- Different types of clearing services used in financial operations

- What happens during the clearing process

- What clearing looks like in a real transaction

- What does the clearing process mean for your finance team?

- FAQ

Clearing is the process of validating and finalizing a financial transaction before the actual transfer of money or assets happens. It ensures that both sides of a transaction agree on the terms, have the right information, and are ready to settle. Without clearing, payments and trades would be riskier, slower, and prone to errors.

You interact with clearing more often than you think. Every time a business sends or receives a payment, clears a card transaction, or settles a trade, clearing happens in the background.

Different types of clearing services used in financial operations

The clearing process changes based on what’s being exchanged—money, securities, or obligations between intermediaries or banks. Each type of clearing handles different risks, speeds, and transaction volumes.

For example, global payment systems process over $3.4 trillion in transactions yearly. These don’t all settle the same way. Card payments, stock trades, and wire transfers each follow their own clearing path.

Payment clearing

Payment clearing is the process of verifying and routing payment instructions between banks before the money moves. It confirms that the payer has the funds and that the details match on both sides.

You see payment clearing every time you process a payroll run, receive a customer payment, or pay a vendor. It happens through networks like ACH, wire transfers, card processors, or real-time settlement systems. In the U.S., the ACH network alone handled over 30 billion payments in 2023, totaling nearly $77 trillion. These include direct deposits, bill payments, and B2B transactions.

Each payment type clears on a different timeline. ACH payments often take one to two business days. Wire transfers settle faster but cost more. Real-time settlement systems like FedNow or RTP offer instant clearing and settlement.

Securities clearing

Securities clearing is the process of confirming and settling trades after buying or selling financial assets like stocks, bonds, or ETFs. It ensures that the buyer receives the security and the seller gets paid.

Every trade goes through a clearinghouse, which acts as a middle layer between the two parties. This reduces the risk of one side failing to deliver. The clearinghouse verifies trade details, calculates obligations, and manages the timing of settlement.

In 2023, the U.S. securities market cleared more than $2 quadrillion in trades through central clearing systems like the DTCC (Depository Trust & Clearing Corporation). That volume makes efficiency and accuracy critical.

Most securities settle two business days after the trade date (T+2), but regulators are now moving toward T+1 to reduce risk and speed up capital access.

Interbank clearing

Interbank clearing is the process banks use to settle payments with each other. When your business sends money to a supplier or receives a customer payment, your bank and the other bank must clear the transaction before funds move.

Central clearing systems handle this behind the scenes. In the U.S., the Federal Reserve’s Fedwire and the Clearing House Interbank Payments System (CHIPS) process high-value transactions between banks daily.

CHIPS alone settles over $1.8 trillion in payments every day. These systems match payment details, calculate net obligations, and move funds across accounts held at central banks.

Interbank clearing reduces risk and prevents every bank from settling each transaction individually. Instead, banks send payment batches and settle only the final net amount owed.

Ramp Treasury connects to your business bank accounts and automatically moves funds between them. It helps you avoid idle cash sitting in low-yield operating accounts by sweeping excess funds into high-yield treasury investments with up to 4.3% APY. This makes your interbank clearing flows work smarter.

What happens during the clearing process

Banks, clearinghouses, and payment networks handle the clearing process. The time it takes depends on the type of transaction. Some clear within seconds through real-time networks. Others, like ACH or securities trades, may take one to two business days.

Step 1. Start by initiating the transaction

You trigger clearing the moment you send a payment, approve an invoice, or execute a trade. This step creates the transaction instruction. It includes the amount, the accounts involved, and the timing.

For example, if you're sending a vendor payment, your system sends this information to the bank or clearing network. Make sure the data you input is complete and correct. This avoids delays later in the process.

Step 2. Verify and match all transaction details

Next, the clearing system checks whether your transaction details match what the receiving party expects. This includes account numbers, payment amounts, currencies, and settlement dates.

If you're receiving funds, confirm that the payer’s information is correct before processing the transaction. Even one mismatch can cause the clearing to fail or get flagged for review.

Step 3. Net multiple transactions when possible

If you process several transactions with the same party, clearing systems will combine them and calculate the net amount owed. This is called netting. It reduces the number of payments and helps you avoid unnecessary fees.

You don’t have to calculate this manually. ACH systems, card networks, and clearinghouses handle this automatically. But you should still track netted amounts so your books reflect the actual cash movement.

Step 4. Run risk checks and confirm compliance

At this stage, the clearing network checks your transaction for risk. It looks at counterparty exposure, credit limits, and regulatory compliance.

Review your internal controls first if you're sending a high-value payment or trading across borders. Make sure you follow your organization's risk policies before the clearing system flags anything.

Step 5. Finalize the transaction through settlement

Once the clearing process confirms the transaction, it moves to settlement, where the money or asset actually changes hands.

You will see the final result in your bank account or trading platform. For same-day or real-time clearing systems, this step happens quickly. For others, like ACH or T+2 securities trades, it may take a day or more. Use this timing to plan for when funds will post or when you can recognize revenue or expenses.

What clearing looks like in a real transaction

Let’s say you run a U.S.-based business and submit a $50,000 vendor payment through ACH. You approve the payment on your finance platform, and your bank receives the instructions. That’s when clearing begins.

The ACH network takes the payment file and starts matching the details, including your account numbers, routing codes, and transaction values. It checks that your bank account has sufficient funds and that the receiving account is valid.

If there are no issues, the network calculates the net amount your bank owes compared to other incoming or outgoing payments. This netting process helps reduce the amount of cash each bank needs to move.

Next, the clearing system runs risk and fraud checks. If the transaction passes, it moves to settlement. This usually happens the next business day unless you select same-day ACH.

The vendor sees the deposit in their account once the settlement is completed. On your side, you update your records and reconcile the payment in your ERP or accounting system.

This is a common clearing flow, one you deal with every time you send or receive non-instant payments.

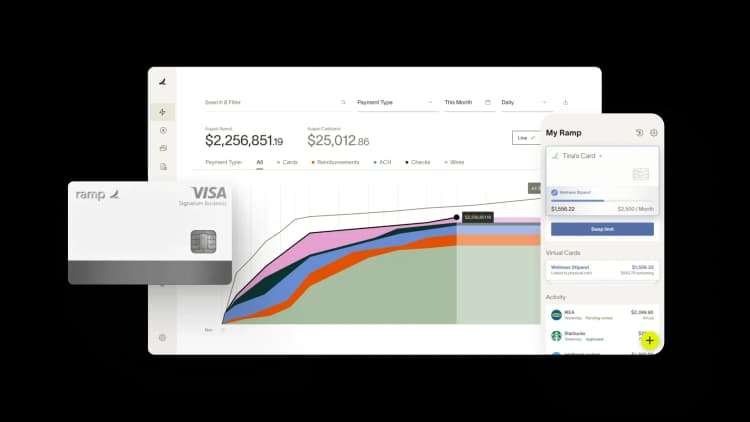

If you are using Ramp to initiate the payment, the system handles more than just the approval. It pushes the payment to the bank, categorizes the expense, and tracks the clearing status. That means less time checking if a vendor got paid and more time focused on what’s actually moving through your accounts.

What does the clearing process mean for your finance team?

Clearing directly impacts how and when your business recognizes cash, tracks expenses, and closes the books. If your team does not understand how clearing works, you risk misreporting cash positions, delaying reconciliations, and missing key reporting deadlines.

When you understand the full clearing cycle, you can forecast cash flow more accurately and reduce the gap between when transactions are approved and when they actually settle. That improves working capital planning and reduces the need for guesswork in close cycles.

For high-volume teams, clearing also shapes how you manage transaction data. A single mismatch in clearing can lead to hours of manual correction. By aligning your internal processes with how banks and clearing systems operate, you avoid rework and speed up audits.

With Ramp Treasury, you don't have to guess where your cash is or when it will clear. The platform gives you a real-time view of both operating cash and idle funds. It also flags when you are at risk of a shortfall or when you have excess cash that could be earning more without compromising liquidity.

FAQ

Is clearing the same as a settlement?

Clearing happens before settlement. Clearing verifies and prepares the transaction, while settlement is when funds or assets actually move between parties. Both steps are necessary, but they serve different functions.

Can a transaction clear but still fail to settle?

A transaction might clear successfully but fail at the settlement stage due to insufficient funds, counterparty issues, or regulatory holds. That’s why both stages need oversight.

Do instant payments skip the clearing process?

Even instant payments like RTP or FedNow still go through a clearing process. It just happens in seconds. The same checks for validity, balance, and authorization still apply.

What happens if a transaction gets stuck during clearing?

Your bank or platform should notify you if a transaction stalls during clearing. The most common reasons are mismatched details, regulatory flags, or insufficient funds. Finance teams should follow up quickly to avoid delayed settlements and downstream reporting issues.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they're seeing the quick payment. That started with Ramp—getting everyone paid on time. We'll get a 1-2% discount for paying early. That doesn't sound like a lot, but when you're dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group