Financial management strategies for business growth

- What are financial management strategies?

- Essential financial planning and goal setting

- Budgeting and cost management systems

- Working capital management strategies

- Profit and loss analysis

- Risk management and financial controls

- Investment and growth strategies

- Technology and automation in financial management

- Whatever your strategy, execute it with Ramp

Financial management strategies are structured approaches businesses use to plan, control, and optimize how money moves through the organization. When done well, they help you stay liquid, manage risk, fund growth, and make better decisions under pressure. These strategies show up in how you set goals, build budgets, manage working capital, evaluate investments, and respond when conditions change.

What are financial management strategies?

Financial management strategies are the policies, processes, and decision-making frameworks that guide how your business plans, allocates, monitors, and protects its financial resources. They turn financial data into actions, helping you balance day-to-day operating needs with long-term value creation.

At a high level, effective financial management connects forecasting, budgeting, cash flow, risk, and performance measurement. Instead of reacting to surprises, you’re proactively shaping outcomes based on clear priorities and reliable information.

These strategies operate at two levels: strategic financial management, which focuses on long-term direction and value creation, and tactical financial management, which handles day-to-day execution and control.

Core objectives stay consistent across both levels:

- Maximize business value by allocating capital to the highest-return opportunities

- Ensure liquidity so the business can meet obligations on time

- Manage risk by anticipating uncertainty and putting controls in place

Poor financial management has real consequences. An analysis by CB Insights found that 38% of failed startups cited running out of cash as a primary reason for failure, highlighting the close link between cash planning, control, and business survival.

Strategic vs. tactical financial management

Strategic financial management focuses on long-term planning and positioning. It includes decisions about capital structure, investment priorities, growth strategy, and financial risk tolerance, all of which shape where your business is headed over the next several years.

Tactical financial management handles the day-to-day mechanics. It covers budgeting, expense tracking, collections, payments, and short-term cash forecasting, ensuring operations stay aligned with broader goals.

Use strategic financial management approaches when you’re evaluating expansion, raising capital, or reallocating resources across the business. Tactical approaches matter most when you’re managing cash flow, enforcing spending controls, or responding to short-term volatility.

Strong finance teams connect both so daily decisions support long-term outcomes.

Essential financial planning and goal setting

Clear financial objectives give your team direction and boundaries for decision-making. Without them, budgets become guesswork, and tradeoffs are harder to justify. Financial goals translate business strategy into measurable targets that guide everyday choices.

SMART financial goals are:

- Specific

- Measurable

- Achievable

- Relevant

- Time-bound

Instead of aiming to “improve cash flow,” you might target reducing your cash conversion cycle by 10 days within the next two quarters. That level of clarity makes progress trackable and actionable.

Your financial decisions should directly support your broader business strategy. Hiring plans, growth initiatives, and product investments all depend on whether your objectives prioritize profitability, liquidity, or expansion.

Create your financial roadmap

A financial roadmap turns goals into a structured plan. It connects forecasts, budgets, and funding needs so you can see how today’s actions affect future outcomes.

A solid financial plan typically includes:

- Revenue forecasts tied to realistic assumptions about pricing, volume, and churn

- Expense projections that distinguish fixed, variable, and discretionary costs

- Cash flow forecasts that highlight timing gaps between inflows and outflows

- Funding assumptions, including debt, equity, or retained earnings

Timelines and milestones keep the plan actionable. Breaking annual goals into quarterly checkpoints makes it easier to adjust when performance or market conditions change.

Budgeting and cost management systems

Effective budgets are realistic, comprehensive, and aligned with strategy. They allocate resources based on priorities rather than historical habits and give managers clear guardrails for spending.

Tracking historical budgets and understanding where your money is going is only part of effective financial management. A critical component is proactive budgeting and forecasting, which ensures that financial resources are allocated optimally to meet business goals.

A well-structured budget helps you:

- Set clear guidelines to manage spending

- Identify key financial dependencies and predict the resources needed to sustain operations

- Make informed financial decisions that align with your business objectives

- Stay on course to maximize your bottom line

Standard budgeting methodologies include zero-based, incremental, and rolling budgets.

| Budgeting methodology | How it works | Best use case |

|---|---|---|

| Zero-based budgeting | You must justify every expense from scratch each budgeting period rather than relying on prior spend. This approach helps eliminate legacy costs and surface inefficiencies. | Businesses undergoing cost restructuring or rapid change |

| Incremental budgeting | Budgets are adjusted by a fixed percentage based on prior periods, making it simple to implement and easy to forecast. | Stable organizations with predictable cost structures |

| Rolling budgets | Cash flow forecasts are updated continuously, extending the planning horizon as periods close and keeping budgets aligned with real-time performance. | Growing or volatile businesses needing flexibility |

Cost control systems translate budgets into daily behavior. Clear spending guidelines, approval workflows, and category-level visibility help prevent overruns without slowing teams down.

Implementing effective cost controls

Strong cost controls balance discipline with flexibility. They give teams autonomy within defined limits while protecting cash and margins.

Common expense tracking methods include:

- Categorizing spend by function or vendor to identify cost drivers

- Monitoring recurring expenses separately from one-time costs

- Flagging out-of-policy spend for review

Spending limits and approval processes should scale with risk and materiality. Low-risk purchases can be automated, while high-value or unusual expenses trigger additional review. Regular reviews ensure controls stay aligned with business needs.

Sample framework: Operating budget

An operating budget focuses on day-to-day revenue and expenses and is typically built on a monthly or quarterly basis.

| Category | Description | Example line items |

|---|---|---|

| Revenue | Expected income from core operations | Product sales, subscriptions, services |

| Cost of goods sold | Direct costs tied to revenue | Materials, hosting, payment processing |

| Operating expenses | Ongoing business costs | Payroll, rent, software, marketing |

| Operating income | Revenue minus COGS and operating expenses | Used to assess profitability |

Working capital management strategies

Working capital is the difference between current assets and current liabilities. It reflects your ability to cover short-term obligations and absorb operational shocks.

Optimizing working capital starts with cash flow forecasting and disciplined timing of inflows and outflows. Even profitable businesses can struggle if cash is tied up in receivables or inventory.

Accounts receivable and payable management directly affect liquidity. Faster collections and well-negotiated payment terms reduce the cash gap without damaging customer or supplier relationships.

Optimizing cash flow cycles

Your cash conversion cycle measures how long cash is tied up in operations. Shortening it improves flexibility and reduces reliance on external financing.

Ways to accelerate collections include:

- Offering early payment incentives to reliable customers

- Automating invoicing to reduce billing delays

- Actively following up on overdue accounts

On the payables side, negotiate terms that reflect your purchasing power and reliability. Inventory management also matters. Excess stock ties up cash, while shortages disrupt revenue. The objective is balance, not minimization.

Profit and loss analysis

Regular profit-and-loss (P&L) template reviews help you understand what’s driving profitability and where margins are under pressure. When paired with balance sheet and cash flow checks, they show whether profits are turning into usable cash and how efficiently the business is operating.

Key metrics to monitor include:

- Gross margin to assess pricing and cost of goods sold

- Operating margin to evaluate efficiency

- Net margin to understand overall profitability

Use P&L insights to guide decisions about pricing, staffing, vendor selection, and investment priorities. Trends over time matter more than single-period results.

Key performance indicators to track

Key performance indicators (KPIs) translate financial performance into signals you can act on.

| KPI category | What it measures | Why it matters |

|---|---|---|

| Revenue growth metrics | Changes in revenue over time by product, customer segment, or channel | Indicates whether demand, pricing, and go-to-market strategies are working |

| Profit margin analysis | Gross, operating, and net margins across periods | Reveals where costs are eroding value and where efficiency gains are possible |

| Expense ratios | Expenses as a percentage of revenue by function | Benchmarks operational efficiency across teams and against industry norms |

Risk management and financial controls

Businesses face financial risks from market volatility, credit exposure, operational failures, and compliance gaps. Identifying these risks early reduces their potential impact and helps protect cash flow and continuity.

Risk assessment typically evaluates both likelihood and severity, often using a simple matrix to prioritize attention and resources. Mitigation strategies can include diversification, reserve planning, and stronger internal controls.

| Impact \ Likelihood | Low likelihood | Medium likelihood | High likelihood |

|---|---|---|---|

| High impact | Monitor closely | Mitigate immediately | Top priority risk |

| Medium impact | Accept or monitor | Mitigate selectively | Mitigate immediately |

| Low impact | Accept | Monitor | Monitor closely |

Debt management is a core part of financial risk control. Keeping leverage at a level your operating cash flow can reliably support reduces exposure during downturns and limits dependence on short-term financing.

Tax planning also affects risk and liquidity. Building tax assumptions into forecasts helps prevent avoidable cash shortfalls when liabilities come due.

Reserve funds provide a buffer when revenue falls, costs spike, or capital becomes more expensive. The goal is to protect payroll and critical operating commitments without relying on last-minute financing.

Internal controls and audits protect assets, data integrity, and compliance. They also strengthen accountability and build trust with investors, lenders, and other stakeholders.

Building your risk management framework

Effective frameworks start with structured risk identification and regular reassessment. Documenting assumptions and stress-testing scenarios improves preparedness.

Contingency plans outline actions to take if revenue falls, costs rise, or funding tightens. Insurance and hedging strategies can further reduce exposure, including:

- General liability and cyber insurance

- Interest rate hedges for variable debt

- Currency hedging for international operations

Investment and growth strategies

Capital allocation decisions determine how quickly and sustainably your business can grow. Every investment competes for limited resources, so prioritization matters.

Diversification reduces dependence on any single product, customer, or market. Reinvestment strategies should favor initiatives that compound value over time while maintaining sufficient liquidity for operations.

Evaluating investment opportunities

Investment evaluation balances return potential with risk. Common return on investment (ROI) methods include:

- Simple ROI, comparing net gain to initial cost

- Payback period, measuring how long it takes to recover the investment

- Net present value, which discounts future cash flows to today’s dollars

Risk-adjusted returns help compare opportunities with different uncertainty profiles. Balancing growth investments with operational needs helps avoid overextension during expansion.

Technology and automation in financial management

Modern financial management relies on integrated software to improve visibility, accuracy, and control. Automation reduces manual work and errors while helping teams move faster.

Automated processes support faster closes, real-time reporting, and consistent policy enforcement. Integration with accounting, payroll, and enterprise resource planning (ERP) systems keeps data accurate across tools.

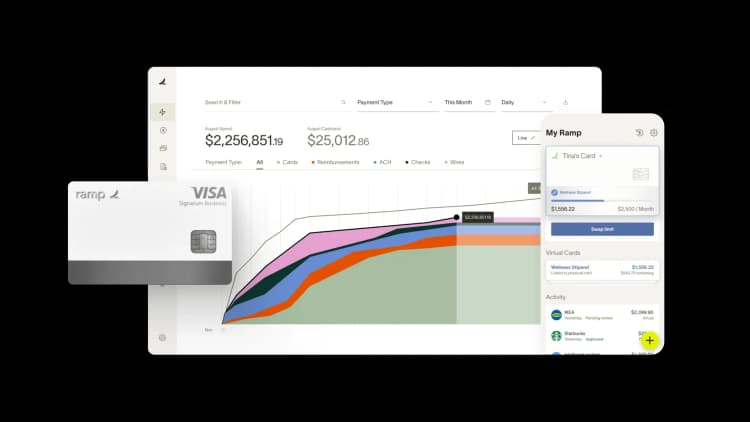

Discover Ramp's corporate card for modern finance

Selecting the right financial tools

The right tools support both strategy and execution. Key features to look for include:

- Real-time spend visibility: Lets finance teams catch spend as it happens rather than weeks later during close, helping prevent budget overruns early

- Automated approvals and controls: Enforces policy without creating manual bottlenecks by routing spend for the right level of review

- Seamless accounting integrations: Reduces reconciliation work and data mismatches, supporting faster closes and more reliable reporting

Evaluate costs against time savings, risk reduction, and scalability. Successful implementations prioritize change management, clear ownership, and phased rollouts.

Whatever your strategy, execute it with Ramp

Financial management strategies only work when they’re executed consistently. Regular reviews, clear accountability, and the right tools turn plans into results.

Ramp transforms financial management through intelligent automation and real-time controls. The platform’s expense management system automatically categorizes transactions and enforces spending policies before purchases happen, not after.

Beyond preventing overspending, Ramp helps you identify savings opportunities through AI-powered insights. The platform analyzes spending patterns across vendors and categories, flagging duplicate subscriptions, unused software licenses, and opportunities to negotiate better supplier rates.

For example, if multiple teams are paying for similar tools, Ramp surfaces these redundancies so you can consolidate vendors and reduce costs.

Assess your current financial management practices, identify gaps, and choose the Ramp solutions that support your goals. Better execution starts with better systems.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits