The best business loans you can get with no credit check

- What is a no credit check business loan?

- Best business loans with no credit check

- How to get a business loan with no credit check

- How Ramp helps businesses access alternative funding

- Access the working capital you need

Whether your business is just starting out or has been in operation for decades, a business loan will come in handy occasionally. However, getting approved for traditional business loans might be difficult for business owners with bad credit scores or no credit history.

Business funding with no credit check can be an excellent alternative to these traditional business loans. But can you get a business loan with no credit check?

The answer is a resounding yes. In fact, there are many different types of business loans that don’t require a credit check. Find out what kinds of loans are available, the risks of these loans, and the best options available below.

What is a no credit check business loan?

Lenders often run credit checks to determine the risk they accept when lending money to borrowers. If you’ve ever applied for a credit card, auto loan, mortgage, or any other consumer loan, you’re familiar with this process.

But credit isn’t just a consumer loan factor. It typically plays a significant role in business loans, which poses a challenge.

Most business loans require you to have good business or personal credit. However, there are business loans without personal credit or business credit requirements. These are known as no credit check business loans.

Types of business funding with no credit check

There are several ways to get your hands on business funding with no credit check. The most common include:

- Friends and family: Consider reaching out to your friends and family for loans to fund your business’s growth.

- Invoice factoring: Invoice factoring companies offer cash advances while you wait for your customers to pay their invoices. When a customer pays an invoice, the money they pay goes to the factoring company to pay back the loan.

- Freight bill factoring: Freight bill factoring is the process of selling the rights to your freight billing for the money you need now. Freight bill factoring is similar to invoice factoring but typically offers a larger amount of working capital.

- Sales-based underwriting: Some companies, like Ramp, offer sales-based underwriting. This means they use your company’s sales data to determine your loan eligibility rather than a credit score.

- Accounts receivable financing: You can also agree to give rights to a portion of your future accounts receivables in exchange for the money you need today.

Best business loans with no credit check

When choosing a business loan with no credit check, you need to consider things like fees, interest rates, and features that can help you build your business. Read on to learn about the best no credit check business loans on the market today.

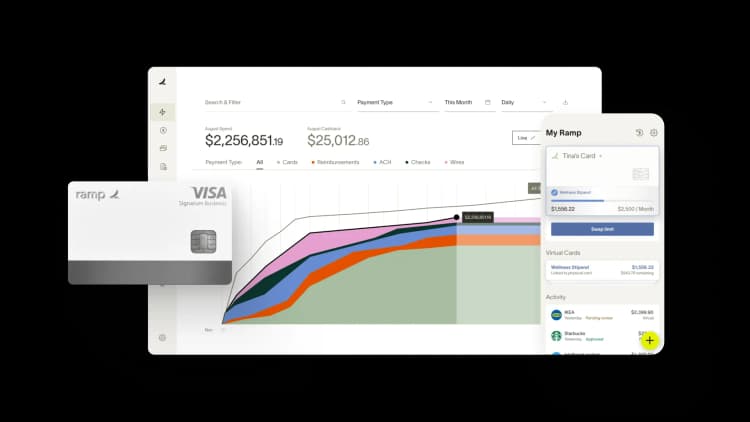

Ramp

Ramp is a modern lending option designed to make the working capital you need available at your fingertips. The company follows a sales-based underwriting process, meaning limited credit history won’t hinder your chances of approval. Some of the most exciting features of Ramp include:

- Higher credit limit: Ramp’s sales-based underwriting leads to credit limits that are up to 40 times higher than you get with traditional options.

- Employee spending cards: Create as many physical and virtual employee spending cards as you need, each with unique spending policies built in that you control.

- Expense management: The Ramp platform features state-of-the-art technology that automatically categorizes expenses, logs receipts, and more. In fact, you could close your books up to 60% faster with Ramp’s help.

- It’s free: Ramp doesn’t charge interest, annual fees, account maintenance fees, or any other fees. The platform and available capital are completely free to access.

Keep in mind that Ramp is a charge card. That means you’ll need to pay your balance off at the end of each billing cycle. However, the company also partners with lenders to make other financing options available.

FundThrough

FundThrough is an invoice factoring company that can put up to $10 million in working capital on your books relatively quickly. Because the company’s interest is in your invoices for work you’ve already done, there’s no need for a credit check. Some of the biggest perks of working with FundThrough include:

- Reasonable rates: FundThrough’s factoring rates range from 2.5% to 5%.

- Cash flow-based approval: FundThrough uses your business bank statements and accounting software to determine your cash flow for approval. So, if you have a steady cash flow, approval is simple.

- Quick funding: Get the working capital you need as soon as the day after you apply.

Although FundThrough can put working capital in your account quickly, there are a few drawbacks. Next-day funding comes with an additional fee, you’ll also pay fees for early payments, and your invoices have to be at least 3 months old to qualify for factoring.

Square Loans

Square is a popular payment platform, but it doesn’t just offer a way to charge your customers’ credit cards. Square also offers a unique approach to lending. Here are the most exciting features of Square Loans:

- Up to $250,000 available: You may be able to access up to $250,000 in working capital.

- Easy application: The loan application process is simple because it uses information from your Square account.

- No interest: Square doesn’t charge interest. Instead, the company charges a set fee that makes it easier to understand the cost of borrowing.

- Repayment: Your loan is automatically repaid by a percentage of daily sales.

This is a great pick for some borrowers, but it’s only available to Square members. Additionally, daily payments reduce your ongoing cash flow and may put additional strain on your business over time.

Kiva

Kiva is a crowdsourcing platform that gives you the ability to tap into business loans from the community rather than traditional banks. Some of the biggest perks of working with Kiva include:

- No collateral requirements: Kiva will never ask for collateral in order to approve your loan.

- Interest as low as 0%: Your interest may be as low as 0%, but pay attention to the terms before you accept the loan, as interest rates can also be pretty high.

- Vetting process: Your credit doesn’t matter at Kiva. Instead, the company vets borrowers in other ways, like endorsements from community members.

The biggest drawback to Kiva is time to funding because you’ll need to wait on peers to fund your loan. So, if you’re looking for same-day business loans with no credit check, you’ll need to look elsewhere.

PayPal Working Capital Loans

PayPal, the popular digital payments platform, isn’t just for accepting payments for goods and services online. If you’re a PayPal user, you may qualify for a working capital loan from the company. Here are the perks of borrowing from PayPal:

- Fast application: PayPal uses your account data to approve the loan, offering a fast and easy application and approval process.

- Fixed fee financing: PayPal doesn’t charge interest. Instead, you’ll pay a fixed fee that makes the cost of funding more transparent.

- Automatic repayments: Repayments are based on daily sales. No payment is due on days without sales.

Some of the biggest drawbacks to PayPal working capital loans are that you must be a PayPal user to take advantage of them, loan amounts are typically small, and you must pay off 5% of your balance every 90 days, which could lead to cash flow issues.

How to get a business loan with no credit check

Follow these steps to increase your chances of getting a no credit check business loan:

- Be prepared: Although you may not need to go through a credit check, you’ll likely need bank statements, profit and loss statements, and your articles of incorporation, at the very least. Make sure you have all your figurative ducks in a row when it comes to your business’s financial documents.

- Apply for the right option: If you don’t have strong daily sales but generate meaningful revenue with only a few clients, options like PayPal and Square may not fit the bill. Look for invoice factoring instead.

- Be honest on your application: Honesty is the best policy in just about every area of life. Be sure to answer all application questions as truthfully as possible.

How Ramp helps businesses access alternative funding

There's no other way to put it: Securing business funding without a credit check is hard. Traditional lenders often require extensive credit histories and high scores, leaving newer businesses or those rebuilding credit with limited options. You might find yourself stuck between needing capital to grow and lacking the credit profile to access it through conventional channels.

Ramp offers an alternative through its modern corporate card that focuses on your business's cash flow rather than personal credit scores. Unlike traditional credit cards that require hard credit pulls and established credit histories, Ramp evaluates your business based on its actual financial health—looking at factors like bank account balances and revenue patterns. This approach means you can access spending power based on what your business is doing today, not what happened in the past.

The platform's expense management capabilities also position your business for alternative funding success. By automatically categorizing expenses, tracking spending patterns, and generating real-time financial reports, Ramp creates the clear financial picture that alternative lenders value. When you approach revenue-based financing providers or invoice factoring companies, you can present organized, accurate financial data that demonstrates your business's viability without relying on credit scores.

Additionally, Ramp's spending controls and virtual card features help you manage cash flow more effectively, reducing the need for external funding in the first place. You can set precise spending limits, create vendor-specific virtual cards, and automate approval workflows—all of which help stretch your existing capital further. This improved cash management often reveals that the funding gap is smaller than initially thought, making alternative financing options more accessible and affordable when you do need them.

Access the working capital you need

Ready to take control of your business finances? Get Ramp and unlock powerful tools that help you save time, cut costs, and make smarter spending decisions—all while giving your team the flexibility they need to move fast.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°