How construction accounting differs in software and practice

- What is the difference between construction accounting and financial accounting?

- Differences in construction accounting software and practice

- Why integrating technology and expertise is crucial in construction accounting

- Get the construction accounting features you need with Ramp

This post is from Ramp's contributor network—a group of professionals with deep experience in accounting, finance, strategy, startups, and more.

Interested in joining? Sign up here.

The world of construction accounting is changing. Construction firms have started embracing software to track their finances as projects grow more complex and companies aim to improve efficiency. In 2021, the global construction accounting software market was valued at nearly $500 million. Industry analysts expect it to almost double by 2027, showing the rapid adoption of these systems.

Yet even as software permeates the industry, construction accounting retains some unique quirks in practice. The long lifecycles of construction projects spanning years, the intricate progress tracking needs, and the role of change orders mid-project are some factors that distinguish it from accounting in other industries.

This can make directly applying generic accounting software challenging. As construction businesses choose and implement these systems, they must consider if and how they support these sector-specific needs.

In this post, we'll explain the unique challenges and nuances of construction accounting compared to traditional financial accounting, including project-based tracking and the significance of job costing. Additionally, we'll discuss the transformative impact of construction accounting software, its automation capabilities, and the necessity of integrating technology with expert knowledge.

What is the difference between construction accounting and financial accounting?

1. Project-based vs. period-based accounting

Construction companies use project-based accounting to track costs and revenue for specific projects, making construction accounting entries vital for detailed financial oversight rather than simply adhering to periods.

This allows them to monitor the profitability of each project separately. Traditional companies instead use period-based accounting, where they allocate costs and revenue to set time intervals like months or years.

Jim Pendergast, Senior Vice President at altLINE Sobanco, explains, "Project-based accounting is so vital in construction because projects can take months or years to complete. Expenses and bills come in over the entire life of the project. If construction firms used period-based accounting, they wouldn't get an accurate picture of whether a project is profitable until it is finished."

But with project-based accounting, they can check on the financial health of a project at any stage. This helps them identify any cost overruns early while still having a chance to correct them.

Additionally, the highly customized nature of construction projects makes project-based accounting necessary. No two projects are exactly alike, with wide variability in types of materials, build specifications, labor requirements, etc.

Project-based accounting also means that cash flows are project-based, meaning their revenue and expenses are tied to specific projects, which can vary significantly in size, duration, and complexity. Non-construction companies often have more stable and predictable cash flows tied to ongoing operations and sales.

Tying costs and revenue specifically to each distinctive project allows for more visible tracking of these unique attributes. Comparatively, traditional period-based accounting is better suited for companies with more consistency across periods.

2. Cost components and job costing

Construction projects tend to be unique, with typically more overhead required for each job such as specific materials, labor costs, equipment, indirect costs, etc. This makes tracking costs at the job level - also known as job costing - essential.

In construction accounting, costs are tracked by individual projects to facilitate job costing, requiring meticulous construction accounting entries for each expense and revenue stream. Key cost components tracked include materials, labor, equipment charges, and subcontractor expenses.

In comparison, traditional accounting in other industries does not emphasize job costing. Products made don't vary as widely, so granular tracking of custom materials/labor costs per job is often less imperative.

Anthony Martin, Founder and CEO of Choice Mutual adds, "Construction accounting uses job costing to routinely estimate costs for bidding, monitor budget-to-actual job performance, support change orders due to scope changes, and apply lessons learned to improve future projects. This per-job costing view differs from traditional accounting's focus on higher-level total expenses and margins."

3. Retention and percentage of completion

Construction accounting handles revenue recognition and job costing differently than traditional accounting. A core difference is using the percentage of completion method to recognize revenue over the course of a project rather than at project completion.

This more accurately matches revenues with expenses incurred to date. Construction accountants track costs incurred compared to total budgeted costs to estimate the percentage complete.

Retention also sets construction accounting apart. When billing clients before a project finishes, construction companies typically retain a portion (often 10%) of each invoice as retainage. This provides an incentive for the contractor to complete the work correctly.

Retainage accrues in unbilled accounts receivable throughout the job. Upon satisfactory project completion, the client releases the accumulated retainage payment. This differs from traditional accounting, where revenue earned is typically billed and collected at around the same time products or services are delivered.

The percentage of completion and retainage concepts align reported revenues with physical construction progress. This prevents frontloading revenues and provides working capital cushioning to handle project hiccups.

Apart from those, it should be noted that smaller construction companies may also choose the cash accounting approach when their project is not so complex or shorter in terms of duration.

Cash accounting recognizes revenue and expenses only when cash is exchanged, offering an easy approach to finance control, which is preferred by smaller operations. While this approach may provide less information about the financial well-being of the project in the long run compared to the accrual methods, it makes accounting easier for firms that do not have the resources to handle the nuances of retention and percentage of completion accounting.

This method notes the variety of accounting methods and focused solutions adopted by the construction industry based on the size and complexity of the organization.

4. The Completed Contract Method in Construction Accounting

The completed contract method (CCM) is another critical method that differentiates construction accounting from its financial accounting counterpart. This method allows companies to postpone revenue and matching expenses until a project is entirely done. This approach is very beneficial to the construction companies for several reasons.

Once fully realized, the completed contract method initially provides a neat and straightforward financial picture of a project. This is particularly advantageous for projects with long timelines, where costs and scope may vary considerably.

Deferring revenue recognition allows firms to eliminate the second step, where costs and revenues are estimated in the middle of a project, thus removing the complexity and potential inaccuracy involved.

In addition, the CCM is in accordance with the cash flow constraints many construction companies have. The nature of their project-based works being the case, recognizing the revenue upon completion helps the financial statement to reflect the actual cash inflows and outlays that arose from the project, offering a more accurate financial health of a company at any point in time.

This approach also provides tax benefit planning. When revenue recognition is deferred, companies can control their tax liability better, reducing their tax liability in years when project completion is staggered.

However, the completed contract method is not suitable or favorable for all construction companies. The percentage of completion method is likely better for companies with short project cycles or needing regular and predictable financial reporting to stakeholders.

The selection of the percentage of completion method or the completed contract method is influenced by many factors, such as project duration, financial stability, and tax considerations.

Differences in construction accounting software and practice

1. Automation and streamlining processes

Construction accounting software allows companies to invest in automating many repetitive tasks and streamline workflows, including generating construction accounting entries and enhancing accuracy and efficiency.

The software centralizes data entry, connects different modules like accounts payable and job costing, and generates reports with a few clicks rather than painstaking spreadsheet work. This automation saves significant time compared to paper-based systems involving ledger books, file folders, and typewriters.

However, the capabilities enabled by the software are only as good as the processes underneath. Companies switching from manual to digital systems often simply replicate inefficient analog methods faster. Truly optimizing operations requires analyzing processes first.

For example, setting up automated invoice approvals based on overcomplicated sign-offs fails to address the root issue. Effective implementation integrates software and improved processes in tandem. Workers adept at both digital tools and operational excellence are essential.

"The right software unlocks automation, but only aligned processes and skilled teams can maximize these capabilities' potential. Technology provides means, while sound accounting practices supply ways. Marrying the two crafts efficient, insightful construction financial management amidst modern complexity." - Ryan Zomorodi, Co-Founder and COO of RealEstateSkills.com.

Furthermore, effective financial management extends beyond project-specific accounting; construction firms also need to consider broader financial strategies for their idle cash. This is where understanding and comparing CD rates can be beneficial.

2. Integration with project management tools

Construction accounting software has been developed to work harmoniously with many industry project management tools such as Procore, Sage 300 CRE, and Viewpoint.

The integration allows real-time transfer of job cost data, budgeting, and scheduling from the two systems. This way, the construction firms can get an integrated perspective of project finances and development in one central location instead of switching back and forth between different programs.

Jay (Yong Jia) Xiao Co-founder, President of SuretyNow, explains, "It also makes manual data entry for users seamless, lowering the risk of errors and increasing efficiency.

Through the custom integration capabilities of construction-specific platforms available today, companies can make their workflows seamless across project management, accounting, and other critical back-office functions which are impossible through standard accounting systems."

3. Reporting and compliance

Andrew Pierce, CEO at LLC Attorney, says, "Construction companies face extensive regulatory and compliance reporting burdens that general accounting software often does not fully support. Specialized construction accounting systems provide detailed tracking, reporting, and compliance tools tailored to the industry's unique needs."

For example, many construction projects have contractual requirements to regularly report certified payroll data.

While general accounting platforms may track payroll costs, construction software integrates seamless certified payroll reporting based on worker classifications, pay rates, local prevailing wage laws, and other construction-specific requirements. This eliminates manual compilation and ensures accurate, streamlined compliance.

Stephan Baldwin, Founder of Assisted Living, adds, "Robust construction accounting systems include detailed analytics on project budgets, actual costs, committed costs, and estimates-to-complete - providing construction financial managers clear visibility into performance relative to bid estimates and contracts.

Dashboard reporting and automated alerts empower proactive management when projects risk going over budget. Such purpose-built functionality represents a marked difference from everyday small business accounting platforms."

Why integrating technology and expertise is crucial in construction accounting

With construction projects' increasing scale and budgets, accounting has to be handled by more advanced software to track more significant transactions and details. However, even the most robust software has limitations like foreseeing costs, detecting outliers or risks, exercising judgment, and consulting with clients.

At this point, the financial acumen and industry knowledge of an experienced construction accountant have become important complements to accounting software.

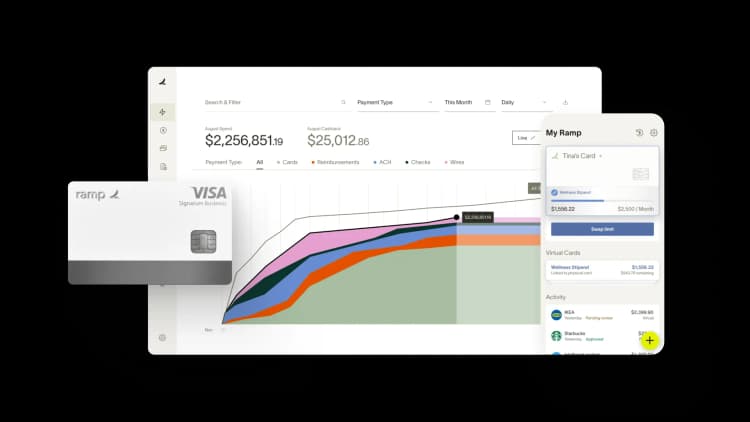

Get the construction accounting features you need with Ramp

Construction accounting demands project-level tracking, job costing precision, and real-time visibility across multiple sites—capabilities most generic accounting software can't deliver without heavy customization. Ramp's accounting automation software adapts to construction-specific workflows through flexible coding dimensions, project-based controls, and intelligent automation that learns your job costing structure.

You can track spend across projects, cost codes, and phases without manual data entry or spreadsheet workarounds. Ramp's AI coding learns your construction accounting taxonomy and automatically applies project codes, cost types, and job numbers as transactions post. When field teams submit expenses or make purchases, Ramp captures project context at the point of spend and routes approvals to the right project managers based on your hierarchy.

Here's how Ramp adapts to construction accounting:

- Multi-dimensional coding: Apply project codes, cost codes, phases, and custom fields to every transaction so job costing stays accurate and audit-ready

- Project-based controls: Set spending limits and approval workflows by project, so field teams stay within budget and finance maintains oversight across all active jobs

- Real-time job costing: Track project spend as it happens with live dashboards that show committed costs, actual spend, and budget variance by job

- Automated receipt collection: Eliminate manual receipt chasing with text-to-submit and auto-matching, so every field expense has documentation tied to the right project

Try a demo to see how construction companies streamline project accounting with Ramp.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°