- Understanding business tax extension

- Who can apply for a business tax extension?

- Advantages of filing a tax extension

- Steps to file a business tax extension

- Do business extensions trigger IRS audits?

- Stay on top of your taxes with smart extension planning

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Key takeaways:

- A tax extension gives you more time to file, but you must still pay any estimated taxes owed by the original deadline.

- To avoid late filing penalties, you must file the correct extension form before your tax deadline.

- The IRS automatically approves most extensions, but errors in your request can cause rejection.

- Using an accounting tool helps track expenses and organize records, making tax filing easier.

- A well-planned extension reduces errors, lowers audit risk, and ensures compliance.

Understanding business tax extension

Business tax extension

A business tax extension is a formal request to the IRS for additional time to file a business tax return. It grants up to six extra months to submit the required documents.

The IRS would not ask you for any reason when filing for an extension. You will only need to file your extension form before your due date.

However, an extension does not give you more time to pay taxes. A business extension only gives you more time to submit the paperwork for your income tax returns. If you owe money, you must estimate and pay it by the original deadline. Otherwise, the IRS charges you a penalty of 0.5% per month on unpaid taxes, which can grow to 25% over time.

Who can apply for a business tax extension?

While most businesses qualify for a tax extension, the deadline varies based on business type.

- Sole proprietorships (single-member LLCs)

If you operate as a sole proprietor or a single-member LLC, you report business income on Schedule C of your personal tax return (Form 1040). You can request an automatic six-month extension by filing Form 4868 before April 15. This moves your filing deadline to October 15. However, you must still pay any taxes owed by April 15 to avoid penalties and interest. - Partnerships and multi-member LLCs

Partnerships and LLCs taxed as partnerships must file their returns using Form 1065 by March 15. If you need more time, submit Form 7004, which extends the business owner’s filing deadline to September 15. Partnerships do not pay income tax at the business level. However, they must issue Schedule K-1 forms to partners, who report their share of income on their personal tax returns. - S corporations

S corporations file Form 1120-S, with a tax deadline of March 15. You can file Form 7004 to extend your original due date to September 15. Like partnerships, S corporations must issue Schedule K-1 forms to shareholders, who report business income on their personal returns. - C corporations

C corporations file Form 1120, with a standard deadline of April 15. Filing Form 7004 extends the deadline to October 15. Unlike S corporations and partnerships, C corporations pay business income tax directly to the IRS. - Nonprofits and trusts

Trusts and tax-exempt organizations like charitable organizations or community groups also qualify for extensions. If your nonprofit files Form 990, you usually have a deadline of May 15. However, submitting Form 8868 can extend your filing deadline to November 15.

Key factors affecting tax extension eligibility

The IRS grants most extensions automatically, but errors, missed deadlines, or unpaid taxes can put your request at risk. If your extension is denied, you must file your tax return immediately to avoid a 5% late filing penalty per month.

- Filing the extension request on time

You must submit Form 7004 (or Form 4868 for sole proprietors) by your original tax deadline. For partnerships and S corporations, this means March 15. C corporations must file by April 15. Missing the deadline results in an automatic late filing penalty. Filing the wrong form can also lead to rejection or processing delays. - Making a good-faith tax payment

A tax extension only gives you extra time to file, not to pay. The IRS requires small businesses to estimate and pay at least 90% of their total tax liability by the original deadline. If you underpay, you may face interest charges of 0.5% per month on the unpaid balance. - Accuracy of information on the extension request

The IRS can reject an extension request if the submitted form is incomplete or contains errors. Business details, including the legal name, EIN, and tax classification, must match IRS records. Any discrepancies could delay approval. - Outstanding tax debts or compliance issues

The IRS may flag your extension request if your business has unpaid taxes, unfiled returns, or past compliance violations. While extensions are generally granted automatically, businesses with a history of non-compliance risk additional scrutiny or denial. - State-specific tax extension rules

A federal tax extension does not always apply to state taxes. Some states grant automatic extensions if you file a federal request, while others require a separate state-specific form. For example, California, Texas, and New York have different filing requirements. Missing state deadlines can lead to state-specific penalties and interest, separate from federal penalties.

Advantages of filing a tax extension

A business tax extension gives you an extension of time if you're waiting for financial documents, dealing with unexpected business disruptions, or need more time to maximize deductions.

Extra time to review financial records

As discussed earlier, a tax extension gives you six more months to organize and review your financial records before filing. This extra time helps you catch errors, find missed deductions, and fix discrepancies that could raise IRS concerns. The IRS corrects nearly 9.4 million tax returns yearly due to calculation mistakes and missing information.

You can double-check income statements, expense reports, and balance sheets to ensure accuracy with an extension. This is especially helpful if you're waiting for K-1 tax forms, 1099s, or other third-party documents that impact your tax return.

Avoiding late filing penalties

If you miss the deadline without an extension, the IRS charges a 5% penalty per month on unpaid taxes. This can add up to 25% of your total balance. Failing to file on time can still lead to penalties even if you don't owe taxes.

With an extension, you move back your filing date and prevent any late filing fees. However, you must still pay your estimated taxes by the original deadline.

Handling unexpected issues

If you are missing key financial documents, an extension prevents you from filing an incomplete or incorrect return. Business disruptions like cash flow issues, system failures, or staff changes can also cause delays. Filing an extension helps you stay organized and avoid rushed mistakes. In 2023, the IRS processed over 19 million tax extensions, showing that many businesses need extra time.

Health emergencies or natural disasters can also impact your ability to file. The IRS sometimes offers automatic extensions for disaster-affected areas, but if not, filing Form 7004 ensures you avoid late penalties.

Steps to file a business tax extension

You can request a business tax extension once per tax year by submitting the required IRS form before your original deadline. An extension is not automatic. You must file the request on time.

Step 1: Know your deadline and choose the right form

Your business structure decides which form you need. Each business type also has a different tax due date.

- Sole proprietors and single-member LLCs file taxes with personal returns. Your deadline is April 15. You must file Form 4868, which extends the April 15 deadline to October 15.

- Partnerships and multi-member LLCs must file Form 1065 by March 15. Submitting Form 7004 moves the deadline to September 15.

- S corporations follow the same March 15 deadline for Form 1120-S. Filing an extension through Form 7004 changes it to September 15.

- C corporations file Form 1120 by April 15. An approved extension through Form 7004 shifts the deadline to October 15.

- Nonprofits and trusts usually file Form 990 by May 15. Filing Form 8868 extends it to November 15.

Step 2: Estimate and pay any taxes owed

As we discussed earlier, a tax extension only gives you more time to file your documents but does not extend your payment deadline. To estimate what you owe, review your income, business deductions, and credits for the calendar year. Use your previous tax return as a guide if your earnings are similar.

You can pay taxes online using IRS Direct Pay, EFTPS, or a debit/credit card. Mailing a check is also an option, but electronic payments process faster and provide instant confirmation.

If you can't pay the full amount, pay as much as possible to reduce penalties. The IRS offers payment plans to taxpayers who need more time to cover your balance.

Step 3: Submit the extension request

You can file your extension request online or by mail. The fastest way is through the IRS e-file system or a tax software provider. If you choose to mail your form, download the correct form, fill it out, and send it to the IRS. However, mailed forms take longer to process, and you won't get instant confirmation.

If you mail it, you should use certified mail to track delivery. Always keep a copy of your submission and any payment receipts for your records.

Step 4: Check your approval status

If you have filed your tax extension electronically, you should get an IRS confirmation within 24 hours. If you mailed your request, processing can take up to four weeks. You can check your status using the IRS e-file system, your tax software, or by calling the IRS.

If your filing extension is approved, your new filing deadline updates automatically. If it is rejected, you must file your tax return immediately to avoid penalties. If you do not receive approval or notice a problem, you should contact the IRS right away.

Do business extensions trigger IRS audits?

Filing a tax extension does not increase your chances of an IRS audit. The IRS processes millions of extension requests annually and approves them automatically if filed correctly. Asking for more time does not put your business at risk.

The IRS audits based on errors, inconsistencies, or unusual financial activity, not extensions. Common audit triggers include large deductions, unreported income, and repeated business losses. If your return has red flags, whether you file on time or after an extension, it may be reviewed by the IRS.

Certain deductions, like home office expenses or vehicle use, often face extra scrutiny. The IRS may ask for proof if you claim that your vehicle is used 100% for business. Payroll tax issues can also attract attention, especially if employee wages or tax withholdings do not align with IRS filings.

Filing an extension can actually help lower your audit risk. Rushed tax filings often contain errors that catch the IRS's attention. Taking extra time to review your financial records ensures your return is accurate, reducing the chances of mistakes that could lead to an audit.

This is why having an organized financial system is crucial. You can keep your financials accurate by tracking expenses, matching receipts, and reducing manual reconciliation with the help of Ramp's Accounting Automation. This reduces errors and ensures all records are up to date.

Stay on top of your taxes with smart extension planning

Planning your tax extension before the deadline helps you avoid penalties and last-minute stress. The IRS allows businesses to request extensions without needing a reason. The extension gives you more time to review financial records, maximize deductions, and submit an accurate return.

Extensions are not just for unexpected delays. They can be a smart tax strategy. If you expect major deductions or tax credits, an extension gives you time to analyze your financials and make informed decisions. Planning ahead ensures you use the extra time the IRS offers to your advantage for better tax preparation.

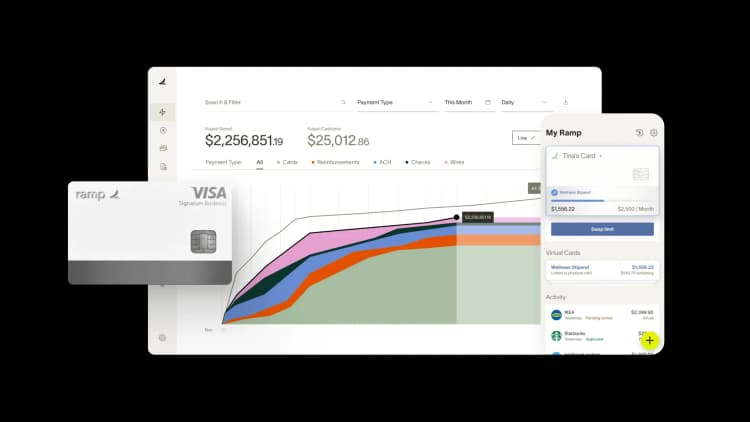

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

The information provided in this article does not constitute accounting, legal, or financial advice and is for general informational purposes only. Please contact an accountant, attorney, or financial advisor to obtain advice with respect to your business.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°