- Can you deduct credit card interest for business?

- When isn’t credit card interest tax-deductible?

- What’s the limitation on business interest expense deductions?

- How to deduct your business credit card interest

- Other tax implications of business credit cards

- How to manage or avoid credit card interest

- Simplify your business tax deductions with Ramp

If you use a credit card to cover business expenses, you’re probably familiar with the sting of interest charges. The good news? Business credit card interest is generally tax-deductible as a business expense, as long as you only use the card for legitimate business purposes.

The Internal Revenue Service (IRS) allows business owners to deduct interest on legitimate business purchases, but not on personal spending. So if you’re using your business card wisely, you might be able to save more at tax time.

We cover when credit card interest is deductible, what the IRS requires, how to claim the deduction, and more.

Can you deduct credit card interest for business?

If you use your business credit card strictly for business expenses, the interest you pay on those charges is generally tax-deductible. This applies to all types of businesses, whether you operate as a sole proprietor, freelancer, self-employed individual, LLC, partnership, or corporation.

As long as the interest stems from legitimate, business-related purchases, you can deduct it when filing your taxes.

Examples of deductible business purchases

Your credit card interest is deductible when the charges are related to ordinary and necessary business expenses, such as:

- Travel expenses, including interest on fuel, airfare, hotel stays, food, and other business-related travel costs

- Entertainment costs, such as taking clients or employees to dinner for business purposes

- Office supplies and equipment, including computers, printers, and other essential tools

- Marketing and advertising, including social media ads, website hosting, and printed materials like business cards

- Business meals, subject to IRS limits

- Professional services, such as accounting, consulting, and legal fees

- Inventory and supplies to operate your business

- Utilities and software subscriptions that are essential to running your business

Discover Ramp's corporate card for modern finance

When isn’t credit card interest tax-deductible?

While credit card interest on business-related expenses is generally deductible, there are specific situations where it is not eligible for a deduction. Understanding these scenarios can help you avoid costly mistakes and ensure accurate tax reporting.

Personal expenses on a business card

If you use your business credit card for personal expenses, you'll need to track how much of your balance is allocated toward business purchases. At tax time, you can only deduct the portion of interest related to business expenses. Interest from personal charges is not deductible.

Interest on personal credit cards

Using a personal credit card for business expenses doesn’t automatically make the interest deductible. You may only deduct the interest if you carefully track and document the business-related charges. This process can be complex and may draw the attention of the IRS. Also, balance transfer fees on personal cards aren’t deductible.

Late payment fees and penalties

While business interest payments are deductible, late payment fees and penalties are not. The IRS does not allow deductions for credit card late fees, over-limit fees, or interest on unpaid penalties.

Cash advance interest and fees

Interest and fees on cash advances from business credit cards are usually not deductible, even if the funds are used for business purposes.

Interest on non-essential or unreasonable business expenses

While most ordinary and necessary business expenses qualify for deductions, the IRS may disallow deductions on expenses that are extravagant, excessive, or unrelated to your business.

Student loans

Tax breaks exist for student loans, but whether you pay them with a personal or business credit card, those payments count as personal expenses and are not deductible.

Are any credit card fees tax-deductible?

Most business credit card annual fees are tax-deductible as a business expense. Balance transfer fees and application or setup fees may also be deductible, but only if you exclusively use the card for business purposes. Keeping detailed records helps ensure you can properly claim these fees.

What’s the limitation on business interest expense deductions?

The limitation on business interest expense deductions comes from the Tax Cuts and Jobs Act (TCJA) of 2017, which introduced new rules for how much interest you can deduct. Here’s what you need to know:

- Interest deduction limitation: Generally, the deduction for business interest expense is limited to the sum of your business interest income, 30% of your adjusted taxable income (ATI), and any floor plan financing interest

- Adjusted taxable income: For tax years beginning before January 1, 2022, ATI was similar to EBITDA (earnings before interest, taxes, depreciation, and amortization). Starting in 2022, ATI is more closely aligned with EBIT (earnings before interest and taxes), which typically results in a lower deduction limit, as it doesn’t include depreciation and amortization.

- Exemptions: Certain small businesses are exempt from this rule if their average annual gross receipts for the prior three years are $27 million or less (as of 2023, adjusted for inflation)

- Real property trades or businesses: These businesses can opt out of the limitation, but they must use the alternative depreciation system (ADS) for their real estate assets

- Farming businesses: Like real estate, farming businesses can also elect out of the limitation, but must use ADS for certain types of property

These rules can be complex, so you should consult with a tax professional to understand how the limitations apply to your specific circumstances.

How to deduct your business credit card interest

To claim your business credit card interest as a deduction on your income tax return, follow these steps:

1. Keep your receipts

Credit card statements might help support your business expenses, but they don’t always show enough detail for the IRS. If it’s unclear whether a purchase was for business or personal use, your deduction could be denied. To make things easier, save all your receipts and use accounting software to automatically log and categorize them.

2. Determine what percentage of your interest is tax-deductible

You can only deduct the percentage of your interest that results from business expenses. If you use your card solely for business, you’re likely eligible to deduct 100% of the interest. Otherwise, calculate the percentage tied to business purchases only.

3. File the proper forms

When you file your tax return, it’s important to file the right forms to claim your deductions. The forms you use to log these deductions depend on the type of business you have:

- S corporations: Line 13 of Form 1120-S

- Self-employed individuals: Line 16b of Schedule C, filed with Form 1040

- Partnerships and LLCs: Line 15 of Form 1065

Is credit card interest tax-deductible on Schedule C?

Credit card interest is tax-deductible on Schedule C if it’s tied to business-related purchases. You can deduct the portion of interest that applies to ordinary and necessary business expenses, but not interest from personal spending.

Other tax implications of business credit cards

In addition to interest deductions, business credit cards can come with other tax implications worth knowing. Here are a few key considerations to keep in mind:

- Taxable rewards and cashback: Business credit cards often come with rewards programs that offer cashback, points, or miles, and they're generally considered taxable income by the IRS. For that reason, it’s important to brush up on accounting rules for credit card rewards

- Annual fees: Business credit cards often come with annual fees. The good news is that these costs are considered legitimate deductible business expenses when filing your taxes

- Employee card usage: Accurately account for personal charges made on employee credit cards and exclude these charges from business tax deductions to avoid any complications

How to manage or avoid credit card interest

You can minimize or avoid credit card interest with these smart practices:

- Pay your balance in full each month to avoid interest charges entirely

- Negotiate a lower APR with your card issuer, especially if you have a strong payment history

- Use business expense trackers to track spending, automate receipt capture, and simplify repayment

- Separate business and personal expenses to make interest deductions easier and reduce errors

Simplify your business tax deductions with Ramp

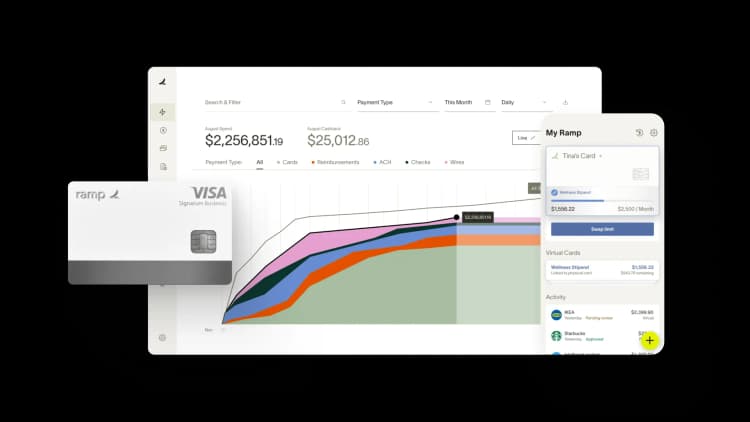

Tax time can be particularly stressful as a small business owner, but it doesn’t have to be. The Ramp Business Credit Card makes managing expenses and deductions effortless with automatic receipt capture, real-time spend tracking, and smart categorization.

Our business credit card puts you in control with customizable spending limits and unlimited physical and virtual cards. We also automatically flag out-of-policy transactions to prevent overspending before it happens.

Plus, earn cashback on spending and get access to more than $350k in partner offers from companies like UPS and Amazon Business. Plus, there are no interest charges because you pay your balance in full each month.

Try an interactive demo and see why Ramp customers save an average of 5% a year across all spending.

FAQs

The amount of business interest you can deduct is generally limited to your business interest income plus 30% of your adjusted taxable income, with some exceptions for small businesses and certain industries.

While you can't deduct the principal amount of credit card payments, businesses can deduct interest and some fees related to business purchases made with the card.

An LLC can deduct interest expenses on business-related debt, including credit card interest, as long as the expenses are ordinary, necessary, and properly documented for business use.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°