Do U.S. Bank business credit cards report to personal credit bureaus?

- How U.S. Bank business credit cards handle credit reporting

- Impact on your personal credit score

- Comparing U.S. Bank to other business credit card issuers

- Benefits of non-reporting cards

- Drawbacks of non-reporting cards

- U.S. Bank business credit cards: Best practices

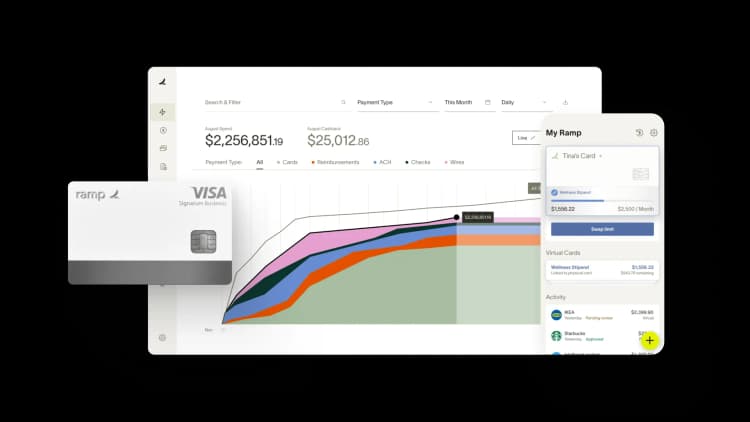

- Apply for a Ramp corporate card with no credit check

No, U.S. Bank business credit cards typically do not report to personal credit bureaus under normal circumstances. U.S. Bank follows the industry standard practice of keeping your business card activity separate from your personal credit reports at Experian, Equifax, and TransUnion.

However, like most issuers, U.S. Bank will report negative information to your personal credit reports if your account becomes seriously delinquent or goes into default. This means that while your regular spending, balances, and on-time payments won't appear on your personal credit profile, missed payments that lead to account delinquency will likely be reported.

How U.S. Bank business credit cards handle credit reporting

U.S. Bank’s standard policy for its small business credit cards, including products like the U.S. Bank Business Triple Cash Rewards World Elite Mastercard and U.S. Bank Business Leverage Visa Signature Card, is not to report regular account activity to personal credit bureaus. Instead, activity is typically reported to business credit bureaus, keeping your business performance separate from your personal credit profile.

Business credit reporting and personal credit reporting operate on different systems. Personal credit bureaus track your Social Security number and individual borrowing behavior. Business credit bureaus track your Employer Identification Number and company details, creating a separate credit file tied to your business.

U.S. Bank business card activity is generally reported to the following business credit bureaus:

- Dun & Bradstreet: Builds your PAYDEX score and tracks vendor and credit relationships

- Experian Business: Maintains a business credit score based on trade lines, payment history, and public records

- Equifax Business: Tracks firmographics, payment trends, and credit exposure

Normal account activity

Under normal conditions, your on-time payments and monthly balances won’t appear on your personal credit report. That includes everyday spending, statement balances, and utilization rates. As long as your account remains in good standing, your personal credit file remains unaffected.

This separation protects your personal credit score from business spending fluctuations. If you charge $50,000 in marketing or inventory in a single month, it won’t affect your personal utilization ratio. That can be helpful if you’re applying for a mortgage or refinancing personal debt.

Exceptions to the rule

U.S. Bank may report to personal credit bureaus if your account becomes seriously delinquent or goes into default. While routine activity isn’t shared, the bank can expand reporting once certain risk thresholds are crossed.

Common triggers include:

- Accounts 60 to 90 days past due: At this stage, the account may be considered seriously delinquent and eligible for broader reporting

- Charged-off accounts: If the balance is written off as a loss, that negative event can be reported to personal bureaus

- Default under personal guarantee: If you’ve personally guaranteed the card and fail to repay, your personal credit can be affected

In most credit agreements, serious delinquency begins around 60 days past due, with more severe consequences at 90 days. At that point, the issuer may escalate collection efforts and expand reporting. Always review your cardmember agreement to confirm specific timelines.

Impact on your personal credit score

Even though ongoing account activity isn’t reported, your personal credit still matters during the application process. When you apply for a U.S. Bank business credit card, the bank performs a hard inquiry on your personal credit, and that inquiry appears on your credit report.

During the application process:

- U.S. Bank checks your personal credit history to assess risk

- A hard inquiry is recorded with one or more personal credit bureaus

- Your approval decision factors in your personal credit profile

A hard inquiry typically lowers your credit score by about 5 to 10 points. Ongoing account management, including balances and payments, won’t affect your personal score unless the account becomes seriously delinquent or defaults.

Application process and credit pulls

U.S. Bank generally pulls from one or more of the major personal credit bureaus: Experian, Equifax, or TransUnion. The specific bureau may vary based on your state and application details, and you typically can’t choose which bureau is used.

Hard inquiries remain on your credit report for up to two years, but their impact on your score diminishes over time. For most applicants, the effect is minor and temporary.

Personal guarantee requirements

Most U.S. Bank small business credit cards require a personal guarantee, which reduces the lender’s risk.

However, a personal guarantee does not automatically mean monthly reporting to personal credit bureaus. It gives the issuer the legal right to pursue you personally if the account defaults. Reporting to personal bureaus typically occurs only after serious delinquency.

Personal guarantee

A personal guarantee is a legally binding agreement that makes you personally responsible for repaying your business credit card debt if your business can’t. Even though the card is issued to your company, the lender can pursue your personal assets if the account defaults.

Comparing U.S. Bank to other business credit card issuers

U.S. Bank follows the common industry approach of separating routine business card activity from personal credit reporting. It differs from issuers like Capital One and Discover, which report ongoing business card activity to personal credit bureaus.

| Issuer | Reports ongoing activity to personal bureaus? | Reports delinquencies? |

|---|---|---|

| U.S. Bank | No | Yes |

| Wells Fargo | No | Yes |

| Bank of America | No | Yes |

| American Express | No (most cards) | Yes |

| Capital One | Yes | Yes |

| Discover | Yes | Yes |

Banks that don’t report to personal credit

Many traditional banks limit personal credit reporting to negative events:

- Wells Fargo typically reports only delinquent or defaulted accounts

- Bank of America generally limits personal reporting to serious delinquencies

- American Express may report negative activity but not regular balances

This structure reflects the industry norm for small business cards backed by personal guarantees. As long as your account stays current, your personal credit report remains insulated from daily business spending.

Banks that do report to personal credit

Some issuers report full account activity to personal credit bureaus:

- Capital One: Reports ongoing business card balances and payments

- Discover: Reports business card activity to personal bureaus

These issuers may use personal reporting as an added risk-management measure. For some business owners, this can help build personal credit. For others, it can increase personal utilization and lower scores during high-spend periods.

Benefits of non-reporting cards

Non-reporting business credit cards let you scale spending without affecting your personal credit utilization. That separation can be especially valuable during rapid growth or uneven revenue cycles.

Protects your personal credit score

When business expenses spike, your personal credit score doesn’t have to move with them. Large balances for inventory or marketing won’t increase your personal utilization ratio or lower your score.

That separation matters even more if you’re planning a major personal financing move, such as buying a home. Keeping business balances off your personal report helps preserve a cleaner personal credit profile.

Greater spending flexibility

Business credit scoring models differ from personal scoring models. While you should still manage balances responsibly, higher utilization on a business card won’t directly impact your personal credit score.

That flexibility lets you deploy capital during seasonal peaks or expansion cycles. For founders managing uneven cash flow, a non-reporting card can function as a working capital tool without affecting personal borrowing power.

Clear financial separation

Keeping business activity off your personal credit report reinforces clean financial boundaries. Your business credit file reflects company performance, while your personal report reflects individual borrowing behavior.

Over time, that separation simplifies documentation, supports cleaner accounting, and protects both your company and your personal financial health.

Drawbacks of non-reporting cards

While non-reporting cards protect your personal credit score, they don’t help you build it.

No personal credit boost

If you consistently make on-time payments, that positive activity won’t appear on your personal credit report. Responsible business card usage won’t strengthen your personal credit profile.

For business owners trying to improve a thin or recovering credit file, that’s a missed opportunity. You’ll need separate personal accounts to build payment history.

No impact on credit mix

Credit mix makes up a smaller but meaningful portion of your personal credit score. Lenders prefer to see a range of account types, including revolving credit and installment loans.

Because a non-reporting business card doesn’t appear on your personal report, it won’t contribute to that mix. Your personal credit diversity remains unchanged.

Limited credit-building leverage

If your goal is to actively improve your personal credit score, a non-reporting business card won’t move the needle. You won’t gain positive payment history or improved utilization metrics on your personal report.

That creates a tradeoff. You gain separation and protection, but you lose the ability to use business spending as a credit-building tool. You should align your business card choice with your broader credit objectives before applying.

U.S. Bank business credit cards: Best practices

To protect both your business and personal credit, treat your U.S. Bank business card as a core financial tool. Pay on time, monitor balances, and align spending with your cash flow strategy. Responsible management helps you avoid personal reporting while strengthening your business credit profile.

Stay in good standing

On-time payments are critical. Falling 60 to 90 days behind can trigger personal reporting and collections.

To reduce risk, set up automatic payments and monitor due dates closely. Forecast revenue and expenses monthly so you can anticipate shortfalls before they become missed payments. Maintaining at least one billing cycle’s balance in reserve can provide a cushion during slower periods.

Build business credit deliberately

Use your U.S. Bank business card consistently and pay the statement balance on time. That positive activity helps strengthen your business credit file over time.

You can also build strong business credit by:

- Obtaining an EIN and registering with Dun & Bradstreet

- Paying vendors that report to business credit bureaus

- Keeping utilization reasonable relative to your credit limit

Apply for a Ramp corporate card with no credit check

U.S. Bank business credit cards generally don’t report ongoing activity to personal credit bureaus, but they do require a personal credit check and personal guarantee. If avoiding personal liability and credit pulls is a priority, you may want to consider an alternative structure.

Ramp’s corporate card requires no personal credit check and no personal guarantee. Your company gets advanced spend controls, automated expense management, and unlimited virtual cards, while your personal credit stays separate from business activity.

If you’re looking for a way to scale business spending without tying it to your personal credit profile, a corporate card model may be a better fit.

FAQs

Closing your U.S. Bank business credit card typically won’t affect your personal credit if the account was in good standing. Your business credit file may reflect the closure, but positive payment history can remain. If the account was delinquent, negative information may already have been reported to your personal credit.

Most issuers don’t allow direct conversion from a business card to a personal card. You would usually need to apply separately for a personal card, which involves a new hard inquiry and independent underwriting.

Corporate cards are generally issued to larger companies and often don’t require a personal guarantee. Reporting is typically tied to the business entity rather than an individual.

Small business cards, including those from U.S. Bank, usually require a personal guarantee and involve a personal credit check during the application process.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits