Turn platform payments into profit

Earn cashback on every vendor payment—no bank integration or pre-funding required.

Earn margin from every payout

Ramp lets you earn interchange on vendor payments without needing to build your own payment stack.

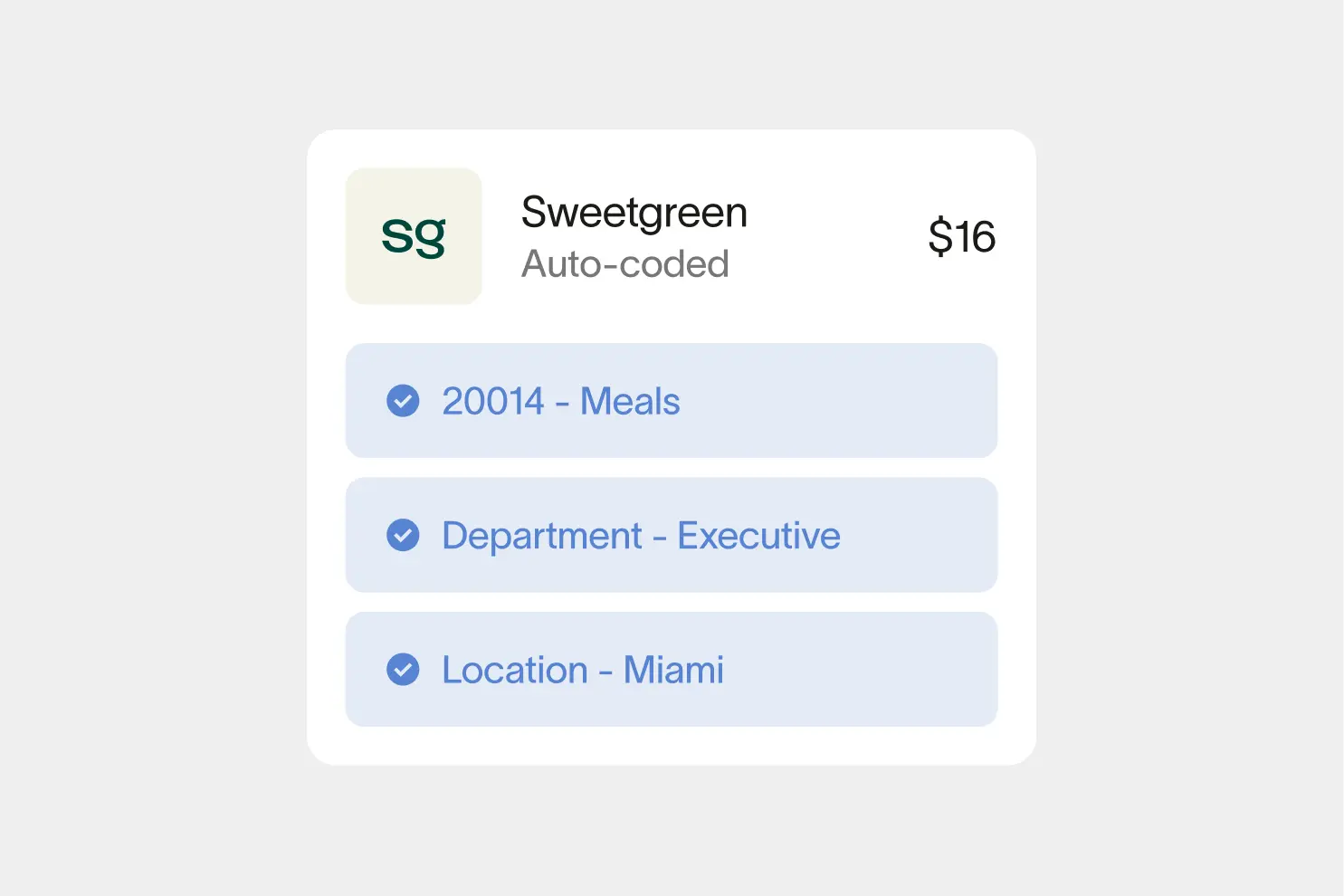

From card to close, fully automated

Use Ramp's API to generate single-use virtual cards with precise spend caps, expiration rules, and metadata for fraud protection and clean reconciliation.

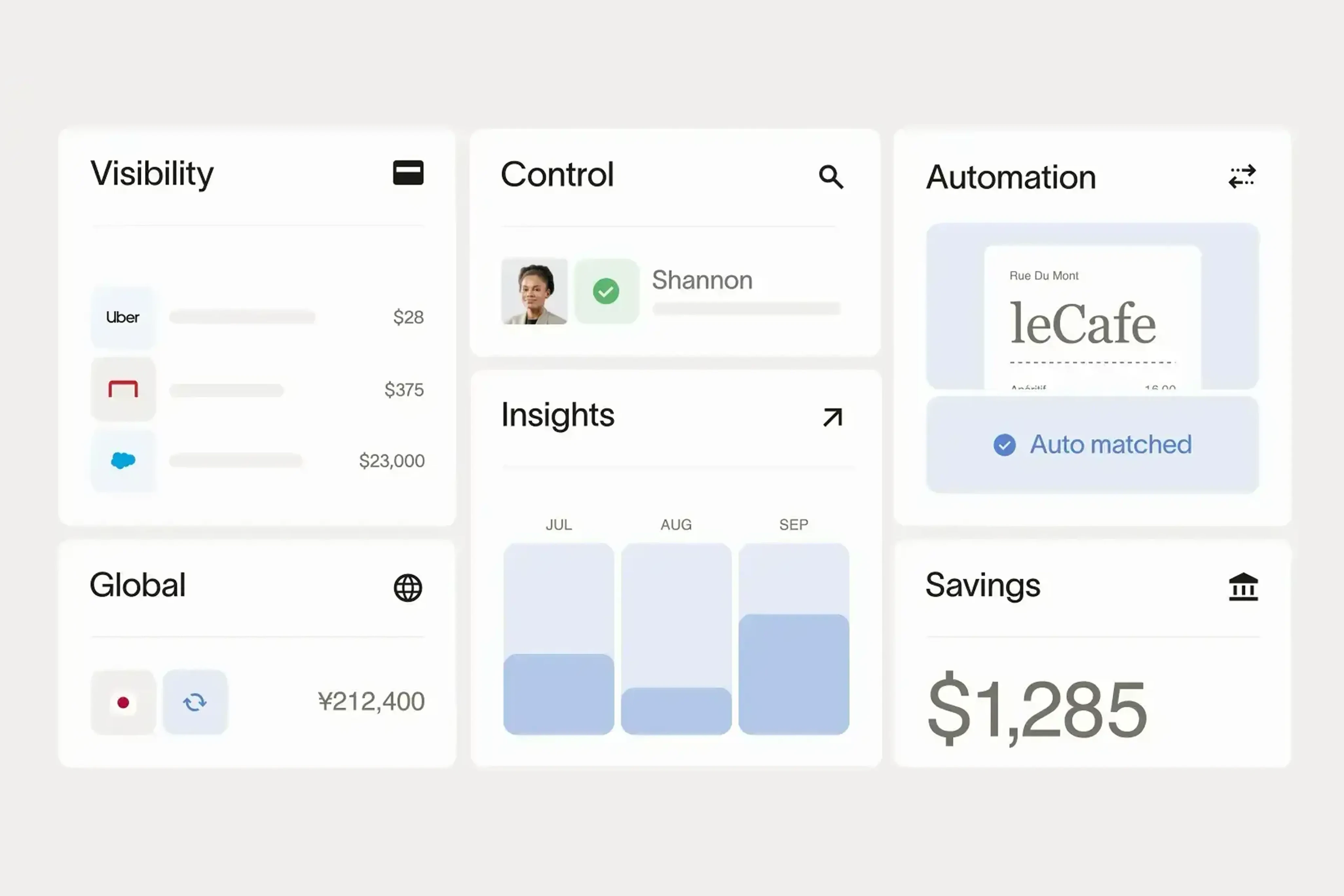

Deliver payments instantly

Eliminate payout delays—vendors receive cards immediately and can use them with no delay.

Go live in under a week

No sponsor bank. No heavy integration. Our API takes abstracts the hard parts away so you can ship zero to one in a matter of days.

FAQs

A virtual card is a payment method generated for a specific transaction or use case. It can be configured with expiration dates, merchant restrictions, and spending caps—ideal for precise, auditable payments tied to a single vendor, booking, or invoice.

Embedded platform payments are ideal for:

- Travel aggregators

- B2B marketplaces

- Field service platforms

If your platform facilitates payments between buyers and suppliers—or needs to control spend per transaction—this solution is for you.

Yes. You can:

- Restrict cards to specific merchant categories (e.g., airlines, hotels)

- Lock cards to specific vendors

- Set spending limits and expiration dates to prevent misuse

Ramp uses a unique Card ID to Transaction mapping so every card is directly linked to the payment, booking, or vendor it represents. This helps:

- Simplify refund workflows

- Support reconciliation even after a card is locked or expired

- Enable webhook notifications for charges, refunds, and declines

Yes. Refunds can still be processed on locked or expired cards, which ensures clean reconciliation without any manual intervention.

Not at all. Ramp handles the hard parts—card issuing, compliance, settlement, and reporting. You focus on your platform; we’ll handle the payment infrastructure.

Platforms earn interchange revenue on every transaction processed through Ramp’s virtual cards—without needing to build a full payments stack.