TMS vs. ERP systems: Do you need both?

- TMS vs. ERP systems: Do you need both?

- Integration between TMS and ERP systems

- Comparison of TMS and ERP systems

- Frequently asked questions

- Earn on your operating cash with Ramp Treasury 1

Key takeaways

- Enterprise Resource Planning (ERP) systems manage broad business processes like sales, human resources, and production, while Treasury Management Systems (TMS) are specialized platforms focused on cash management, payment workflows, cash flow forecasting, and maintaining operational liquidity.

- While ERP systems handle broad business operations, TMS solutions focus on maximizing yield on operating cash while ensuring bills are paid on time through automated alerts and payment scheduling.

- Integration capabilities are crucial for modern TMS platforms, with automated syncing to ERP systems for accurate GL mapping and streamlined reconciliation.

TMS vs. ERP systems: Do you need both?

Most businesses already have an ERP system to manage their core business processes—from sales and HR to basic accounting. The key question is whether to add a dedicated Treasury Management System (TMS) alongside it.

A standalone ERP system is sufficient for businesses that:

- Maintain simple bank account structures

- Have straightforward cash flows with minimal daily payments

- Don't need to optimize their operating cash for earnings

- Can manage with basic payment scheduling capabilities

A TMS becomes important when organizations need to:

- Maximize earnings on operating cash balances

- Generate accurate cash flow forecasts and projections

- Automate daily cash position monitoring and fund transfers

- Process high volumes of same-day payments efficiently

- Need automated alerts for low balances or upcoming bills

- Want seamless reconciliation with their ERP system through automated account syncing

The decision ultimately comes down to the complexity of your cash management needs. If your primary focus is on basic business operations and simple financial tracking, your ERP system may be sufficient. However, if optimizing cash positions and streamlining payment operations are priorities, adding a dedicated TMS that integrates with your existing ERP can provide significant value.

When both systems are used together, the TMS handles specialized treasury operations while automatically syncing transaction data to the ERP, maintaining accurate financial records across both platforms.

Integration between TMS and ERP systems

Modern treasury management systems integrate seamlessly with enterprise resource planning platforms through automated accounting syncs, providing real-time visibility and streamlined financial operations. This integration eliminates manual reconciliation work and ensures accurate financial reporting across systems.

Key integration touchpoints include:

- Automated journal entry creation for cash transfers between bank accounts, with proper debit and credit mapping to the correct GL accounts

- Daily syncing of cash balances and account activity to maintain up-to-date financial records

- Direct integration with major ERP platforms including NetSuite, Sage, QuickBooks Online, and Xero, plus universal CSV options for other systems

The integration process has evolved beyond traditional file-based transfers to more sophisticated approaches. Modern TMS solutions connect directly to ERP systems, enabling automated daily syncs that maintain accurate records without manual intervention. For businesses that require more control, manual sync options allow finance teams to review and approve transfers before they post to the general ledger.

Error handling and reconciliation have also improved significantly. Today's integrated systems provide detailed sync histories, allowing teams to quickly identify and resolve any failed transfers. They can also track the status of each transaction, ensuring nothing falls through the cracks during the reconciliation process.

For organizations with multiple entities or accounts, these integrations support sophisticated mapping capabilities. Different earnings accounts can be created for each business entity, and cash accounts can be properly tracked and categorized within the ERP system. This maintains clean books while providing the granular visibility needed for effective treasury management.

Comparison of TMS and ERP systems

Feature | ERP System | Treasury Management System |

|---|---|---|

Primary Business Function | Manages broad business operations (Human resources, sales, production, basic accounting) | Specialized cash management and payment operations |

Cash Management | Basic bank balance tracking | • Real-time cash position monitoring and forecasting |

Payment Capabilities | Standard payment processing | • Same-day ACH payments |

Accounting Integration | Core accounting system | • Automated GL mapping |

Cash Optimization | Basic cash tracking | • High-yield cash accounts |

System Integrations | Central business platform | • Connects with major ERP systems (NetSuite, Sage, QuickBooks, Xero) |

User Controls | Standard business permissions | • Configurable approval workflows |

Frequently asked questions

What is a Transportation Management System?

A Transportation Management System (TMS), also known as a TMS, is specialized software that helps companies optimize their logistics through freight and transportation management, including planning, executing, and tracking shipments across their supply chain. For example, a trucking company might use a TMS to automatically select the best carriers and routes while their Enterprise Resource Planning (ERP) System handles billing and inventory, with the TMS managing tasks like real-time load tracking, route optimization, and freight payments.

What is a Warehouse Management System?

A Warehouse Management System (WMS), also known as a WMS, is software that manages and optimizes day-to-day warehouse operations, including inventory tracking, order fulfillment, and real-time stock monitoring. It integrates with ERP Systems for inventory data and TMS platforms for shipment coordination, while providing specialized warehouse-specific features.

What is a Customer Relationship Management System?

A Customer Relationship Management (CRM) System, also known as a CRM, is software that helps companies track and manage all their customer interactions. While ERP Systems handle core business operations, a CRM focuses on customer relationships, sales pipelines, and marketing activities, typically integrating with the ERP to share customer and sales data.

Is Salesforce an ERP or CRM?

Salesforce is primarily a CRM (Customer Relationship Management) System, though it has expanded beyond its original CRM focus through additional modules and platforms. While it can integrate with or provide some ERP-like functionalities, its core purpose remains managing customer relationships, sales pipelines, and marketing activities - making it a CRM that typically works alongside separate ERP Systems rather than replacing them.

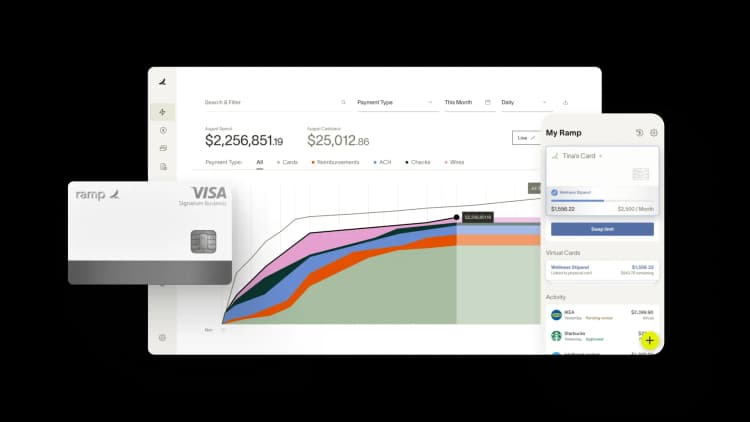

Earn on your operating cash with Ramp Treasury1

You shouldn’t have to compromise between yield and liquidity. With Ramp Treasury, you can earn 2.5%2 on operating cash while saving hours every week on cash management. Automate fund transfers to keep your balances optimized, and schedule deposits so you always have enough cash on hand.

Free, same-day ACH helps you extend vendor payment terms by up to three days, giving you valuable extra working capital. Pay bills exactly when they’re due without incurring fees or delays, all while keeping vendors happy and your cash flow flexible.

Enjoy peace of mind with FDIC insurance3 up to millions of dollars in the Ramp Business Account. Open a free Ramp Treasury account in under a minute.

1) Ramp Business Corporation is a financial technology company and is not a bank. All bank services provided by First Internet Bank of Indiana, Member FDIC.

2) Get up to 2.5% in the form of annual cash rewards on eligible funds in your Ramp Business Account. Cash rewards are paid by Ramp Business Corporation and not by First Internet Bank of Indiana, Member FDIC. Cash rewards are subject to change. See the Business Account Addendum for more information.

3) Customers with a Ramp Business Account can use the ICS service provided by IntraFi Network LLC. Ramp is a financial technology company, not an FDIC-insured depository institution. Banking services are provided by First Internet Bank (FIB), member FDIC. Subject to the terms of the applicable ICS Deposit Placement Agreement, FIB will place deposits at FDIC-insured institutions through IntraFi’s ICS service. A list identifying IntraFi network banks appears at https://www.intrafi.com/network-banks. Certain conditions must be satisfied for “pass-through” FDIC deposit insurance coverage to apply. To meet the conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage. Deposits are insured by the FDIC up to the maximum allowed by law; deposit insurance only covers deposits in the Ramp Business Deposit Account in the event of the failure of the FDIC-insured bank.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits