Finance automation for life sciences companies.

A finance automation platform that combines corporate cards, expense management, accounts payable, procurement, travel, and reporting into one unified system.

Eliminate expense reports

Stay focused on conferences, trunk shows, and demos. Report expenses instantly by SMS, app, or email.

Explore expense managementVendor payments in minutes

Pay CROs, lab suppliers, and others with no transaction fees on Bill Pay. Ramp automatically scans complex invoices, tags every line item, and applies custom rules.

Explore accounts payableTrack OPEX in real time

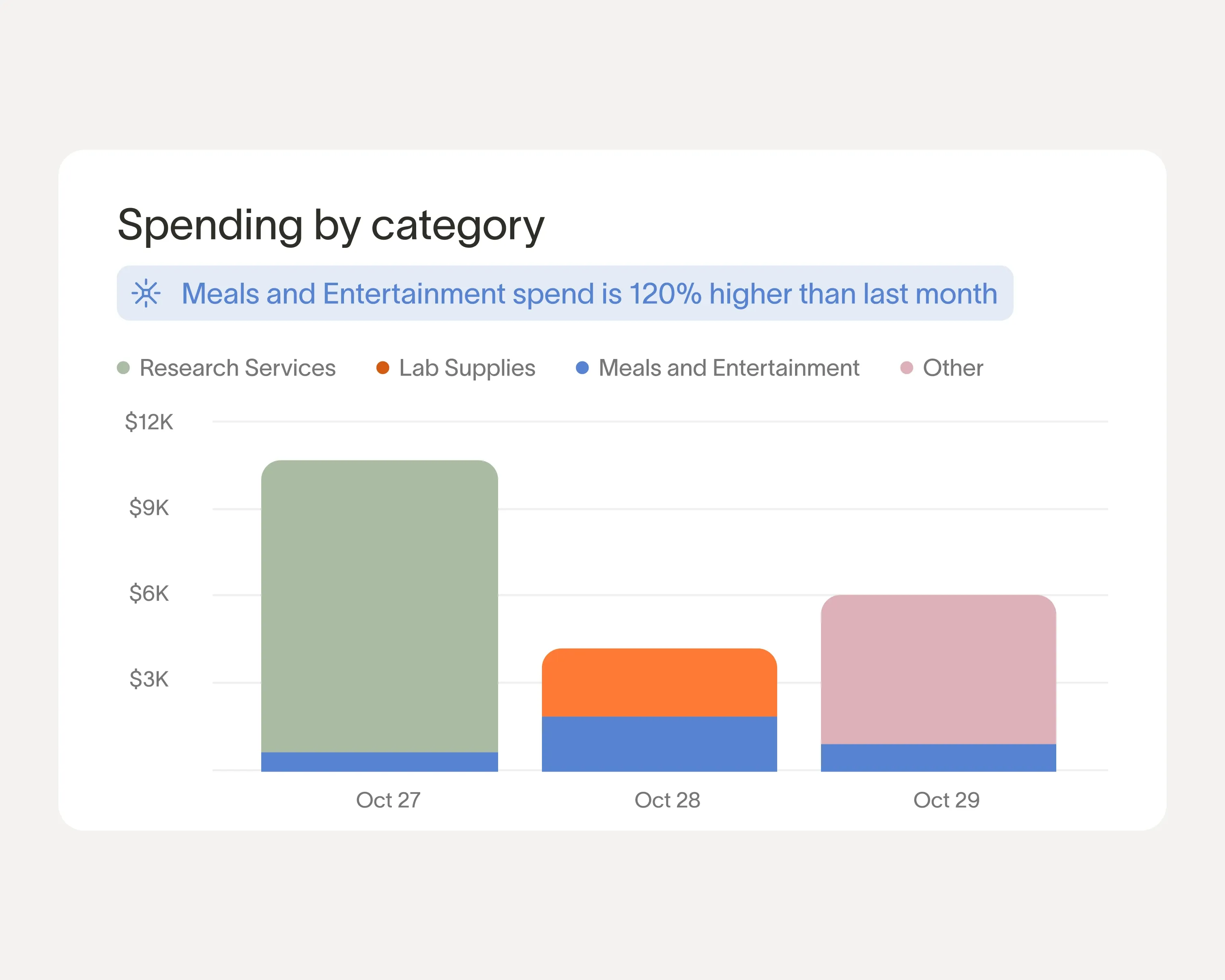

Track R&D, clinical trials, and other critical spend in live dashboards to identify trends, overspending, and cost-saving opportunities.

Explore reporting

Built-in Sunshine Act compliance

Stay audit and Transparency Reporting–ready with built-in compliance and integrate with MedPro Systems for real-time HCP search & Federal CMS Open Payments (“Sunshine Act”), State & Local Aggregate Spend reporting.

Explore Ramp’s Sunshine Act