How to prepare and organize your business tax documents

- How business tax documents protect and benefit your company

- Common types of business tax documents

- Preparing business tax documents

- How to organize and manage business tax documents

- How long should you keep your tax documents?

- Organize tax documents automatically with Ramp's receipt matching and centralized storage

Business tax documents are the financial records that show your company's income, expenses, and tax obligations. These include income tax returns, invoices, payroll records, bank statements, and receipts – all the documents that help verify your business's financial activity.

To stay compliant with the IRS and claim your deductions, you must ensure your business tax documents are organized and maintained accurately.

Key takeaways

- Keep income, expense, payroll, and tax records well-organized for accurate filing.

- Regularly review and update documents to avoid last-minute issues.

- Double-check all records before filing to prevent errors or IRS audits.

- Store tax documents for the required period to ensure compliance.

- Use cloud-based accounting software to automate tracking, storage, and depreciation calculations.

How business tax documents protect and benefit your company

You already know you need to keep tax records - but well-organized documentation does more than just satisfy IRS requirements. Here's how proper tax documentation strengthens your business:

Maximize your deductions and minimize audit risk: The IRS audits 8.8% of businesses annually, focusing on companies reporting large deductions or inconsistent income. With organized records of office expenses, travel costs, and employee wages, you can confidently claim every eligible deduction while having the documentation ready if the IRS requests proof. Remember: if you underreport income by more than 25%, the IRS can audit your returns for up to six years. The IRS plans to increase the percentage of business tax returns audited to 22.6% by tax year 2026.

Access financing when you need it If you need a business loan, having your tax documents will help secure it. Most banks require 2-3 years of tax returns to assess your company's financial health. Clean, organized tax records demonstrate your business stability and improve your chances of securing financing at favorable terms.

Stay protected during disputes: Your tax documents provide an ironclad record if an employee questions their payroll or a vendor disputes a payment. This documentation serves as concrete proof in legal situations and helps you maintain compliance with labor and tax regulations.

Use cloud-based accounting software that integrates with Ramp to automatically track and categorize transactions. This creates an organized audit trail and makes it easier to identify potential deductions throughout the year.

Common types of business tax documents

Every business entity, regardless of size or ownership, must maintain its tax documents to track its income, expenses, and paychecks. While the specific forms you need depend on your business structure, the core tax documents remain largely the same across all businesses.

Tax documentation

The IRS assigns different forms for corporations, partnerships, and sole proprietors to make their tax payments.

If your business is a C corporation, you must file Form 1120 to report income, deductions, and tax liability. Unlike other business types, C corps pay federal income tax before distributing profits to shareholders. You must submit this form once a year before April 15 or the 15th day of the fourth month after your fiscal year ends.

You don't pay corporate taxes if your business is an S corporation. Instead, profits and losses pass through to shareholders, who report them on their individual income tax returns. You must file Form 1120-S annually by March 15. Each shareholder also gets a Schedule K-1, which shows their share of the company's income.

If you have a sole proprietorship or a single-member Limited Liability Company, you have to report your business income on Form 1040, using Schedule C. This form tracks income, expenses, and net profit or loss from business activities. The due date for filing is April 15, the same as personal tax filings.

If you miss a deadline, the IRS may charge 5% per month on unpaid taxes, up to 25%.

Income Documentation

The IRS requires businesses to report all business income, whether from sales, services, or other revenue streams.

- Invoices

They are a record of a sale issued to a customer for goods or services provided. Invoices serve as proof of revenue and are necessary for tracking accounts receivable. The IRS may require them to verify reported income.

- Sales receipts

These receipts are provided to your customer after a purchase, confirming payment. Receipts verify sales transactions and are essential for businesses that collect sales tax. The IRS recommends keeping sales receipts for at least three years in case of an IRS audit.

- Bank statements

They are a summary of financial transactions in a business account, including deposits, withdrawals, and transfers. These statements provide a clear record of incoming and outgoing funds. They help reconcile income with invoices and receipts, ensuring that no revenue is left unreported.

- Form 1099-NEC

This business tax form is issued to independent or self-employed contractors who earn $600 or more from a business. It is used by businesses that hire freelancers, consultants, or contract workers. This form ensures that all nonemployee compensation is reported to the IRS. If you hire independent contractors, you must send them Form 1099-NEC by January 31 each year.

- Form 1099-MISC

This tax form is used to report various types of payments, such as rent, prizes, and legal fees. Businesses use this form to report payments made to individuals or entities that aren’t employees.

Expense & deduction records

Expense and deduction records are documents that track your business spending and help you claim tax deductions.

- Business expense receipts

These are proof of purchases made for business-related expenses. The IRS requires receipts to validate office supplies, travel, and advertising deductions. Each receipt should include the date, amount, vendor, and purpose of the expense.

- Vendor invoices

A bill received for services or products purchased from suppliers, providers, or contractors. Vendor invoices help track business expenses and ensure proper deduction claims. If audited, you'll need invoices to prove payments made for business-related services.

- Utility bills

These are statements for electricity, internet, water, and phone services used for business operations. These expenses can be deducted if they are directly related to business activities, and you'll need your utility bills to support your claim.

- Loan & interest statements

They are documents showing payments made on business loans, including interest paid. The interest you pay on your business loans is tax-deductible, and you would need your loan statements to provide proof of these payments.

- Office rent & lease agreements

They are contracts for office or commercial space rentals. Rent is a fully deductible business expense. Your lease agreements provide proof of payments and terms.

- Advertising & marketing expenses

These include invoices and receipts for ads, social media campaigns, website hosting, and marketing services. Advertising costs in the US are 100% tax-deductible, but the IRS may request records to confirm expenses.

Preparing business tax documents

The time you spend preparing your business tax documents depends on your operational scale and organization system. On average, small business owners spend around 80 hours per year handling taxes. On the other hand, larger companies with more complex finances may require several weeks to prepare their tax documents with the help of tax professionals.

Gathering required tax information

If you keep all your records updated, gathering everything for tax filing may take a few hours to a couple of days. If your documents are disorganized or missing, it can take weeks to track them down.

To avoid any delays, you should set a schedule for organizing your financial records. You should review and update your tax documents every month instead of waiting until tax season. This prevents last-minute stress and ensures you have everything ready when it's time to file.

Double-checking accuracy

Mistakes in your tax documents can lead to IRS penalties, delayed refunds, or even audits. Start by verifying your income and expense records. Compare your invoices, bank statements, and receipts with your reported earnings. The IRS uses automated matching systems to check your income against 1099s and W-2s. If the numbers don't match, it could result in an audit.

Review all deductions and tax credits carefully before you e-file your tax returns. If you miss eligible deductions, you'll overpay. If you claim the wrong ones, you could face penalties. Make sure that you also compare your current federal tax return with previous filings. If your income drops suddenly or your deductions increase sharply, the IRS may flag your return and request documentation to verify accuracy.

How to organize and manage business tax documents

A well-organized tax record system ensures accurate reporting, smooth audits, and easier financial planning. Whether you use digital tools, cloud storage, or a traditional filing system, maintaining a clear structure prevents last-minute scrambling.

Developing a strategic filing system

A filing system is a structured way to store, organize, and manage documents for easy access and retrieval. A good filing system ensures that documents are stored securely and can be found quickly when needed.

Start by sorting your records into categories like income, expenses, payroll, asset records, and tax filings. Use a consistent naming system for digital files and label physical folders clearly. Businesses with structured filing systems reduce tax prep time by up to 40%.

You can use a physical filing system using labeled folders and cabinets or a digital one, where records are stored in cloud-based software. Most businesses use a combination of both.

Using cloud-based accounting software

With cloud-based accounting software like QuickBooks and Xero, you can automate record-keeping, track expenses, and organize financial data in real time. They also allow you to access your tax records from anywhere. This is especially helpful for businesses with remote teams or multiple locations.

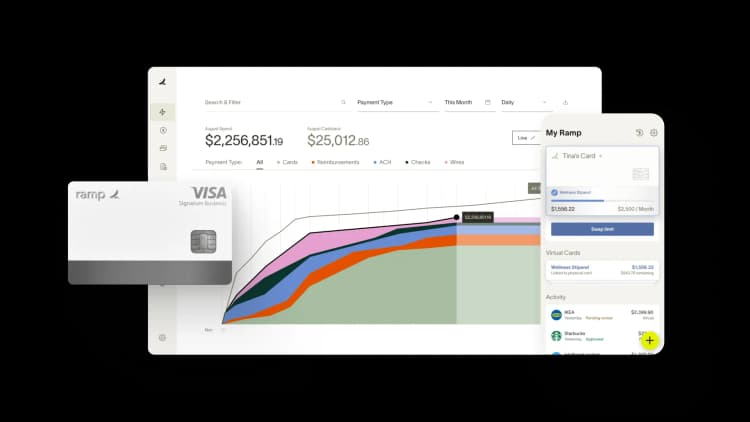

To automatically sync your transactions, receipts, and reimbursements, you can use Ramp, which integrates seamlessly with your accounting software. It also simplifies expense tracking by automatically categorizing transactions, ensuring accuracy, and reducing manual work. This not only saves time but also helps you pay taxes and finalise your bookkeeping records faster with minimal errors.

How long should you keep your tax documents?

For most tax returns, the IRS requires you to store them for at least three years. The IRS can audit your return within three years of filing, so you should keep supporting documents like receipts, invoices, and payroll records for at least that long.

However, some situations may require you to retain your tax documents even longer. If you've underreported your income by more than 25%, the IRS can review records for up to six tax years. If you file a fraudulent return or fail to file, there is no time limit, meaning the IRS can audit you at any time.

Apart from this, employment tax documents, including Form W-2, 1099, and payroll tax filings, should be stored for at least four years after filing. Property and asset records should also be kept until at least three years after a taxpayer sells or disposes off the asset.

Organize tax documents automatically with Ramp's receipt matching and centralized storage

Tax season brings chaos when receipts are scattered across email threads, expense reports, and employee phones. You need every transaction documented and categorized correctly, but chasing down missing receipts and organizing documents manually eats up hours you don't have.

Ramp eliminates the paper chase by capturing and organizing tax documents automatically from the moment a transaction posts. Every purchase comes with a receipt, collected via text, email, or mobile upload, and Ramp matches it to the right transaction instantly. You'll never scramble to find proof of purchase or worry about missing documentation when auditors come calling.

Here's how Ramp keeps your tax documents organized and audit-ready:

- Automatic receipt collection: Ramp texts cardholders immediately after each purchase to collect receipts, so documentation is complete before employees forget or lose paper copies

- Instant matching: Receipts are matched to transactions automatically using AI, eliminating manual sorting and ensuring every expense has supporting documentation

- Centralized storage: All receipts, invoices, and supporting documents live in one searchable platform, so you can pull what you need in seconds instead of digging through folders

- Smart categorization: Transactions are coded to the right GL accounts and tax categories in real time, so your records are organized by deduction type from day one

- Audit ready: Every transaction includes a complete history of approvals, receipts, and coding decisions, giving auditors the context they need without extra work from your team

Ramp's accounting automation software turns tax prep from a scramble into a simple export, with every document organized, categorized, and ready to defend.

Try an interactive demo to see how Ramp keeps your tax documents organized year-round.

The information provided in this article does not constitute accounting, legal, or financial advice and is for general informational purposes only. Please contact an accountant, attorney, or financial advisor to obtain advice with respect to your business.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits