Are business credit card rewards taxable?

- Are business credit card rewards taxable income?

- When business credit card rewards become taxable

- How different types of rewards are taxed

- How to use your business credit card rewards

- Tax reporting requirements for business credit card rewards

- Types of business credit card rewards

- Best practices for managing business credit card rewards and taxes

- Simplify expense management and tax deductions with the Ramp Business Credit Card

Business credit card rewards can feel like free money. But are they taxable? Most business credit card rewards aren’t taxable because the IRS treats them as rebates on your purchases — even on cards that offer perks like cashback, points, or no annual fee.

That said, not every reward qualifies as a rebate. Understanding which ones count as taxable income helps you stay compliant and avoid surprises at tax time.

Note: The cashback percentages, limits, fees, and other figures mentioned in this article are for illustrative purposes only. They do not represent guaranteed or expected rates. Actual terms, credit limits, rewards, and approval criteria vary by card issuer and may change at any time. Readers should verify current details directly with each issuer before applying.

Are business credit card rewards taxable income?

In most cases, business credit card rewards aren’t taxable. The IRS generally treats rewards earned through spending as rebates, not income, meaning the cashback, points, or miles you earn from regular business purchases usually won’t increase your tax bill.

If you spend $1,000 on business expenses and earn $20 back in rewards, your actual cost is $980. That $20 isn’t income—it simply reduces what you paid. According to IRS Publication 525, purchase-based rewards are considered price adjustments rather than taxable income. The key difference lies in how you earned those rewards. If they’re tied directly to your spending, they’re rebates that lower your business expenses. If you received them without spending, like a no-strings-attached sign-up bonus, the tax treatment changes.

Think of credit card rewards as a discount at checkout. When you get 10% off at a store, you don’t pay taxes on the savings. The IRS treats purchase-based rewards the same way.

The IRS rebate rule explained

The IRS treats rewards earned from business spending as rebates that reduce your purchase costs rather than taxable income. When you earn rewards from business spending, they’re viewed as a reduction in what you paid, not as new income. For example, if you spend $1,000 and earn $20 back, your actual business expense is $980.

This “rebate rule” means you should technically reduce your deductions by the amount of the reward. If you deducted the full $1,000 purchase, you’d overstate your expense by $20. Most small businesses don’t track these small differences precisely, and the IRS rarely pursues them for minor amounts.

Common non-taxable reward scenarios include:

- Cashback earned on business purchases like office supplies or travel

- Points or miles accumulated through business credit card spending

- Rewards earned from advertising or recurring operational costs

As long as you spent money to earn the reward, it’s considered a rebate that lowers your cost, not taxable income.

When business credit card rewards become taxable

Some business credit card rewards count as taxable income when you didn’t spend money to earn them. Here’s how to know when rewards cross into taxable territory:

- If you spent money to earn the reward: It’s usually a rebate that reduces your business expense. Not taxable.

- If you didn’t spend money to earn the reward: It’s likely taxable income. Examples include cash bonuses just for opening an account, referral bonuses, or promotional prizes.

In short, if the reward comes from a purchase, it’s a rebate. If it doesn’t, the IRS may treat it as taxable income.

Sign-up bonuses and tax obligations

Whether a sign-up bonus is taxable depends on whether spending was required to earn it. Some promotional offers—such as those commonly found on 0 APR business credit cards—also include sign-up bonuses, and the same tax rules apply.

Bonuses that require you to meet a minimum spending threshold are generally treated as rebates. For example, if you spend $5,000 to earn a $500 bonus, that amount offsets your purchase costs and isn’t taxable.

Cash bonuses with no spending requirement are considered income. If a card issuer gives you $200 simply for opening an account, that reward is taxable because it wasn’t connected to business spending.

Card issuers must report non-purchase rewards of $600 or more (rising to $2,000 in 2026) on Form 1099-MISC. Even if you don’t receive a form, smaller cash bonuses are still technically taxable and should be included in your business income.

Referral bonuses and other taxable rewards

Referral and promotional rewards are treated as taxable income because you earn them without making purchases.

Referral bonuses fall into this category. If you refer another business owner and receive $100, that payment counts as compensation for your referral activity. Other taxable rewards include:

- Cash or gift cards received from promotions unrelated to spending

- Contest winnings or sweepstakes prizes

- Special bonuses for account milestones or participation in marketing offers

If you didn’t spend money to earn the reward, the IRS is likely to view it as income that adds to your business revenue.

Start building your business credit

Getting a business credit card using your EIN number helps build your business credit. A good business credit score can lead to more favorable loan terms and repayment options.

How different types of rewards are taxed

The form your rewards take doesn’t change the basic tax rule. Cashback, points, and miles all follow the same principle: if the reward was earned through business spending, it’s a rebate and not taxable income.

Cashback rewards

Cashback earned from business purchases is treated as a rebate that reduces your expense. For example, earning 2% back on a $500 office furniture purchase means your actual cost was $490, and that’s the amount you should technically deduct.

Most businesses don’t adjust their deductions for small cashback amounts, and the IRS hasn’t enforced this strictly. Still, claiming the full purchase price while keeping the cashback technically overstates your expense slightly.

Travel points and miles

Points and miles can be tricky because their value depends on how you redeem them. The IRS doesn’t require assigning a dollar value to points earned from business spending since they’re considered rebates.

Personal use changes the picture. If you earn points from business travel but redeem them for a personal vacation, you’ve converted a business rebate into a personal benefit. Technically, this could be taxable, but enforcement is rare. The IRS issued guidance in 2002 stating that it won’t consider taxes underpaid when employees or individuals use miles earned from business travel for personal purposes.

Statement credits and gift cards

Statement credits work like cashback and follow the same rebate rule. If you earn a $50 credit from business spending, it reduces your deductible expense by $50.

Gift cards are more nuanced. If the card was earned through spending, it’s treated as a rebate. But if it was given as a promotional reward or bonus without a spending requirement, it’s taxable income equal to its face value.

How to use your business credit card rewards

You can redeem business credit card rewards for things like statement credits, travel, or gift cards. But when you use rewards, there are a few tax-related points to keep in mind.

Can I use business credit card rewards for personal use?

Whether you can use business credit card rewards for personal use depends on your card’s terms and your company’s policies. Check both before redeeming rewards. In general, it’s legal to use rewards for personal travel or expenses, but doing so can blur the line between business and personal use. Keep careful records if you decide to use rewards personally.

Can I deduct business expenses paid for with rewards?

Most purchases and fees made with a business credit card are tax-deductible. However, this doesn’t apply to expenses paid with credit card rewards. For instance, if you book airfare using airline miles, you can only deduct the portion of the cost you paid out of pocket, not the part covered by rewards.

Avoiding misuse of rewards

Converting rewards into cash equivalents or attempting to “game” rewards systems can create tax issues. In one 2021 court case, a couple was ordered to pay taxes on more than $300,000 earned through a manufactured spending scheme. Use your rewards as intended by your card provider. Redeeming points for cash equivalents or reloadable debit cards could cause the IRS to classify them as taxable income.

Tax reporting requirements for business credit card rewards

You generally won’t receive tax forms for business credit card rewards earned from purchases. Card issuers don’t issue 1099s for cashback, points, or miles that come from spending because those rewards are considered rebates.

The exception comes when rewards aren’t tied to purchases. If you receive $600 or more ($2,000 starting in 2026) in cash bonuses, referral incentives, or promotional rewards during the year, the issuer must report that amount to the IRS using Form 1099-MISC. This amount usually appears in Box 3 as “Other Income.”

You may also receive a Form 1099-K for certain prepaid or gift-card rewards that function as payment cards. If you receive one of these forms, report the income on your business tax return. The issuer has already provided the information to the IRS, so omitting it could trigger a notice. Even if you don’t receive a 1099, you’re still responsible for reporting taxable rewards. The threshold determines only when the issuer must report, not whether the income is taxable.

Types of business credit card rewards

Here’s a breakdown of the most common business credit card rewards and how your business can earn and use them:

| Reward type | How it’s earned | How it can be used |

|---|---|---|

| Cashback rewards | You receive a percentage of what you spend on eligible purchases. Some cards limit cashback to select spending categories, while others apply to all. | credit toward your card balance; deposit into your bank account; gift card; check |

| Airline miles | You receive a certain number of miles for every dollar spent in eligible categories. Many business credit cards offer one or two miles per dollar spent. | airline tickets; hotel stays and other travel expenses, in some cases |

| Points | You earn a set number of points per dollar spent in eligible categories. Some cards award points on all purchases; others limit rewards to select categories. | online shopping in card-supplied catalogs; credit toward your card balance; credit toward travel purchases; gift card; donation to charity |

| Welcome offers | You receive bonus points, cashback, or miles after spending a certain dollar amount during an introductory period. | you can redeem your welcome bonus the same way you redeem all other rewards from your card. |

| Travel credits | You receive a travel credit of a set amount for each year that you hold the card. | airline or hotel reservations; rental cars and other travel expenses, in some cases |

| Special privileges | You receive access to airport lounges, discounts at select stores, and other exclusive perks for cardholders. | present your card and request the lounge access or store discount. Each card provides specific instructions. |

Best practices for managing business credit card rewards and taxes

Good record-keeping prevents tax headaches and helps you maximize your rewards without running into compliance issues down the road.

Recordkeeping strategies

Track which rewards came from business spending versus promotional bonuses or referrals. A simple spreadsheet noting the date, amount, and source of each reward helps you separate rebates from taxable income at year-end.

Keep your credit card statements and reward redemption confirmations for at least three years. If you receive a 1099-MISC for rewards, file it with your tax return. This documentation proves the nature of your rewards if questions arise during an audit.

For more on record-keeping best practices, see IRS Publication 334.

Accounting for rewards in your books

Record purchase-based rewards as reductions to the original expense category. If you earned $50 cashback on office supplies, reduce that expense by $50 instead of creating a separate income line. Taxable rewards such as referral bonuses should be recorded as miscellaneous income. This keeps your revenue categories clean and shows that these amounts aren’t tied to core operations. Most accounting software also has a category for credit card rewards or rebates.

When to consult a tax professional

Consult a tax professional if you earn substantial rewards, mix personal and business use, or handle international transactions. Red flags include receiving multiple 1099 forms for rewards, earning more than $5,000 annually in bonuses, or using rewards programs across multiple entities. If you’re unsure how to report rewards, or you’ve already filed returns without including them, a CPA can clarify the correct approach and help you stay compliant.

Simplify expense management and tax deductions with the Ramp Business Credit Card

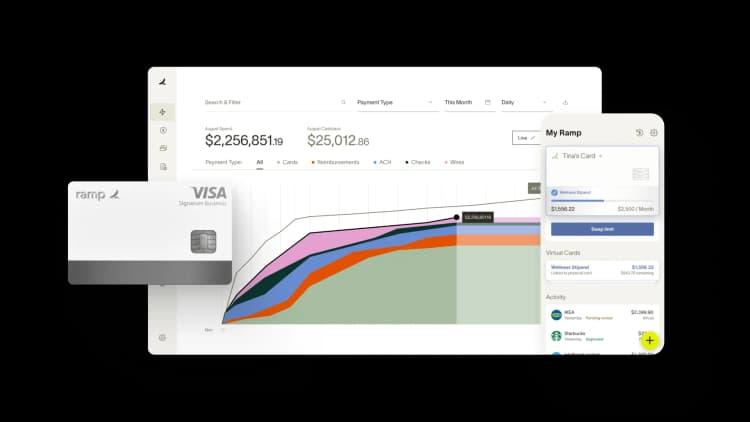

Whether you make business purchases with a credit card, debit card, or cash doesn't matter to the IRS. It’s your responsibility to know what’s taxable and what’s not. That's why the Ramp Business Credit Card was designed to integrate seamlessly with popular accounting platforms.

Ramp also enables you to quickly log receipts and categorize your expenses in real time. You have complete control over account spending limits, empowering every member of your team to spend responsibly and within budget. And with the Ramp card, you earn cashback on eligible purchases.

Apply for the Ramp Business Credit Card and learn how companies save an average of 5%.

The information provided in this article does not constitute accounting, legal or financial advice and is for general informational purposes only. Please contact an accountant, attorney, or financial advisor to obtain advice with respect to your business.

This article is for informational purposes only and does not constitute tax, accounting or legal advice. The tax treatment of credit-card rewards depends on specific facts and circumstances, as well as changes in law and IRS guidance. Please consult a qualified tax professional for advice tailored to your situation.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits