Calculate New Mexico’s per diem allowance for your business travel

New Mexico’s vibrant mix of cities, desert landscapes, and cultural landmarks makes business travel planning essential. The state’s per diem rates provide clear guidelines for lodging, meals, and incidental expenses, allowing businesses to manage costs effectively across varied destinations.

By following New Mexico’s per diem guidelines, companies can ensure fair employee expense reimbursement, support compliance with federal regulations, and create a consistent travel expense framework for their teams.

New Mexico per diem calculator

Calculate your per diem allowance by inputting your travel dates and destination details, including location, county, and city.

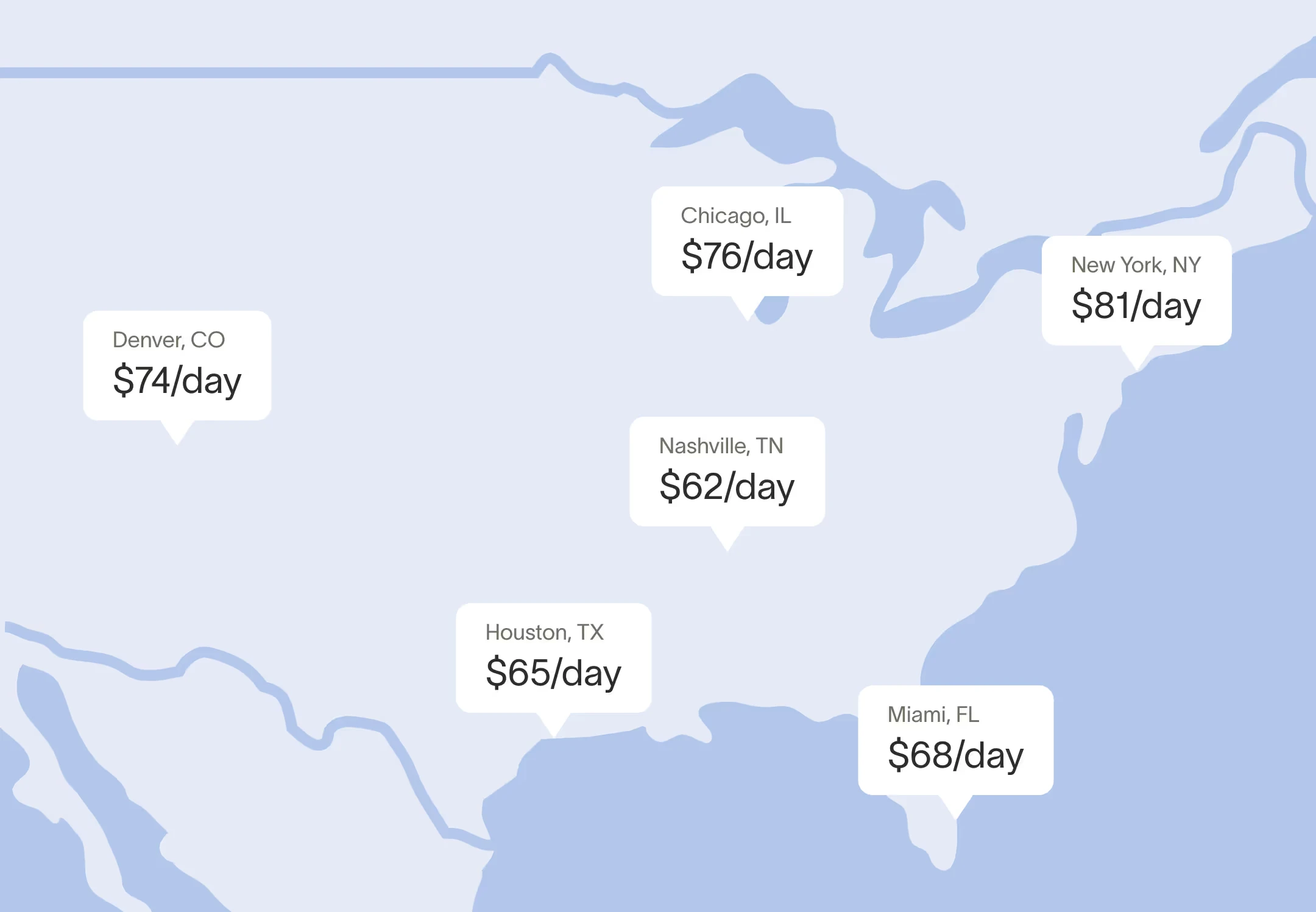

New Mexico per diem rates

If you visit a New Mexico city without a specific per diem rate, the standard federal rates apply: $110 for lodging and $68 per day for meals and incidentals. Set by the General Services Administration (GSA), these rates are effective from October 2025 through September 2026.

For cities with location-specific rates, the GSA provides fixed per diem amounts to account for cost variations. Here are the New Mexico cities with specific per diem rates:

| County | Oct 2025 | Nov | Dec | Jan 2026 | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Default* | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 |

| Bernalillo | $144 | $144 | $144 | $144 | $144 | $144 | $144 | $144 | $144 | $144 | $144 | $144 |

| Eddy | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 | $155 |

| Santa Fe | $167 | $142 | $142 | $122 | $122 | $167 | $167 | $167 | $167 | $167 | $167 | $167 |

| Taos | $128 | $128 | $128 | $128 | $128 | $128 | $128 | $128 | $128 | $128 | $128 | $128 |

| County | M&IE Rate |

|---|---|

| Default* | $68 |

| Bernalillo | $80 |

| Eddy | $74 |

| Santa Fe | $80 |

| Taos | $74 |

Automate travel spend controls based on per-diem rates

Following New Mexico’s per diem rates not only supports accurate expense reporting and IRS compliance but also promotes financial accountability across teams. Standardized per diem rates create a clear structure for travel expenses, helping to streamline reimbursements and simplify internal workflows.

Ramp makes business travel easier by:

- Setting precise, location-based per diem rates that support compliance and expense control

- Enabling employees to track their allowances in real time, helping them stay on budget and understand their limits

- Simplifying per diem management with tools like GSA rate integration and custom multipliers, making travel expense processes seamless for both admins and employees.

Simplify your business travel from booking to expense tracking with Ramp