Recurring revenue loans explained: Benefits, requirements, and key concepts

- What are recurring revenue loans?

- How do ARR loans work?

- Benefits and drawbacks of ARR financing

- How to calculate ARR and other metrics lenders use

- Steps to secure ARR funding

- Alternative funding options if you don't qualify for ARR financing

- Get the capital you need with Ramp

Recurring revenue loans have emerged as a powerful financing tool for subscription-based businesses that need growth capital but lack the traditional profitability metrics banks require. These loans use your annual recurring revenue (ARR) as collateral rather than hard assets or EBITDA, making them accessible to companies still investing heavily in growth.

If you're running a SaaS company with predictable subscription revenue but minimal profits, ARR financing could bridge the gap between venture rounds or help you reach profitability without diluting ownership. This guide breaks down everything you need to know about recurring revenue loans, from how they work to whether they're right for your business.

What are recurring revenue loans?

Recurring revenue loans are a type of debt financing tailored to businesses with predictable, contract-based revenue streams, particularly SaaS companies. Unlike traditional bank loans, which are based on hard assets and profitability, ARR loans use the value of predictable revenue streams to determine the amount they’re willing to lend, and on what terms.

Three key terms help define this financing model:

- ARR serves as your primary metric; it's your monthly recurring revenue (MRR) multiplied by 12, excluding one-time fees or non-recurring services

- Paid-in-kind (PIK) interest allows you to defer cash interest payments by adding them to your loan principal.

- Revenue-based underwriting means lenders focus on metrics like net dollar retention and customer churn rather than traditional profitability measures

The main differentiator is revenue-based underwriting. ARR represents the value of the recurring revenue that a business can expect to receive over a 1-year period, often used in the context of subscription-based businesses with long-term contracts. Lenders evaluate your customer contracts, retention rates, and revenue predictability rather than requiring positive EBITDA or significant assets as collateral.

How do ARR loans work?

Lenders evaluate your company's ARR to determine the potential loan amount, often providing financing based on a multiple of your monthly or annual recurring revenue. The underwriting process examines your recurring revenue quality, customer retention metrics, and growth trajectory rather than current profitability.

When a business approaches a lender for an ARR-based loan, the lender will scrutinize the ARR calculation to understand customer churn, contract lengths, discounting practices, and any other factors that could affect the stability and predictability of the revenue to assess their risk.

Interest and repayment structure

PIK interest allows interest to accrue for a set number of years, where the debt principal due on the date of maturity increases in exchange for the deferred payout of the cash interest expense. This structure preserves your cash for investments during critical growth periods.

In contrast to traditional EBITDA financing, most ARR loans offer minimal or zero amortization during the initial growth phase. You'll typically pay interest only (or PIK it) until maturity, when the full principal becomes due.

Leverage based on ARR

Lenders typically offer loans equivalent to a multiple of your MRR, usually in the range of 3–12x. Your specific multiple depends on your growth rate, retention metrics, and market position.

This is a sharp contrast from traditional debt-to-EBITDA ratios. While conventional loans might offer 3–5x EBITDA leverage, ARR loans are based instead on revenue predictability.

Covenants and triggers

Lenders often limit their risk by using loan covenants, which are requirements the borrower must follow to avoid penalties or even a technical default. Many ARR loans have specific covenants attached, such as maintaining a minimum growth rate or customer churn rate.

One of the defining covenants of ARR financing is the concept of the conversion date or “flip,” which defines a specific date when the ARR terms flip to traditional EBITDA terms. This transition reflects the assumption that you'll become profitable as you mature.

However, recent trends show that some lenders have eliminated the EBITDA flip covenant, while others have introduced a “toggle” option that allows the borrower or lender to choose whether to keep using ARR terms or flip to cash flow financing terms.

Benefits and drawbacks of ARR financing

ARR loans address critical pain points for growth-stage companies that traditional financing can't solve, but they also carry risks you’ll need to evaluate.

Benefits of ARR loans

- Non-dilutive growth capital: Unlike equity financing, ARR loans let you access capital without giving up ownership, meaning you keep more control of your business and its future direction. This becomes especially valuable when you're between funding rounds, providing additional runway without having to accept a down round or unfavorable terms.

- Cash flow flexibility with PIK interest: PIK toggle agreements give you the option to defer interest payments if needed. This flexibility is especially valuable during periods of heavy investment in sales and marketing.

- Speed of approval compared with banks: The streamlined application and approval process for ARR funding can provide quicker access to capital compared to traditional bank loans. While banks might take months evaluating financial statements and projections, ARR lenders can often close within weeks.

Drawbacks of ARR loans

- More expensive than traditional loans: ARR loans usually cost more than traditional bank financing. This premium reflects the higher risk lenders take on by focusing on revenue rather than profitability. You're essentially paying for flexibility and accessibility.

- Potential for covenant breaches: Revenue volatility is a major threat to covenant compliance. Customer churn, delayed renewals, or slower growth can quickly push you below required covenant thresholds.

- Over-leverage during slow growth periods: Taking maximum leverage when you’re growing quickly creates vulnerability when that growth slows. Interest can grow fast, increasing the risk of default. If you've borrowed 3x ARR expecting continued growth, even a modest slowdown can make your debt burden unsustainable.

How to calculate ARR and other metrics lenders use

Accurate SaaS financials ensure smooth underwriting and ongoing compliance. Have these metrics on hand as you start evaluating ARR lenders:

New vs. expansion vs. contraction ARR

Lenders will examine your ARR components to determine the quality of your revenue. New ARR from customer acquisition demonstrates market demand, expansion ARR from existing customers shows product stickiness and upsell capability, and contraction ARR from downgrades or partial churn reveals retention challenges.

Calculate each component monthly:

- New ARR: Revenue from customers who weren't paying last month

- Expansion ARR: Increased revenue from existing customers

- Contraction ARR: Decreased revenue from customers still paying

- Net-new ARR: New ARR + Expansion ARR – Contraction ARR

Net dollar retention

Net dollar retention (NDR) measures revenue retained and expanded from existing customers. You can calculate it by dividing current-period revenue from a customer cohort by the same cohort's revenue from 12 months ago, including expansions and contractions.

Strong NDR indicates that customers find increasing value in your product over time. This metric often matters more than growth rate since it demonstrates sustainable unit economics.

Gross margin adjustments

Lenders may adjust your ARR based on gross margins to reflect true revenue quality. Your ARR calculation should only capture reliably recurring revenue from subscription fees, while profit from maintenance, consultancy, or services fees should be excluded unless they’re included in the subscription.

High-margin software revenue receives full credit, while lower-margin services revenue might be discounted. Professional services, implementation fees, and one-time charges typically get excluded entirely from ARR calculations.

Steps to secure ARR funding

If you’re pursuing ARR financing, following these steps can help streamline your fundraising process and improve terms:

Step 1: Collect financial and SaaS metrics

Prepare all the necessary documentation before approaching lenders:

- Monthly customer cohort analyses, showing retention and expansion

- Customer acquisition cost (CAC) and payback periods

- Detailed ARR build showing all components

- Historical and projected cash burn rates

- Customer concentration analysis

- Churn analysis by segment and cohort

Step 2: Build a borrowing base model

Create a financial model showing your debt capacity under various scenarios. Include sensitivity analyses for different growth rates, churn levels, and covenant thresholds. Project your path to EBITDA profitability and the covenant flip timing.

Model the impact of PIK interest on your total debt burden. Show how different toggle decisions affect your leverage ratios over time.

3. Shortlist and pitch lenders

Research lenders that specialize in ARR financing for your company stage and industry. Target 5–8 lenders with relevant experience. Prepare a concise pitch deck highlighting your ARR quality, growth trajectory, and path to profitability. Emphasize factors that differentiate you from typical ARR borrowers.

4. Negotiate term sheet and covenants

Focus negotiations on the terms that matter most for your business:

- PIK toggle availability and pricing

- Covenant headroom and cure rights

- Prepayment penalties and call protection

- Allowable acquisitions and investments

- Timing and conditions for the EBITDA flip (or negotiate whether the loan should include one at all)

Push for maximum flexibility while growth is strong.

5. Close and begin covenant reporting

Once you've picked a lender and agreed on terms, the closing process typically takes 2–4 weeks. Prepare for extensive due diligence on customer contracts, revenue recognition policies, and financial projections.

Post-closing, establish robust reporting processes. ARR loans require additional reporting obligations, including customer count analysis, churn, booking, subscription billing rate, and customer retention. Monthly or quarterly reporting keeps lenders informed and builds trust for future flexibility requests.

Alternative funding options if you don't qualify for ARR financing

If ARR loans don't fit your situation, or if you’re unable to qualify for favorable terms, consider these alternatives:

Venture debt

Venture debt is a viable option for more established startups that have been through initial VC funding rounds and have measurable EBITDA or ARR. However, recipients often have a higher risk profile than banks would accept, so this form of debt financing can be expensive, and lenders will generally take a warrant on the loan.

Key differences from ARR loans include:

- Requires a recent equity raise from recognized VCs

- Typically includes warrants, which create dilution

- Shorter terms (24–48 months)

- Lower leverage multiples

- Often includes financial covenants tied to cash runway

Revenue-based financing

Revenue-based financing involves repayment as a percentage of cash receipts, where investors get a fixed monthly percentage of a company's revenue in return for their investment. This is usually capped at 1.5–3x the initial investment.

This structure works for businesses with immediate cash flow but irregular growth patterns. You pay more when revenue is strong and less during slow periods, providing natural flexibility.

Traditional bank revolvers

For companies with positive EBITDA or significant assets, bank credit facilities offer the lowest cost of capital. Startups can apply for various types of bank loans, such as term loans or SBA loans, and are typically secured by hard assets or personal guarantees from the founders.

Banks will require profitability, assets, or guarantees, but offer:

- Lower interest rates

- Longer terms

- Higher absolute dollar amounts

- Less restrictive covenants once established

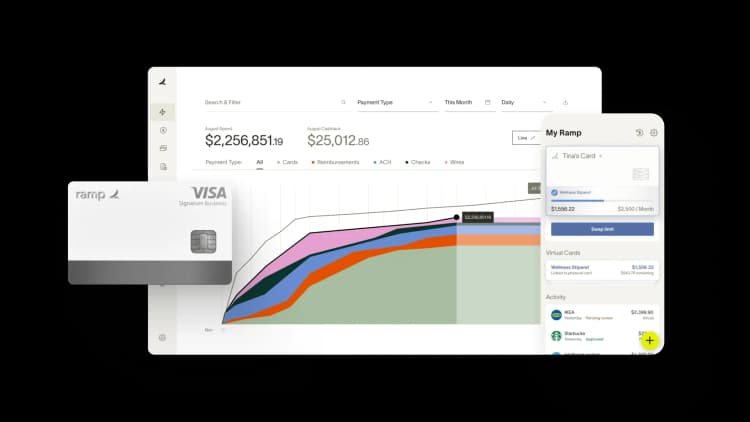

Get the capital you need with Ramp

ARR financing can offer you the money you need for growth, but in some cases, the risks might outweigh the rewards. Ramp's corporate cards can help extend your runway and ease cash flow pressure.

Ramp offers credit limits higher than traditional business credit cards, giving your company the financial flexibility to move faster, operate with fewer constraints, and manage expenses at scale.

You’ll also get built-in tools to spend your capital smarter. Ramp’s expense management software automatically tracks and categorizes your transactions in real time, and custom spending limits help you control expenses at the point of sale.

Try an interactive demo and see why companies that use Ramp save an average of 5% a year across all spending.

FAQs

Most ARR loans close faster than traditional bank financing, within a few weeks to 2 months, due to streamlined underwriting focused on revenue metrics. The exact timeline depends on your preparedness with financial documentation and the complexity of your revenue model.

Lenders typically exclude one-time services revenue from ARR calculations since it's not recurring, though some may consider contracted ongoing services. Subscription-based support or success services built into annual contracts might qualify if they demonstrate similar retention to your core product revenue.

Covenant breaches may trigger higher interest rates, additional reporting requirements, or, in extreme cases, a technical default. Most agreements include cure periods and rights, giving you time to inject capital or negotiate amendments before facing severe consequences.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they're seeing the quick payment. That started with Ramp—getting everyone paid on time. We'll get a 1-2% discount for paying early. That doesn't sound like a lot, but when you're dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group