8 best accounting software for construction companies and contractors

- How accounting software improves profitability for construction companies

- Best construction accounting software

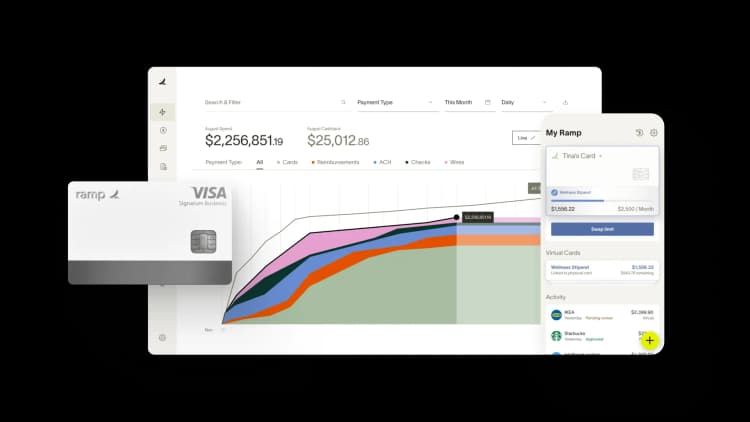

- Track job costs in real time with Ramp's automated coding and project-level spend visibility

Contractors deal with job costing, change orders, progress billing, and fluctuating material prices, making generic accounting software insufficient. Construction-specific accounting software helps businesses track project expenses, manage contracts, process invoices, and comply with tax and labor laws. Unlike traditional accounting software, it accounts for variable costs, fluctuating timelines, and multi-phase billing, making it essential for companies juggling multiple projects at once.

How accounting software improves profitability for construction companies

On average, it takes three to five years for a construction company to become profitable. High startup costs, fluctuating material prices, and delayed payments create significant financial challenges in the early years.

Accounting software helps accelerate this process by improving cash flow, controlling costs, and ensuring projects stay profitable. Instead of relying on spreadsheets or manual tracking, contractors gain real-time visibility into project expenses, labor costs, and outstanding invoices. This allows them to reduce waste and prevent cash flow shortages.

- Prevents financial leaks by tracking expenses in real-time

Construction companies often lose money due to untracked costs, billing errors, and unexpected expenses. These small losses add up quickly without a proper system, delaying profitability. Accounting software automates expense tracking, categorizes costs, and alerts businesses to budget overruns, ensuring every dollar is accounted for.

- Speeds up payments and improves cash flow

The construction industry’s average payment cycle is 74 days. Many businesses struggle to stay afloat because they aren’t getting paid on time. Accounting software automates invoicing, tracks outstanding payments, and sends reminders to clients, helping businesses get paid faster and avoid cash flow shortages. With Ramp, construction companies can reduce their bank reconciliation time by 75%.

- Reduces payroll errors and labor miscalculations

Labor is one of the biggest expenses in construction, and even minor payroll errors can lead to significant financial losses. Accounting software ensures accurate wage calculations, tax deductions, and compliance with labor laws, preventing overpayments and costly penalties.

- Improves job costing accuracy for better pricing

Many construction companies struggle to price their projects correctly, leading to underbidding and thin profit margins. Accounting software tracks all job-related costs, including materials, labor, and subcontractors, helping businesses set accurate project budgets and avoid underpricing their services. Companies that use job costing effectively increase their profit margins by an average of 6%.

- Provides financial clarity for smarter decision-making

Many new construction businesses operate on guesswork rather than solid financial data. Without clear financial reports, it’s hard to tell whether a business is truly profitable. Accounting software offers real-time insights, cash flow forecasts, and profitability reports, allowing business owners to make informed financial decisions that drive faster growth. With Ramp, construction companies can speed up their month-end close by over a month.

Best construction accounting software

The right accounting software solution depends on company size, project complexity, and financial management needs. A small residential contractor may need a simple system to track invoices and expenses, while a large commercial firm requires advanced job costing, payroll integration, and financial forecasting.

1. Foundation Software: Best for contractors managing payroll

Foundation Software is a construction-specific accounting platform that handles complex payroll, job costing, and financial reporting. Unlike general accounting tools, it’s designed to support contractors working across multiple states, unions, trades, and jurisdictions.

With nearly 40 years of industry experience and being trusted by over 43,000 construction professionals nationwide, the Foundation helps construction firms track costs, manage compliance, and streamline payroll processes.

Key benefits

- Automates payroll processing, ensuring compliance with union rules, prevailing wages, and multi-state tax laws.

- Tracks job costs in real-time, helping contractors monitor labor, materials, and overhead expenses.

- Eliminates redundant data entry, reducing errors and saving time on financial reporting.

- Customizable financial statements and construction reports for better project insights.

- Integrates with CrewHQ, Estimating Edge, McCormick, Payroll4Construction, Arcoro, ExakTime, and FollowupCRM for a seamless workflow.

Drawbacks

- Requires time to learn due to its extensive features and industry-specific accounting tools.

- The opaque pricing structure requires potential users to contact the company for a quote.

- Requires initial setup and training to maximize its full capabilities.

Foundation is best suited for contractors managing large payrolls, multi-state operations, and complex job costing and business needs. It’s an excellent choice for commercial builders, industrial contractors, and government-funded projects that require detailed cost tracking and compliance management.

Integrating Ramp with Foundation simplifies construction expense management by automating transaction tracking and providing real-time financial insights. Ramp syncs expenses directly into Foundation, eliminating manual data entry and ensuring faster, more accurate reconciliations. With automated receipt matching, expense categorization, and a real-time dashboard, contractors can monitor project costs instantly and optimize cash flow.

2. Freshbooks: Best for independent contractors

FreshBooks is a user-friendly accounting solution designed for small construction businesses and independent contractors. Its cloud-based system allows contractors to manage their financial health on the go, making it ideal for those juggling multiple projects and clients.

Key benefits

- Easy invoicing and payment tracking, reducing late payments and improving cash flow.

- Automated expense tracking and receipt scanning, minimizing manual data entry.

- Built-in time tracking, ensuring accurate billing for labor and project hours.

- Cloud-based collaboration allows real-time access to financial data from anywhere.

- Fast and responsive customer support, with direct access to real people instead of chatbots.

Drawbacks

- Limited construction-specific features, lacking advanced job costing and project budgeting tools.

- It is not ideal for large-scale contractors, as it lacks features like payroll management and WIP reporting.

- Limited integrations with construction management software, requiring manual data entry for some workflows.

FreshBooks is particularly useful for contractors who handle client invoicing, track billable hours, and need a mobile-friendly solution for managing expenses.

3. Jonas Construction: Best for service-based construction firms

With over 30 years of industry experience, Jonas Construction is trusted by contractors who need detailed job tracking, work order management, and seamless integration between the field and back office. Unlike generic accounting tools, it combines financial management, service dispatch, project scheduling, and job costing into a single platform.

Key benefits

- Tracks job costs, work-in-progress (WIP), and revenue in real-time for accurate financial oversight.

- Integrates accounting, payroll, and service dispatch to streamline operations.

- Features automated work order management and billing tools to reduce manual errors.

- Supports detailed project scheduling and daily logs to improve efficiency in the field.

- Offers integrations with QuickBooks, Procore, DocuSign, Microsoft Office 365, and FieldConnect for smooth data sharing.

Drawbacks

- Limited character space for job names and contract numbers, which can restrict data entry.

- Fewer third-party software integrations compared to competitors.

- The learning curve is due to its feature-rich interface, which requires initial training for full adoption.

Jonas Construction is best suited for specialty contractors, service-based construction firms, and mid-sized contractors needing strong job costing and dispatch scheduling. It’s particularly useful for mechanical, electrical, HVAC, and plumbing contractors who need real-time cost tracking, subcontractor management, and efficient service billing.

You can sync your transactions with Jonas Construction Software using Ramp's universal CSV, enabling instant expense tracking, automated receipt matching, and real-time financial insights.

4. QuickBooks Online: Best for tracking job costs

QuickBooks Online is a widely used accounting software that simplifies financial management for small and mid-sized construction businesses. It offers expense tracking, invoicing, and job costing. Unlike specialized construction accounting tools, QuickBooks Online is a general accounting platform but integrates with industry-specific apps like Buildertrend, Corecon, and Housecall Pro.

Key benefits

- Automates income and expense tracking, reducing manual bookkeeping errors.

- Simplifies invoicing and payment processing, ensuring faster payments from clients.

- Tracks job costs in real-time, helping contractors monitor project profitability.

- Manages contractor payments and tax forms, automating W-9 and 1099 tracking.

- Provides mobile access, allowing users to manage finances from any device.

- Integrates with construction-specific tools, improving workflow efficiency.

Drawbacks

- Lacks advanced construction accounting features, such as retainage tracking and compliance reporting.

- Limited job costing depth, requiring third-party integrations for more complex cost management.

- It can get expensive with add-ons, especially for businesses needing multiple integrations.

QuickBooks Online is best suited for independent contractors and subcontractors looking for a straightforward accounting system. It’s ideal for companies that need expense tracking, invoicing, and tax management without the complexity of enterprise-level software.

With a one-click integratetion, contractors can use Ramp + QuickBooks together to automate receipt collection, take advantage of real-time budget tracking, and custom spending controls that prevent overspending before it happens. Ramp also captures expenses instantly, syncs them directly into QuickBooks, and applies smart rules to streamline reconciliation.

5. Sage 300 CRE: Best for multi-entity construction businesses

Sage 300 Construction and Real Estate (CRE) is a comprehensive accounting and project management solution built for large contractors, developers, and property managers. It provides end-to-end financial visibility, risk management, and project tracking.

With over 1,400 prebuilt report formats and real-time collaboration tools, Sage 300 CRE ensures accurate cost tracking, seamless communication between teams, and better financial decision-making. It’s designed to reduce project risks and improve cash flow management.

Key benefits

- Comprehensive financial reporting with 1,400+ pre-built reports, allowing detailed cost analysis and forecasting.

- Real-time project collaboration, keeping teams aligned on budgeting, scheduling, and cost tracking.

- Comprehensive risk management tools, helping businesses identify and mitigate financial and operational risks.

- Integrated document management, ensuring easy access to contracts, invoices, and compliance records.

- Seamless real estate management allows firms to track leases, property financials, and maintenance schedules.

Drawbacks

- Has a higher learning curve due to its wide range of features and customizable options.

- Higher cost compared to basic accounting solutions, making it more suitable for larger firms.

- It is not ideal for small businesses, as it may be too complex for contractors needing a simpler system.

Sage 300 CRE is particularly valuable for companies that handle multiple large-scale projects, require in-depth reporting, and need an integrated system for accounting and operations.

6. Acumatica: Best for compliance-focused construction firms

Acumatica is a cloud-based ERP solution designed to streamline accounting, project management, and financial tracking for construction businesses. Built for growing construction firms, Acumatica offers scalable cloud access, allowing field teams and office staff to collaborate seamlessly from anywhere. Its powerful automation tools reduce manual data entry, helping businesses improve efficiency and maintain better financial oversight.

Key benefits

- Real-time financial tracking allows contractors to monitor budgets, costs, and revenue in one system.

- Seamless cloud-based access, keeping teams connected from the field to the office.

- Advanced automation tools, reducing manual work and improving efficiency with AI-powered features.

- Integrated compliance management, ensuring adherence to industry regulations with built-in reporting tools.

- Scalable for growing construction firms, adapting to increased project complexity and business expansion.

- Strong third-party integrations, syncing with ProEst, Procore, Microsoft Office, DocuSign, and ADP.

Drawbacks

- More difficult to learn, especially for businesses new to ERP systems.

- Customization can be complex, requiring additional time for setup and training.

- Higher cost for smaller firms, as it’s designed for businesses looking for comprehensive financial management.

Acumatica is best suited for contractors managing multiple projects, tracking job costs in real-time, and needing automation to improve efficiency.

7. CoConstruct: Best for project bidding

CoConstruct is a construction and property management platform designed to help home builders, remodelers, and contractors streamline project finances, bidding, and client communication. It combines budget tracking, invoicing, and proposal management in one place. It’s an excellent choice for builders who frequently bid on projects, manage multiple subcontractors, and need clear financial insights to maintain profitability.

Key benefits

- Simplifies project bidding and proposal management, helping builders secure more contracts efficiently.

- Tracks expenses and real-time financial data to ensure projects stay on budget.

- Integrates with QuickBooks, Xero, The Home Depot Pro Xtra, and Gusto HR/Payroll for seamless accounting and payroll management.

- Offers cash rebates on materials, allowing builders to earn back money on purchases.

- Provides online payment options, making it easier to process client and subcontractor transactions.

Drawbacks

- Limited reporting functionality compared to some competitors.

- Fewer integration options than larger construction accounting platforms.

- It may not be ideal for large-scale contractors needing advanced job costing and compliance tracking.

For real estate developers and property managers, CoConstruct’s CRM tools, proposal tracking, and online payment capabilities make it a solid choice for managing renovations and new builds.

8. Procore: Best for integrated project accounting

Procore is a construction-specific accounting and project management platform designed for general contractors, real estate developers, and large construction firms. It provides a centralized hub for managing finances, tracking project progress, and streamlining communication between teams, clients, and vendors.

With over 1,000,000 projects globally, Procore is built to handle complex construction operations, from retail centers and office buildings to industrial plants and housing complexes.

Key benefits

- Seamless integration of financial data with project management, reducing errors and improving accuracy.

- Unlimited user access, allowing teams to collaborate in real-time.

- Advanced reporting and forecasting tools powered by machine learning for better financial insights.

- Strong integrations with accounting platforms like QuickBooks, Sage Intacct, Viewpoint Vista, and Xero.

- Customizable workflows for progress billing, funding source tracking, and budget management.

Drawbacks

- Steep learning curve due to the platform's extensive accounting functions and financial tools.

- The opaque pricing structure requires businesses to request a quote for cost details.

- It is a project management tool, meaning additional accounting software may be needed for bookkeeping and tax compliance.

Procore is best suited for large general contractors and developers who are handling multiple construction projects with complex financial structures. It’s particularly valuable for businesses that require detailed project cost tracking, seamless collaboration, and integration with their existing accounting tools.

Track job costs in real time with Ramp's automated coding and project-level spend visibility

Construction companies need accounting software that tracks job costs as they happen, not weeks after the fact. Without real-time visibility into labor, materials, and equipment expenses by project, you risk budget overruns, inaccurate bids, and delayed invoicing that strains cash flow.

Ramp's accounting automation software gives you project-level spend tracking from the moment a transaction posts. Every purchase is automatically coded to the right job, cost category, and GL account using AI that learns your accounting patterns. You'll see exactly what each project costs in real time, so you can catch overages early and make informed decisions about resource allocation.

Here's how Ramp supports accurate job costing:

- Auto-code to projects: Ramp's AI codes transactions across all required fields—including project codes, cost types, and classes—so every expense lands in the right bucket without manual entry

- Enforce project budgets: Set spending limits by project and get alerts when teams approach thresholds, so you control costs before they spiral

- Track vendor spend by job: See which subcontractors and suppliers are charging what on each project, making it easier to validate invoices and negotiate better rates

- Close books faster: Ramp syncs coded transactions to your ERP automatically and posts accruals so job costs hit the right period, even when invoices arrive late

With Ramp, you get the granular visibility construction accounting demands without the manual coding work that slows teams down.

Try a demo to see how Ramp automates job costing for construction companies.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits