Supplier management: Definition, process, and cost-saving strategies

- What is supplier management?

- Why supplier management matters

- 9 supplier management strategies that cut costs

- How to choose supplier management features that drive savings

- Tracking the impact: KPIs every finance team should monitor

- Enhance your supplier management with Ramp

Supplier management has evolved from a back-office task into a strategic lever for controlling costs and strengthening supplier relationships. In a business environment where inflation pressures margins and supply chain disruptions remain common, effective supplier management helps procurement teams stay ahead instead of reacting to issues later.

According to BCG, companies leveraging AI-powered procurement tools are already seeing 15–45% savings in procurement costs, while their competitors struggle with spreadsheet chaos and manual processes.

What is supplier management?

Supplier management encompasses all activities involved in selecting, onboarding, monitoring, and optimizing vendors throughout their lifecycle to maximize value and reduce risk. It gives procurement and finance teams a structured way to extract more value from every dollar spent while protecting the organization from operational and compliance issues.

A strong supplier relationship management framework supports these activities by promoting collaboration, consistency, and long-term value across your supplier base.

Market context

The procurement landscape is evolving quickly as companies digitize vendor relationships. The e-sourcing software market is expected to grow at a 9% CAGR through 2031, according to Verified Market Research, reflecting the shift toward smarter, more automated sourcing.

AI adoption has accelerated as well. According to a Wharton School survey, 94% of procurement professionals now use AI at least once a week to streamline tasks and surface insights. At the same time, new environmental, social, and governance (ESG) regulations are requiring teams to rethink supplier strategies and improve documentation.

The shift from transactional purchasing to strategic supplier management represents one of the biggest opportunities for cost savings and operational stability that many companies may see this decade.

Key components of supplier management

Understanding the supplier lifecycle helps you identify where modern procurement tools can make the biggest impact:

- Discovery and prequalification: Finding and vetting potential suppliers against your requirements

- Onboarding and risk checks: Collecting documents, risk scores, and bank details before a supplier can be paid

- Contracting and ordering: Negotiating terms, creating purchase orders (POs), and managing catalog items

- Performance management: Tracking delivery, quality, and compliance metrics over time

- Renewal or exit: Deciding whether to continue, renegotiate, or end supplier relationships

Supplier management vs. vendor management vs. procurement

These related terms are often used interchangeably, but they each play a distinct role within sourcing:

| Function | Primary focus | Goal | Common activities |

|---|---|---|---|

| Supplier management | Strategic oversight of supplier relationships across the lifecycle | Maximize long-term value and reduce risk | Performance tracking, relationship management, contract optimization |

| Vendor management | Day-to-day management of service providers and operational vendors | Ensure service delivery and compliance | Service level agreement (SLA) tracking, issue resolution, payment coordination |

| Procurement | Transactional purchasing and sourcing processes | Acquire goods and services at the best price and terms | Purchase order creation, bidding, contract negotiation |

You can use vendor management software or broader supplier relationship management platforms to connect these functions and automate supplier tracking, onboarding, and performance analytics.

Why supplier management matters

The value of supplier management goes beyond contracts and compliance. It’s a core driver of savings, stability, and operational efficiency across your business.

Cost-saving strategies

Supplier management directly impacts your bottom line by uncovering savings opportunities. Centralized supplier data helps you identify pricing inconsistencies, eliminate maverick spending, and consolidate purchases for volume discounts.

Stronger processes also improve your leverage during negotiations. With clear historical data and supplier performance insights, you can push for better pricing and payment terms. Over time, these improvements add up to measurable, repeatable savings across categories.

Risk mitigation benefits

Effective supplier management helps you avoid compliance issues, quality problems, and costly disruptions. Automated supplier risk monitoring lets you spot early warning signs, such as financial instability or ESG violations, and address them before they escalate.

Maintaining a diverse, well-vetted supplier base also protects your operations if a key vendor fails or global conditions shift unexpectedly.

Operational efficiency gains

Digitizing supplier processes makes everything run more smoothly, from onboarding new vendors to approving payments. Automation reduces manual data entry and can cut purchase order cycle times significantly, giving your team more time to focus on strategic work.

Real-time visibility into spend and supplier performance also helps you make faster decisions, collaborate more easily across departments, and stay proactive rather than reactive.

9 supplier management strategies that cut costs

These 9 data-driven strategies show exactly how to cut costs, boost efficiency, and improve performance across your vendor network:

1. Centralize supplier data for a single source of truth

Fragmented supplier information spread across spreadsheets, email threads, and disconnected systems creates hidden cost drains. When your team can’t quickly access contract terms, historical pricing, or performance data, you negotiate from a weaker position and miss savings opportunities.

Integrating data from your enterprise resource planning (ERP) system, corporate cards, and accounts payable tools into a unified view solves this problem. Modern procurement platforms like Ramp consolidate supplier records from multiple sources into a single dashboard, making patterns easier to spot.

2. Automate onboarding and qualification with AI checks

Manual supplier onboarding consumes time and increases the risk of missed documentation or inconsistent verification. AI-powered Know Your Business (KYB) checks help teams verify legal status, ownership, and sanctions exposure quickly and accurately.

Automated systems can manage document collection, tax ID verification, insurance validation, and sanctions screening without manual intervention. This reduces onboarding times, ensures consistent compliance standards, and lowers the risk of approving sanctioned or high-risk entities.

3. Use performance scorecards to enable data-backed negotiations

Subjective vendor relationships often lead to subjective pricing. Performance scorecards solve this by quantifying delivery timeliness, quality, invoice accuracy, and responsiveness.

For example, a manufacturing company discovered that its preferred vendor had a 73% on-time delivery rate while a backup supplier averaged 95%. With this data, they negotiated a 7% rebate from the primary vendor and moved 30% of volume to the higher-performing supplier, saving $340,000 annually on a $5 million category.

4. Consolidate spend to preferred suppliers for volume discounts

Tail spend—the many small suppliers that make up a small share of spend—reduces leverage and increases transaction costs. Consolidating purchases with preferred suppliers can unlock meaningful volume discounts.

| Scenario | Annual spend | Number of suppliers | Average discount | Total cost |

|---|---|---|---|---|

| Fragmented | $1,000,000 | 50 | 5% | $950,000 |

| Consolidated | $1,000,000 | 10 | 18% | $820,000 |

| Savings | $130,000 |

The key is identifying categories where multiple suppliers offer similar goods or services, then consolidating strategically while maintaining supply security.

5. Trigger competitive bids with predictive market insights

AI-driven procurement tools monitor commodity indices, currency movements, and market conditions to identify optimal buying windows. For example, when aluminum prices fall or the U.S. dollar strengthens against a supplier’s currency, automated alerts can prompt an RFQ to secure better pricing.

This moves procurement from reactive to proactive. Instead of discovering price drops during renewal discussions, you can time negotiations with favorable market conditions and capture immediate savings.

6. Tie contracts to dynamic pricing and inflation clauses

Static multi-year contracts can become costly during inflation spikes. Including dynamic pricing tied to recognized indices such as the Producer Price Index or commodity benchmarks ensures pricing adjusts fairly within predefined thresholds.

Modern procurement software can monitor these indices and trigger notifications when thresholds are reached. This protects suppliers during inflationary periods and prevents unexpected 20–30% price increases at renewal.

7. Integrate purchase orders with cards and AP for real-time controls

The traditional procure-to-pay (P2P) process often creates control gaps because purchase orders are approved separately from actual spend. Connecting POs directly to virtual cards closes these gaps.

When Ramp issues a virtual card tied to a specific PO, the system automatically enforces approved amounts, matches invoices to receipts, flags overspend, and blocks unauthorized transactions. This reduces maverick spending and provides real-time visibility into budget consumption.

8. Embed ESG metrics to avoid non-compliance penalties

ESG compliance has shifted from optional to required in many regions. New regulations now mandate carbon reporting and social compliance verification, with penalties reaching 5% of global revenue, according to the World Economic Forum.

Embedding ESG scoring into supplier selection and monitoring helps you avoid fines and surface cost-efficient alternatives that align with sustainability goals.

9. Forecast demand and inventory with supplier collaboration portals

Rush orders and stockouts lead to premium freight costs and production delays. Supplier collaboration portals support joint demand planning by sharing forecast data, inventory levels, and production schedules in both directions.

This visibility enables suppliers to anticipate your needs, offer better pricing for predictable volume, and reduce the bullwhip effect that amplifies small shifts in demand into larger disruptions.

How to choose supplier management features that drive savings

The right software can turn supplier management from a manual process into a performance engine. Here’s what to look for in a platform that supports savings, compliance, and efficiency.

Must-have capabilities for procurement teams

Not all procurement software delivers equal value. Prioritize tools that offer:

- AI-based risk scoring: Continuous monitoring of financial health, compliance status, and performance metrics

- Self-service supplier portals: Reduce administrative work by allowing suppliers to update their own information

- Integrated PO and card workflows: Close control loops between approval and payment

- Contract repository with alerts: Ensure you never miss a renewal or renegotiation window

- Custom approval paths: Adapt workflows to your organization’s requirements

- Mobile-first approvals: Support fast decisions without desktop dependency

Data integrations and analytics to look for

A supplier management platform is only as strong as its data connections. Look for:

- Pre-built connectors to major ERPs such as SAP, Oracle, and NetSuite

- Real-time card transaction feeds

- AP system integration for invoice matching

- Compatibility with business intelligence tools

- Open APIs for custom integrations

Key analytics outputs should include touchless invoice rate (with a target above 80%) and real-time budget burn dashboards that reduce the risk of overruns.

Security, compliance, and governance questions to ask vendors

Before adopting a procurement platform, evaluate its approach to data protection and oversight:

- Is data encrypted in transit and at rest using industry-standard protocols?

- What SOC 2 controls are in place, and can you provide audit reports?

- How is supplier personally identifiable information (PII) segregated and protected?

- Can you provide complete audit trails of all user actions and system changes?

- Do you support role-based access controls for multi-entity organizations?

Tracking the impact: KPIs every finance team should monitor

Measuring supplier performance and process efficiency helps you prove ROI and identify improvement opportunities. Tracking both financial and operational KPIs shows which suppliers create value and where performance or compliance gaps may be costing you money.

Hard-dollar savings formula

Quantifying supplier management ROI requires tracking both direct and indirect savings:

Total savings = (Price reductions * Volume) + Process cost savings

Example calculation:

- Negotiated 5% price reduction on $1.5 million annual spend = $75,000 savings

- Consolidated from 20 to 5 suppliers, saving 100 hours per month at $50 per hour = $60,000 savings

- Total annual savings = $135,000

Essential supplier KPIs

Beyond cost reductions, performance and efficiency metrics reveal how well your supplier network operates. Key indicators include:

- On-time delivery rate: Measures reliability; target 95% or higher for critical materials

- Quality rate: Tracks defect or return percentages; leaders maintain under 1% defect rates

- Cycle time: Days from requisition to payment (target under 5 days for standard orders)

- Touchless invoice rate: Percentage of invoices processed with zero human intervention (target above 80%)

- Cost competitiveness: Compares current supplier pricing to market averages

- ESG compliance rate: Percentage of suppliers meeting sustainability and ethics standards (target 100% for tier-one suppliers)

- Audit resolution time: Average days to resolve findings (target under 30 days)

- Duplicate or fraudulent payments: Indicator of process control (goal: zero)

Creating supplier scorecards

Weighted supplier scorecards help standardize evaluations across cost, quality, delivery, and compliance. Assign heavier weights to the factors most important to your operations.

A simple scoring structure might look like this:

| Category | Example metrics | Weight | Scoring method |

|---|---|---|---|

| Cost | Price competitiveness, cost savings | 30% | % variance vs. target |

| Quality | Defect rate, return rate | 25% | % of items meeting spec |

| Delivery | On-time delivery rate | 25% | % on-time shipments |

| Compliance | ESG adherence, documentation completeness | 20% | % compliant vendors |

Addressing performance issues

When a supplier underperforms, early intervention matters. Start with a structured review to discuss scorecard results and agree on a corrective action plan outlining targets, timelines, and responsibilities.

If issues persist, reduce order volume, introduce performance clauses, or evaluate alternative suppliers. The goal is not to penalize vendors but to create accountability and support long-term improvement.

Maintaining open communication turns short-term transactions into long-term partnerships. Regular performance reviews, transparent data sharing, and collaboration tools help align expectations and build trust.

Risk and compliance indicators

Monitor these risk metrics to avoid costly surprises:

- Percentage of suppliers with completed risk profiles (target 100% for critical suppliers)

- Number of ESG non-conformities identified and remediated

- Average days to resolve audit findings (target under 30 days)

- Incidents of duplicate or fraudulent payments (goal: zero)

Enhance your supplier management with Ramp

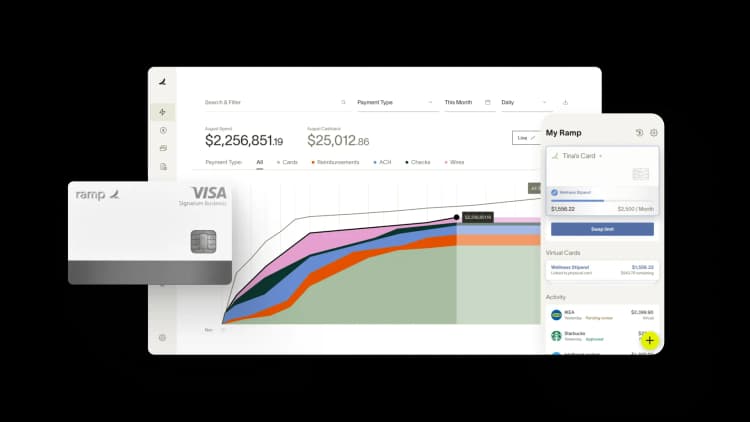

Effective supplier management means moving beyond spend tracking to use data as a strategic tool for savings, transparency, and strong relationships with vendors. After applying strategies to centralize data and automate processes, Ramp’s vendor management software helps you take the next step with complete visibility and control.

- Track all vendor data in one place: We automatically log transactions for every business you pay, letting you search, filter, and analyze spend to find savings opportunities

- Instantly record and manage contracts: Extracts key contract details, like SKU names, start and end dates, and renewal terms, so you always have accurate information at your fingertips

- Stay ahead of renewals: Get automatic reminders 60 and 30 days before contracts expire, giving you time to renegotiate or adjust usage before renewal

- Eliminate wasted software spend: Our Seat Intelligence connects to Okta to surface inactive licenses, usage trends, and cost-per-user data for smarter optimization

- Negotiate better pricing with market data: Our Price Intelligence benchmarks your software costs against millions of real transactions, helping you instantly see whether you’re getting a fair deal

With Ramp, you gain the visibility, automation, and intelligence to manage suppliers efficiently. Learn more with a free interactive demo.

FAQs

The key steps include sourcing, onboarding, performance management, and supplier relationship management.

By fostering supplier collaboration, aligning suppliers with business needs, and managing supplier performance, SRM drives better cost savings and reduces supply risk.

Businesses evaluate supplier performance using KPIs such as on-time delivery rate, product quality, and cost efficiency.

A great supplier management process utilizes data for decision-making instead of intuition. Data-driven insights paired with automation help you build transparent supplier relationships since stakeholders can view performance via KPIs.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°