Top 7 Mercury alternatives and competitors in 2026

- What happened with Mercury Bank?

- 1. Ramp

- 2. Novo

- 3. Relay

- 4. Bluevine

- 5. NorthOne

- 6. Wise

- 7. Rho

- Advantages of Ramp over other Mercury alternatives

- Why Ramp is the best Mercury alternative for businesses

Over the past couple of years, businesses using Mercury Bank have faced significant changes. The digital bank, known for its ease of use and robust financial tools, announced plans to close accounts for startups in 37 countries, including 13 in Africa, by August 22, 2024.

These changes stemmed from updated compliance policies and increased oversight from federal regulators, leaving many businesses scrambling for new banking solutions. As Mercury tightens its eligibility requirements, startups are forced to adapt quickly and find alternatives that meet their operational needs.

Here’s what you need to know about Mercury Bank’s policy changes and the best alternatives to switch to in 2026.

What happened with Mercury Bank?

Mercury Bank stopped serving startups tied to certain countries, citing compliance challenges. Federal auditing of its partner bank, Choice Bank, revealed risky account openings in restricted regions, pushing Mercury to implement stricter policies. Many of the affected countries are on the Financial Action Task Force (FATF) “grey list,” which flags them for inadequate measures to counter financial risks.

Who is affected?

- Ukrainian founders: Mercury no longer supports companies based in Ukraine, though US-based founders with Ukrainian passports are still eligible.

- Nigerian founders: US-based Nigerian startups face similar restrictions, with Mercury pointing to compliance risks tied to FATF review.

- Other regions: Croatia and previously restricted regions in Africa are also impacted, further narrowing Mercury’s customer base.

What does this mean for startups and small businesses?

Startups in affected regions now face the urgent challenge of securing reliable banking alternatives to maintain operations. For many, this disruption emphasizes the need to partner with financial institutions that have both robust compliance systems and a commitment to serving businesses in underserved regions.

Mercury’s decision also reflects a broader issue in global banking—striking the right balance between regulatory compliance and inclusivity. For startups, it’s a reminder to evaluate banking options carefully to ensure long-term stability and accessibility.

So who exactly is the best alternative for startups and small businesses using Mercury Bank? Many are looking for financial platforms that not only simplify banking but also provide small business corporate credit cards and tools for managing expenses. Here are the top seven Mercury Bank alternatives and competitors in 2026.

1. Ramp

Ramp is an all-in-one financial operations platform designed to empower businesses with smarter, faster, and more efficient financial management. By combining AI-driven insights, corporate cards with built-in controls, and automation tools, Ramp streamlines expense tracking, vendor payments, accounting processes, and more.

Trusted by over 15,000 customers, ranging from startups and small businesses to mid-sized and large enterprises, Ramp has become the ultimate finance platform. Ramp has saved their businesses a total of over $600M and 8.5M hours of work—and these savings have tripled year-over-year.

With Ramp, businesses gain unparalleled visibility into their spending, enabling better decision-making and reducing inefficiencies across their financial operations. Whether you’re scaling a startup or managing a large enterprise, Ramp is a top alternative for Mercury, designed to grow with you, saving time and resources at every step.

Here’s a breakdown of Ramp’s key features:

Enhanced financial control

- Corporate cards with built-in controls: Ramp corporate cards come with preset controls to prevent out-of-policy spending. With unlimited custom virtual cards featuring specific permissions tailored to various needs, such as ad spending or remote work stipends, you can prevent spending in restricted categories.

- Financial security: Provides high-security features like 3DS enrollment and SSO logins and is compatible with Apple Pay and Google Pay. Ramp’s cards are widely accepted, functioning in over 200 countries and supporting transactions in 40 currencies.

- Cashback rewards: Ramp offers cashback on spending, allowing you to reinvest savings into growth. For example, Teo Evanick, Financial Controller at Mode said "Switching to Ramp was an immediate success. As far as ROI, we received over $10k in cashback last year with technically no upfront investment." With Ramp, you can experience the same level of success and cost savings.

Smarter expense management

- AI-powered expense management: Ramp simplifies your expense management by auto-generating receipts and categorizing expenses. This feature saves you significant time by automatically collecting and matching receipts, ensuring accurate and compliant expense submissions. It also flags non-compliant expenses, alerting you of out-of-policy spending.

- Seamless expense submission and automation: You can easily submit expenses through SMS, a mobile app, or integrations with platforms like Gmail, Lyft, and Amazon. Ramp automates the submission process, generating receipts and saving recurring memos, making it easier for you and your managers to handle expenses.

Advanced insights and automation

- Vendor management and price intelligence: Using crowd-sourced data from millions of transactions, Ramp provides insights into software costs, helping you negotiate better deals. You can instantly compare costs and view cost-per-user details, ensuring that you do not overpay for your software needs.

- Copilot: Ramp’s Copilot feature uses AI to provide you with detailed transaction data, answer financial questions, and suggest ways to reduce costs. It can automate complex tasks like setting up workflows and generating reports, freeing up your time for more strategic activities.

Streamlined accounting and global reach

- Enhanced accounting and bookkeeping: Ramp's smart accounting tools streamline your bookkeeping by auto-coding transactions based on receipts. This reduces manual entry errors and speeds up the monthly close process.

- Integrations: Ramp has more than 200 integrations with ERPs and accounting systems like QuickBooks, NetSuite, Xero, and more.

- Global reach and ease of use: Ramp’s platform supports local issuing and debiting in 33 countries, making it ideal if your business deals with global payments. Its ease of use and powerful financial tools make Ramp a perfect solution for streamlining financial processes and enhancing operational efficiency.

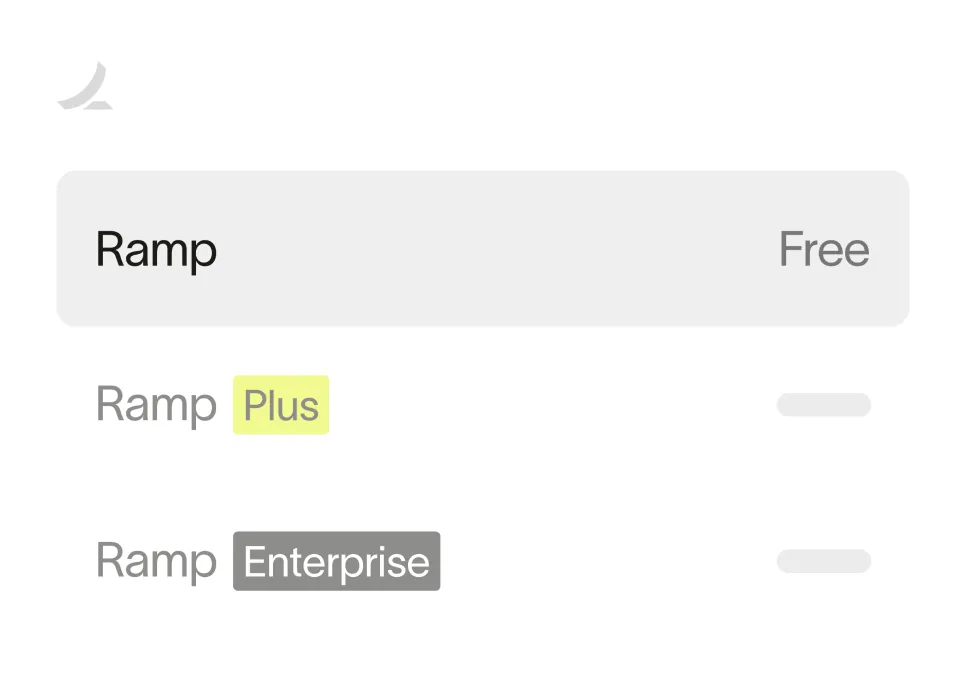

Ramp pricing

Whether you’re a startup, global enterprise, or somewhere in between, Ramp is designed to save you time and money. Ramp provides a free tier that’s ideal for startups and small businesses, which includes key products like unlimited corporate cards, accounts payable automation, accounting, procurement, and more. With Ramp Plus, you gain access to more advanced features for $15 a month per user, while Ramp Enterprise pricing requires a custom quote.

Ramp is more than just a financial platform—it’s a comprehensive solution designed to simplify expense management, enhance financial control, and streamline operations for businesses of all sizes. With its powerful tools, global reach, and focus on automation and insights, Ramp empowers companies to save time, reduce costs, and drive growth effortlessly. Try Ramp.

For a detailed comparison of Ramp against Mercury, refer to Ramp vs Mercury.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

2. Novo

Novo offers an online banking solution tailored for small businesses. The service aims to simplify financial management. You can use Novo to handle your business banking needs. The platform does not charge hidden fees and is designed to have straightforward requirements.

Key features

- Easy account setup: Novo provides a checking account that you can set up in just a few minutes. There are no monthly fees or minimum balance requirements, making it an accessible choice for businesses of all sizes.

- Quick payments: Novo bank offers a feature called Novo Boost, this feature is designed to accelerate Stripe payment processing. The platform also offers Express ACH payments.

- Integrated tools: You can connect Novo business bank accounts with business tools like Stripe and PayPal, allowing you to create and send as many customized invoices as you need without extra charges.

- Safe banking: Your deposits are protected by FDIC insurance up to $250,000 through their partner bank, Middlesex Federal Savings. Your data is safeguarded with bank-grade encryption and Novo debit cards come with Mastercard's Zero Liability and ID Theft Protection programs.

- Money management: Novo's Reserves feature enables automatic allocation of funds for specific purposes such as taxes or future purchases to reduce manual tracking of different financial obligations.

3. Relay

Relay offers an online banking and money management platform for business financial management. The platform includes features for cash flow management. These tools are designed to help streamline and organize financial operations for business owners.

Key features

- Free accounts and flexibility: Relay's banking platform operates without common fees like account fees, overdraft fees, or minimum balance requirements. You can access up to 20 individual checking accounts and two savings accounts.

- Payment options: Relay supports various payment methods including ACH transfers, wires, and checks and integrates with payment processors such as PayPal, Stripe, and Square.

- Expense control and savings: Offers expense management features, including the ability to issue up to 50 virtual or physical Visa debit cards. These cards can have customizable spending limits and can be assigned to team members.

- Bookkeeping and integration: Offers integration with QuickBooks Online and Xero, which can assist with your bookkeeping processes. Relay also works to standardize vendor data, capture receipts, and sync financial transactions.

- Security measures: Includes security features such as FDIC insurance up to $3 million through Thread Bank and Visa Zero Liability Protection. The platform uses two-factor authentication and biometric security measures for additional risk prevention.

- Team access and permissions: Provides role-based user permissions that allows you to give access to financial management tasks to accountants, bookkeepers, or other team members.

4. Bluevine

Bluevine offers a robust business banking platform designed to support your small business's growth and financial health. The platform includes options for low fees, access to working capital, and financial tools. These features are designed to help you manage your business finances.

Key features

- Checking and savings options: Bluevine's business checking account offers 2.0% APY on balances up to $250,000. The account has no monthly fees and allows unlimited transactions and free standard ACH transfers.

- Funding and credit availability: Provides a business line of credit with limits up to $250,000. Moreover, the application process does not affect your personal credit score.

- Cashback: Offers a Business Cash Back Mastercard that provides cashback on business purchases without a limit and with no annual fee.

- Financial management tools: Integrates with financial tools like QuickBooks Online, allowing you to manage accounts payable and receivable from one platform.

- Safety features: Includes security features such as two-factor authentication, data encryption, and text alerts for potentially suspicious activity.

- Online banking services: Bluevine offers online financial management tools, allowing you to use mobile check deposits and automated account management features.

5. NorthOne

NorthOne provides a business banking platform that combines sales, payments, and budgeting features in what they call a “Connected Bank Account.” This approach aims to integrate various financial management aspects. You can use this to oversee different parts of your business finances from one account.

Key features

- Clear account overview: NorthOne's business banking platform includes features for various financial transactions such as ACH, Same-Day ACH, wires, bill pay, and checks. The platform offers FDIC insurance up to $250,000 through The Bancorp Bank, N.A. to protect your deposits.

- Bill payment system: Includes a Bill Payments Hub, allowing you to scan invoices, schedule payments, and manage bills in one location.

- Income tracking: Offers a Revenue Dashboard feature to show incoming funds from platforms such as Stripe, PayPal, Square, Shopify, Amazon, and eBay and track gross revenue and return volume.

- Accounting integrations: Integrates with accounting software including QuickBooks, Wave, Patriot Accounting, and Zoho. This feature syncs financial data in real-time and lets you gain access to unlimited historical transactions.

- Secure banking: Allows multiple users to access the account and uses security features including two-factor authentication and data encryption.

- Organized cash management: NorthOne includes an 'Envelopes' feature that allows you to organize your funds into custom categories, which function like digital folders to set aside money for taxes, payroll, or investments.

6. Wise

Wise, formerly known as TransferWise, offers a platform for managing your money across borders. The service focuses on international payments and transfers. It aims to offer speed and security while keeping fees low.

Key features

- Global money transfers: Wise offers money transfers in over 40 currencies and with multi-currency accounts, you can hold, manage, and convert funds in different currencies as well.

- Interest rate options: Provides an interest feature for USD balances where if you choose to use this feature, you can earn a 4.95% Annual Percentage Yield (APY). Wise's partner banks also provide FDIC insurance up to $250,000 on these balances.

- Security encryption: Wise uses HTTPS encryption and two-step verification to protect your accounts. All funds are held with established financial institutions like JPMorgan Chase Bank, ensuring that your money is safe.

- Integration with third-party systems: Wise integrates with accounting software such as Xero, QuickBooks, and FreeAgent. These features are designed to assist with financial management and may help streamline administrative tasks.

7. Rho

Rho is a modern fintech platform built to help businesses simplify their finances and optimize operations. It combines corporate banking, payments, and expense management into one cohesive platform, designed to deliver efficiency for growing companies.

Key features

- Integrated banking: Rho provides a business banking platform with integrated checking accounts, high-yield savings accounts, and payment processing so that businesses can centralize their financial activities.

- Corporate cards with custom controls: Rho’s corporate cards come with customizable spending controls that integrate with your budget.

- Automated accounts payable: Offers AP automation tools to simplify bill payments by allowing users to schedule, approve, and pay vendors seamlessly. It supports ACH, checks, and wire payments.

- Financial reporting: With Rho, businesses gain access to real-time reporting and financial insights, helping them track spending, monitor budgets, and make data-driven decisions. These tools integrate with leading accounting software like QuickBooks and NetSuite for easier bookkeeping.

- Fraud detection: Employs encryption, fraud detection tools, and other security features to ensure the safety of your funds and data. All deposits are also FDIC-insured up to $250,000 through Rho’s partner banks.

Advantages of Ramp over other Mercury alternatives

When comparing Ramp with other financial solutions like Novo, Brex, and more, several features stand out, making Ramp an excellent alternative for your business:

1. Spending controls and automation

Ramp offers advanced spending controls and automation tools that go beyond the basics of corporate cards and banking services. Its comprehensive platform automates expense management with features like real-time expense reporting, receipt matching, and spend analysis, helping you streamline financial processes and gain deeper visibility into your spending.

2. Cost savings

Ramp's program rewards you with cashback on purchases, making it an excellent way to reduce expenses. This is especially valuable for startups or small businesses looking to maximize their budgets.

3. No fees

Ramp is renowned for its no-fee policy, which includes no annual fees, foreign transaction fees, or hidden charges. This transparent approach ensures you benefit from a straightforward financial solution without any unexpected costs.

4. Integrated vendor management

Ramp’s platform includes tools to manage vendor relationships, such as contract management and negotiation insights. These features are invaluable for businesses working with multiple suppliers, helping you optimize vendor interactions and reduce inefficiencies.

5. User-friendly experience

Ramp provides an intuitive platform that is easy to set up and use. Its seamless onboarding process and user-friendly interface make it accessible, even for those with limited financial management experience.

Why Ramp is the best Mercury alternative for businesses

Ramp stands out as an ideal choice for businesses of all sizes due to its comprehensive approach to expense management and financial automation. With cost-saving features, advanced spending controls, and a no-fee policy, Ramp delivers unparalleled value to its users.

Additionally, Ramp offers tools for managing vendor relationships and a highly intuitive platform that simplifies financial management. This combination allows you to manage your finances more efficiently, freeing up resources to focus on growth and innovation.

Ready to transform your business finances? Get started with Ramp.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they're seeing the quick payment. That started with Ramp—getting everyone paid on time. We'll get a 1-2% discount for paying early. That doesn't sound like a lot, but when you're dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group