How to manage 10x the invoices in half the time

- Automate invoice processing completely—no, really

- Remove bottlenecks without sacrificing control

- Easily process invoices in bulk

- Top questions from the webinar

- Watch the full webinar

Too often, AP processes break down as the company grows. What works for processing 50 invoices a month often requires significant adjustment to handle hundreds, let alone thousands, of invoices. At 1000 invoices, an inefficient process can require over 140 hours of work— nearly a full month of work for one person! As companies grow, AP processes need to evolve.

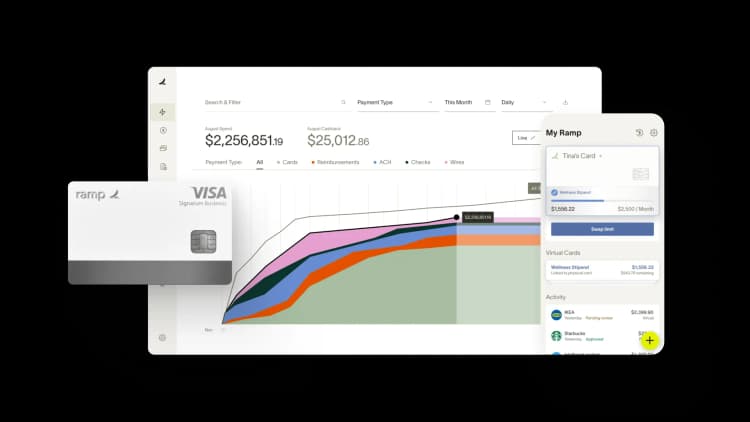

We recently hosted a webinar covering best practices for managing large volumes of bills. In the session, we showed how finance teams can save time with AP technology that works for them: tools like Ramp Bill Pay efficiently handle invoice variations, balance control with efficiency, and minimize redundancy.

Below is an overview of the discussion and the top questions we received during the live session. Want to see it all in action? Check out the replay here.

Automate invoice processing completely—no, really

Despite the slew of AP automation solutions on the market, did you know nearly 70% of AP team time is still spent on manual data entry? Many systems struggle to capture details from complex invoices, especially those with dozens of line items, multiple pages, or ambiguous layouts.

Ramp Bill Pay is designed to handle all of these situations and more:

- Ramp’s AI reads and understands the language within the invoice, allowing it to grasp context and meaning. For example, it recognizes phrases like “Net 45” as payment terms and calculates the due date accordingly.

- The tool will also automatically extract line item descriptions and dollar amounts. Say goodbye to tedious copying and pasting—even for invoices with 10+ lines.

- Expedite coding by creating default coding rules for specific vendors or leverage personalized suggestions based on invoice content and history.

Staci Robinson runs AP at Pair Eyewear and she estimates Ramp Bill Pay has helped her cut invoice processing time by as much as 80%. Previously, her team juggled numerous spreadsheets and manual uploads. Now, with Ramp, everything syncs effortlessly. "We love how Ramp and NetSuite work together," she says. “It feels like they were made for each other."

Remove bottlenecks without sacrificing control

Most AP systems make finance teams choose between blanket controls that slow down processes or minimal oversight that increases risk:

- Blanket control: Any change to a bill, even fixing a typo, requires full re-approval, causing significant delays.

- Minimal oversight: All bill changes are allowed without checks, risking unauthorized adjustments.

With Ramp, you no longer have to sacrifice control for efficiency. You can define exactly which changes to a bill require re-approval. For example, turn off re-approval for scheduling changes, but keep it on for payment amount modifications.

Easily process invoices in bulk

AP teams waste time on repetitive, tedious actions because many tools aren’t optimized for high-volume processing. The small, manual updates add up quickly.

For instance, we found it takes an AP team member 15 seconds on average to update coding for a single bill. They need to search for it, click in, select the correct codes, verify details, and save. Multiply these clicks by 100 invoices per week and you’re suddenly losing around 20 hours per year on tasks that should be effortless

Ramp Bill Pay is built to cut out this unnecessary work. With the ability to quickly create and edit bills in bulk, update fields, and pay multiple invoices at once, Ramp eliminates redundant manual actions. This streamlined process frees up your AP team to work faster and focus on more valuable tasks.

Top questions from the webinar

- Can you code an entire invoice at once while keeping separate lines for the amounts? Yes, you can bulk-code invoices from the tables view.

- Can we assign a dedicated employee to verify bank information instead of the CFO or a manager? Yes, you can set a specific person to review updates to vendor details.

- If we require approval for changes to a vendor’s bank information, when do those changes take effect? Once the bank information is approved, it's automatically updated in relevant bills.

- Can you assign bill approvers on a vendor level instead of the invoice level? Yes, with the advanced approvals on Ramp, you can configure approval routing, including approvals based on the vendor.

- What’s the turnaround time from when a new vendor is added to when you can send them a payment? As soon as you would like! Ramp allows you to create new vendors while creating bills. As long as all your company approvals are met, Ramp can initiate payment on the bills.

- Can we set custom billing terms? We allow default terms to be set at the vendor level, but we do not have custom billing terms available at this time.

- Do you have 1099 reporting? We have vendor onboarding that can collect vendor tax details via Ramp, including TIN verification. We can also track if a vendor should receive a 1099 based on Bill Pay spend for the year. At the end of the year, you can download a CSV file of tax details collected via Ramp for all 1099 vendors. We’re working on additional 1099 features that will be available later this year.

- Do you integrate with Acumatica? Yes, Ramp customers can connect their account to Acumatica to sync transactions, bills, statement payments, vendors, and more. More info here.

- Can vendors update their own banking information? Yes, vendors can update their banking and company information via the Ramp Vendor Portal. These changes automatically route to your team for review.

- Can you copy a previous month’s bill entry to save time on coding? We’re currently working on several features in this area, such as creating a copy of a previous bill and applying its line items. They are on the roadmap for Q4!

- Can we pay bills with a Ramp card? Sometimes vendors take a long time to send their payment details. If your vendor accepts Visa cards, you can pay their invoices with a Ramp card. You can either manually enter card details into the vendor's payment portal or automatically send details via a secure link. See more information here.

Watch the full webinar

During the session, Ramp Bill Pay’s Head of Product Elena Weissmann also previewed upcoming features that will help AP teams streamline communication, manage cash flow, and access more payment methods. Catch the replay here and stay on top of all other product updates via our announcement page.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°