- Eliminate payment errors and track spend against purchase orders

- Approve bills anytime, anywhere, and safeguard your vendor data

- Adapt travel rules for your team’s needs and gain real-time insights

- Take charge of your team’s finances with enhanced tools for collaboration

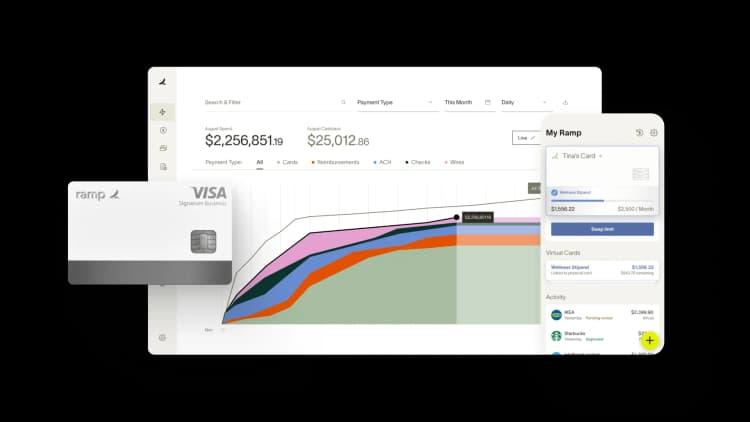

As the seasons change, so do the ways you can manage your finances in Ramp. Our October product updates are designed to remove friction, boost productivity, and keep your business running smoothly. From approving bills on the go to implementing advanced fraud controls, these releases touch virtually every corner of your financial operations.

Let’s dive in.

Eliminate payment errors and track spend against purchase orders

3-way matching

Our advanced 3-way match system allows you to compare purchase orders, invoices, and item receipts to ensure you’re only paying for the goods you’ve actually received. Ramp automates this process, alerting you to discrepancies so they can be resolved quickly. This reduces the risk of overpayments and ensures your accounts payable team only processes accurate invoices.

Simplify purchase order tracking with direct transaction matching

Tracking spend for purchase orders just got easier. You can now directly match card transactions to a PO—no more tedious workarounds like using memo fields to manually connect POs to transactions. Link your card spend to purchase orders without needing a bill, streamlining your procurement process and ensuring accurate financial tracking.

Learn how Precision Neuroscience improved its procurement process by 50%. Read the story >

Approve bills anytime, anywhere, and safeguard your vendor data

Approvals on mobile

Bill approvals just got more flexible. With Ramp’s mobile app, approvers can now greenlight bills directly from their phone, whether they’re using iOS or Android. This keeps approvals moving, even when key team members are on the go. Faster approvals mean fewer bottlenecks, keeping teams productive and business flowing smoothly, no matter where you are.

Protect against unauthorized changes to vendor information

Fraud prevention just got an upgrade. With the ability to trigger approval chains for vendor edits, you now have control over any changes to vendor information—especially critical fields like ACH details. This proactive approach to managing vendor changes helps safeguard your business from unauthorized updates.

Customize approval re-triggers

Not all changes require a full re-approval process. With Ramp’s new settings, users can choose which fields (vendor, amount, payment schedule) will require re-approval, and make payment details optional when creating bills. This is especially useful for AP clerks who might not be the ones managing payments. Avoid redundant approvals and streamline your workflow, saving time for your team.

Select specific cards for vendor payments

If you’re paying a vendor with a Ramp card, you can now select exactly which card you’ll be using. This simplifies the matching process between bills and transactions, reducing confusion and making reconciliation a breeze. More precision, less guesswork. This feature enhances transparency and accuracy when paying bills.

Bulk actions for bill management

With new filtering, sorting, and bulk action capabilities for Ramp’s dashboards, managing large volumes of bills is now more efficient than ever. Mark bills as paid, remind approvers, or retry payments all from one place. Bulk actions speed up repetitive tasks, allowing you to focus on the what.

See how to manage 10x the invoices in half the time >

Adapt travel rules for your team’s needs and gain real-time insights

Multiple travel policies by employee type

Travel should accommodate the varied needs of your employees. Now, admins can set different travel policies for specific employee groups, whether it’s adjusting flight class for busy sales teams or making economy-plus available for those long flights. This level of customization ensures that every trip is in line with your company’s policies, no matter who’s booking it.

Enhanced admin reporting

We’ve redesigned the travel dashboard to give admins more control and insight. Now, you can view monthly spending charts, group transactions by user or trip, and track pending requests. Exporting data to CSV? That’s coming soon too! Real-time monitoring means spotting trends and addressing out-of-policy transactions immediately, rather than dealing with surprises at the end of the month.

Learn how STUDS replaced 4 tools with Ramp >

Take charge of your team’s finances with enhanced tools for collaboration

New reporting features for managers and department owners

Managers and department owners can now take full control of their team’s finances. New reporting features provide detailed, real-time insights into spending patterns, empowering leaders to spot anomalies and optimize budgets. This feature gives managers and department leaders the tools they need to monitor spending, making it easier to prevent financial surprises before they happen.

Bookkeepers as managers

For teams looking to better reflect their organizational structure within Ramp, bookkeepers can now act as managers. This means they can invite users, issue spend, and maintain their managerial responsibilities within the approval process. Ensure smooth operations by giving team members the permissions they need.

See how to make real- time decisions with Ramp’s reporting >

From travel management to bill approvals, these updates make it easier to manage spend, prevent fraud, and empower your teams. It’s not just about saving time—it’s about creating smarter, more cohesive processes that drive your finances forward. Check out our upcoming webinar on Tuesday, Oct 15 to see it all in action.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits