What's the difference between an invoice and a bill?

- Defining invoicing and billing

- Billing vs. invoicing: Key differences compared

- When to use a bill vs. an invoice

- How to manage invoices and bills effectively

- Simplify managing invoices and bills with Ramp Bill Pay

Managing payments is a fundamental part of running any business. The terms invoicing and billing are often used interchangeably during the payment process, but that’s not always correct.

Both are crucial for tracking payments, and understanding the difference will help you speed up payment workflows and reduce errors. In this article, we help clarify the difference between invoicing and billing, when to use each, and how to optimize your process.

Defining invoicing and billing

Invoicing and billing are often confused, but they each have distinct meanings and purposes within accounts payable (AP). An invoice is a request for payment from a seller to a buyer for specific goods and services. A bill is a statement of charges, usually asking for immediate payment.

It's easy to mix them up because they involve similar and interconnected processes in finance. But knowing the difference helps you with tracking, bookkeeping, cash flow, and communication.

What is invoicing?

Invoicing is a formal payment request sent to a customer or client for a specific transaction. It goes beyond billing by including detailed key information, including:

- Invoice number

- Date of issue

- Payment terms (e.g., net 30)

- Itemized list of the goods or services provided

- Subtotals, taxes, and total amount due

- Contact information for the seller and the buyer

- Accepted payment methods

Invoices are more common in B2B transactions and play a critical role in recordkeeping and legal documentation.

What is billing?

Billing refers to the process of notifying customers about payments owed and maintaining records of financial transactions. It’s integral to cash flow management, ensuring businesses track the money customers owe them.

Bills are more common in B2C transactions and are generally less formal than invoices, but they often request funds immediately. Some examples of bills include:

- A restaurant bill that lists the items consumed and the total amount owed

- Utility bills for monthly gas, electric, or internet charges

In some cases, businesses use third party billing, where an external company handles the billing process on behalf of the service provider. This is common in healthcare, telecommunications, and subscription services where specialized billing companies manage payment collection and customer communication.

Why do people confuse billing and invoicing?

People often confuse bills vs. invoices because both aim to facilitate payments. However, the key difference lies in their scope:

- Invoicing focuses on a specific transaction, providing detailed information that supports legal, financial, and operational needs.

- Billing encompasses the broader process of tracking and managing payments across multiple transactions.

Billing vs. invoicing: Key differences compared

Understanding the differences between invoicing and billing is essential for effectively managing payments and financial processes. While both serve as payment tools, their purposes, details, and timing differ significantly, making each one suited to distinct scenarios:

Invoicing | Billing | |

|---|---|---|

Purpose | Creates detailed payment requests for individual transactions | Tracks and manages payments, ensuring cash flow monitoring |

Timing | Issued at any stage of the sales cycle: Prepayment, partial payment, or final payment; includes recurring invoices | Typically issued after delivery of a product or completion of a one-time service |

Payment terms | Specifies payment terms such as due dates or late fees | Generally requires immediate payment or has a short due date |

When it's used | Common in B2B transactions, such as for professional services or large purchases | Common in B2C settings such as retail stores or restaurants |

Documentation | Used for legal records, tax compliance, and inventory tracking | Tracks transactions, but doesn’t typically come into play for legal or inventory purposes |

Example | A consultant sends an invoice for project work completed | A restaurant provides a bill after a meal |

When to use a bill vs. an invoice

Deciding whether to use an invoice or a bill depends on three factors:

- Transaction type: When the transaction is simple and you complete it instantaneously, use a bill. If it’s more complex and involves a formal contract or ongoing work, use an invoice.

- Business model: B2C businesses generally use bills for customers. B2B transactions are typically better serviced with invoices.

- Payment timing: When you request payment at the point of sale or expect it immediately, a bill is the right option. Payments via invoices are ongoing, or as you complete a project or deliver a service.

Examples of when to use a bill vs. invoice

Let’s look at a few examples to illustrate further when to use billing vs. invoicing:

- You own a barbershop. Your customers make appointments or walk in for haircuts at a set posted rate. Once they receive their haircut, you would provide them with a bill since you expect immediate payment.

- You hired a freelance web developer. When you began the engagement, you and the developer signed a contract with set payment terms. This is an ongoing relationship that requires monthly payments. The web developer would issue invoices for payment since the transactions are more complex, and the rates and scope of work are based on the terms of the contract.

When deciding whether to use bills or invoices, it’s important to consider both the context and the complexity of the transactions. In a longer payment cycle, an invoice is likely best, but if it’s for an immediate sale, you should probably opt for a bill.

How to manage invoices and bills effectively

Efficiently managing invoices and bills is key to maintaining a healthy cash flow and avoiding late payments. By setting a clear invoicing process and embracing automation, you can simplify this critical task and focus on what matters: growing your business.

1. Set clear payment terms

Establishing and communicating clear payment terms upfront is a foundational step in managing invoices effectively. Standardized templates can help ensure that every invoice includes:

- Payment due dates

- Accepted payment methods

- Late payment policies or penalties

Net 30 payment terms are relatively standard for invoices, but you may also see net 15, net 45, or net 60, with the number representing how many days you have to pay. Clear communication with vendors and clients up front reduces disputes and speeds up payment collection.

2. Integrate payment gateways

Payment delays often stem from friction in the payment process. Integrating a payment gateway, like PayPal, Stripe, or Square, with your invoicing system removes these obstacles. Here’s how:

- Clients can pay directly from their invoices, simplifying the process

- Payments are automatically updated in your system, reducing manual work

- Faster, more convenient payment options improve client satisfaction

For example, enabling a click-to-pay feature allows clients to settle invoices in seconds, helping you collect payments faster and reduce overdue accounts.

3. Explore invoice templates and software

Consider invoice templates and software for consistency. Both can help automate, track, and streamline your billing and invoicing workflows.

- An invoice template helps reduce errors. It also ensures you include your correct contact information and branding every time.

- Invoicing software helps automate recurring invoices, sends payment reminders, tracks invoice and bill status, and should integrate with your existing accounting tools.

You can find free invoice templates in Microsoft Word and Google Docs, or use Ramp's own free invoice generator.

4. Schedule reviews of your invoice billing process

Setting aside time to review your invoices and bills regularly ensures that overdue payments and upcoming deadlines never slip through the cracks. Whether you conduct reviews weekly or monthly, here’s what to focus on:

- Generate accounts payable aging reports to track overdue invoices

- Identify trends, such as consistently late-paying clients or recurring billing issues

- Prioritize follow-ups for invoices nearing their due dates

- Look for opportunities to improve efficiency and reduce or eliminate bottlenecks in the invoice management process

5. Consider dedicated invoice software

If you create your invoices and bills manually, dedicated invoice software can be a game-changer. Automating the invoice workflow saves you time and reduces the risk of human error. You’ll gain better insights from tracking your invoices and online payments, and you can sync with your accounting software to streamline the entire workflow.

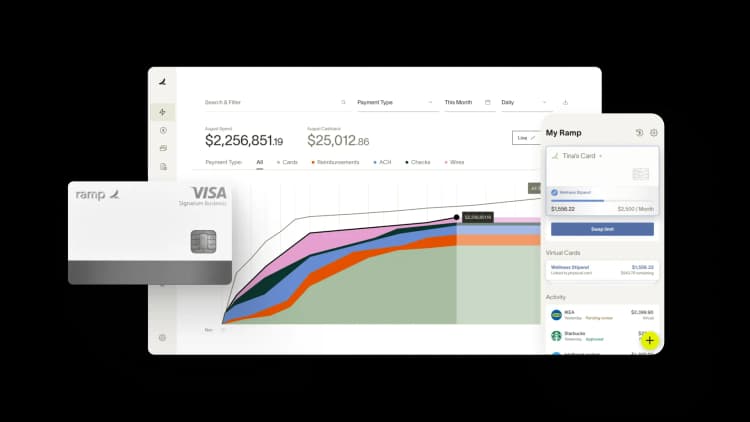

Simplify managing invoices and bills with Ramp Bill Pay

Ramp Bill Pay is an autonomous AP platform that eliminates manual invoice work through four AI agents—handling everything from transaction coding and fraud detection to approval summaries and automatic card payments to vendors. The platform captures invoice data at 99% OCR accuracy and processes bills 2.4x faster than legacy AP software1.

Need a dedicated invoice automation tool? Ramp works as a standalone solution. Want everything connected? Pair it with Ramp's corporate cards, expense management, and procurement for unified spend visibility. Either way, companies using Ramp see up to 95% improvement in financial visibility2.

Ramp's touchless automation tackles the bottlenecks that slow AP teams down:

- Four AI agents: Automate invoice coding, flag fraud before payment, create approval summaries with vendor and pricing context, and process card-eligible payments directly through vendor portals

- Intelligent invoice capture: Extracts every line item at 99% OCR accuracy—no manual data entry required

- Automated PO matching: Compares invoices against purchase orders with 2-way and 3-way matching to catch discrepancies before payment

- Custom approval workflows: Set up multi-level approval chains with routing rules that match your org structure

- Real-time invoice tracking: See exactly where every invoice stands from receipt to payment

- Flexible payment methods: Pay vendors via ACH, card, check, or wire transfer

- International payments: Send wires to vendors in 185+ countries

- Batch payments: Pay multiple vendors in a single batch to streamline payment cycles

- Recurring bills: Automate regular vendor payments with templates

- Real-time ERP sync: Sync bidirectionally with NetSuite, QuickBooks, Xero, Sage Intacct, and more for always-current records

- AI-assisted GL coding: Automatically map transactions to the right accounts based on historical patterns

- Reconciliation: Close books faster with automatic transaction matching

Why finance teams choose Ramp

Ramp is redefining what touchless invoice processing looks like—accurate, fast, and built for how modern finance teams actually work. Run it as your standalone AP solution or connect it across your full spend stack for end-to-end control.

Over 2,100 verified reviewers on G2 rate Ramp 4.8 out of 5 stars, ranking it the easiest AP software to use. Teams switch to Ramp to cut manual work, prevent costly errors, and close books faster.

Stop chasing invoices. Start automating them. Learn more about Ramp's invoice management software.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

FAQs

In accounting, billing refers to generating and sending invoices, which can be confusing since bills and invoices serve different functions. Bills are used for payments on goods and services that are due upon receipt, while invoices generally have payment terms.

Yes, in the accounting world, an invoice is a billing document. But it’s not a bill itself: An invoice is a formal request from a seller to a buyer to pay for goods and services based on the terms of a contract, while a bill is a statement of charges presented directly after the sale.

An invoice is neither a receipt nor a bill. It's a commercial document used to request payment for goods or services the customer has already received. They get a receipt when they pay. A bill is also a request for payment, but it’s due upon delivery of the goods and services.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits