How to check your Bank of America business credit card application status

- How can I check my Bank of America business credit card application status?

- How long does Bank of America take to approve business credit card applications?

- Why is my credit card application pending?

- Get approved for a Ramp card in 1-3 days on average

If you have recently submitted an application for a business credit card from Bank of America and are eager to know the status of your request, there are multiple convenient ways to check for updates. Bank of America offers a simple process for applicants to stay informed about the progress of their application, whether it be through online means or other methods.

In this guide, we'll provide you with the step-by-step process for checking the status of your Bank of America business credit card application. We'll begin with the convenient online method, and also cover alternative ways to find out this information.

How can I check my Bank of America business credit card application status?

You can easily check your business credit card application status through Bank of America's website. Here are the steps to follow:

Online method

- Visit the Bank of America Website:

- Go to the official Bank of America website at www.bankofamerica.com.

- Log in:

- Click on the “Login” button typically located at the top right corner of the homepage.

- Enter your online banking ID and passcode to access your account.

- Navigate to Application Status:

- After logging in, locate the section related to credit cards. This might be under "Accounts," "Credit Cards," or a similar section.

- Find and click on an option labeled “Application Status” or “Check Application Status.”

- View status:

- Upon selecting the application status option, you will be able to see the status of your credit card application, including details such as approved, pending, or if additional information is needed.

Phone method

- Prepare your information:

- Before you call, have your application reference number and other relevant personal details handy, as you may need to verify your identity.

- Call customer service:

- Dial the Bank of America customer service number for credit card inquiries: 1-800-732-9194.

- Follow the prompts:

- Listen to the automated menu options and follow the prompts to navigate to the section regarding credit card application status.

- Speak to a representative:

- If the automated response does not provide the details you need, or if you have further questions, you can opt to speak directly with a customer service representative for assistance.

Visit a branch

- Locate your nearest Bank of America branch:

- Use the branch locator on the Bank of America website or a map application to find the closest location.

- Visit the branch:

- Go to the branch during its operating hours. It's a good idea to bring identification and any documents related to your application.

- Ask for help:

- Speak with a bank officer once you arrive. Provide them with your identification and necessary information so they can help you check the status of your credit card application.

How long does Bank of America take to approve business credit card applications?

The approval time for a Bank of America business credit card can vary, but generally, applicants can expect a decision within 7 to 10 business days. However, in some cases, if additional information or further review is required, it might take longer to receive a final decision. If you don't receive a response within the expected timeframe, it's a good idea to check the status of your application using one of the methods detailed above to get an update.

Does Bank of America offer instant approval credit cards?

Yes, Bank of America does offer instant approval for some of its credit card applications. This is typically possible when you apply online, and the system can verify your information quickly against national credit bureau data. If there are any discrepancies, further review, or additional information required, the approval process will take longer.

Why did Bank of America deny my credit card application?

If Bank of America denied your credit card application, it might be due to various common factors such as a low credit score, insufficient income, or high debt-to-income ratio. Negative entries on your credit report like late payments, defaults, or numerous recent credit inquiries could also influence their decision, as these elements are indicative of higher financial risk.

To understand the specific reasons behind the denial, refer to the adverse action notice provided by Bank of America. This notice will outline the main factors from your credit report that impacted the decision. For further clarification and to explore options to improve your chances in future applications, consider contacting Bank of America directly or reviewing your credit report for any potential inaccuracies that need correction.

Why is my credit card application pending?

If your credit card application is labeled as "pending," it usually indicates that the issuer requires more time to assess your information before reaching a verdict. This situation commonly occurs when the issuer needs to confirm your personal or financial information, or when they are handling a large number of applications.

This extended review period may be influenced by a variety of factors, including your credit history, the accuracy of the information provided in your application, and internal delays.

Here are a few typical explanations for why your credit card application may be in a pending state:

- Unfinished application: If any necessary sections are left empty or completed incorrectly, the issuer will require additional time to obtain the accurate details.

- Credit assessment: The issuer may need more time to carefully examine your credit record, particularly if there are inconsistencies or if your credit score is on the edge of meeting their standards.

- Verification procedures: You may be required to complete extra verification measures in order to validate your identity, income, or employment information, especially if the submitted documents do not adequately support your application.

- Fraud prevention measures: Issuers perform thorough checks to prevent fraud. If any suspicious activity is detected, they may delay your application for further examination.

- Operational hold-ups: Occasionally, a large number of applications, technical complications, or internal procedures on the issuer's side may cause delays.

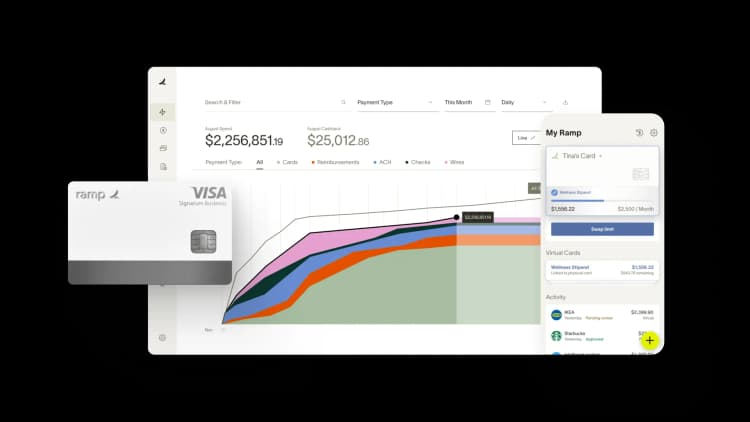

Get approved for a Ramp card in 1-3 days on average

If your company needs a credit card, Ramp's corporate card could be the solution. Unlike conventional business credit cards, Ramp doesn't require a credit check or personal guarantee. As a result, our approval process typically only takes one day.

Additionally, our cards offer advanced capabilities for managing expenses and an unlimited supply of free employee cards, both physical and virtual. These are just some examples of the features Ramp provides:

- No annual or setup fees: Start using Ramp’s corporate card and expense management software without any initial or recurring charges.

- Expense management features: Implement spending controls, automate the collection of receipts, and simplify the process of reporting expenses.

- Accounting software integrations: Ramp seamlessly connects with major accounting systems such as QuickBooks, Xero, Sage Intacct, and NetSuite, enhancing your ability to close your books up to eight times faster.

Disclaimer: Content on Ramp's blog may change, and opinions are those of the authors and not necessarily Ramp's. The information in this article is provided in good faith for general informational purposes, but does not constitute accounting, legal, or financial advice. Please contact an accountant, attorney, or financial advisor to obtain advice with respect to your business. Ramp is not liable for any losses or damages.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits