t invest any more than this amount into your startup. With this approach, the value of your startup is calculated by determining the fair market value of your physical assets, plus the costs that went into acquiring them.

Of course, this method doesn’t paint the whole picture of your startup’s current or future value, because the success of your venture also depends on your intangible assets. As a result, some investors may use this approach to lowball a company’s valuation.

Discounted cash flow method

The discounted cash flow approach, also known as the DCF method, helps entrepreneurs predict their company’s future cash flow and apply a discount rate to get their expected rate of return on investment. Because startups represent a significantly higher risk to investors than established companies, a higher discount rate is applied to the calculation.

But because this method uses financial forecasting, you may need a market analyst to properly utilize it—meaning this may not be a good option for founders who are just starting out.

For more information on different startup valuation methods, start by reading this blog post from investor relationship management company Visible.

Although many of these methods work great for pre-revenue or early-stage startups, in the future you may need to work with a service provider for 409A valuation analyses and other needs. In these cases, you may decide to work with companies like Carta or PitchBook for a more accurate valuation for your startup.

Make your funding dollars go further with Ramp

Of course, the most foolproof way to raise funds for your company is by listening and delivering value to your customers—accurate valuations and investor offers will follow.

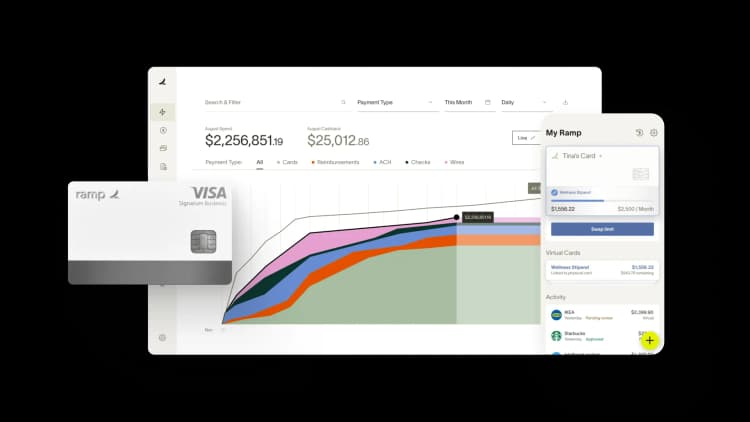

In the meantime, though, it’s important to manage your existing funds properly, so you can reduce burn and achieve the best valuation possible. By showing you where your money is being spent, Ramp’s corporate card for and accounting software for startups can help you streamlining operations, grow sustainably, and later on, make the most of VC and programmatic funding.

To learn how Ramp can help you save time and money during fundraising and beyond, take a tour of our product today.

FAQs

An equity investor invests money into a company, typically in exchange for a share of ownership in the business. Although there is no guarantee that they’ll get a return on their investment, they expect their shares to increase in value over time with the growth of the company.

Once you’ve validated your startup idea, you can use one (or more) of the above methods to value your startup. In fact, investors recommend using multiple methods to help you get a better sense of your startup’s real value and future potential.

Startups are more difficult to assess than their traditional business counterparts, specifically because of the lack of information available on the company’s trajectory. So, the more business data you have, the more accurate your valuation becomes.

A good startup valuation is one that allows both founders and investors to do their best work for the company.

On the founder side, a good valuation gives entrepreneurs the money they need to reach the appropriate milestones for their development phase. It also allows them to spend more time on growing their business and less time on fundraising.

Similarly, a good startup valuation for investors ensures they’re able to provide input on the growth and direction of the company—without alienating the founders with an overly-large ownership stake.

For more information, this resource from Fundz offers a look at average startup valuations by funding round in recent years.

A low valuation gives startups more room to maneuver and less pressure from investors than if they had received a much higher valuation. A low valuation may also make an acquisition easier and more profitable for founders.

And even if you receive a lower valuation than expected, it may be advantageous in the long run. Having even one investor represents a vote of confidence in your company, which can be hard to come by as a new startup without much of a reputation or revenue. This one investor can eventually pave the way for more funding down the road.

Starting with a high valuation can make it difficult for founders to meet the new milestones expected of the company. This is because startups are expected to grow in proportion to the raise amount and raise even more money in every subsequent funding round.

If you plan on selling your company in the future, a high valuation also means that the sale price of your company must meet certain thresholds to get the approval from your investors. If they won’t receive the profit they expect from the transaction, they may veto the acquisition entirely.

By default, most pre-revenue startups have a negative valuation because they haven’t made any money yet.

But because investors are more interested in the future value of a company, a negative valuation doesn’t necessarily represent the full picture of a startup’s value. Investors also consider factors such as the reputation of the brand or founder, the startup’s customer base, the hotness of the industry, and more when they evaluate potential investments.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits