Tax deduction tips for sole proprietors

- What are tax deductions?

- Which expenses are tax deductible for sole proprietorships?

- Which expenses are non-deductible for sole proprietorships?

- Tax deduction tips for sole proprietors

- How Ramp simplifies expense management

As a sole proprietor, writing off business expenses is a way to reduce your taxable income. This, in turn, can provide you with more cash flow, and more money to invest back into your business.

In this article, we’ll explain which business expenses are eligible for deduction within a sole proprietorship and give you some key tips for overcoming deduction challenges. First, though, here’s a brief explanation of what tax deductions are within a small business context.

What are tax deductions?

Tax deductions are business expenses you can use to offset revenue on your federal and state tax returns, lower your taxable income, and minimize your small business tax burden.

When you deduct expenses, they lower your taxable income. The actual tax savings depends on your tax rate. For example, if you are in the 25% tax bracket, then a $1,000 tax deduction reduces your tax liability by roughly $250.

Understanding how sole proprietors pay taxes

A sole proprietorship is known in the tax world as a “disregarded entity.” This means the business isn’t treated as separate from the business owner. Instead, income earned by the company is reported on the owner’s personal tax return, Schedule C of Form 1040.

Sole proprietors have to pay two kinds of taxes on their net income:

- Federal (and sometimes state) income taxes

- Self-employment tax (SE tax). This is the self-employed version of Social Security tax and Medicare taxes.

All income you earn as a sole proprietor is subject to income taxes, but you only have to pay SE tax if your net earnings from self-employment are $400 or more for the tax year.

Since sole proprietors don’t have taxes withheld from their earnings, the IRS requires you to pay estimated taxes throughout the year. These estimated taxes include both income and self-employment taxes.

Fortunately, as a sole proprietor, you can use deductible business expenses to lower their taxable income and reduce their self-employment income and tax burdens.

Which expenses are tax deductible for sole proprietorships?

A wide range of expenses can qualify as tax deductions for sole proprietors.

According to Internal Revenue Service (IRS) rules, business expenses must be both ordinary and necessary to qualify for a tax deduction. An "ordinary" expense is common and accepted in your field of business. A "necessary" expense is helpful and appropriate for your business operations, although not necessarily indispensable.

Ordinary and necessary expenses will vary depending on your industry, operations, and the size of your business. Here are some common examples of costs you might deduct:

- Materials and office supplies

- Business insurance premiums

- Advertising and marketing

- Interest expense

- Business meals

- Bank fees

- Payments to independent contractors

- Salaries and wages

- Depreciation

- Rent

- Employee health insurance deduction

- Taxes and licenses

- Utilities

- Telephone and internet

- Business travel expenses

- Home office deduction

- Vehicle use

- Legal and professional services

- Education and training

- Contributions to a self-employed retirement plan

- Fees to file your tax return using TurboTax or other software

- Up to $5,000 of startup costs

- One-half of self-employment tax

IRS Publication 334, Tax Guide for Small Business and Publication 587, Business Use of Your Home, provides more examples of deductible business expenses, guidelines for estimating self-employment tax, and rules for claiming the home office deduction and other tax write-offs.

Sole proprietors may also qualify for the qualified business income (QBI) deduction. This deduction isn't tied to any particular tax write-offs. Instead, it allows eligible sole proprietors to deduct 20% of their qualified business income from their personal tax return.

Your qualified business income deduction may be limited depending on the type of business you own and your taxable income. Check out the IRS’s FAQs on the qualified business income deduction or work with a tax professional to determine whether you qualify.

Whatever deductions you claim, it's important to document the deduction. As with itemized deductions you claim on your personal tax return, you need to be able to support deductible business expenses with a receipt or other documentation confirming the date, amount, and business purpose.

Which expenses are non-deductible for sole proprietorships?

The list of deductible expenses is long, but all your spending for business purposes isn’t necessarily deductible. Some costs can’t be deducted, even if you purchase them through your business accounts.

- Political contributions and lobbying expenses

- Fines and penalties

- Gifts valued over $25

- 50% of business meals

- Commuting to and from work

- Personal deductions

- Anything illegal

- Clothing you wear to work that can be worn elsewhere

- Membership dues for clubs organized for recreational or social purposes

- Entertainment expenses

- Travel expenses when the purpose of the trip is primarily personal

- Taxes paid to the IRS

Tax deduction tips for sole proprietors

Chances are, you didn’t start a business because you have a passion for paperwork. And with everything else on your to-do list, you might put tracking business expenses on the back burner. The problem is, once you fall behind, it’s tough to get caught up on your bookkeeping and ensure you account for every potential deductible business expense.

The following tips can help you capture those business expenses and take advantage of every opportunity to lower your taxable income and tax liability.

Open a separate business bank account/business credit card

Mixing personal and business finances is a common issue for sole proprietors, but it can lead to tax preparation complications, missed tax deductions, and potential scrutiny from the IRS.

Opening a separate business bank account and business credit card and running all of your business expenses through those accounts can simplify record-keeping and make it easy to identify business transactions for the tax year.

Use accounting software

Many sole proprietors rely on tracking business income and expenses in a spreadsheet. These methods might work when you’re just starting out. But as your business grows and you have more transactions, you’ll likely find this method far too labor-intensive and error-prone.

This is where accounting software comes in. These programs can automate the process for you and greatly simplify the process. Accounting software program subscriptions are tax deductible, and their benefits—fewer errors and major time savings—far outweigh the cost.

Leverage expense management software

Keeping receipts and expenses manually is time-consuming and often results in lost receipts and unclaimed tax deductions.

Expense management software can integrate with your accounting software to automate many steps in the expense tracking process, ensuring every transaction is recorded and substantiated with a corresponding receipt. If the IRS or your state tax authority selects your tax return for an audit, you won’t have to scramble to produce supporting documentation for your tax write-offs.

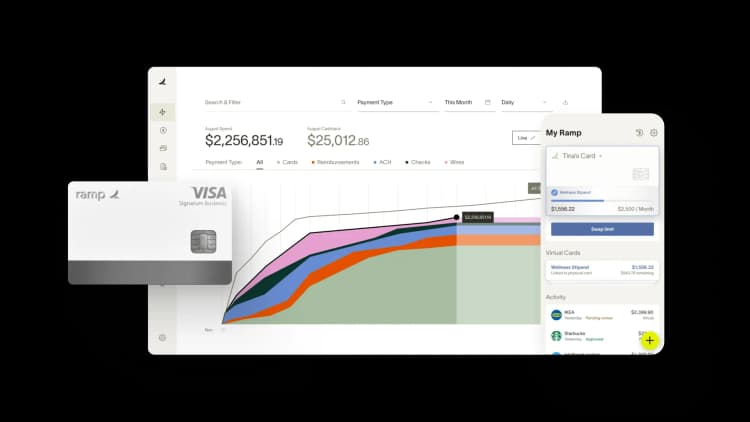

How Ramp simplifies expense management

Ramp solves the challenges of tracking expenses and managing receipts for sole proprietors and other small business owners. Its innovative features streamline managing expenses, paying bills, and closing the books.

Here’s how Ramp can transform your approach to handling business expenses:

- Accurate record keeping. Ramp automatically collects receipts and ensures expenses are coded and categorized consistently. This feature helps you to keep tabs on your spending, ensuring no deductible expense goes unrecorded.

- Simplify reconciliations. With Ramp, you don’t need to review every line item. Automation processes transactions, and the software flags mistakes and other issues that need attention.

- Real-time data. Ramp syncs with your accounting software with just one click. This allows you to get real-time insights to help you understand spending patterns, manage budgets more effectively, and make informed decisions that could reduce your taxable income and result in tax savings.

- Automate accounts payable. Ramp extracts invoice details and streamlines approvals. You can eliminate accounts payable data entry while ensuring vendors get paid on time.

By leveraging Ramp’s features, you can overcome the common pitfalls of expense management and capture every eligible deduction accurately. This saves and significantly reduces the stress associated with tax season, so you can focus more on growth and less on paperwork.

If you want to claim every tax deduction you’re entitled to, request a demo or try Ramp for free today.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits