What is a treasury management system (TMS)?

- What is a treasury management system?

- Core treasury management system functions

- Key benefits of a TMS

- Cash management vs. treasury management

- How to select a treasury management software

- Earn on your operating cash with Ramp Treasury 1

Businesses need more than just traditional banking solutions to manage their investments and payments efficiently.

A treasury management system (TMS) can automate the management of your company’s financial operations. A TMS enables modern finance teams to take control by tracking and automating processes such as cash flow, investments, liquidity, and risk management.

Here, we define what a treasury management system is, describe its core functions and benefits, and offer tips on how to select the best TMS solution for your business case.

What is a treasury management system?

A treasury management system (TMS) is software that helps businesses automate specific aspects of their financial operations, including cash flow, investments, and risk management.

A TMS allows you to centralize your view of financial data while automating the transfer of cash between operating and investment accounts, enabling your business to optimize returns while ensuring sufficient funds are available to cover your business expenses.

You’re probably used to a cash management system that focuses on the day-to-day financial management required to meet your obligations. Treasury management enables CFOs and other finance leaders to take a broader view of financial health, facilitating long-term strategies.

A TMS helps your finance team solve these key problems:

- Manual inefficiencies: These systems can optimize cash flow and eliminate the manual work usually required to export data and make decisions about where and how to move funds

- Lack of real-time visibility: By integrating with a company’s bank accounts and other platforms that store financial data, such as accounts payable or enterprise resource planning (ERP) software, you gain a bird's-eye view into your full financial health in real time. A TMS with an API to your bank provides information much more quickly to track your full financial health.

- Risk management: Automating and centralizing all financial data supports a more proactive risk management strategy. In addition, the TMS provides tools to identify and mitigate risks, such as regulatory compliance, interest rate and foreign exchange fluctuations, and liquidity issues.

Core treasury management system functions

Now that we’ve covered the basics of treasury management systems, let’s dig into their core functions.

The five basic tools of treasury management are cash and liquidity management, payment workflow and automation, bank connectivity and automation, risk and compliance management, and reporting and analytics:

Cash and liquidity management

Through direct bank connections, a TMS gathers and displays real-time data to support daily cash management functions, including cash positioning, funding, and investment. This enables your business to actively monitor liquidity planning, ensuring you meet financial obligations and strategically invest unused cash balances.

Payment workflows and automation

A TMS streamlines payment processes by integrating with accounts payable systems to automate workflows and ensure timely vendor payments, reducing manual entry. They often support various payment methods, including ACH, wire transfers, virtual cards, and the payment approval process.

Features such as payment scheduling and extended payment terms help you optimize cash flow while maintaining strong vendor relationships.

Bank connectivity and automation

By connecting multiple financial institutions, your TMS automates repetitive tasks such as payment processing, reconciliation, and financial reporting, minimizing the need for manual intervention and reducing human error. It also improves visibility and control across all your accounts simultaneously, allowing you to focus on higher-level financial strategy.

Risk and compliance management

TMS can identify and mitigate financial risks related to foreign currency fluctuations, interest rate changes, and credit exposure. It may also provide treasurers with tools to evaluate these risks, ensuring compliance and protecting the company's financial stability, including audit trails and regulatory reporting.

Reporting and analytics

A TMS provides customizable dashboards and real-time reporting, allowing you to predict cash flow based on historical data, current financial trends, and scenario analysis. This helps you plan for future liquidity needs, address potential shortfalls, and allocate resources effectively.

Key benefits of a TMS

The benefits of a TMS include:

- Increased efficiency and reduced manual work: Typical manual processes involve exporting business account balances into Excel spreadsheets, calculating upcoming payments, and choosing where to invest excess cash. A TMS automates these tasks, giving you time back to focus on what matters.

- Improved accuracy and fewer errors: By removing the manual aspects of treasury management, you reduce the risk of human errors. That means increased accuracy across all your accounts.

- Real-time cash visibility and better decision-making: You gain a centralized view of your company’s bank balances and returns on investments, along with upcoming payments and payment history, all in one dashboard. This visibility supports better cash flow forecasting and financial decision-making.

- Enhanced risk management and compliance: A TMS provides a proactive approach to risk management and compliance. You can identify potential issues early and work to mitigate them before they become a larger problem.

- Cost savings and faster ROI: By leveraging data across your bank accounts and financial platforms, TMS can identify surplus funds and invest them strategically, ensuring maximum returns while maintaining sufficient liquidity for operational needs.

Cash management vs. treasury management

Treasury management and cash management are related but serve different purposes:

- Cash management focuses on short-term liquidity to ensure funds are available for daily expenses, such as payroll and supplier payments. It involves optimizing accounts payable, receivables, and fund transfers to maintain operational efficiency.

- Treasury management, on the other hand, takes a broader, strategic approach. It oversees cash forecasting, investment decisions, debt management, and financial risk mitigation.

While cash management ensures liquidity for daily operations, treasury management aligns financial strategy with long-term stability and growth. As your company scales up, you may notice your finances becoming more complex. In that case, regular day-to-day cash management just doesn’t cut it anymore.

This is why businesses turn to treasury management as a strategy, and where treasury systems come into play.

How to select a treasury management software

Selecting the right TMS for your business requires a strategic, multi-stage approach. In addition to cost, consider these key components:

Integration capabilities

You need a TMS that will properly connect with your various accounts, banks, and systems via API, EDI, or file-based transfers. Connecting with your ERP system allows for seamless data flow between accounting, procurement, and business operations. Connecting to your accounting software streamlines your financial systems, and integrating with your bank accounts ensures all your data is in one place.

Scalability and customization

According to Deloitte's 2024 Global Corporate Treasury Survey, 49% of respondents said they're prioritizing a scalable corporate treasury. Ideally, your chosen TMS will not only meet immediate demands, but can also adapt and expand as your business evolves. Choose a system that addresses current needs and anticipates future growth. It’s also important to find a treasury system you can customize to your specific workflows and reporting needs.

Vendor support and implementation

When you onboard a new TMS software, it could take anywhere from a few months to a year, depending on the complexity of your financial transactions. Before you get started, make sure you understand the level of customer support you can expect from your vendor for onboarding, implementation, training, and troubleshooting over time.

Cost and ROI considerations

Different vendors offer different pricing models, including monthly or annual subscriptions, license or one-time fees, and transaction-based costs. The type of system and pricing model you choose primarily depend on your business type and financial situation.

Consider the total cost of implementing this tool over time and its ROI. This includes the initial cost, recurring subscription costs or fees, and the estimated value of real-time visibility into cash flow, increased efficiencies, and reduced risk exposure.

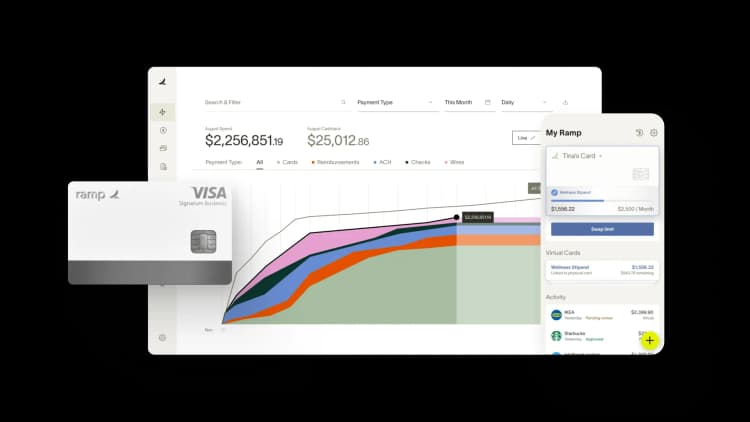

Earn on your operating cash with Ramp Treasury1

You shouldn’t have to compromise between yield and liquidity. With Ramp Treasury, you can earn 2.5%2 on operating cash while saving hours every week on cash management. Automate fund transfers to keep your balances optimized, and schedule deposits so you always have enough cash on hand.

Free, same-day ACH helps you extend vendor payment terms by up to three days, giving you valuable extra working capital. Pay bills exactly when they’re due without incurring fees or delays, all while keeping vendors happy and your cash flow flexible.

Enjoy peace of mind with FDIC insurance3 up to millions of dollars in the Ramp Business Account. Open a free Ramp Treasury account in under a minute.

1) Ramp Business Corporation is a financial technology company and is not a bank. All bank services provided by First Internet Bank of Indiana, Member FDIC.

2) Get up to 2.5% in the form of annual cash rewards on eligible funds in your Ramp Business Account. Cash rewards are paid by Ramp Business Corporation and not by First Internet Bank of Indiana, Member FDIC. Cash rewards are subject to change. See the Business Account Addendum for more information.

3) Customers with a Ramp Business Account can use the ICS service provided by IntraFi Network LLC. Ramp is a financial technology company, not an FDIC-insured depository institution. Banking services are provided by First Internet Bank (FIB), member FDIC. Subject to the terms of the applicable ICS Deposit Placement Agreement, FIB will place deposits at FDIC-insured institutions through IntraFi’s ICS service. A list identifying IntraFi network banks appears at https://www.intrafi.com/network-banks. Certain conditions must be satisfied for “pass-through” FDIC deposit insurance coverage to apply. To meet the conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage. Deposits are insured by the FDIC up to the maximum allowed by law; deposit insurance only covers deposits in the Ramp Business Deposit Account in the event of the failure of the FDIC-insured bank.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits