Accounting for startups: Everything you need to know

- What is startup accounting?

- Cash vs. accrual accounting for startups

- Financial statements for startups

- Key metrics every startup should track

- Setting up your startup’s accounting system

- Best accounting software for startups

- Bookkeeping best practices for startups

- Common bookkeeping mistakes to avoid

- Tax planning and compliance

- Preparing for investors and due diligence

- When to upgrade your accounting function

- Automate startup accounting with Ramp's AI-powered platform built for visibility and control

Startup accounting is the process of managing your company’s financial transactions so you can maintain accurate records and clearly communicate financial health to investors and stakeholders. As a founder, you’re balancing product development, customer acquisition, and team growth, and accounting often slips down the priority list as a result.

That’s a costly mistake. According to CB Insights, 38% of startups fail due to cash flow problems. Solid accounting and bookkeeping practices give you the visibility you need to make informed decisions, stay compliant, and build investor confidence from day one.

What is startup accounting?

Startup accounting is the process of tracking, recording, and analyzing your company’s financial transactions from day one. It covers everything from logging expenses and revenue to preparing financial statements and managing cash flow, with the goal of maintaining accurate records that help you run the business and clearly communicate financial health to stakeholders.

Unlike traditional small business accounting, startup accounting comes with added complexity. You’re often managing investor capital, tracking burn rate, projecting runway, and preparing for multiple funding rounds at the same time.

Because many startups operate at a loss in their early stages while scaling quickly, accounting isn’t just about reporting past performance. It plays a central role in planning, cash management, and making informed decisions as your company grows.

Cash vs. accrual accounting for startups

Cash and accrual accounting differ in when you record income and expenses, which can significantly affect how your startup’s financial health appears on paper.

Cash accounting records transactions only when money changes hands. You recognize revenue when payment hits your bank account and record expenses when bills are paid. Many early-stage startups start with cash accounting because it’s simpler and makes it easy to see exactly how much cash you have available.

Accrual accounting records transactions when they occur, regardless of when cash moves. If you invoice a customer in March but receive payment in April, accrual accounting recognizes that revenue in March, when it’s earned. Expenses follow the same principle, which creates a more accurate picture of ongoing performance.

As your startup grows, accrual accounting often becomes necessary. Once you raise significant funding, carry inventory, or approach $25 million in annual revenue, you’ll likely need to switch to accrual accounting. Generally accepted accounting principles (GAAP) require accrual accounting, which matters when investors review your financial statements.

The method you choose also affects how performance trends look over time. For example, billing $50,000 in December but collecting payment in January results in very different monthly revenue figures depending on the method you use. Cash accounting shows no December revenue and stronger January numbers, while accrual accounting reflects the revenue in December, when it was earned.

Is accrual accounting best for startups?

Most startups use cash accounting early on and switch to accrual as the business grows. Accrual accounting provides a clearer view of financial health and is preferred by accountants, investors, and lenders because it complies with GAAP.

Financial statements for startups

Three core financial statements give you a clear view of your startup’s financial health and help investors evaluate performance, risk, and sustainability.

Profit and loss statement

The profit and loss statement, also called an income statement, shows whether your startup made or lost money over a specific period. It lists revenue at the top, subtracts expenses, and ends with your net profit or loss.

For example, if your SaaS startup earns $100,000 in subscription revenue in a quarter but spends $150,000 on salaries, marketing, and cloud infrastructure, your P&L shows a $50,000 loss. This is common for early-stage startups that are investing heavily in growth before reaching profitability.

Balance sheet

The balance sheet shows what your startup owns, what it owes, and the value left for shareholders at a specific point in time. It follows a simple equation:

Assets = Liabilities + Equity

If your startup has $500,000 in cash, $50,000 in equipment, $20,000 in unpaid customer invoices, and $100,000 in outstanding vendor bills, your balance sheet shows $570,000 in assets and $100,000 in liabilities. The remaining $470,000 represents equity, which helps investors assess financial stability.

Cash flow statement

The cash flow statement tracks how cash moves in and out of your business through operating, investing, and financing activities. Unlike the P&L, it reflects actual cash movement rather than accounting entries.

Your startup might show a $75,000 profit on its P&L, but if customers haven’t paid their invoices yet, the cash flow statement may reveal only $30,000 collected. This statement is critical for monitoring runway and identifying potential cash shortages before they become serious problems.

Key metrics every startup should track

Beyond standard financial statements, these metrics help you measure growth, manage cash, and demonstrate traction to investors.

Burn rate and runway

Burn rate is how much cash your startup spends each month beyond what it earns. Runway is how long you can operate before running out of money. Together, they show how much time you have to reach profitability or raise your next funding round.

If you have $600,000 in the bank and spend $50,000 more than you earn each month, your burn rate is $50,000 and your runway is 12 months ($600,000 / $50,000). Many founders track these weekly and look for ways to extend runway by increasing revenue or reducing costs.

Customer acquisition cost (CAC)

Customer acquisition cost measures how much you spend on sales and marketing to acquire a single customer. You calculate it by dividing total sales and marketing expenses by the number of customers acquired during a given period.

This metric helps you assess whether your growth is sustainable. If you spend $10,000 on marketing and acquire 50 customers, your CAC is $200. Investors typically expect customer lifetime value to significantly exceed acquisition costs, especially for venture-backed startups.

Monthly recurring revenue (MRR) for SaaS

Monthly recurring revenue represents the predictable subscription revenue your SaaS startup expects each month. You calculate it by multiplying the number of paying customers by the average monthly subscription price.

MRR is a core metric for SaaS businesses because it highlights recurring income rather than one-time sales. For example, 200 customers paying $99 per month generate $19,800 in MRR, which investors often use to evaluate growth momentum and scalability.

Gross margin and unit economics

Gross margin shows how much revenue remains after covering the direct costs of delivering your product or service, expressed as a percentage. Unit economics focus on whether each sale is profitable after accounting for variable costs like hosting, support, or fulfillment.

These metrics reveal whether your business model can scale sustainably. SaaS companies often target gross margins of 70–80%, while e-commerce businesses may operate closer to 30–50%. Negative unit economics signal that you lose money on each sale, which needs to be addressed before scaling further.

Setting up your startup’s accounting system

Getting your accounting infrastructure right early saves time, reduces errors, and makes it easier to scale as your business grows. More than 535,000 new businesses were registered in the US in November 2025 alone, and many founders underestimate how quickly financial complexity can add up.

Choosing between DIY and professional help

Many founders handle basic bookkeeping themselves at the earliest stage, when transaction volume is low and budgets are tight. As soon as you raise funding, hire employees, or start generating meaningful revenue, outsourcing accounting often becomes the more practical option.

Common signs that it’s time to bring in professional help include:

- Missing tax deadlines or uncertainty about what you owe

- Disorganized records that don’t reconcile with bank statements

- Investor scrutiny that requires clean, review-ready financials

- Complex activity such as equity compensation, inventory, or multi-currency transactions

Typical costs range from $500–2,000 per month for bookkeeping services and $2,000–10,000 or more for year-end tax preparation or fractional CFO support, depending on complexity and volume. Many early-stage startups start with fractional services to balance cost control with expert guidance.

Opening business bank accounts

Separating personal and business finances protects your limited liability status, simplifies tax preparation, and signals professionalism to investors and partners. Open a dedicated business checking account as soon as your company is formed, and look for accounts that offer:

- Low or no monthly fees

- Easy integration with accounting software such as QuickBooks or Xero

- Sufficient transaction limits as you scale

- Multi-user access with permission controls

Many startups open separate accounts for operating expenses, tax reserves, and payroll. Keeping funds earmarked for taxes in a dedicated account helps prevent cash shortfalls and improves visibility into true operating cash.

Establishing a chart of accounts

A chart of accounts is the organized list of all financial accounts in your general ledger. It serves as the backbone of your accounting system, making reporting easier and giving you clearer insight into where money comes from and where it goes.

Most startups begin with a simple structure that includes assets, liabilities, equity, revenue, and expenses. SaaS companies may separate hosting and customer success costs, while e-commerce businesses often need more detailed inventory and fulfillment accounts. Start simple and add detail over time as your reporting needs become more sophisticated.

Best accounting software for startups

The right accounting software helps you automate routine tasks, reduce errors, and maintain real-time visibility into your startup’s financial health. As your business grows, the platform you choose should scale with increasing transaction volume, more users, and more complex reporting needs.

Key features to prioritize include integration with your bank and payroll systems, flexibility as your operations expand, and reporting that produces investor-ready financial statements without heavy manual work.

QuickBooks Online

Capterra: 4.3 out of 5 | G2: 4.0 out of 5

QuickBooks Online offers a broad set of tools for bookkeeping, invoicing, expense tracking, and tax preparation. Its tiered plans support everything from basic bookkeeping to more advanced needs such as inventory tracking, project profitability, and revenue recognition, making it a common choice as startups scale.

Pros:

- Accessible from anywhere with an internet connection

- Strong integration ecosystem

- Familiar interface for many accountants

Cons:

- Higher payment processing fees than some alternatives

- Costs increase significantly at higher tiers

- Payroll management may require add-ons or manual workflows

Pricing:

- Simple Start: $19/month

- Essentials: $37.50/month

- Plus: $57.50/month

- Advanced: $137.50/month

Xero

Capterra: 4.4 out of 5 | G2: 4.4 out of 5

Xero is known for its clean interface and strong reporting capabilities. It includes bank feeds, customizable reports, online payments, and automated sales tax handling across all plans, which makes it appealing for startups that want simplicity without sacrificing insight.

Pros:

- Intuitive user experience

- Robust financial reporting

- Effective for small and growing businesses

Cons:

- Report customization can feel limited

- Mobile app lacks some desktop features

- Pricing increases over time

Pricing:

- Early: $25/month

- Growing: $55/month

- Established: $90/month

FreshBooks

Capterra: 4.5 out of 5 | G2: 4.5 out of 5

FreshBooks focuses on invoicing, expense tracking, and client management, making it a strong option for service-based startups. Its interface is easy to navigate, and it offers features that support billing workflows and client communication.

Pros:

- Simple expense tracking

- Strong customer support

- Easy invoicing workflows

Cons:

- Reporting can feel overly complex for some users

- Electronic payments don’t work with all banks

- Frequent product changes may require adjustment

Pricing:

- Lite: $21/month

- Plus: $38/month

- Premium: $65/month

- Select: Variable pricing

Zoho Books

Capterra: 4.4 out of 5 | G2: 4.4 out of 5

Zoho Books offers robust automation for invoicing, expense tracking, and bank reconciliation, along with detailed financial reporting. It’s particularly appealing for startups already using other Zoho products or operating with tight budgets.

Pros:

- Automates invoicing and expense tracking

- Detailed reporting and payment reminders

- Generous free tier for very small teams

Cons:

- Steeper learning curve than some alternatives

- Limited third-party integrations

- User caps across pricing tiers

Pricing:

- Free: $0/month

- Standard: $20/month

- Professional: $50/month

- Premium: $70/month

- Elite: $150/month

- Ultimate: $275/month

Bookkeeping best practices for startups

Consistent bookkeeping keeps your financial records accurate, simplifies tax preparation, and gives you reliable data for day-to-day decisions. These habits don’t require much time when done regularly, but falling behind can create significant cleanup work later.

Key practices to put in place early include:

- Establish a regular bookkeeping schedule: Log transactions daily, review accounts weekly, and reconcile bank statements monthly

- Create a document retention system: Organize receipts, invoices, contracts, and bank statements to support audits and tax filings

- Categorize expenses correctly: Assign transactions to the right accounts so reports reflect true spending patterns and deductions aren’t missed

- Capture receipts as expenses occur: Record expenses immediately instead of reconstructing them weeks later

- Reconcile accounts regularly: Match accounting records to bank and credit card statements monthly to catch errors and maintain accurate cash balances

These routines help ensure your books are complete and trustworthy, which becomes increasingly important as transaction volume grows and outside stakeholders start reviewing your financials.

Common bookkeeping mistakes to avoid

Even careful founders make bookkeeping mistakes that create problems during tax season, investor due diligence, or financial planning. Avoiding these common issues early can save time, money, and stress later.

- Mixing personal and business expenses: Using personal cards for business purchases or vice versa creates confusion at tax time. Open dedicated business accounts and use them exclusively for company transactions.

- Failing to track small expenses: Small purchases like meals or software subscriptions add up quickly and are legitimate deductions. Capture every business expense to understand true spending and maximize tax savings.

- Neglecting expense categorization: Dumping transactions into generic categories makes it harder to spot cost patterns or prepare accurate financial statements. Take a moment to assign the correct category to each transaction.

- Waiting too long to reconcile accounts: Letting months pass before reconciling increases the risk of errors and fraud. Monthly reconciliation keeps records accurate while transactions are still fresh.

- Ignoring accounts receivable aging: Outstanding invoices hurt cash flow and can leave money uncollected. Review your AR aging regularly and follow up on late payments promptly.

Tax planning and compliance

Staying on top of tax obligations protects your startup from penalties, preserves cash, and keeps you in good standing with federal and state authorities. Early planning also makes it easier to forecast cash needs and avoid surprises as your business grows.

Understanding your tax obligations

Your startup may be responsible for federal income tax, state income tax, and local business taxes, depending on where you operate. C corporations pay corporate income tax, while LLCs and S corporations typically pass income through to owners, who report it on their personal returns.

As a founder, you’ll likely need to make quarterly estimated tax payments using Form 1040-ES if taxes aren’t withheld from your income. Missing these payments can lead to penalties and a large balance due at year end.

Once you hire employees, you’re responsible for payroll taxes, including Social Security, Medicare, and unemployment taxes. You’ll withhold taxes from employee paychecks, issue W-2 forms each year, and file 1099 forms for contractors you pay $600 or more annually. Payroll tax mistakes carry serious penalties, which is why many startups outsource payroll early.

Tax deductions startups often miss

Thoughtful tax planning helps you keep more cash in the business to fund growth and extend runway. Commonly overlooked deductions include:

- Home office deductions: Deduct a portion of rent, utilities, internet, and insurance if part of your home is used exclusively for business

- Research and development credits: Federal and state R&D credits can offset costs tied to product development, process improvements, and prototyping

- Startup and organizational expenses: Deduct up to $5,000 in startup costs and $5,000 in organizational expenses in your first year, then amortize the rest over 15 years

- Equipment and software purchases: Computers, office furniture, and software subscriptions are generally deductible, and Section 179 allows immediate expensing of many equipment purchases

Working with a CPA who specializes in startups can help you identify deductions and credits specific to your business model and avoid costly compliance mistakes.

Preparing for investors and due diligence

Investors closely examine your financial records during due diligence, so clean books and organized documentation matter well before you start fundraising. They typically expect profit and loss statements, balance sheets, cash flow statements, cap tables, and bank statements covering the past 12–24 months. When your accounting is accurate and current, you can answer questions quickly, reduce friction, and help deals move faster.

Disorganized or unreliable financials raise red flags. Common issues include inconsistent revenue recognition, missing documentation for large expenses, unexplained cash flow gaps, and personal expenses mixed with business transactions. Unreconciled accounts or frequent adjustments to prior periods can also undermine investor confidence.

Strong preparation goes beyond clean books. Financial projections should be grounded in real metrics and realistic assumptions about customer growth and costs. Basic controls such as approval workflows, regular reconciliations, and documented processes create clear audit trails and demonstrate that you can manage investor capital responsibly.

When to upgrade your accounting function

You've outgrown your current accounting setup when closing monthly books takes weeks instead of days, you can't answer basic financial questions without digging through spreadsheets, or your bookkeeper is overwhelmed by transaction volume. Other signs include preparing for an audit, expanding internationally, or needing sophisticated cash flow forecasting that your current system can't handle.

As you scale past Series A, consider bringing on a fractional or full-time CFO who can provide strategic financial guidance beyond basic bookkeeping. A CFO helps with fundraising, board reporting, financial modeling, and building relationships with banks and investors. They'll also implement proper financial controls and help you make data-driven decisions about resource allocation and growth strategies.

Building an in-house finance team typically starts with hiring a controller or senior accountant to manage day-to-day accounting operations, followed by financial analysts as complexity increases. Most startups reach this stage after raising Series B or hitting $10–$20 million in annual revenue. The right timing depends on your transaction volume, business model complexity, and reporting requirements.

Sophisticated financial planning and analysis (FP&A) becomes valuable when you need scenario planning for different growth trajectories, detailed unit economics analysis, or department-level budget management. Advanced FP&A helps you model the financial impact of strategic decisions such as expanding to new markets, launching products, or adjusting pricing.

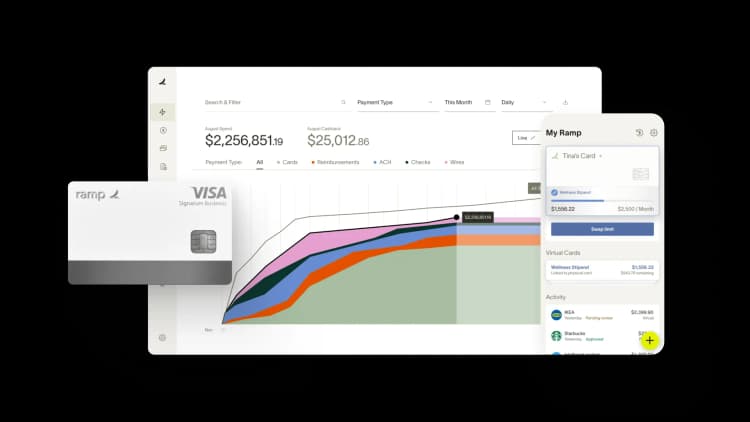

Automate startup accounting with Ramp's AI-powered platform built for visibility and control

Startups need real-time cash visibility and compliant accounting from day one, but manual processes make it nearly impossible to track spend, close books on time, or scale operations efficiently. Ramp's accounting automation software eliminates these bottlenecks by automating transaction coding, receipt collection, and month-end close so you can focus on growth instead of chasing receipts.

Ramp codes every transaction automatically as it posts, learning your accounting patterns and applying feedback across all required fields. You'll see a 67% increase in zero-touch codings compared to rules-only systems, which means fewer manual entries and faster close cycles. Ramp also collects receipts automatically through email forwarding, text uploads, and mobile capture, then matches them to transactions in real time so you never scramble for documentation during audits.

Here's how Ramp supports compliant startup accounting:

- Real-time spend visibility: Track cash flow across cards, reimbursements, and bills in one unified dashboard

- Automated policy enforcement: Set spend limits and approval workflows that prevent out-of-policy transactions before they happen

- Audit-ready records: Maintain complete transaction histories with receipts, approvals, and coding details stored automatically

Try a demo to see how startups build scalable accounting operations with Ramp.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits