Top 5 QuickBooks Alternatives: Backed By Ramp Intelligence

QuickBooks is one of the most recognized names in accounting software, widely used by small businesses, freelancers, and enterprises alike. Its comprehensive features cover everything from invoicing to tax preparation. However, it's not a one-size-fits-all solution. Whether you're looking for a more affordable option, specialized features, or a simpler interface, there are plenty of alternatives to QuickBooks that may suit your business needs better.

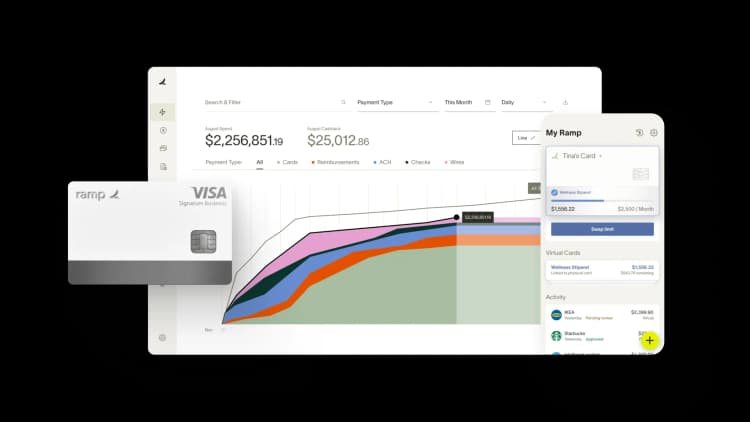

Using proprietary Ramp data, we analyzed how businesses across industries are spending on different accounting tools, including QuickBooks and its competitors. This guide will help you navigate the best alternatives, leveraging real-world data to inform your decision-making process.

1. Xero

Best for: Small and Medium-Sized Businesses Needing Flexibility

Xero is a cloud-based accounting platform designed for small and growing businesses. It offers robust features like invoicing, bank reconciliation, and reporting—similar to QuickBooks—but is often praised for its intuitive interface and flexible integrations.

Key Features:

- Invoicing, expense tracking, and financial reporting

- 800+ integrations with third-party apps

- Unlimited users on all plans

Pricing: Starting at $13 per month

Why Consider Xero?

Xero’s user-friendly interface and affordable pricing structure make it a compelling choice for SMBs looking for a flexible and scalable accounting solution. It’s also known for seamless integration with other financial tools.

Ramp Insights: Our Ramp data shows that Xero is seeing increasing adoption, particularly among small-to-medium businesses looking for an alternative to QuickBooks. The table below outlines a detailed comparison between QuickBooks and Xero.

Vendor | Business Count | Avg. Spend/Business | Adoption Trend |

|---|---|---|---|

QuickBooks | 1,600 | $300 | +8% MoM |

Xero | 1,200 | $250 | +10% MoM |

2. FreshBooks

Best for: Freelancers and Service-Based Businesses

FreshBooks is designed specifically for freelancers and service-based businesses. Unlike QuickBooks, which is often suited for a broad range of industries, FreshBooks focuses on simplifying invoicing, time tracking, and expense management.

Key Features:

- Automated invoicing and expense tracking

- Time-tracking and project management

- Client-based accounting

Pricing: Starting at $6 per month

Why Consider FreshBooks?

FreshBooks is an excellent choice for businesses focused on client billing and project management. Its simple invoicing and time-tracking tools provide a user-friendly experience for freelancers.

Ramp Insights: FreshBooks has become the go-to accounting tool for freelancers and service providers, outpacing QuickBooks in some niche markets. Here’s how the two compare:

Vendor | Business Count | Avg. Spend/Business | Adoption Trend |

|---|---|---|---|

QuickBooks | 1,600 | $300 | +8% MoM |

FreshBooks | 1,000 | $200 | +12% MoM |

FreshBooks has seen a steady increase in adoption among freelancers due to its specialized features and competitive pricing.

3. Sage Intacct

Best for: Enterprises Needing Advanced Reporting

Sage Intacct is an advanced cloud-based accounting software aimed at mid-market companies and enterprises. It offers more complex features like multi-entity management, revenue recognition, and extensive reporting capabilities, which go beyond QuickBooks.

Key Features:

- Multi-entity accounting and global consolidations

- Advanced reporting and financial management

- Strong compliance and audit capabilities

Pricing: Customized for enterprise clients

Why Consider Sage Intacct?

If your company needs advanced financial management and reporting, Sage Intacct provides more robust features than QuickBooks, particularly for growing enterprises.

Ramp Insights: Sage Intacct has gained a strong foothold among enterprises that require complex financial reporting and compliance tools. Below is a comparison based on Ramp data:

Vendor | Business Count | Avg. Spend/Business | Adoption Trend |

|---|---|---|---|

QuickBooks | 1,600 | $300 | +8% MoM |

Sage Intacct | 800 | $350 | +9% MoM |

Sage Intacct’s focus on advanced features makes it an ideal choice for companies that have outgrown QuickBooks.

4. Zoho Books

Best for: Businesses Looking for an All-in-One Solution

Zoho Books offers an all-in-one suite that includes accounting, CRM, inventory management, and project management. It's a more affordable alternative to QuickBooks and can be integrated with the broader Zoho ecosystem.

Key Features:

- End-to-end accounting with GST compliance

- Integration with Zoho CRM, Zoho Inventory, and more

- Customizable workflows

Pricing: Starting at $10 per month

Why Consider Zoho Books?

Zoho Books is an excellent alternative for businesses already using other Zoho apps. Its seamless integration across the Zoho ecosystem makes it a more cohesive option than QuickBooks for companies needing multiple business management tools.

Ramp Insights: Zoho Books is increasingly popular among small-to-medium businesses that need an all-in-one solution. Here’s how it stacks up against QuickBooks

Vendor | Business Count | Avg. Spend/Business | Adoption Trend |

|---|---|---|---|

QuickBooks | 1,600 | $300 | +8% MoM |

Zoho Books | 900 | $180 | +10% MoM |

Zoho Books is quickly becoming the tool of choice for businesses seeking to streamline their operations.

5. Wave Accounting

Best for: Freelancers and Very Small Businesses

Wave is a completely free accounting platform designed for freelancers and very small businesses. It offers basic accounting features, such as invoicing and expense tracking, at no cost, making it a strong competitor to QuickBooks for budget-conscious users.

Key Features:

- Free invoicing, receipt scanning, and expense tracking

- Paid services include payroll and payment processing

Pricing: Free (with paid add-ons)

Why Consider Wave Accounting?

For very small businesses or freelancers that don’t need advanced features, Wave offers a free and straightforward alternative to QuickBooks.

Ramp Insights: Wave has gained significant traction among budget-conscious users, particularly freelancers. Here’s how it compares to QuickBooks:

Vendor | Business Count | Avg. Spend/Business | Adoption Trend |

|---|---|---|---|

QuickBooks | 1,600 | $300 | +8% MoM |

Wave Accounting | 700 | $100 | +6% MoM |

Wave’s free pricing model makes it an appealing choice for freelancers and very small businesses.

According to Ramp Data

Looking at the data, QuickBooks remains the most widely used accounting platform, especially among small to medium-sized businesses. However, each of the alternatives—Xero, FreshBooks, Sage Intacct, Zoho Books, and Wave—offers unique benefits that may better fit specific business needs.

- Xero and FreshBooks stand out for their ease of use and are excellent for SMBs and freelancers, respectively.

- Sage Intacct is a better choice for enterprises needing more advanced reporting and financial management.

- Zoho Books offers a seamless all-in-one solution for businesses already integrated into the Zoho ecosystem.

- Wave remains a popular choice for freelancers and businesses with very tight budgets.

Each alternative provides unique advantages based on your business’s needs, and Ramp’s proprietary spend data provides real-world insights to help you make the best decision.

Don't miss these

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group

“We’ve simplified our workflows while improving accuracy, and we are faster in closing with the help of automation. We could not have achieved this without the solutions Ramp brought to the table.”

Kaustubh Khandelwal

VP of Finance, Poshmark