How to check your Capital One business credit card application status

- How can I check my Capital One business credit card application status?

- Why is my credit card application pending?

- Get approved for a Ramp card in 1-3 days on average

If you have recently submitted an application for a Capital One business credit card and are keen to know the status of your request, there are multiple convenient ways to access this information. Capital One offers a simple process for applicants to stay informed about the progress of their application, whether through online methods or other channels.

In this guide, we'll provide you with step-by-step instructions on how to check the status of your Capital One business credit card application. We'll begin with the simple and convenient online method and also discuss alternative ways to obtain this information.

How can I check my Capital One business credit card application status?

Online method

To check the status of your Capital One business credit card application online, you can follow these steps:

- Visit the application center: After submitting your application, you should have received an email from Capital One with a unique link to their Application Center. If you can't find the email, you can access the Application Center directly through the Capital One website.

- Login requirements: To log in, you'll need the last four digits of your Social Security number, your birth date, and your ZIP code.

- Check status: Once logged in, you can view the status of your application. This area also allows you to upload any additional information needed to process your application.

Phone method

To check the status of your Capital One business credit card application by phone, you can follow these steps:

- Gather necessary information: Before you call, make sure you have your application reference number, if available, and Social Security number ready. This will help verify your identity and facilitate the status check.

- Call the customer service number: Dial 800-903-9177, which is the customer service hotline for Capital One credit card applications.

- Follow voice prompts: The automated system will guide you through the process. You may need to enter your Social Security number and other personal details using your phone keypad.

- Speak with a representative: If the automated system does not provide the status of your application, or if you prefer to speak to someone, you can choose to connect with a customer service representative who can provide further assistance and detailed information about your application status.

Unlike many other banks, Capital One does not offer the option to check credit card application status at their branches because they focus on digital and phone-based customer service for credit card inquiries. If you need to check the status of your Capital One business credit card application, your best options are to use their online Application Center or to call their customer service line.

What credit score do you need for a Capital One business credit card?

To qualify for a Capital One business credit card, you generally need a credit score that falls within the good to excellent range. For instance, some of Capital One's business credit cards may be accessible to those with good credit, typically around a FICO score of 670 and above. However, for premium cards or those with more significant rewards, an excellent credit score, often 700 or higher, may be necessary to qualify. These cards offer benefits like 0% introductory APRs, cash back rewards, and more, but come with higher credit standards.

Why is my credit card application pending?

When your credit card application is described as "pending," it generally indicates that the credit card issuer requires more time to examine your details and make a final decision. This pending status can occur due to a need for additional verification of your personal or financial information, or it may be due to the issuer managing a high volume of applications.

Several factors can prolong the review period of your application, including:

- Incomplete application: Missing or incorrectly filled fields in the application necessitate further inquiries by the issuer to obtain accurate information.

- Credit review: The issuer might need extra time to conduct a detailed analysis of your credit history, particularly if there are any inconsistencies or if your credit score is close to their threshold.

- Verification processes: Further steps may be required to verify your identity, income, or employment, especially if the documents you provided are not clear or complete.

- Fraud checks: Issuers perform detailed reviews to detect and prevent fraud. Any suspicious activity may lead to additional scrutiny of your application.

- Operational delays: High volumes of applications, technical issues, or internal administrative processes can also delay the decision on your application.

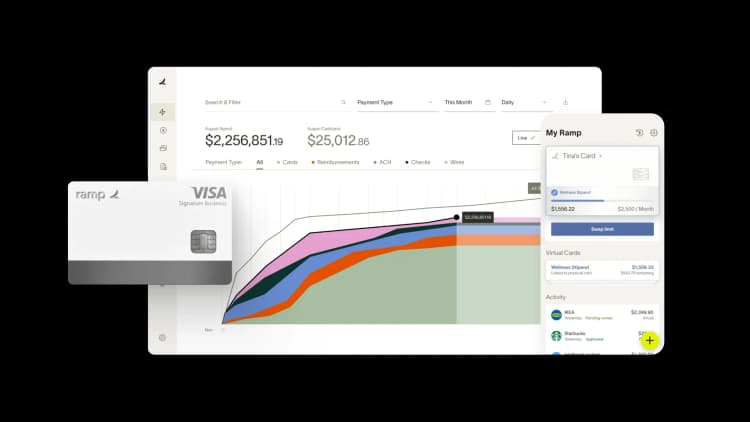

Get approved for a Ramp card in 1-3 days on average

If your business needs a credit card, Ramp’s corporate card may be the answer. Unlike traditional business credit cards, Ramp doesn’t require a credit check or personal guarantee. As a result, our approval process takes just one day on average.

Plus, our cards come with advanced spend management features and unlimited free physical and virtual employee cards. Here are just a few features you can expect from Ramp:

- No annual fee: Get started with Ramp’s corporate card and expense management software for free. No annual fees or setup fees.

- Expense management tools: Set spending limits, automate receipt collection, and streamline expense reporting.

- Accounting integrations: Ramp connects with leading accounting platforms like QuickBooks, Xero, Sage Intacct, and NetSuite to help you close your books 8x faster.

Disclaimer: Content on Ramp's blog may change, and opinions are those of the authors and not necessarily Ramp's. The information in this article is provided in good faith for general informational purposes, but does not constitute accounting, legal, or financial advice. Please contact an accountant, attorney, or financial advisor to obtain advice with respect to your business. Ramp is not liable for any losses or damages.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits