- What is employee empowerment?

- The biggest barrier of true employee empowerment

- Empower employees to make spending decisions

- Full employee empowerment

When the COVID-19 pandemic scattered workers and ushered in an era of remote work, even the most centralized companies were compelled to trust people to make their own decisions and get their jobs done on their own time and in their own way. Lucky for them, it turns out that increased employee empowerment actually improves jobperformance.

What is employee empowerment?

Employee empowerment is the practice of entrusting your employees with as much flexibility and autonomy as possible and letting them define the organization's culture for getting work done in the best possible way. A famed Stanford study once found that home workers got 13% more work done than comparable office workers, and more recent research suggests that the US economy will be 5% more productive in the coming years as workers work remotely at least part of the time.

“As we’ve moved to virtual work, we haven’t just coped, we’ve actually thrived,” says Walmart CTO Suresh Kumar. “We are more focused on the things that have the greatest impact for our customers, associates and the business.”

In a hybrid working environment, leaders are looking to blend the independence of remote work with the collaboration that comes from a return to the office to create an engaged company culture. And the evidence is convincing: empowered and engaged employees do the best work. “For most workers, some activities during a typical day lend themselves to remote work, while the rest of their tasks require their on-site physical presence,” reads this report from McKinsey.

But yet, even with the multitude of benefits, some aspects of the hybrid working model haven’t caught up with the times. This often leaves many decision-makers frustrated and searching for solutions that can both improve the employee experience and help employees improve their well-being. Companies also have to ensure that employee engagement is having a positive effect on the business's bottom line and that organizational goals are being achieved.

The biggest barrier of true employee empowerment

Cultural and technological barriers to greater autonomy have been shattered, but one area that is still stuck in the old world is employee spending, impeding true employee empowerment. Simply put, until now we had neither the flexible expense policies nor the tools to facilitate them. Done right, empowering employees to spend what they need bolsters trust, fosters loyalty, improves employee satisfaction, and reduces employee turnover.

Expense policies were once the domain of rigid, even sprawling, finance departments. But as modern streamlined companies look to stay competitive, they can struggle to balance the desire to empower employees with the imperative of controlling spend. The changing nature of work has only exacerbated this dilemma. As one study found, expense policy violations skyrocketed 292% amid the work-from-home culture accelerated by the COVID-19 pandemic.

"Done right, empowering employees to spend what they need bolsters trust and breeds loyalty"

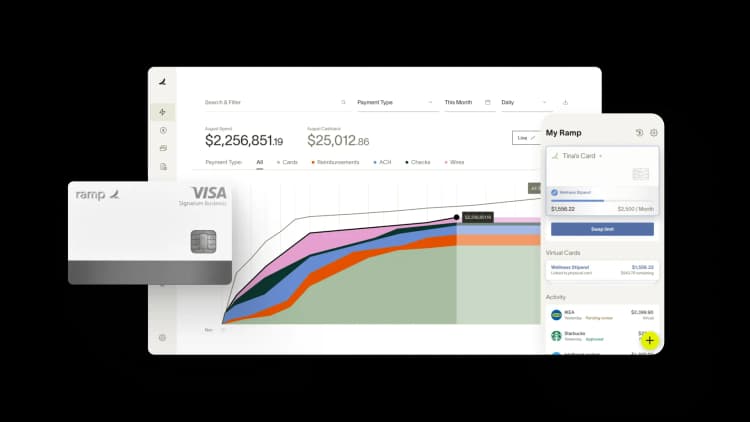

But smartphones, email, Slack and SMS offer new opportunities for rebalancing the equation. Just as those channels make it easier than ever before to connect with coworkers, management and clients, a centralized expense platform like Ramp uses these same channels to simplify expense reporting.

Even now, many businesses remain stuck in the past. And frankly, it’s starting to look a little ridiculous.

Employees front costs with their personal credit cards, before submitting lengthy expense reports to seek reimbursement. In a case where a business traveller pays for big-ticket purchases like flights, accommodation, food, and supplies, spending can run into the thousands of dollars and seriously impact household cash flow. Other companies persist in the opposite approach, issuing high-limit business credit cards and then chasing employees to make them repay mistakes or unapproved expenses.

Rather than create trust, arrangements like this build resentment, and deputize finance teams as both police departments and collection agencies. Such adversarial relationships create ill will and mistrust between departments that are supposed to be working together. Perhaps most consequential, traditional arrangements like these cut line of business (LOB) leaders out of the expense process altogether. That means they lack contemporaneous knowledge of how their team members are spending departmental or project budgets even as employees are frustrated with filing reports.

As our Creative Director, Diego Zaks, puts it, “At the end of the day what you need is the resources to do your job and achieve your objectives."

Empower employees to make spending decisions

Leaders that empower employees are particularly effective at encouraging creativity and influencing behavior. They are more likely to be trusted by their direct reports. Giving employees the means to spend what they need, and empowering them to do so, strengthens these same bonds. Employees that feel psychologically empowered report increased job satisfaction, organizational commitment and demonstrate improved performance. They are less stressed, and the company improves retention.

Give every employee their own corporate card

This practice can liberate creativity while codifying spending policies, workflow, and financial oversight. Decisions on spending priorities devolve to individual line managers, boosting efficiency and breeding good will. Managers are closer to the work and better positioned to know exactly the justification for a given expense. They set card limits based on prior experience, and easily scale them up or down using platforms like Ramp.

Managers keep an eye on purchases and budgets in real-time. They point the way forward, and immediately review and approve costs falling outside the normal day-to-day spend. Teams feel the company trusts them to make spending decisions.

Minimize admin overhead

Leaders who empower their teams delegate authority to employees, ask for their input, and encourage autonomous decision-making processes. Freed of the administrative burden of expense reports and feelings of micromanagement, employees are able to do their jobs better. With this degree of autonomy, they show increased faith in upper management and their own LOB leader. More invested in the company, they put forth more effort and make a more positive impact.

When all spending is pre-approved, out-of-policy spending is nearly impossible. Whereas traditional corporate cards like American Express offer little by way of advanced oversight, this new class of cards, and the affiliated methods for tracking expenses, offer granular controls that prevent problems before they start. Not only does this save the company money, but it cuts out unnecessary admin work.

Everyone can dedicate their time and skills to doing what they do best. Creatives spend more time creating, and salespeople focus on selling. And isn’t that the whole point?

Our finance controller Edwine Alphonse says, “There is no conflict, there is no tension. You can see what they are spending on. Employees don’t have to use their personal card anymore. They are empowered.”

Full employee empowerment

Just as an earlier era of digital tools decentralized communication, the combination of new platforms and revised policies look poised to revolutionize expenses. When employees define the tools they need to get their job done, increased efficiency, good vibrations and improved group dynamics follow. Teams that feel empowered perform better. New expense platforms like Ramp meet employees where they already are. In a changed work environment, going back to the office looks a lot like going back to the future.

FAQs

A great way to empower employees is to give them their own corporate cards. Implementing this practice can help liberate creativity, boost efficiency, and breed good will.

There are many benefits of employee empowerment. The biggest is probably that empowered and engaged employees perform better and generally do the best work. More empowerment leads to better employee feedback, more job enrichment, and more profitability for the company, without forcing additional responsibilities.

There are many to empower employees properly, largely depending on which area you are looking to empower. To fully empower employees, you should let them define the tools they want to use to do the job. This improves efficiency, leads to good vibrations in the team, and better group dynamics.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits