Best treasury management software solutions in 2025

- Ramp

- Center

- Rho

- Mercury

- Relay

- Arc

- Meow

- Payhawk

- Kyriba

- HighRadius

- SAP S/4HANA Cloud

- Look to Ramp Treasury for the Solution

Treasury management is the process of overseeing a company’s liquidity and financial resources, like cash, assets, and liabilities, in order to achieve financial goals. Treasury management software helps corporate treasurers achieve these goals. It does this by automating tasks and centralizing the treasury function so that corporate teams have the information they need to make better financial decisions. Treasury management software can be used by any business: small businesses, large businesses, growing companies, nonprofits, financial institutions, and government agencies.

Treasury management software is an essential part of a successful and profitable business. By helping you monitor cash inflows and outflows, this technology gives you greater control over working capital. But it does so much more than help you monitor cash. A well-positioned treasury software can:

- Make cash more predictable.

- Improve banking relationships.

- Make cash flow management forecasts more accurate.

- Expedite payment processes.

- Reduce manual workload requirements.

- Make financial reports more accurate.

- Improve compliance with regulatory standards and accounting principles.

- Increase returns on investments.

- Help you manage treasury risks and financial risks, like operational inefficiencies, supply chain disruptions, and fiscal policy changes.

The 2024 Global Corporate Treasury Survey conducted by Deloitte asserts that “treasurers are becoming the driving force of the cash culture in an organization.” To fully embrace that strategic role, corporate treasurers should implement software that helps them better their cash positioning.

Here are 12 treasury management software platforms to consider.

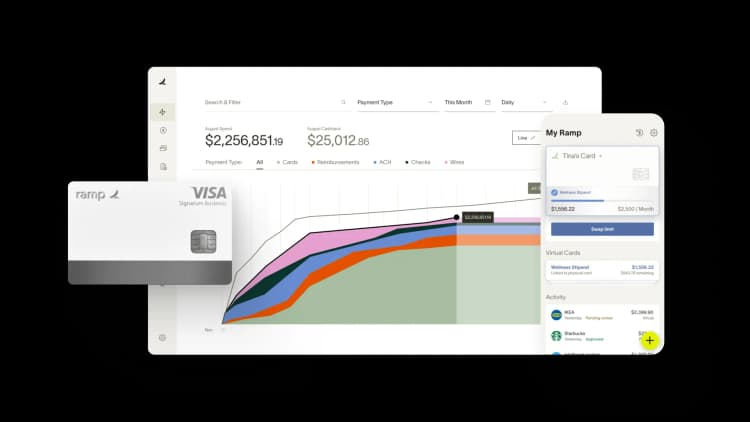

Ramp

Ramp Treasury is an all-in-one financial operations platform designed to save you time and make workflows simpler. Within its easy-to-use platform, you can automate fund transfers, schedule deposits, adjust vendor payment terms, and so much more.

Key Features:

- Integrates with your ERP so that transfers and earnings are automatically recorded to the correct GL accounts

- Builds an audit trail by requiring authorizations to perform certain treasury functions

- Sends alerts about balances so you can always cover your bills

- Partners with an FDIC-insured bank and offers cash rewards to those with Ramp deposit accounts

- Delivers a beautiful design and thoughtful workflows to improve the user experience

Products:

- Ramp Business Account: A deposit account through First Internet Bank of Indiana, with no minimum balance requirement, no opening or maintenance fees, no transfer caps, and no transaction limits. Deposit accounts receive FDIC insurance up to tens of millions of dollars.

- Ramp Investment Account: Deposits are invested into Invesco Premier U.S. Government Money Portfolio (FUGXX) with brokerage services provided by Apex Clearing Corporation. No account fees, same-day ACH, and next-day liquidity.

- Ramp Corporate Card: A $0 annual fee card with no personal guarantees and no late payment fees that offers cash rewards. Requires a minimum of $25,000 in a Ramp Business Account to qualify.

Pros:

- Cash rewards: Idle funds stored within Ramp’s Business Accounts can earn cash rewards of up to 2.5%.

- FDIC insured: Funds are FDIC insured, even deposits worth tens of millions of dollars, which make it a great way to earn returns on operating funds — even payroll.

- Same-day ACH: Helps you pay bills timely by offering same-day ACH payments.

- Free: Costs $0 to sign up for a Ramp Business Account, has no annual fees, requires no minimum deposits, and has no transfer limits.

Cons: Financial Assistant Janey C. reports that she struggled to do thing “like setting work flows and creating different reports” when she first started using it.

Center

Center is a corporate card and expense management solution that promises a smoother month-end close, increased compliance, and insight into cash management to help you make better decisions.

Key Features:

- Helps users gain visibility into procurement spend and employee travel expenses with its CenterCard Mastercard

- Offers a virtual card for employees to use with all the same controls of its physical cards

- Customizable for your business’s processes, policies, and approval workflows

- Analyzes patterns and trends to spot outliers

Products:

- CenterCard: Corporate card with physical and virtual options, with no upfront investment or annual fees.

Pros:

- Automatic reconciliation: Decreases time spent on P-card reconciliation by automating the reconciliation process.

- Tighter control over expenses: Offers real-time reports to control spending before it gets out of hand.

- Simplifies travel bookings: Makes it easier for employees to book travel expenses and easier for management to approve that spending.

- Better visibility: Shows details of and trends in employee spending habits.

Cons: An accounts payable specialist Emma B. has reported that “reporting options of Center feel limited.”

Rho

Rho is a spend management system that automates certain treasury functions. Its goal is to boost user profitability, and the software does that by providing insight into spending habits for procurement, employee travel, and other everyday spending. Rho also offers banking services and corporate cards.

Key Features:

- Offers checking accounts, savings accounts, and corporate cards all on one platform

- Helps users invest in government-backed treasury bills

- Allows users to customize spend policies like approved spend amounts, budgets, authorized users, and approved merchants

- Allows employees to submit receipts via the application and automatically approve purchases or send to the appropriate manager for review

Products:

- Rho Checking Accounts: Provided by Webster Bank, N.A., Member FDIC that are FDIC-insured up to $250,000 per entity.

- Rho Savings Accounts: Built on a network of over 400 FDIC-insured banks. This allows companies holding funds above $250K to access up to $75M in FDIC deposit insurance per entity.

Pros:

- Spend enforcement: Controls spending by only permitting authorized users to make purchases.

- Automation: Automates expense workflows by setting and enforcing spending rules.

- Complementary products: Offers business checking accounts, business credit cards, and investment accounts, and cash can be moved easily from one account to another.

- Customer support: Offers 24/7 customer support to answer questions.

- Low-cost benefits: Lets users send free ACH payments without asking for a monthly platform fee.

Cons: Investments within Rho’s platform can only be placed in Treasury Bills, and users might prefer to hold operating income in other investments like mutual funds.

Mercury

Mercury Treasury is a cash management platform and banking service for startups. It helps its users earn high returns on deposit accounts, automate cash management systems, and make money transfers quickly and efficiently.

Key Features:

- Beautiful and simple dashboard with connectivity that brings together all aspects of the corporate treasury department

- Automates aspects of the treasury department, like transfers, payments, and invoicing

- Accepts customer payments by credit card, Apple Pay, Google Pay, wire, ACH transfer, and ACH debit

Products:

- Mercury Checking and Savings Accounts: Deposit accounts are offered through Choice Financial Group and Evolve Bank & Trust, and are eligible for up to $5 million in FDIC insurance.

- IO Business Credit Card: The IO Mastercard is a charge card available for businesses that maintain at least $25,000 in a Mercury account that offers cashback on all spending.

- Mercury Treasury: Mercury partners with Apex Clearing Corp and invests users’ funds into low-risk mutual funds offered by Morgan Stanley and Vanguard and offers returns of up to 4.44%.

Pros:

- Easy transfers: Can easily transfer funds between Mercury Treasury investment accounts and its checking or savings accounts.

- Good for startups: Offers deals for startups, like discounts on software packages and access to venture financing.

- Tailored access: Lets users tailor permissions to each member or lock card spending to only certain merchants, helping manage expenses.

Cons: CEO of a small business, Natasha D., reports that Mercury is slow to respond, “taking 2-3 business days.”

Relay

Relay is small business banking that helps users control spending and save more. It offers free online business accounts that are great for medium-sized businesses with multiple budgets and teams.

Key Features:

- Consolidates all payments in one place so you have a good overview of your income

- Dashboard that provides a clear picture of cash flow so you can make informed decisions about spending

- Robust expense tracking by capturing receipts, standardizing vendor names, and keeping records of team spending

Products:

- Relay Checking Account: Deposit accounts are offered through Thread Bank and provides FDIC insurance of up to $3 million.

- Relay Savings Account: Deposit accounts can earn up to 3.03% APY and have up to $3 million in FDIC insurance through Thread Bank.

- Relay Corporate Card: Physical and virtual Via debit cards can be associated with a Relay bank account.

Pros:

- Account options: Lets users have up to 20 different bank accounts to allocate income as they please.

- Automation: Automates transfers between accounts.

- Assists in saving money: Offers savings accounts so that users can reserve funds for taxes, investments, or emergencies.

- Integrations: Integrates seamlessly to QuickBooks Online and Xero.

Cons: NerdWallet reports that deposited checks are held for up to 7 days.

Arc

Arc is an intelligent capital management resource for private companies and lenders. It helps you with your treasury management system, and helps you save for the future with AI-powered capital market solutions — and it does so on one simple-to-use platform.

Key Features:

- Users can earn rewards on card spend and on funds stored within a business account

- Interface is sleek, modern, and easy to understand, and summarizes all Treasury functions

- Relationship managers available 24/7 to assist via email, phone, or Slack

- Partners with Stripe for money transmission services; with Goldman Sachs Bank for Business account funds; and with Evolve Bank & Trust for Wallet account funds

Products:

- Arc Business and Wallet Accounts: Operating accounts to manage day-to-day cash needs like payroll, bills, and invoices with no minimum balances or monthly fees and offers free wires and same-day ACH.

- Arc Treasury and Reserve Accounts: Investment accounts that safeguard capital with up to $5 million in FDIC insurance through a bank sweep program with BNY Mellon Pershing. Investment options are Money Market Funds, Treasury Bills, and Mutual Funds.

- Arc Card: Issued by Celtic Bank and serviced by Stripe. You can use virtual or physical debit cards.

Pros:

- Competitive yield: With Arc’s treasury account, you can earn up to 4.54% in returns.

- Automation: Arc Treasury can perform automatic transfers

- No fees: Arc Treasury Accounts have no opening fees, transfer costs, or minimum balance requirements.

Cons: NerdWallet points out that Arc does not have a mobile app.

Meow

Meow is a banking platform for businesses, specializing in solutions for real estate funds, VCs, and startups. It helps treasury departments by offering banking services (like checking accounts, charge cards, and investment accounts), invoicing and bill collection options, and offers financing assistance.

Key Features:

- High interest rate checking accounts and investment accounts help you manage both operating cash and investments in one place

- Quick and painless transfers from Treasury accounts into Business accounts

- Ability to create custom invoices

- Integration capabilities with most common accounting software on the market

Products:

- Business Checking Account: A high interest checking account provided by Grasshopper Bank and OMB Bank, with zero wire or ACH fees and APY of up to 3.52%.

- Corporate Credit Card: A way to earn up to 2% on every purchase with no annual fees, no minimums, and no credit checks.

- Treasury Accounts: Investment accounts through BNY Pershing for you to purchase U.S. Treasury Bills.

Pros:

- Integrations: Integrates seamlessly with existing payroll and accounting software, including QuickBooks, Gusto, and Xero.

- Controls spending: Lets you set approvers and spend limits for different users across your organization.

- Financing options: Helps you apply for business financing, term loans, lines of credit, and SBA loans.

Cons: Multiple reviewers wanted to invest in Meow and said their account managers never got back to them to set up the meeting.

Payhawk

Payhawk is a spend management solution for multinational businesses. It manages a business’s treasury operations by offering corporate cards, monitoring expenses, and syncing with AP to make business payments simple.

Key Features:

- Links external cards to Payhawk’s system to streamline card management

- Its bank card collects receipts at the point of sale to eliminate chasing receipts for expense approvals

- Matches receipts to transactions and reconciles differences

- Has a report builder and lets users export those reports to Excel for further review

Products:

- Payhawk Cards: Virtual or physical credit and debit cards through Visa.

Pros:

- Integration: Has over 10 native bidirectional ERP integrations, including SAL, NetSuite, and Quickbooks.

- Controls company spend: Has the ability to assign spend policies and create budgets for users or expense types.

- Financial data capture: Offers an easy-to-use portal and app with an AI-powered camera to capture data from expense receipts.

Cons: Mathijs Vreedeveld gave good ratings to Payhawk on TrustPilot but said that “there was some trouble understanding the issue” he was having.

Kyriba

Kyriba is treasury management software that helps its users optimize cash and liquidity. It centralized the payment and expenses process by connecting its software to your banks, ERP systems, and other business applications. This provides better visibility into costs and enhances management’s control over funds.

Key Features:

- Keeps record of critical bank account information and stores documents securely, including information for foreign bank and financial accounts

- Interactive data visualizations for better insight into liquidity and risk

- Cloud-based customizable dashboard that helps improve understanding of cash position

- Provides data analytics on liquidity, cash flow, payments, risk, compliance, and supply chain finance to improve financial decision making

Pros:

- Seamless integration: Connects to banking partners, ERP systems, and other data providers to centralize the treasury department into one platform.

- Better cash visibility: At a moment’s notice, you can see where your cash is, and the analyses the software provides can help you stay ahead of market volatility.

- Lower banking costs: Kyriba analyses your bank fees, helping you reduce the overall costs of your banking relationships.

- Reduces risks: Helps develop cost-effective hedging strategies to mitigate treasury risk.

Cons: Alex B, a mid-market employee, said that “Kyriba support has difficulties sometimes.”

HighRadius

HighRadius is an AI-powered treasury management solution that is easy to use and connects seamlessly to your ERP and banking partners. The software leverages AI agents to deliver real-time visibility into the corporate treasury department and offers strategic insight for CFOs to make better decisions.

Key Features:

- Provides cash flow forecasting with 95%+ accuracy with AI-driven models

- Offers real-time snapshots of cash to improve global cash visibility

- Automates approval workflows following user-defined rules to ensure compliance

- Monitors payment statuses to ensure timely settlements

- Facilitates payments across multiple banks under one unified platform

Pros:

- Security: The software has enhanced payment security with built-in fraud detection to help mitigate fraud risk.

- Automation: Automates manual tasks across reconciliation, cash positioning, banking, and payment approvals.

- Payment dashboard: Lets users initiate and track payments from multiple banks, all from the same dashboard.

- Useful insights: The software collects data, then uses that information to build analytics that can provide users with strategic insights into their cash position.

Cons: Salesforce Developer Viran K has reported that “new people find [HighRadius Treasury and Risk] hard to learn.”

SAP S/4HANA Cloud

The SAP S/4HANA Cloud is a treasury and risk management solution that integrates with trading platforms, banks, and accounting software. While it does many things, it markets itself as a centralized platform for trading activities. It helps companies perform transactions and analyze trading data in real time.

Key Features:

- Calculates and reports foreign exchange risks

- Generates hedging proposals following both IFRS and US GAAP

- Consolidates trading information, including deals requests, from multiple trading platforms

- Downloads data automatically from multiple market data providers to aid in decision making

Pros:

- Integration: The software links to your treasury and risk management workflows, all of which can be accessed from their cloud-based dashboard.

- Increased efficiency through process automation: Treasury processes are automated to boost efficiencies from start to finish.

- Deployment flexibility: Users can choose to deploy the software on-premises, via the public cloud, via a private cloud, or a hybrid of one or more of these models.

- Real-time processing: The software’s in-memory database means that it doesn’t require batch processing, letting businesses execute processes in real time, from anywhere.

Cons: Assistant Manager Ankit J. said that SAP S/4HANA Cloud is “very costly” and “difficult to understand initially.”

Look to Ramp Treasury for the Solution

Consider switching to Ramp Treasury1. It lets you store operating cash in a free-FDIC-insured Business Account; invest cash into money market funds; and has no fees, minimum deposits, or transfer limits. It’s not only a great way to keep your cash and treasury functions all in one place, but it’s a great way to earn 35X more than other products on the market.

1) Ramp Business Corporation is a financial technology company and is not a bank. All bank services provided by First Internet Bank of Indiana, Member FDIC.

Get up to 2.5% in the form of annual cash rewards on eligible funds in your Ramp Business Account. Cash rewards are paid by Ramp Business Corporation and not by First Internet Bank of Indiana, Member FDIC. Cash rewards are subject to change. See the Business Account Addendum for more information.

Customers with a Ramp Business Account can use the ICS service provided by IntraFi Network LLC. Ramp is a financial technology company, not an FDIC-insured depository institution. Banking services are provided by First Internet Bank (FIB), member FDIC. Subject to the terms of the applicable ICS Deposit Placement Agreement, FIB will place deposits at FDIC-insured institutions through IntraFi’s ICS service. A list identifying IntraFi network banks appears at https://www.intrafi.com/network-banks. Certain conditions must be satisfied for “pass-through” FDIC deposit insurance coverage to apply. To meet the conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage. Deposits are insured by the FDIC up to the maximum allowed by law; deposit insurance only covers deposits in the Ramp Business Deposit Account in the event of the failure of the FDIC-insured bank.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group