How to make a balance sheet in Excel: Free template

- What is a balance sheet?

- Key components of a balance sheet

- Creating a balance sheet using Excel

- Customizing your balance sheet template

- Balance sheet examples and best practices

- Automate balance sheet prep with AI-powered accounting that codes, syncs, and reconciles for you

A balance sheet shows your business’s assets, liabilities, and equity at a moment in time. Without it, you can’t accurately track your company’s financial health.

Building one from scratch in Excel can be time-consuming and prone to errors. Download Ramp’s free Excel balance sheet template to save time, stay organized, and improve accuracy in your reporting.

A well-structured Excel template gives you a clear picture of your finances and helps you keep assets, liabilities, and equity in balance.

Get our free Balance Sheet Template

What is a balance sheet?

A balance sheet is a financial statement that shows your company’s assets, liabilities, and equity at a specific point in time. It’s a snapshot of your financial health, highlighting what you own and what you owe.

Every balance sheet follows a simple formula:

Assets = Liabilities + Equity

- Assets: What your company owns

- Liabilities: What your company owes

- Equity: The value remaining for owners after debts are paid

The equation must always balance; your total assets should equal your total liabilities and equity.

Balance sheets in business

A balance sheet helps you track financial progress and make informed business decisions. It also promotes transparency by ensuring compliance with accounting standards and giving stakeholders an accurate view of your company’s position.

Regularly maintaining your balance sheet ensures financial statements reflect reality, which supports better management, planning, and reporting. Lenders and investors often rely on these statements when evaluating your business.

The balance sheet is one of three key financial statements. Here’s how it compares to an income statement and cash flow statement:

| Financial statement | What it's for | Timing |

|---|---|---|

| Balance sheet | Shows a company's assets, liabilities, and equity | At a specific point in time |

| Income statement | Shows revenue, expenses, and net profit or loss | Over a period of time |

| Cash flow statement | Shows how funds move in and out of the company | Over a period of time |

Key components of a balance sheet

A balance sheet has three main components: assets, liabilities, and equity. Understanding how they relate gives you a clear picture of your company’s financial health.

Assets

Assets are what your business owns that have value. Examples include:

- Cash on hand

- Accounts receivable, or money customers owe you

- Inventory ready to be sold

- Property, plant, and equipment (PP&E)

Assets are divided into two categories:

- Current assets: Short-term assets you can convert into cash within one year, like cash, accounts receivable, and inventory

- Noncurrent assets: Long-term assets that can’t be quickly converted to cash, such as property or equipment

Liabilities

Liabilities are what your business owes to others. Common examples include:

- Credit card balances

- Mortgages

- Short-term loans

- Long-term loans

- Bonds payable

Liabilities are also classified as:

- Current liabilities: Debts due within one year

- Noncurrent liabilities: Debts due after one year

Equity

The equity section reflects the value of funds shareholders have invested in the company, along with retained earnings. Retained earnings are profits kept in the business instead of being distributed as dividends.

The formula for shareholder equity is:

Shareholders’ equity = Total assets – Total liabilities

This represents the residual value of the company’s assets after subtracting liabilities. It includes both contributed capital and accumulated retained earnings.

Maintaining a healthy debt-to-equity ratio is key to long-term stability. While benchmarks vary by industry, a ratio between 0.5 and 2.0 is generally considered healthy.

Book value vs. market value

The book value of your business reflects what it’s worth on paper based on recorded assets and liabilities, while market value reflects what investors would pay today. They often differ because book value is based on historical costs, whereas market value changes with demand and perception.

Creating a balance sheet using Excel

Now that you understand the components of a balance sheet, let’s walk you through the step-by-step process to ensure your balance sheet is accurate, clear, and up-to-date.

Step 1: Set up your spreadsheet

Open a new Excel workbook and name the worksheet “Balance Sheet.” Create headers for “Assets,” “Liabilities,” and “Equity.” Add subheadings like “Current Assets” and “Long-term Liabilities” for better organization.

Step 2: Pick the balance sheet date

Choose a specific date for your balance sheet, typically the last day of the quarter (March, June, September, December) or the month if you prepare monthly reports.

Step 3: List all of your assets

Start by listing all your current assets (cash, accounts receivable) in order of liquidity. Follow this with non-current assets (property, equipment), ensuring you include both monetary and non-monetary assets.

Step 4: Add up all of your assets

Sum up all the assets listed to get the total asset value. Verify this total against the company’s general ledger for accuracy.

Step 5: Determine current liabilities

List all liabilities due within a year, such as accounts payable, short-term notes payable, and accrued liabilities.

Step 6: Calculate long-term liabilities

Identify liabilities that extend beyond one year, like long-term loans, bonds payable, pension plans, and mortgages.

Step 7: Add up liabilities

Combine the totals of current and long-term liabilities to find the overall liabilities value.

Step 8: Calculate owner’s equity

Calculate retained earnings (profits reserved for reinvestment) and total shareholders’ equity (share capital plus retained earnings).

Step 9: Verify the balance

Ensure that the sum of liabilities and owner’s equity equals total assets. If it doesn’t, review and correct any discrepancies.

By following these steps and maintaining regular updates, you’ll have a comprehensive and insightful view of your business’s financial health, enabling you to make informed and strategic decisions.

For a quicker solution, you can use Ramp’s pre-made balance sheet template to streamline the process. Download now!

Also, if you want a balance sheet template in word document format, download this template.

Customizing your balance sheet template

Understanding how to make a balance sheet in Excel is step one. Tailoring the template to your business makes it genuinely useful:

- Adding or removing line items: Right-click a row to Insert a new line or Delete one you don’t need. Rename labels so every line reflects a real asset or liability.

- Modifying formulas: When you add or remove rows, update any totals. Click a total cell to check the formula range and adjust it to include the right rows.

- Formatting and branding: If you plan to share the sheet with stakeholders, polish the presentation. Add your logo, align fonts and colors with your brand, and keep spacing consistent. Use cell styles sparingly so the numbers stay easy to read.

- Documenting assumptions: Add a short “Notes” area (date, preparer, methodology for estimates like depreciation). Clear notes make reviews and audits faster

- Versioning: Duplicate the tab for each period (e.g., “Balance Sheet – Mar 2025”) so you can compare changes over time without overwriting prior periods

Common tweaks to consider:

- Cash breakdown: Separate operating cash from restricted cash

- Receivables aging: Add a line for allowance for doubtful accounts

- Inventory detail: Split raw materials, WIP, and finished goods if relevant

- Debt schedule link: Reference a separate tab for loan balances and amortization

- Equity detail: Add rows for owner draws, additional paid-in capital, or treasury stock

Industry-specific customizations

Different business models call for small tweaks to the template so the totals still roll up cleanly.

Retail

- Add separate inventory lines for merchandise in stock, in transit, and goods on consignment

- Include sales taxes payable and gift card liabilities under current liabilities

- Track payment processors (e.g., card payouts) in accounts receivable and vendor balances in accounts payable

Service-based

- Replace inventory with unbilled revenue or work in progress for projects

- Add prepaid expenses for software, insurance, or retainers

- Include deferred revenue for upfront client payments as a current liability

Manufacturing

- Split inventory into raw materials, work in progress, and finished goods

- Add machinery and equipment under noncurrent assets, plus cumulative depreciation

- Consider a separate schedule for overhead allocation and depreciation expenses feeding back into the balance sheet

Tip for all three: When you add or rename rows, update the total ranges so assets, liabilities, and equity still tie out.

Balance sheet examples and best practices

Knowing how to create a balance sheet can be tricky. Here’s an example for a hypothetical company that shows how line items might appear:

| Balance Sheet | ||||

|---|---|---|---|---|

| As of 12/1/25 | ||||

| ASSETS | Amount | LIABILITIES & EQUITY | Amount | |

| Current Assets: | Current Liabilities: | |||

| Cash | $50,000 | Accounts payable | $20,000 | |

| Accounts receivable | $35,000 | Short-term loan | $7,500 | |

| Inventory | $25,000 | Mortgage (current due) | $65,000 | |

| Prepaid expenses | $10,000 | Total: | $92,500 | |

| Total: | $120,000 | |||

| Noncurrent Assets: | Noncurrent Liabilities: | |||

| Property, plant & equipment (PP&E) | $250,000 | Long-term debt | $150,000 | |

| Total: | $250,000 | Total: | $150,000 | |

| Owner’s Equity: | ||||

| Common stock | $50,000 | |||

| Retained earnings | $77,500 | |||

| Total: | $127,500 | |||

| Total Assets: | $370,000 | Total Liabilities & Equity: | $370,000 |

Balance sheet ratios

Simple ratios help you interpret the numbers in your balance sheet:

- Current ratio = Current assets ÷ Current liabilities. A ratio above 1.0 suggests you can cover short-term obligations comfortably.

- Debt-to-equity ratio = Total liabilities ÷ Shareholders’ equity. Most industries aim between 0.5 and 2.0, depending on leverage tolerance.

Common balance sheet mistakes to avoid

Look out for these common issues when preparing your balance sheet:

- Not balancing the sheet: Your assets should always equal your liabilities plus equity

- Overstating assets: Use current, accurate values and account for depreciation

- Omitting noncash expenses: Non-cash expenses like depreciation or amortization affect true asset value

- Mixing personal and business finances: Keep them separate to ensure accuracy

- Ignoring accruals: Missing accrued income or expenses creates mismatched reports

Maintain clear documentation, compare against prior balance sheets, and use recognized accounting standards such as GAAP to ensure consistency and accuracy.

When and how often to update your balance sheet

How often you update your balance sheet depends on company size and reporting needs:

- Small business: Monthly or quarterly

- Mid-sized business: Monthly

- Large enterprise: Quarterly (as required by the SEC)

- Nonprofits: Quarterly

You should also refresh it when key financial events occur, such as:

- Major asset purchase or disposal

- New loans or repayments

- Change in ownership

- Mergers or acquisitions

- Company restructuring

- Financial audits

Year-over-year comparisons reveal growth and liquidity trends over time. Create a duplicate tab in Excel for each period so you can track changes and spot patterns easily.

Integration with accounting software

Automating your balance sheet with accounting software like QuickBooks, FreshBooks, or Ramp helps ensure accuracy and real-time reporting. Integration allows for:

- Real-time data updates

- Automatic classification of assets and liabilities

- Audit trails and version history

- Seamless connection to budgets and other financial reports

- Secure cloud storage

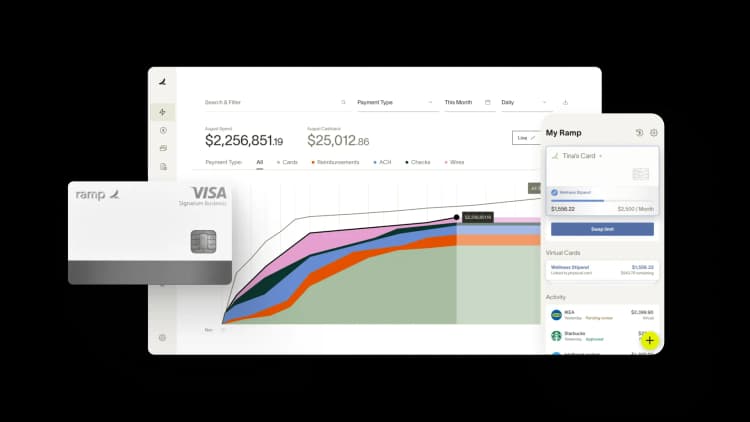

Automate balance sheet prep with AI-powered accounting that codes, syncs, and reconciles for you

Creating accurate balance sheets in Excel is time-consuming and error-prone. You're manually pulling data from multiple sources, coding transactions, reconciling accounts, and double-checking formulas—all while racing against month-end deadlines.

Ramp's accounting automation software eliminates the manual work that slows down balance sheet preparation. Instead of exporting data and building spreadsheets from scratch, you get real-time visibility into your financial position with automated coding, syncing, and reconciliation built in.

Here's how Ramp streamlines balance sheet creation:

- AI codes transactions automatically: Ramp learns your accounting patterns and codes every transaction across all required fields as it posts, so your data is categorized correctly from the start

- Auto-sync to your ERP: Ramp identifies in-policy transactions and syncs them to your accounting system automatically, ensuring your balance sheet reflects current data without manual entry

- Real-time reconciliation: Use Ramp's reconciliation workspace to spot variances and surface missing entries instantly, so you catch discrepancies before they affect your balance sheet

- Automated accruals: Ramp posts and reverses accruals automatically when context is missing, ensuring all expenses land in the right period for accurate reporting

- Audit-ready records: Every transaction includes receipts, approvals, and coding history, so you have the documentation you need to support balance sheet figures

With Ramp handling the data collection and categorization, you spend less time in Excel and more time analyzing what your balance sheet reveals about your business.

Try a demo to see how Ramp helps finance teams close their books 3x faster.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits