Zero-based budgeting: What it is and how to implement it

- What is zero-based budgeting?

- Zero-based budgeting vs. traditional budgeting

- Benefits of zero-based budgeting

- Disadvantages of zero-based budgeting

- How to implement zero-based budgeting

- Best practices and tips

- ZBB case studies: Real-world impact

- Track every dollar and eliminate budget bloat with Ramp

Most finance teams build next year’s budget by simply adding a few percentage points to last year’s numbers. The result? Departments keep funding outdated projects and unused tools.

Zero-based budgeting (ZBB) flips the script. Instead of tweaking an old budget, you start from scratch each cycle and justify every expense. This method suits companies fighting bloat, nonprofits maximizing donor dollars, and any organization that suspects spending has drifted from its priorities.

What is zero-based budgeting?

Zero-based budgeting is a budgeting method where every expense must be examined and justified from scratch for each new cycle.

The core philosophy of ZBB is that past spending doesn’t guarantee future funding. Each line item for fixed and variable expenses, from software licenses to salaries, needs a clear rationale based on current goals. This philosophy challenges the assumption that existing expenses are necessary. It forces leaders to ask why money should be spent, not merely how much.

Texas Instruments manager Peter Pyhrr developed zero-based budgeting in the late 1960s as a way to combat the inefficiencies he saw in traditional budgeting. The approach gained national attention when Jimmy Carter, then governor of Georgia, implemented it across state agencies in the early 1970s.

Carter later promoted ZBB at the federal level during his presidency. While government adoption proved challenging, the private sector embraced the methodology, particularly during economic downturns when companies needed to scrutinize every dollar.

How zero-based budgeting works

The process involves several deliberate steps that require participation from across your organization:

- Identify decision units: Break your organization into distinct units or activities that can be analyzed independently. Think departments, programs, or specific functions such as recruiting or customer service.

- Define decision packages: For each unit, managers create detailed proposals (decision packages) that describe the activity, its costs, and its benefits. These packages essentially make the case for why the expense deserves funding.

- Rank decision packages: Leadership ranks all packages across the entire organization based on their value and alignment with company goals. This ranking process is where the tough choices happen.

- Justify from zero: Each package must stand on its own merits. Managers can't simply point to last year's budget. They need to explain what the organization gets for its money and what would happen without this spending.

- Evaluate alternatives: For each activity, teams explore different ways to achieve the same outcome at various cost levels. Maybe the full proposal costs $200,000, but a scaled-back version could deliver 80% of the value for $120,000.

- Allocate resources: Once rankings are complete, leadership allocates the budget starting with the highest-priority packages and working down until the money runs out. Lower-ranked packages get cut or deferred.

- Review and approve: Senior leadership reviews the final budget to verify it matches organizational priorities, then approves funding for the selected packages

Most organizations implement zero-based budgeting over several months, not weeks. The first cycle is typically the most time-consuming, often 3 to 6 months, because teams are learning the process and building decision packages from scratch.

Subsequent cycles move faster as people become familiar with the methodology and can refine existing packages rather than creating everything anew. Many companies phase in ZBB gradually, starting with one department or business unit before expanding org-wide.

Zero-based budgeting vs. traditional budgeting

Zero-based budgeting and traditional budgeting represent fundamentally different philosophies about how business leaders should allocate resources. Traditional budgeting assumes continuity—last year's spending provides the foundation for this year's plan. Zero-based budgeting assumes nothing and demands that every expense prove its worth from scratch.

Here’s a quick comparison:

| Factor | Zero-based budgeting | Traditional budgeting |

|---|---|---|

| Starting point | Blank slate—starts at zero | Previous year's budget |

| Justification | Every expense must be justified | Only changes need justification |

| Time required | 3–6 months (initial cycle) | 2–4 weeks |

| Resource intensity | High—requires detailed analysis | Low to moderate |

| Flexibility | High—easy to reallocate resources | Low—maintains existing patterns |

| Cost visibility | Complete view of all spending | Limited to incremental changes |

| Manager involvement | Extensive—all managers build cases | Moderate—focused on adjustments |

| Best for | Cost reduction, realignment, change | Stable operations, predictable needs |

| Risk of cuts | Everything evaluated equally | Historical spending protected |

| Implementation complexity | High—significant learning curve | Low—familiar process |

In practice, the difference is philosophical. Traditional budgeting treats existing expenses as justified until proven otherwise. Zero-based budgeting reverses that logic: no expense is justified until it proves its value. This shift changes how managers think about their departments: instead of defending increases or cuts to their baseline, they defend the baseline itself.

Incremental budgeting, the most common traditional approach, adjusts the previous year's budget up or down based on expected changes. If your department spent $1 million last year, you might request $1.05 million this year to account for inflation and growth. The conversation focuses on that $50,000 delta, not the original $1 million. ZBB examines all $1.05 million with equal scrutiny.

Key differences in approach

Traditional budgeting starts with last year's numbers as the baseline. Managers justify changes to that baseline, such as new hires, additional software, expanded programs, etc. The bulk of the budget goes unexamined because it represents ongoing operations. ZBB starts with a blank spreadsheet. Every position, every subscription, every program needs justification regardless of how long it's existed.

Justification requirements differ dramatically between the budgeting strategies. In traditional budgeting, you explain why you need more (or can accept less) than last year. In zero-based budgeting, you explain why you need anything at all. This means ZBB requires managers to articulate the value and purpose of activities that may have run on autopilot for years.

Traditional budgeting might take a few weeks as departments tweak last year's numbers and submit requests. Zero-based budgeting can take months, especially during the first implementation. Every manager becomes part researcher, part advocate, building detailed cases for their operations. The resource demand is significantly higher up front.

When to use each method

Zero-based budgeting works best when an organization needs to realign spending with strategy or eliminate bloat. Traditional budgeting makes more sense when operations are stable and predictable.

Zero-based budgeting is ideal when:

- Spending has drifted from business priorities

- The company faces margin pressure or major structural change, such as a merger

- Leadership wants more accountability and a deeper understanding of cost drivers

Traditional budgeting fits when:

- Operations are consistent and cost drivers are well understood

- Teams need a faster budgeting process with fewer resource demands

- Fixed costs dominate, making a full reset unnecessary

Many organizations combine both methods, starting with ZBB in one department to uncover efficiencies, then using traditional budgeting elsewhere to maintain stability.

Benefits of zero-based budgeting

Businesses implementing zero-based budgeting typically see cost reductions between 10–20% within the first cycle, according to data from Ernst & Young. Studies and real-world implementations consistently attribute these savings to eliminating legacy spend and redirecting dollars to current priorities.

The biggest wins come from surfacing costs that have gone unquestioned: unused software, programs that outlived their purpose, and teams sized for yesterday’s needs. When every dollar competes for funding, money moves toward work that advances today’s goals.

Zero-based budgeting also builds accountability and visibility. Managers must explain each expense every period, and leadership gets a clear line of sight into what delivers results, not just what was funded last year.

Strategic advantages of zero-based budgeting

Beyond immediate cost savings, zero-based budgeting delivers several longer-term benefits that strengthen organizational performance:

- Alignment with goals: Budgets reflect current priorities rather than historical baselines

- Flexibility: Funds can shift quickly when markets or strategies change

- Better decisions: The analysis deepens understanding of cost drivers and trade-offs, which improves resource allocation

These advantages compound over time as you build institutional knowledge about your business’s cost structure and value drivers.

Disadvantages of zero-based budgeting

Zero-based budgeting demands significant time from managers and finance teams. The first implementation cycle can consume 3–6 months of planning and analysis. This time investment pulls people away from their regular work, creating operational strain during the budget process.

The methodology requires specialized skills that many businesses lack initially. Finance teams need strong analytical capabilities to evaluate decision packages fairly. Managers need the ability to articulate value propositions clearly and quantify benefits convincingly. Smaller companies may struggle to build this expertise internally.

Departments often resist ZBB because it feels threatening. Managers who've run the same programs for years suddenly face the prospect of losing funding entirely. This fear can lead to sandbagging and inflated justifications. The process may also encourage short-term thinking as managers emphasize immediate results over long-term investments.

Common implementation obstacles

Beyond these fundamental challenges, you may encounter several practical hurdles when rolling out zero-based budgeting across your operations:

- Cultural resistance and change management issues: Employees accustomed to incremental budgeting see ZBB as disruptive and burdensome. Middle managers feel threatened by increased scrutiny. Leadership must address these concerns proactively through communication and by demonstrating commitment to the process.

- Technical and system requirements: ZBB generates massive amounts of data as teams create detailed decision packages. Spreadsheets quickly become unmanageable. You need budgeting software that can track packages, facilitate ranking, and enable scenario analysis across hundreds or thousands of line items.

- Training and skill development needs: Most managers have never built a decision package or ranked activities by value. Finance teams may lack experience facilitating ZBB processes. Successful implementation requires substantial upfront training and ongoing coaching as people learn the methodology through practice.

These obstacles are surmountable, but you should anticipate them and plan accordingly rather than assuming smooth adoption.

How to implement zero-based budgeting

Successful zero-based budgeting starts with preparation and securing buy-in from leadership and department heads. Set expectations about time and ownership, align on goals, and decide whether to pilot in one function before scaling. Many teams begin with a pilot to build confidence and templates that carry forward.

1. Define decision units

Decision units are the building blocks of zero-based budgeting. Each unit represents a distinct activity or function that can be analyzed independently, things such as recruiting, customer support, product marketing, or facilities management. Units should be meaningful enough to evaluate on their own but not so granular that you create thousands of packages.

Start by mapping your organizational structure and identifying natural breakpoints where activities have clear owners and measurable outputs. A marketing department might split into decision units such as digital advertising, content creation, events, and market research. Each unit should have someone who can speak authoritatively about its costs, benefits, and alternatives.

2. Develop and rank decision packages

Each decision package needs three core elements: a clear description of the activity, a detailed cost breakdown, and a compelling explanation of the value delivered. Managers should spell out what happens if the package doesn't get funded and describe alternative approaches at different funding levels—perhaps a $200,000 version and a scaled-back $120,000 version.

Ranking packages requires a consistent evaluation framework. Create scoring criteria based on factors such as strategic alignment, revenue impact, risk mitigation, and operational necessity. Have multiple reviewers score each package to reduce bias. This ranking process determines funding priority, so the methodology must be transparent and defensible to maintain credibility.

3. Review and allocate resources

Leadership reviews ranked packages in priority order, starting at the top and working down until the budget is exhausted. This evaluation focuses on validating the rankings, identifying packages that may have been scored incorrectly, and making final judgment calls. The review team should include executives who can assess strategic fit and operational feasibility.

Final allocation decisions often involve difficult trade-offs between competing priorities. Leadership may fund 80% of packages fully, fund another 10% at reduced levels, and cut the bottom 10%. These decisions should reflect company strategy. If innovation is a priority, research and development packages should rank high even if other areas deliver more immediate returns.

Document everything thoroughly, including which packages received funding and the rationale for key decisions. This creates accountability for spending decisions, provides a starting point for the next budget cycle, and helps communicate outcomes to teams whose packages didn't make the cut.

Best practices and tips

The success or failure of zero-based budgeting depends entirely on your company's structure and communication abilities. You should clearly outline objectives and decide the timeframe for the project before you begin. Here are a few best practices for implementing your new zero-based budget system:

- Use automated expense-tracking tools: Expense automation software gives you real-time visibility into spending and helps measure performance over time

- Define roles and responsibilities: Set expectations early, assign ownership, and empower employees to make informed decisions

- Set goals and milestones: Establish what success looks like and track progress throughout the cycle

- Schedule regular reviews: Frequent check-ins keep numbers accurate and ensure the process adapts to changing needs

- Be patient: Early resistance and mistakes are normal. Give the system a few cycles before deciding whether it works for your organization.

With persistence and proper execution, zero-based budgeting can transform how your company manages expenses and drives financial performance.

ZBB case studies: Real-world impact

Companies such as Unilever, Anheuser-Busch, and Mondelez have all implemented zero-based budgeting to control costs. When Kraft and Heinz merged in 2015, they used ZBB to target $1.5 billion in annual savings.

During the pandemic, apparel brand GUESS relied on the same approach to cut about $60 million from its quarterly expenses and reduced its capital spending to roughly a third of prior levels.

Governments have used the method too. Facing a $9.9 billion budget shortfall in 2003, the State of Texas required agencies to submit zero-based budgets. The shift helped close the gap and reduce general revenue spending for the first time since World War II.

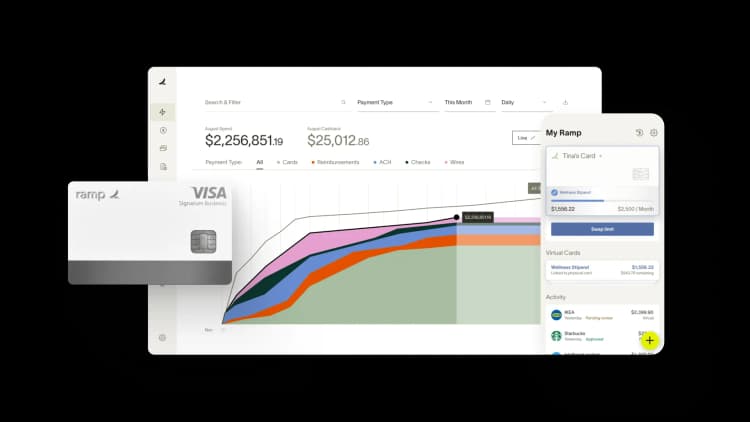

Track every dollar and eliminate budget bloat with Ramp

Unjustified expenses and budget bloat often stem from the same root problem: lack of visibility. When you can't see where money goes until month-end, overspending becomes the norm rather than the exception.

Ramp Budgets gives you real-time tracking across every spending category, so you can justify each expense and cut waste before it compounds. Ramp monitors budgets across departments, vendors, categories, and custom dimensions as transactions happen. You'll know exactly how much remains in any budget at any moment—no more waiting for reconciliation to discover overages.

Here's how Ramp helps you justify every expense and eliminate bloat:

- Set threshold alerts: Configure notifications when spending approaches or exceeds budget limits, so you catch potential overages before they happen

- Approve with full context: Review the projected budget impact, remaining balance, and spending history for every transaction before approving it

- Assign budget ownership: Give department heads and team leads direct visibility into their budgets so they can self-manage spending without bottlenecking finance

- Track hierarchically: Nest budgets within parent budgets to monitor spending at both granular and org-wide levels simultaneously

- Monitor all spend types: See cards, reimbursements, procurement, and accounts payable in one view, including committed spend from outstanding POs

When every stakeholder can see their budget in real time and every approval includes full spending context, unjustified expenses become harder to slip through.

Learn more about how Ramp helps you track budgets and eliminate unnecessary spending.

FAQs

ZBB is a budgeting approach that uses a clean slate every period a budget is created. That is, the previous period’s budget is not taken into consideration. Traditional budgeting, in contrast, is a financial planning process where budgets and expenditures from the previous period carry over into the next.

One main advantage of ZBB is its focus on expenses, not the bottom line of the business. This creates a much more focused budget and enables companies to reduce costs. Zero-based budgets are also independent from previous budgets, which provides companies with more financial flexibility.

Zero-based budgeting can be used by individuals for personal finance, but is largely used by businesses for its budget planning advantages.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits