3,293* teams chose Ramp over Brex.

Our product velocity, driven by customer dedication, has consistently won over 50,000 companies. Yours could be next.

Opens ChatGPT in a new tab.

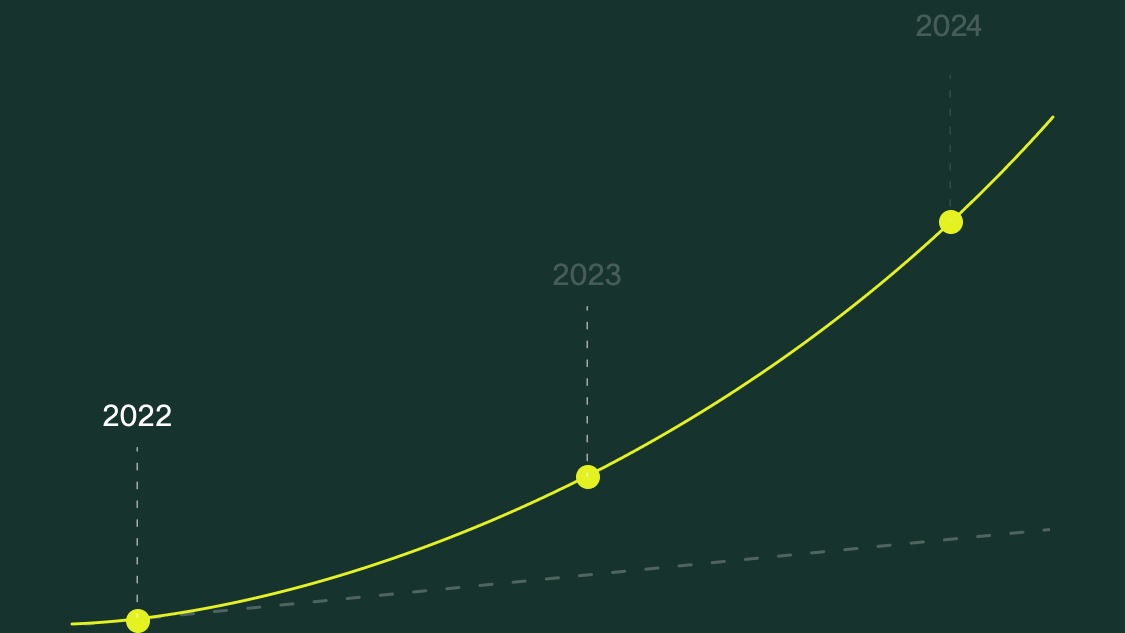

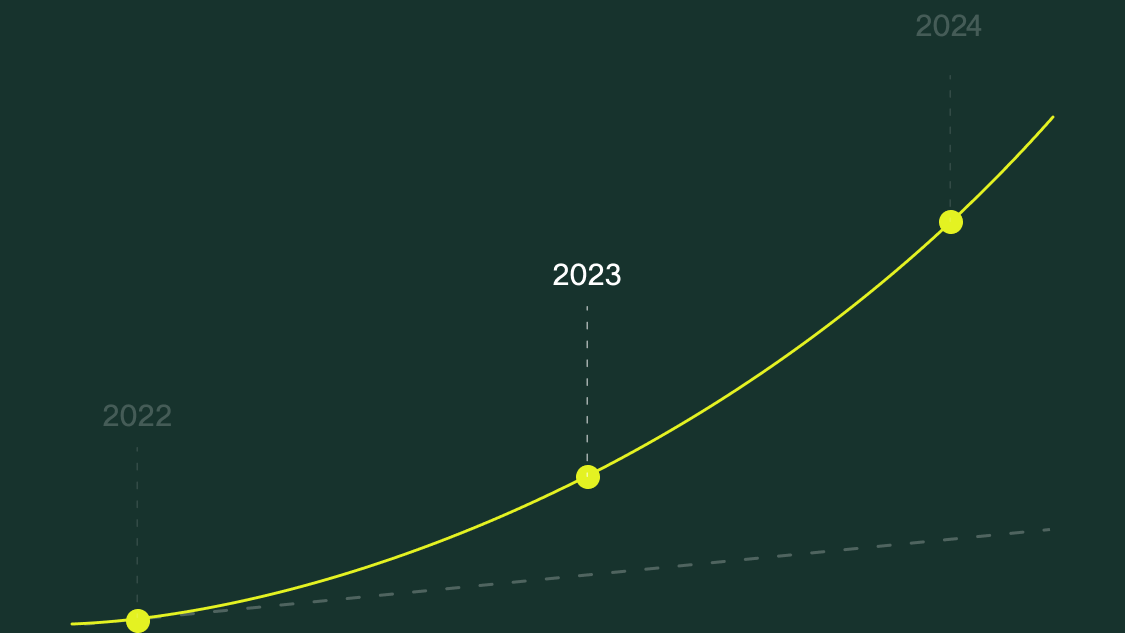

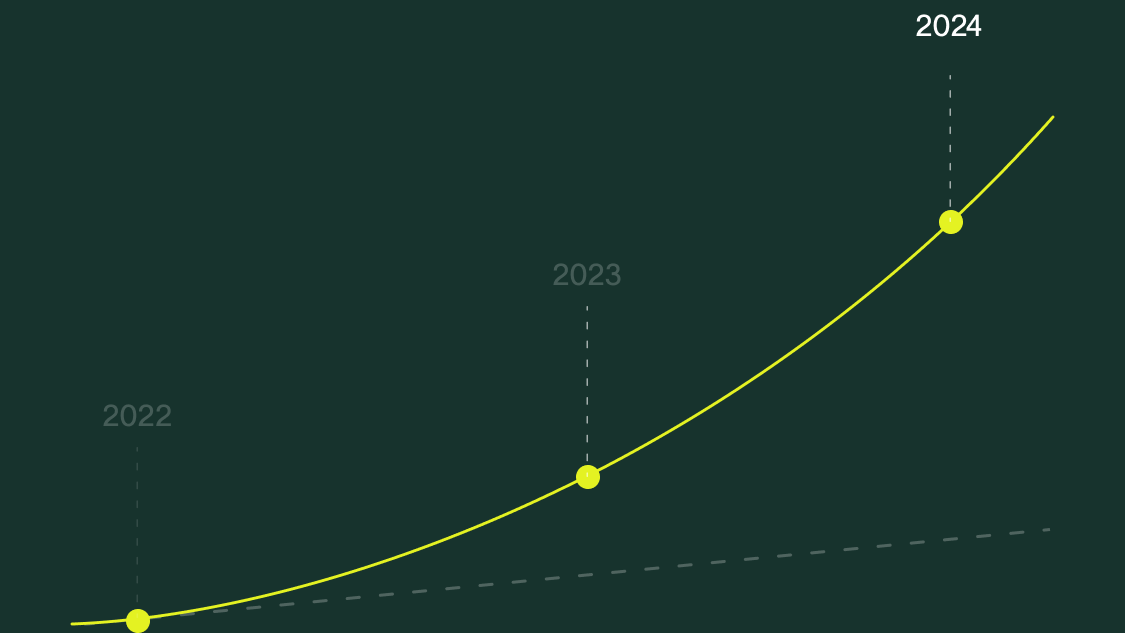

Projections lie. Numbers don't.

Ramp over the past

three years

• 4x revenue growth

• Launched Ramp Bill Pay

• 150+ releases including Ramp Intelligence and Ramp Procurement

• 2x revenue growth

• 15,000+ customers

• 50,000+ customers with 1M+ users

• Raised a series D-2 round• 200+ releases to date including Ramp Travel

Two out of three** new businesses choose Ramp. Here’s why:

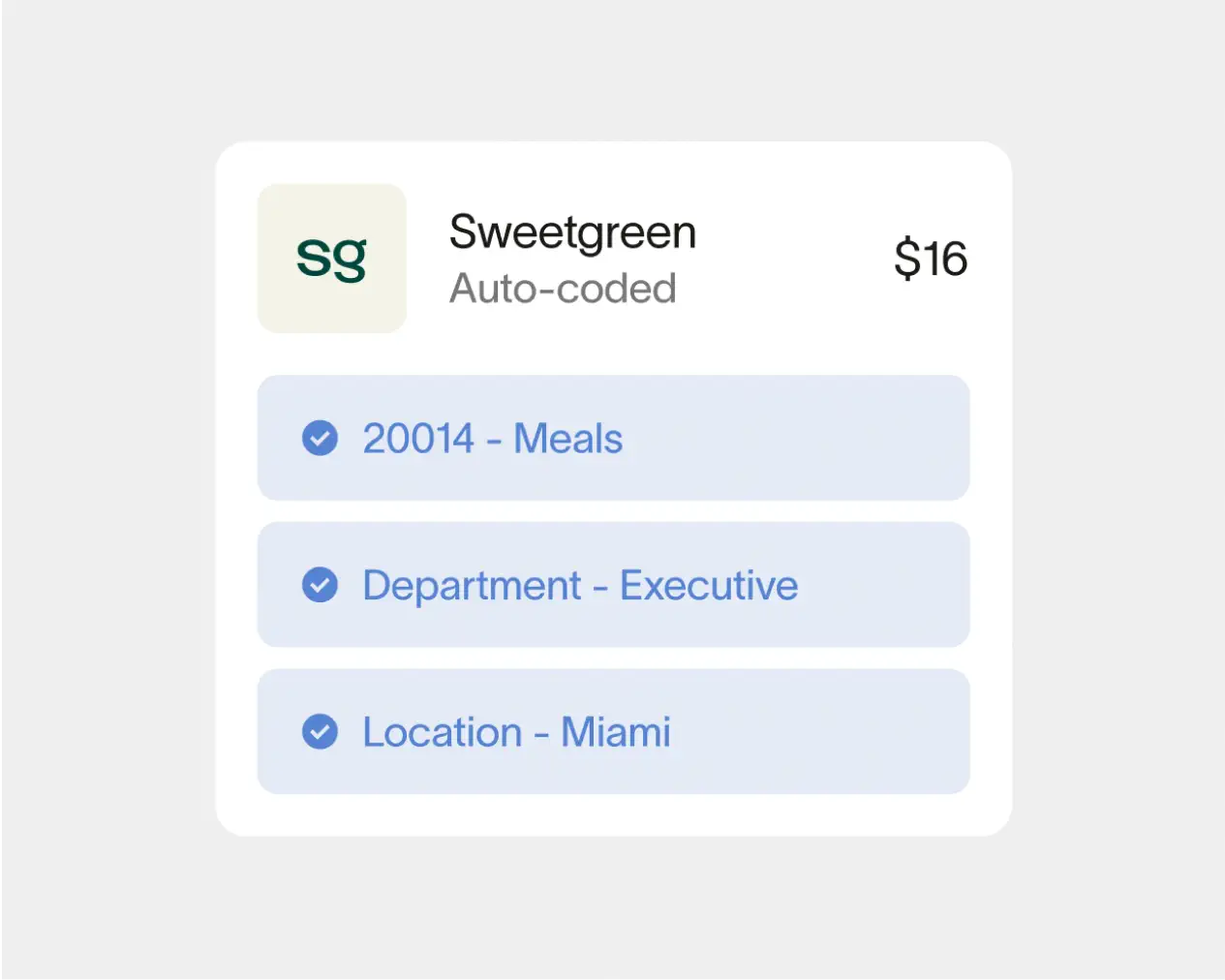

Expenses, done in 2 minutes.

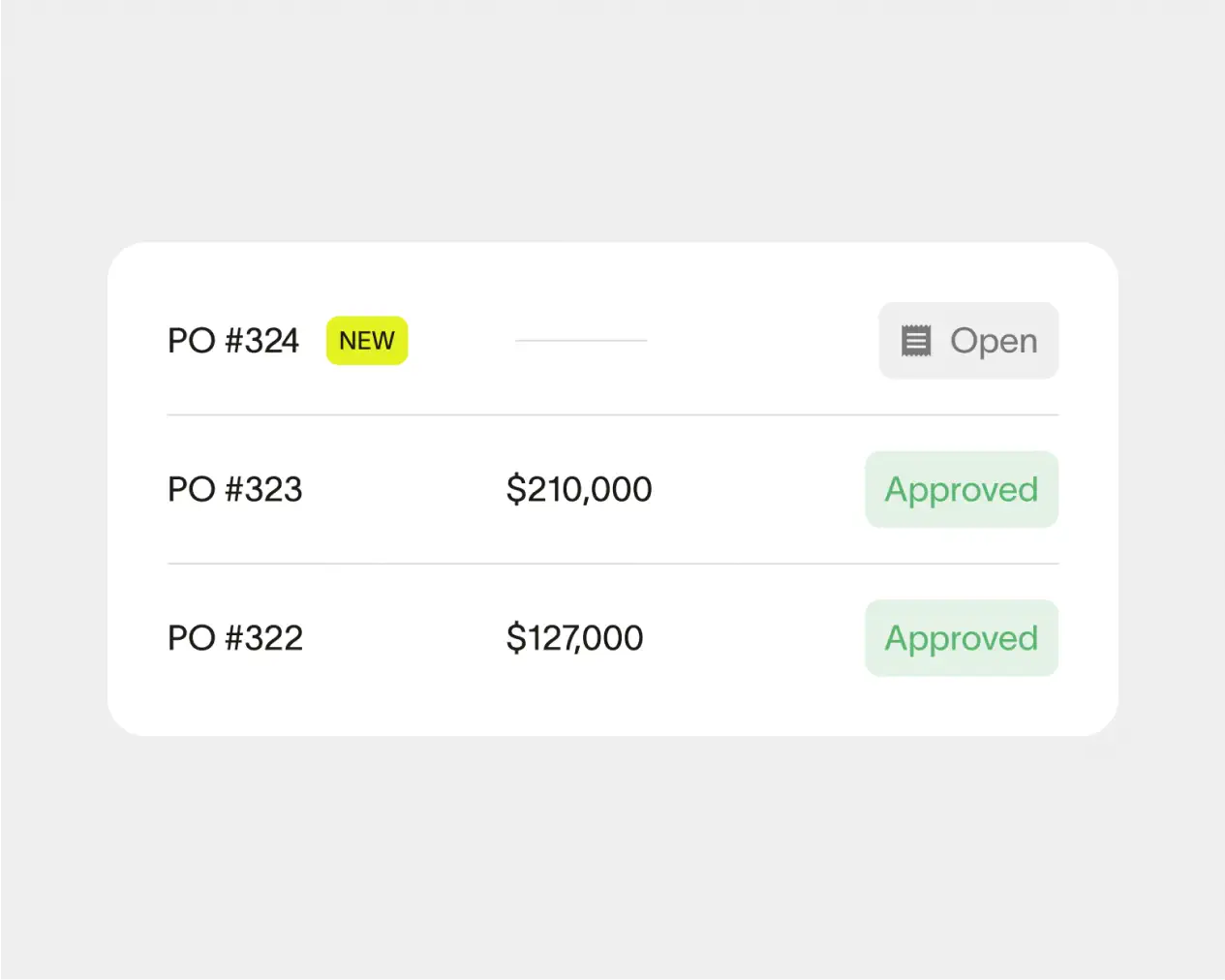

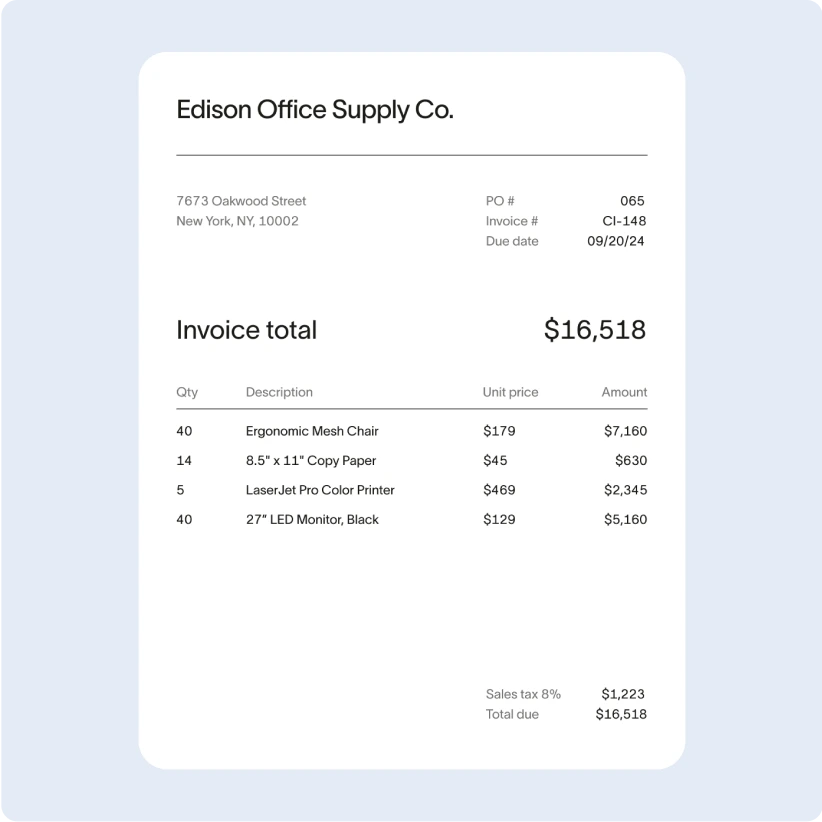

The easiest procure-to-pay.

Audit-proof accounting.

“Our finance team and employees alike love Ramp for its ease of use, spend visibility, and excellent customer service. Its modern spend controls help us all take accountability for the operating efficiency of the company.”

Ivan Makarov

Former VP of Finance, Webflow

Expect more from your financial operations platform.

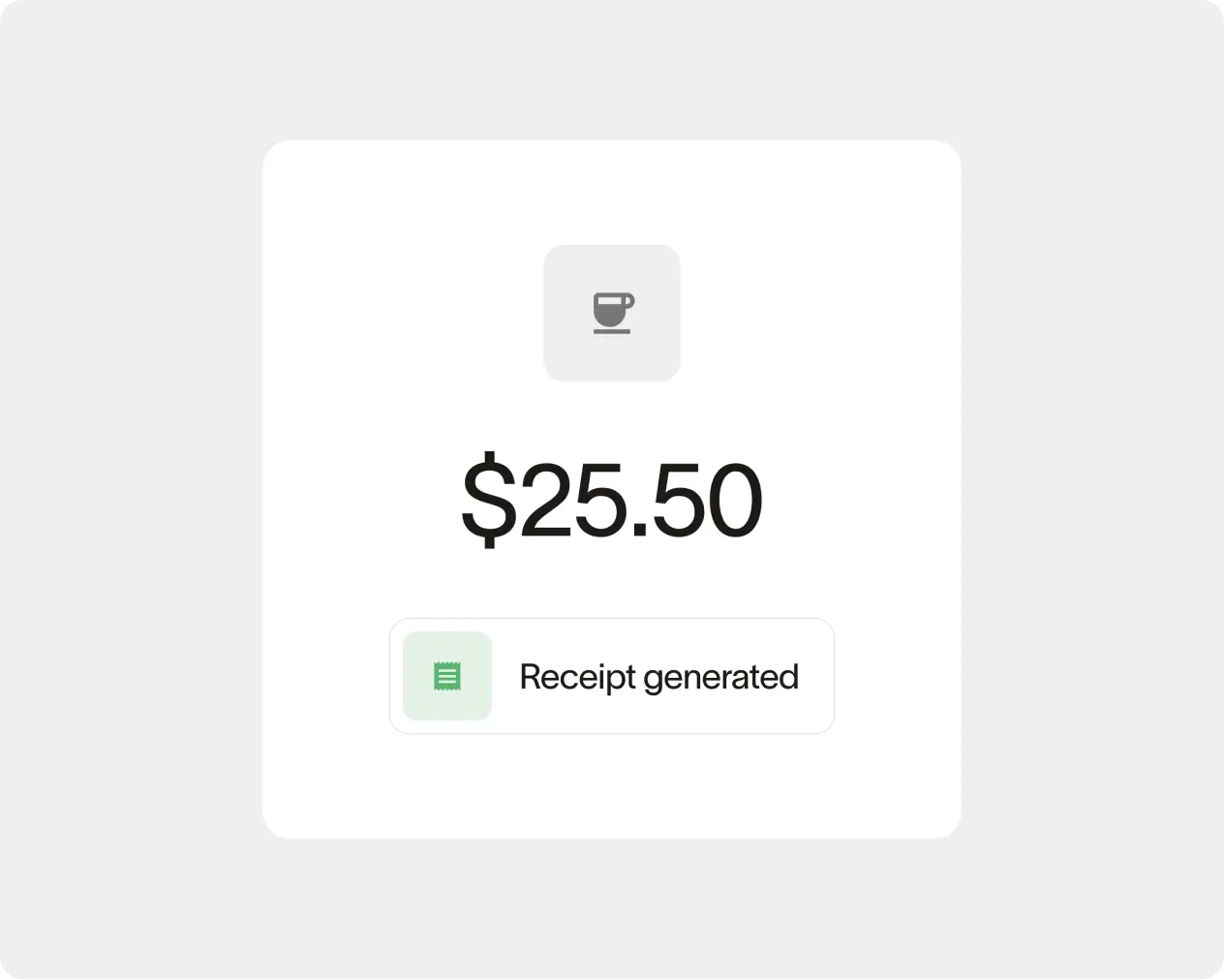

“In the year we used Brex, we averaged ~70% of transactions missing a receipt. In the first 2 months of Ramp, only 12% of transactions missed a receipt. No change in policy, only changes in software.”

Compare Ramp vs Brex on G2

Prioritizing speed?

Ramp is built for you.

Ramp is the preferred choice for modern finance teams.

Ramp’s AI does the work for you.

Procure it all, and pay in one place.

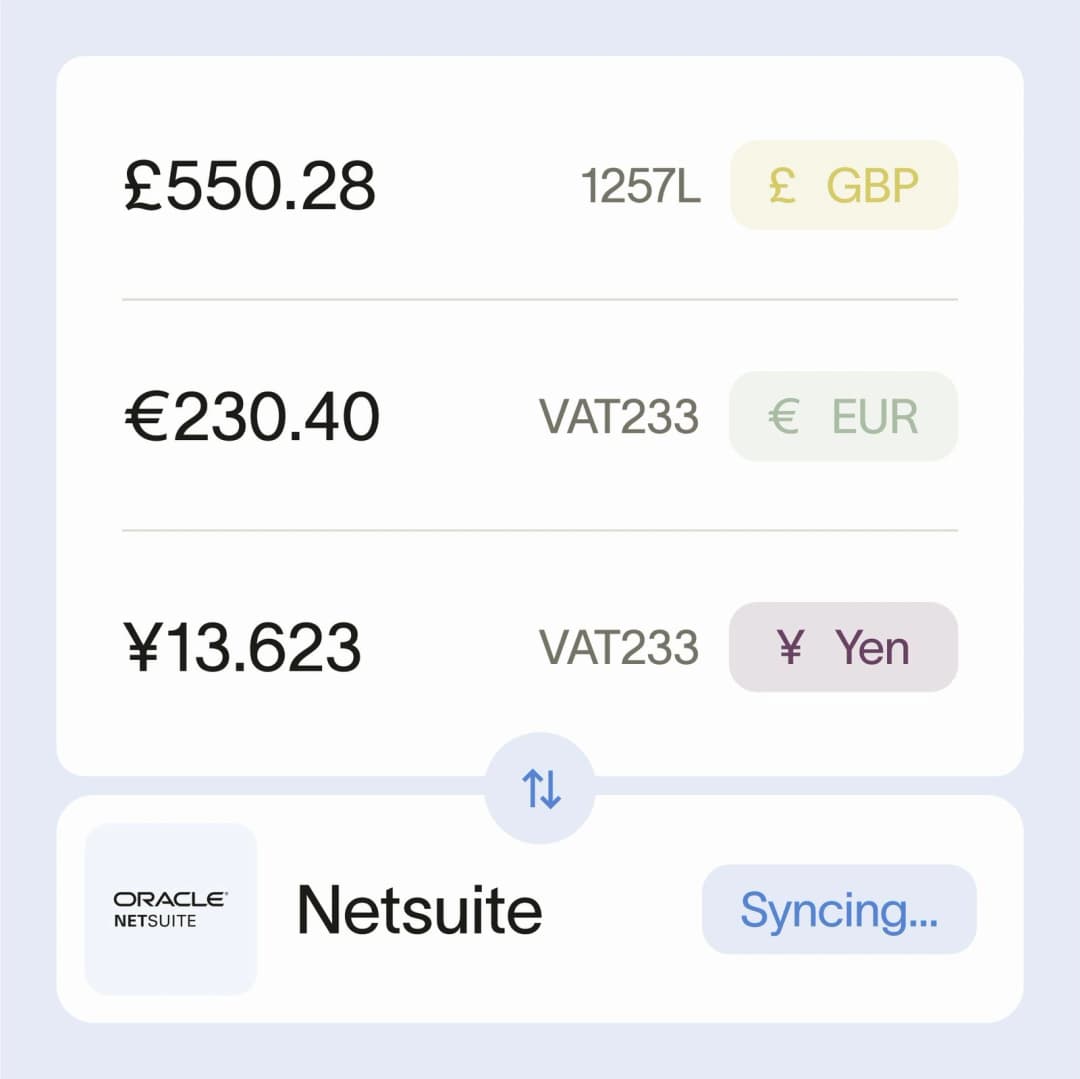

Multiple countries? No problem.

Get started in minutes.

Whether you’re building your business, expanding internationally, or cutting costs, Ramp just works.

“We had to pivot from our old system really quickly, but we were completely up and running on Ramp in less than 6 weeks from even hearing about it, I honestly didn't think we could pull it off but we did.”

Roxane Cosnard des Closets

Sr. Manager, Financial Systems