Research shows modern corporate cards bolster—not hinder—compliance

- Issuing corporate credit cards helps companies increase overall expense policy compliance

- Cards with spend controls further boost this compliance

- Broader deployment of corporate cards results in positive ROI for companies of all sizes

- Larger companies relying heavily on corporate cards

- Issuing cards helps companies save on expense management tools

- More automation results inincreased satisfactionwith expense policies and less difficulty enforcing employee spend compliance

- Embracing corporate cards paired with expense management software leads to stronger compliance; operations

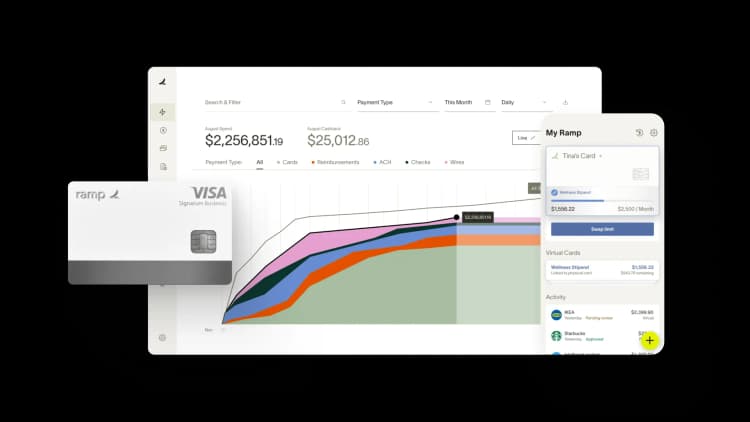

As finance teams get ready to navigate rocky macroeconomic conditions in 2023, encouraging responsible team spending behaviors has become a necessity. One critical focus area is expense management: how can businesses avoid putting themselves at greater risk for out of policy spend, save money, and still yield a positive ROI? Based on our latest research, we have an answer: switching employee reimbursements to corporate cards.

With corporate cards, employees enjoy greater autonomy in making spending decisions for work and no longer have to ostensibly provide interest-free loans to their employers, while businesses save money on tooling and don’t need to waste time tracking out of policy spend. In addition, companies achieve greater ROI in areas like operational efficiency and rigor.

Keep reading to learn more about how switching to corporate cards can be a secret weapon for helping your business grow.

Issuing corporate credit cards helps companies increase overall expense policy compliance

Companies who do not offer wider card deployment cite compliance and risk concerns as their top reasons, particularly among respondents from companies who do not currently offer corporate cards to any employees. However, our data shows that just the opposite is true: issuing cards is actually correlated with an increase in responsible spending habits.

In our study, more than three-quarters (77%) of respondents from companies that issue corporate cards to employees report that employees with corporate cards are more compliant with expense policies than those without.

This greater adherence to expense policies means that companies don’t need to choose between giving employees more autonomy in their spending or being forced to track down out-of-policy spend.

For example, at UpEquity, a technology-enabled mortgage startup, managers use Ramp cards as much as possible. “I gave a card to every department head and gave them the authority to issue new cards to their employees,” explains Tyler Bliha, Head of Strategy and Finance. “Getting people cards and getting them on the platform takes about 10 seconds.” Decentralizing oversight of corporate cards saves time for Tyler and empowers UpEquity employees without adding risk, as Tyler and his team can quickly review, approve, and reject any purchases made on the platform.

Cards with spend controls further boost this compliance

Respondents whose corporate card offers spend controls are 10% more likely to say that employees with a corporate card are more compliant than those without one. These controls help businesses know where spend is going before it happens, and offer finance leaders peace of mind that cardholder expenses will be kept in-policy. Spend controls available with modern cards can include the ability to set card spend limits (even at the daily level), prevent big-ticket charges, and block entire categories or vendors.

Respondents from businesses that embrace automation when it comes to handling corporate credit card expenses are 11% more likely than those who don’t to say they’re satisfied with their company’s employee expense policy.

They’re also much more likely to say they’ve seen a positive ROI from distributing corporate credit cards to employees (56% vs 40%) and are 10% less likely to say they find it difficult to manage and enforce employee expense policy compliance.

This shows that it isn’t just the card itself that offers tangible value, but rather pairing cards with the right software that makes a real impact.

Broader deployment of corporate cards results in positive ROI for companies of all sizes

Additionally, broader deployment also results in positive returns for companies across the board.

When asked how they’ve specifically seen a positive ROI from offering credit cards, respondents commonly identified improvements in financial reporting & analysis, employee experience, and efficiency as key outcomes.

Respondents of all sizes also reported being satisfied with their corporate credit card. “Perks”, “ease of use”, “tracking & reporting”, and “efficiency” were key themes that emerged when respondents were asked why they were satisfied with their company’s corporate credit card.

Corporate cards with expense management capabilities are able to provide accurate and up-to-date financials that can help finance leaders implement greater operational rigor, no extra legwork required.

“I know the data is tracked well, and that we’re empowering our leaders by providing high-quality information all the way into their P/L that they can drill down and review. It allows me to run a pretty small team by empowering the rest of the leaders in the organization."- Josh Reeves, CFO, Walther Farms

Larger companies relying heavily on corporate cards

More than three-quarters of respondents say their small or midsize business offers corporate credit card eligibility to its employees, with larger businesses more likely than smaller ones to offer corporate cards (87% vs 68%). Over half of all respondents (53%) say their company has only begun offering corporate credit cards and expense reimbursements within the past two years. Larger companies who have more employees and greater spend amounts may feel the squeeze of out-of-control spend sooner and in larger amounts than smaller businesses, necessitating the need for compliance.

Issuing cards helps companies save on expense management tools

More than 4 in 5 respondents (86%) whose company issues corporate credit cards to employees say that corporate cards have saved their company money because they can use fewer other tools to manage employee expenses.

This tech stack consolidation can yield major savings and is especially valuable during market downturns.

“Being able to save along the way means that we have some wiggle room in terms of the tools we can bring on and the people we can hire. [The savings we’ve realized with Ramp] mean everything in terms of not only revenue return on the investment, but also operations in general.”-Alicia Coleman, Marketing Operations Manager at WizeHire

More automation results inincreased satisfactionwith expense policies and less difficulty enforcing employee spend compliance

Regardless of company size or breadth of corporate card deployment, respondents are more likely to say their company’s handling of corporate credit card transactions is more automated than manual. Three-quarters of respondents say their company uses accounting software integrations to help process transactional data from corporate cards.

Embracing corporate cards paired with expense management software leads to stronger compliance; operations

By increasing corporate card deployment that offers best-in-class expense management software, businesses can increase ROI, save money on their tech stacks, and most importantly, boost expense policy compliance. See how Ramp can help your company achieve all of the above today.

Methodology

To obtain these insights, we commissioned research firm Morning Consult to interview 500 US small (25-74 FTE) and medium-sized (75-499 FTE) business financial policy decision-makers and decision-influencers. The margin of error for topline data for this survey is +/-5%.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°