How Ramp is dedicated to supporting businesses with their banking needs

- Businesses deserve a banking provider they can rely on

- Ramp is here to bolster your financial stability

- A smarter way to manage your finances

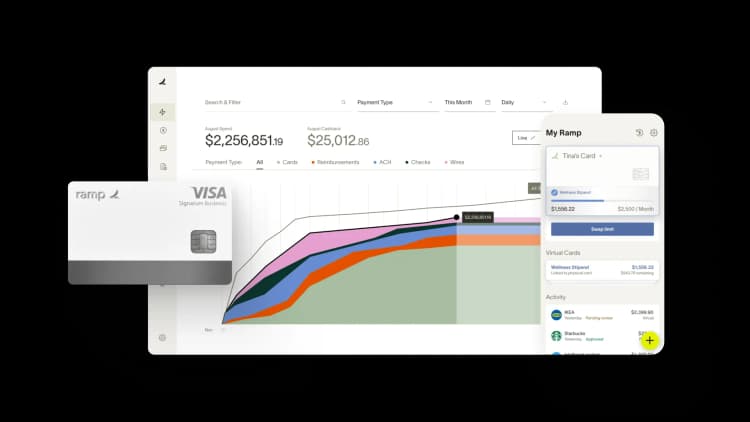

Over the last week, we’ve been working hard to ensure Ramp customers retain stable spend limits and minimize business disruption. Many of them are now grappling with transferring their entire banking operations to new platforms while simultaneously maintaining cash flow. Today, we're announcing that we have expanded our solutions to give customers more control over their finances. With Ramp, businesses can find trusted banking providers with our priority referral program and have the freedom to connect multiple bank accounts to one centralized spend management platform to reduce their risk.

"We pay our customers government fees by check, and the bank collapse put all those payments in limbo. Ramp was able to increase our limit in 24 hours and connect our new bank account quickly, so our families can continue on their immigration journey."- Xiao Wang, CEO & Co-Founder, Boundless Immigration

Businesses deserve a banking provider they can rely on

Right now, businesses everywhere are looking for better ways to safeguard and manage their assets. Events from this past week have shined a huge spotlight on the importance of financial diversification and risk management.

Our data shows Ramp customers are changing their banking habits. Many are moving to new banks, with 3-8% asset increases in banks like Bank of America and Wells Fargo. Smaller businesses are more likely to connect with digital and regional banks, while larger businesses are veering toward enterprise banking partners.

In the near term, the stability of businesses may depend on their ability to:

- Find stable banking providers who have a long track record of putting customers first and delivering high-quality reliable services.

- Diversify assets across providers to reduce single points of failure.

- Keep financial operations streamlined even as businesses diversify where they store their funds.

Legacy corporate card and expense management software providers can’t help companies who need to perform crucial tasks such as instantly setting up employees with new cards or integrating bank accounts, owing to bulky systems and a lack of personalized customer support.

Business owners and finance teams deserve better peace of mind. They deserve financial solutions that ensure stability and drive real savings.

Ramp is here to bolster your financial stability

Ramp is not a bank, but from day one, we’ve provided our customers with innovative solutions to help finance teams operate at their very best. Customers have the freedom of choice to connect multiple bank accounts to one centralized spend management platform, thereby supporting diversification and decreasing risk.

"This recent situation with the banks put us in a terrible position. All our financial services, including cards, were locked into one provider. Now with Ramp we're able to connect multiple banking partners, and see a consolidated view of our spend in one platform.”-Sara Mauskopf, CEO & Co-Founder, Winnie

We are offering expanded solutions to help businesses swiftly secure their finances:

- Get introductions to reputable banks.We work with some of the most reliable banking partners in the industry who have dedicated resources to support Ramp customers with account openings. In the first 48 hours we’ve already helped hundreds of customers with over $1B in deposits connect to new banking solutions.

- Diversify your holdings and easily connect multiple bank accounts to one centralized spend management platform.Ramp offers connections to the top 100 banks (and thousands of others), ensuring higher credit limits for your business,higher than traditional options. On average, Ramp customers maintain two to four banking accounts at any given time.

- Centralize spend and manage business payments seamlessly across card, checks, ACH, and international wires.

- Spend smarter using our card anchored by finance automation software.Save with card controls, flexible capital, and real-time insights designed for your bottom line.

A smarter way to manage your finances

Let’s get you back to running your business as quickly and efficiently as possible. We are committed to ensuring the safety and stability of assets for both new and existing customers. If you need a new card provider, sign up for Ramp today.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°