How a corporate card without expense management can cost you

You might think that a corporate card with good cashback or points is sufficient for your business's expense management needs. However, that would be shortsighted.

Companies who want to make their teams more efficient and achieve greater ROI are increasingly realizing the value of expense management tools. These tools can help business owners dig deeper into the context of their business spending, which is especially important in these economic times when expense management has become a necessity—not a nice-to-have. Without these tools, businesses of every size can accrue hidden costs on top of rising operating costs. While rewards like cashback can be helpful, expense management tools can actually provide a long-term market advantage.

Right now, businesses are being hindered by inflation that is making it even more expensive to fund day-to-day operations. Three-quarters of small businesses report being negatively affected by rising costs in the past six months, according to a recent Goldman Sachs survey.

Our own spending benchmarks for Q2 2022 show that companies big (and small) are seeing an uptick in spending across many categories. For example:

- Shipping expenses soared for large enterprises, increasing 103% to overtake advertising, as their top expense. Software spend spiked too, up 68.3% on Q1 2022.

- Merchandise costs remained the top expense for small businesses, although airlines, restaurants, and cloud computing transaction volume grew the fastest.

- Advertising was the top expense for large SMBs and mid-market companies, while airline and restaurant costs were the fastest growing.

Expense management tools can help combat these rising costs and arm businesses with the technology they need to navigate the current economic climate and avoid costly mistakes, such as:

1. Missing saving opportunities

With the speed of business today, companies need to be able to get real-time insights into their spending at the click of a button, not at the end of the month. They also need to have access to the insights they need to ensure that they’re saving cash whenever possible and aren’t throwing money down the drain, e.g. on duplicate spend.

2. Chasing out-of-pocket expenses

Out-of-pocket expenses are a clear example of the drawbacks of not investing in expense management. Think about your own processes for a moment. Are you relying on employees to email you their invoices and receipts, and then having to manually track down and rectify out-of-policy spend? These steps can all be a real drain on finance’s time and it can create additional costs. With functionality like spend controls and pre-established expense policies, which can streamline these processes, you’ll be able to avoid such costly and unnecessary steps.

3. Overpaying for software

Once your SaaS needs pass around $10,000 for a piece of software, pricing can often seem like a black box. You could be vastly overpaying for contracts and not even know it. Procurement tools can help you manage vendors, stay notified of better prices, and even negotiate costs like pricing, terms, and licenses.

4. Encountering messy vendor payments

Your vendors and suppliers each have their own payment terms and billing cycles. When you don’t have any flexibility in paying these contracts, you could be stuck adhering to rigid payment terms or late fees, which is a recipe for lumpy cash flow.

5. Wasting top talent's time

The human factor just might be the biggest of all the hidden costs of unmanaged operating expenses. Employees usually don’t want to spend any time dealing with clunky expense systems that were designed for how businesses ran in the 90s.

Similarly, finance doesn’t want the end-of-month close to feel like a game of hide-and-seek, one where they constantly have to nag teams and managers for mundane expense reports. Today, your talent wants to focus on high-value work that they actually enjoy.

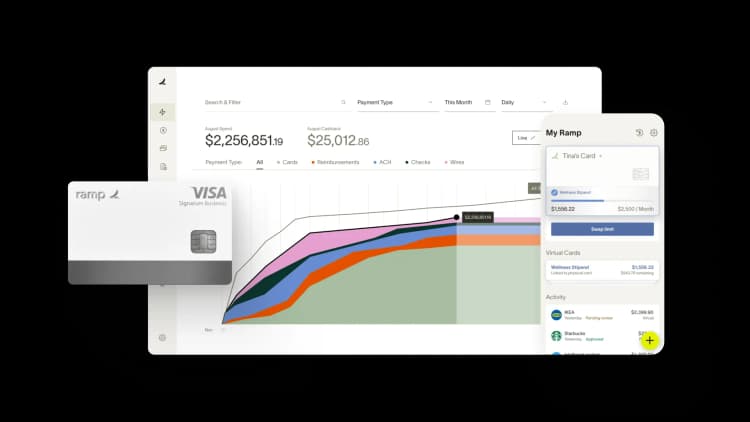

Getting serious about expense management

Simply relying on monthly cashback as your main perk won’t solve any of the above errors. However, combining cashback with tools such as enterprise expense management software that can help you manage expenses, streamline operations, and automate the pain away will help set your business up for long-term growth. Businesses that use Ramp save an average of 3.5% in their first year. See how much expense management can save your team by signing up today.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits