8 best accounting software for real estate businesses

- How to simplify bookkeeping with real estate accounting software

- Best accounting software for real estate businesses

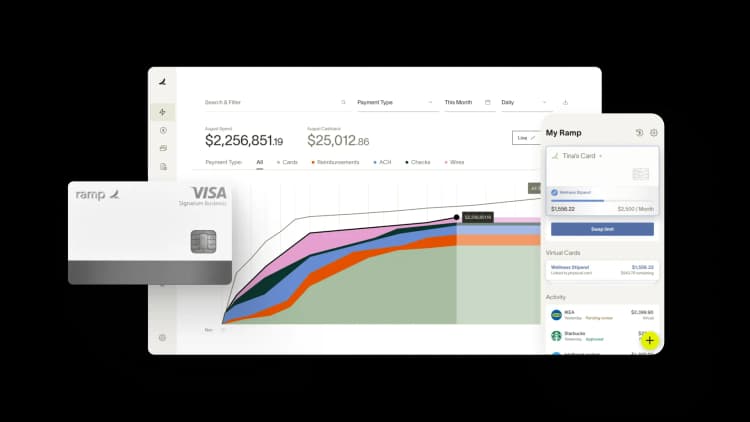

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Real estate accounting software is a financial management tool that helps agents, brokers, and property managers track income, expenses, commissions, lease payments, and tax liabilities in one place. Unlike generic accounting solutions, these platforms often include property-specific features like rent tracking, escrow management, and automated tax calculations.

How to simplify bookkeeping with real estate accounting software

A lot of real estate agents spend significant time on bookkeeping, often logging around 80 hours a year on accounting tasks. For solo agents and small teams, this takes away valuable time that could be spent closing deals or finding new clients. Real estate accounting software cuts this time down drastically by automating financial tasks, reducing errors, and keeping records organized.

Automated expense tracking

Real estate agents deal with a lot of expenses, including marketing costs, office rent, MLS fees, and travel expenses. Accounting software automatically categorizes and records these transactions, ensuring nothing is overlooked. A study by the Small Business Administration found that poor financial management is a factor in 82% of small business failures, making automation critical for agents managing fluctuating income.

Commission management

Tracking commissions manually can lead to miscalculations and missed payments. The right accounting software logs commissions, calculates deductions, and tracks pending payments, keeping every transaction transparent. This is especially useful for agents working on multiple deals at once.

Real-time bank reconciliation

Manual bank reconciliation is time-consuming and prone to errors. Real estate accounting software syncs with bank accounts, automatically matches transactions, and flags discrepancies, preventing costly mistakes. This feature keeps cash flow in check and ensures financial accuracy.

Faster tax preparation

Tax season can be overwhelming, especially with complex deductions like vehicle mileage, home office expenses, and client entertainment. Accounting software organizes tax-deductible expenses, generates financial reports, and integrates with tax filing tools, saving time and reducing audit risks. Around 40% of small businesses incur penalties due to tax errors, highlighting the importance of accurate record-keeping. By using Ramp to automate your expenses, you can close your books 50% faster each month.

Better cash flow management

With real estate transactions varying from month to month, agents need a clear picture of their cash flow. Accounting software provides real-time financial insights, tracks outstanding invoices, and sends payment reminders, helping agents maintain a steady financial balance.

Best accounting software for real estate businesses

Not all real estate businesses have the same accounting needs. For solo agents, lightweight software with simple expense tracking and commission management works best. Small real estate teams benefit from tools that support multiple users, automate invoicing, and sync with tax software. Large property management firms, on the other hand, need advanced solutions with lease tracking, escrow management, and multi-entity accounting.

1. Zoho Books: Affordable accounting solution for landlords

Launched as part of the Zoho ecosystem, Zoho Books is a cloud-based accounting software serving thousands of businesses worldwide. Known for its affordability and ease of use, it is designed to help users track income and manage their expenses. With a wide range of integrations across payment processors, cloud storage, and productivity tools, Zoho Books streamlines financial operations while keeping data secure and accessible.

Key benefits

- Automates recurring invoices to simplify rent collection.

- Tracks expenses in real time to improve financial visibility.

- Generates custom financial reports to analyze property performance.

- Integrates with PayPal, Stripe, and Zoho CRM for a seamless workflow.

- Includes built-in tax management tools to ensure compliance.

Drawbacks

- No automated rent payment tracking, requiring manual processing.

- Complex setup for real estate accounting, making it less intuitive for beginners.

Zoho Books works well for those managing residential units, short-term rentals, or small commercial properties. It is a cost-effective solution for tracking income, generating invoices, and managing expenses.

You can link your spend management platform to Zoho Books to simplify financial tracking. Real estate professionals can save time by having property expenses sync automatically, streamlining vendor payments, and accessing dashboards that show rental income alongside operating costs in one place.

2. Wave: Best for managing rental income

Wave is a free cloud-based accounting software built for real estate agents, independent landlords, and small property managers who need a straightforward way to track income and expenses.

The platform makes it easy to send invoices, categorize expenses, and reconcile bank transactions without requiring advanced accounting knowledge. Since you can start for free, Wave is a great option for those who want basic accounting features without the cost of premium software.

Key benefits

- Creates and tracks invoices for rental payments, commissions, and services.

- Automatically categorizes expenses, making bookkeeping easier.

- Syncs with bank accounts for real-time transaction updates.

- Scans and digitizes receipts to simplify record-keeping.

- Generates basic financial reports to track cash flow and profits.

Drawbacks

- Lacks advanced accounting features, making it less useful for larger real estate firms.

- No built-in property management tools like lease tracking or automated rent collection.

- Customer support is only available with paid add-ons, limiting help to free users.

Wave works well for real estate agents, independent landlords, and small property managers who need a simple way to manage basic accounting tasks.

3. Bench: Best for expert bookkeeping support

Established in 2012, Bench is a bookkeeping service designed for small businesses wanting hands-off financial management. Instead of traditional accounting software, Bench provides a dedicated team of bookkeepers who handle financial records, reconcile transactions, and prepare tax-ready reports. This makes it a great choice for real estate professionals looking to simplify their bookkeeping without spending hours on manual data entry.

Key benefits

- Provides a dedicated bookkeeper to manage financial records and reconcile accounts.

- Delivers monthly financial reports to help track rental income, expenses, and profitability.

- Syncs with Stripe, PayPal, Square, and Amazon for seamless transaction tracking.

- Offers year-end financial packages to simplify tax preparation.

- Uses Plaid integration for secure document sharing and automatic data syncing.

Drawbacks

- Limited customization for financial reports, making it less flexible for complex real estate accounting.

- No built-in real estate management tools like lease tracking or rent collection.

- Does not offer payroll services, requiring separate software for employee payments.

Bench is best for real estate professionals who need hands-off bookkeeping and tax preparation. It’s ideal for those who prefer human-led bookkeeping support instead of managing finances through traditional accounting software.

You can integrate Ramp with Bench to improve your real estate financial management processes. Ramp's Universal CSV integration automatically codes transactions and syncs them to Bench, reducing manual data entry and errors. This integration provides real-time financial insights, helping you make informed decisions about your properties.

4. Entrata: Best for AI-driven leasing and maintenance tracking

Entrata is a comprehensive property management platform used by more than 20,000 apartment communities across the U.S. It integrates leasing, maintenance, accounting, and business intelligence into a single system, making property management more efficient. Entrata’s AI-driven automation reduces manual workload by streamlining rent collection, maintenance requests, and tenant communication.

Key benefits

- Automates rent collection and tenant payments, ensuring steady cash flow.

- AI-powered maintenance tracking speeds up issue resolution and reduces delays.

- Delivers real-time financial reports for more informed decision-making.

- Seamlessly integrates with leasing, utility management, and revenue tracking tools for centralized operations.

- Offers a built-in vendor payment system, simplifying expense management and reducing administrative workload.

Drawbacks

- Requires manual tax preparation, increasing the need for external software.

- Lacks real estate-specific tax deduction tools, limiting its use for tax optimization.

Entrata is especially beneficial for real estate teams managing multiple properties across different locations. It integrates leasing, utility management, and revenue tracking into one system, simplifying financial and operational workflows.

5. QuickBooks: Best for simplifying real estate tax preparation

QuickBooks is one of the most widely used accounting platforms, serving millions of businesses across various industries, including real estate. Known for its financial tracking, expense management, and reporting tools, QuickBooks provides comprehensive accounting solutions.

It provides comprehensive accounting solutions but lacks built-in property management features. QuickBooks integrates with hundreds of third-party apps, like Tenant Ledger, allowing real estate professionals to customize it for rental income tracking and expense categorization.

Key benefits

- Categorizes rental income and expenses by property to keep financial records organized.

- Generates Schedule E tax reports to simplify real estate tax filings and deductions.

- Tracks security deposits separately from rental income for proper financial management.

- Allows automatic bank feeds and reconciliations, ensuring accurate and up-to-date transactions.

- Supports mileage tracking for real estate agents to log travel expenses for tax deductions.

- Enables batch invoicing for tenants to streamline rent collection and late fee management.

Drawbacks

- It is not designed specifically for real estate, requiring manual customization.

- No built-in property management tools like lease tracking or maintenance management.

- Difficult to navigate, especially for users new to accounting software.

- Higher cost compared to some real estate-focused accounting solutions.

QuickBooks is best for real estate agents, investors, and property managers who need powerful accounting software with customizable features. It works well for professionals who already use third-party property management tools.

You can connect QuickBooks to your spend management system to save time on manual expense entry. Many real estate firms find that integrating Ramp with QuickBooks help them track property expenses automatically, monitor cash flow in real-time, and speed up month-end closing with fewer errors. This integration can also simplify tax preparation with automatic expense categorization.

6. NetSuite: Best for managing multiple properties

NetSuite is a cloud-based accounting and ERP platform built for real estate firms, property managers, and investors handling high-volume financial operations. It combines accounting, financial planning, and CRM tools, helping businesses track revenue, manage leases, and oversee multiple properties.

Key benefits

- Automates revenue tracking and compliance with ASC 606 and other financial regulations.

- Supports lease accounting standards like ASC 842 and IFRS 16.

- Manages multiple locations and entities, making it easier to track finances across properties.

- Provides real-time financial data with cloud access from any device.

- Offers detailed dashboards and reports to monitor cash flow, expenses, and revenue trends.

Drawbacks

- Takes time to set up and learn due to its advanced features.

- Higher cost compared to accounting tools made for smaller businesses.

- Requires customization to fit specific real estate needs, which may add setup time.

NetSuite works best for large real estate firms, property management companies, and real estate investors who need a system to track multiple properties, handle lease compliance, and manage finances across different locations.

7. DoorLoop: Best for user-friendly property management

Founded in 2019, DoorLoop has quickly become a trusted solution for real estate owners, property managers, and landlords looking for an all-in-one accounting and property management software. It streamlines rent collection, tracks expenses, and automates financial reporting, making managing residential, commercial, and mixed-use properties easier.

Key benefits

- Automates rent collection and sends reminders to tenants.

- Syncs with bank accounts via Plaid to categorize income and expenses automatically.

- Integrates with QuickBooks Online, making accounting and reconciliation seamless.

- Offers customizable dashboards for tracking lease agreements and property performance.

- It supports bulk rent payment processing, reducing property managers' manual work.

Drawbacks

- Lacks advanced features for tax management, requiring additional software.

- The learning curve can be tough for first-time users.

- No ACH payments are included in the starter plan.

DoorLoop is ideal for small to mid-sized property managers, landlords, and real estate investors. It’s particularly useful for those managing residential rentals, commercial spaces, or self-storage units and want to generate financial reports from a single platform.

8. Spacebase: Best for automated lease management

Founded to help businesses manage complex lease portfolios, Spacebase has grown into a trusted platform for lease accounting and compliance. Designed for real estate professionals, property managers, and finance teams, it simplifies lease tracking, financial reporting, and regulatory compliance. With integrations for NetSuite, Workday, and Oracle, Spacebase helps thousands of businesses streamline lease management and financial operations.

Key benefits

- Automates lease accounting to ensure compliance with ASC 842 and IFRS 16.

- Generates custom financial reports and exports them to accounting software.

- Tracks lease terms, payment schedules, and discount rates in one place.

- Integrates with NetSuite, Workday, and Oracle for seamless data transfer.

- Automates expense tracking, rent collection, and invoice approvals.

Drawbacks

- Initial data import can be time-consuming, especially for large lease portfolios.

- No mobile app, limiting on-the-go lease management.

Spacebase is ideal for property managers and businesses handling multiple lease agreements. If your business needs automated lease tracking, compliance management, and seamless financial integration, Spacebase offers a structured solution to simplify operations.

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits