American Express Blue Business Cash Card credit limit

- Understanding the American Express Blue Business Cash Card

- How American Express determines credit limits

- Typical credit limit ranges

- Business credit card requirements

- Strategies for getting a higher credit limit

- Access higher credit limits with Ramp

Knowing your expected credit limit before applying for a business credit card helps you manage spending and avoid cash flow surprises. A limit lower than you planned can disrupt operations and force last-minute workarounds.

The American Express Blue Business Cash Card is a popular choice for small business owners who want straightforward cashback rewards. It provides a simple way to earn returns on eligible business purchases, making it worth a closer look for companies seeking more flexible purchasing power.

Note: Any cashback percentages, limits, fees, and other figures mentioned in this article are for illustrative purposes only. They do not represent guaranteed or expected rates. Actual terms, credit limits, rewards, and approval criteria vary by card issuer and may change at any time. Readers should verify current details directly with each issuer before applying.

Understanding the American Express Blue Business Cash Card

The American Express Blue Business Cash Card offers simple, dependable cashback rewards that appeal to many business owners.

| Feature | Details |

|---|---|

| Rewards rate | 2% cashback on purchases up to $50,000 per year; 1% cashback thereafter |

| Annual fee | $0 |

| APR | 16.99%–26.99% variable |

| Welcome offer | 0% intro APR for the first 12 months, plus $250 statement credit after spending $3,000 in the first 3 months |

| Foreign transaction fee | 2.7% of each transaction |

| Target audience | Small to medium businesses seeking simple cashback without annual fees |

These core features help you quickly see what this card offers and whether it aligns with your company’s spending habits.

What are eligible purchases on the Blue Business Cash Card?

“Eligible purchases” on the American Express Blue Business Cash Card include common business expenses like office supplies, utilities, business travel, dining, and retail purchases.

Cash advances, balance transfers, traveler’s checks, fees, interest charges, person-to-person payments, gift cards, prepaid cards, gambling, and cryptocurrency transactions are excluded from cashback rewards.

Discover Ramp's corporate card for modern finance

How American Express determines credit limits

American Express bases your credit limit on a mix of personal and business factors:

| Factor | Description | Influence on limit |

|---|---|---|

| Personal credit score | Primary determinant for most applicants | High |

| Business credit score | Gains importance as the company matures | Medium |

| Annual revenue | Higher revenue supports larger limits | High |

| Time in business | Demonstrates stability and repayment history | Medium |

| Industry risk | Certain industries carry higher default risk | Variable |

- Personal credit score: A major factor in approval and starting limit. Scores above 690 typically qualify for higher limits.

- Business credit score: Matters more for mature companies. Reports from bureaus like Dun & Bradstreet help Amex gauge reliability

- Annual business revenue: Indicates ability to manage larger lines of credit

- Time in business: Longer track records usually earn higher limits

- Industry type and risk level: Some industries have higher risk profiles, which can lower offered limits

These factors work together to create a complete picture of your creditworthiness and help American Express determine an appropriate limit for your business needs.

How Expanded Buying Power works

The American Express Blue Business Cash Card offers Expanded Buying Power, which lets you spend beyond your assigned credit limit. This flexibility depends on your creditworthiness, spending habits, and payment history.

Expanded Buying Power isn’t unlimited. American Express calculates it case by case, and it can change from month to month. Businesses with strong payment histories may sometimes be approved to spend modestly above their assigned limit, depending on profile and repayment consistency. Exact flexibility varies by issuer and individual credit factors. You’ll need to pay any amount over the limit in full each billing cycle to avoid interest or penalty fees on the entire balance.

Is the American Express Blue Business Cash Card metal?

No, the American Express Blue Business Cash Card is not made of metal. It features a standard plastic construction with a distinctive blue design that reflects its name.

Personal vs. business credit factors

American Express gives the most weight to your personal credit history, especially if you’re a new business or sole proprietor. Your credit score, payment history, and existing debt levels are key indicators of how you’ll manage business credit.

Business factors, such as annual revenue, time in operation, and industry type, also play a role. Amex may request documents such as bank statements or tax returns when you apply for higher limits. Consistent revenue and cash flow help demonstrate stability.

In most cases, personal credit carries the most influence, followed by business revenue and time in operation. A strong personal profile can offset a younger business, while established businesses with solid revenue can sometimes compensate for a slightly lower personal score.

What is a good credit score?

Your credit score affects both your approval odds and the credit limit American Express offers. Scores range from 300 to 850, with higher numbers showing stronger creditworthiness.

Typical credit score tiers include:

- 800–850: Excellent

- 740–799: Very good

- 670–739: Good

- 580–669: Fair

- 300–579: Poor

Most business credit cards require scores in the good-to-excellent range, and higher scores often qualify you for better limits and rates.

Typical credit limit ranges

Credit limits for the American Express Blue Business Cash Card vary based on your financial profile, but most new cardholders start between $5,000 and $25,000.

American Express is generally more conservative with initial limits than some other issuers. Chase Ink Business cards often start between $5,000 and $25,000, while Capital One Spark cards can range from $10,000 to $30,000 for qualified applicants. Bank of America business cards typically start around $3,000 to $15,000.

Credit limits by business profile

Your business’s size and financial profile largely determine the credit limit American Express offers. Typical limits by business type include:

- New businesses (under 2 years): Starting limits usually range from $5,000 to $10,000. Personal credit carries the most weight at this stage, and scores above 720 can help you reach the higher end of the range.

- Established small businesses: Those operating for 2–5 years with steady revenue often qualify for limits between $10,000 and $25,000. Reliable payment history and revenue growth help justify these larger lines.

- Medium-sized businesses: Companies with more than five years in operation and $500,000–$2 million in annual revenue often receive limits from $25,000 to $50,000. Strong business credit and healthy cash flow support higher capacity.

- High-revenue businesses: Firms earning over $2 million a year may qualify for limits of $50,000 or more. American Express may extend even higher lines to long-established companies with excellent credit and repayment history.

Your specific limit will depend on the combination of factors American Express evaluates during the application process and their risk assessment.

Is the American Express Blue Business Cash Card worth it?

The American Express Blue Business Cash Card offers a straightforward cashback structure. For example only, if a card offered 0.5% on eligible purchases, earnings would scale with spend up to a certain threshold. Actual rates and reward caps vary by program.

Business credit card requirements

American Express considers several key factors when approving applicants for the Blue Business Cash Card, including credit score and business revenue. The company generally looks for credit scores of 670 or higher. While some applicants with lower scores may be approved, those above 720 tend to have stronger approval odds and may qualify for higher initial credit limits.

American Express doesn’t set a firm revenue requirement, but most approved applicants report annual business revenue of at least $50,000. Higher revenue can boost your approval chances and lead to better limits.

Application checklist

Having the right information ready before you apply speeds up the process and helps you avoid delays or document requests. Gather the following before you start your application:

- Business legal name and DBA (if different)

- Physical business address and phone number

- Business structure (sole proprietorship, LLC, corporation, partnership)

- Tax ID or EIN (SSN acceptable for sole proprietors)

- Date business was established and industry category

- Number of employees and estimated annual revenue

- Recent bank statements showing cash flow

- Business tax returns (past 1–2 years)

- Profit and loss statements

- Personal tax returns (if you’re a sole proprietor or new business owner)

- Documentation for existing business debts or credit lines

American Express may not require all of these up front, but having them ready helps you respond quickly if verification is needed.

Common reasons for denial

Understanding common reasons for denial helps you strengthen your application before applying:

- Low personal credit score: Scores below 670 reduce approval odds. Late payments, collections, or charge-offs on your credit report can lead to automatic denial.

- Insufficient business revenue: Inconsistent or low annual revenue raises concerns about repayment ability. American Express looks for steady cash flow to support regular payments.

- Too many recent credit inquiries: Applying for several credit cards or loans in a short period signals financial strain. More than three or four inquiries in six months can hurt your chances.

- High debt-to-income ratio: Heavy personal or business debt compared with income signals higher risk to lenders

- Incomplete or inaccurate application: Errors, blank fields, or mismatched information between your application and credit report can trigger denial

- Recent bankruptcy or major derogatory marks: Bankruptcies, foreclosures, or tax liens usually result in automatic denial. American Express typically requires several years of clean credit before approval.

Addressing these issues early improves your approval odds and may also position you for a higher starting limit.

Strategies for getting a higher credit limit

Strong credit and thorough documentation can help you qualify for a higher limit on your American Express Blue Business Cash Card.

Apply with accurate and complete information about your business revenue and operations, and make sure all legitimate income is counted. Your personal credit score carries significant weight, so review your report in advance and correct any errors.

Emphasize your business’s stability and time in operation. If you’re a sole proprietor, include your personal income to strengthen your application. It’s best to apply when your financials are at their strongest rather than during slower periods.

When and how to request credit limit increases

Wait at least 6 months after opening your account before requesting an increase. During that time, build a record of on-time payments and consistent card use. You can request an increase online through your Amex dashboard or by calling the number on your card.

Provide updated revenue figures, especially if your income has grown since applying. American Express may run a hard credit inquiry for limit increase requests, which can temporarily affect your score.

Avoid making multiple requests too close together. Waiting at least six months between requests—and, ideally, about a year—shows financial discipline and gives time to demonstrate growth.

Automatic credit limit increases

American Express sometimes grants automatic credit limit increases without a formal request. These typically occur after 12–18 months of responsible use with no late payments. Spending close to your current limit while paying balances in full each month indicates that you could benefit from additional capacity.

Building business credit to qualify for more

A strong business credit profile can help you qualify for higher limits over time. Try these steps to build and strengthen it:

- Establish a business credit profile through Dun & Bradstreet by obtaining a D-U-N-S number

- Open trade lines with vendors who report to business credit bureaus, and maintain consistent payment patterns

- Keep credit utilization below 30% on all business cards

- Pay every bill on time, including utilities and vendor accounts that report to credit bureaus

- Consider taking out a small business loan or line of credit to diversify your credit mix

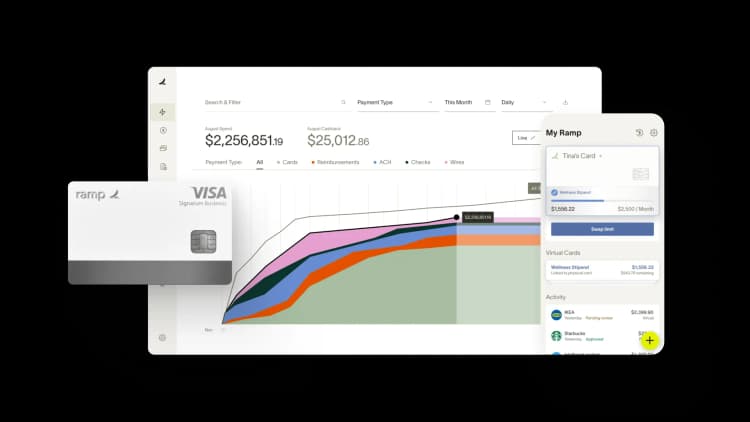

Access higher credit limits with Ramp

At Ramp, we’re dedicated to helping small businesses access the funds they need to accelerate their growth. As a new business, you may not be eligible for a loan from traditional lenders due to insufficient revenue or a short business history. But if you have ecommerce sales revenue coming in, Ramp’s sales-based underwriting can help.

Ramp's corporate card may extend significantly higher credit limits than many competitors, depending on each customer’s financial profile and underwriting criteria. That’s because we use our connections to some of the largest commerce platforms and marketplaces in the industry, including Shopify, Stripe, and Amazon, to underwrite credit limits for businesses using their commerce sales data. To qualify, all you need is one year of sales data.

Learn more about Ramp’s commerce sales-based underwriting.

Content on Ramp's blog may change, and opinions are those of the authors and not necessarily Ramp's. The information in this article is provided in good faith for general informational purposes, but does not constitute accounting, legal, or financial advice. Please contact an accountant, attorney, or financial advisor to obtain advice with respect to your business. Ramp is not liable for any losses or damages. The information provided in this article has not been officially confirmed by American Express and is subject to change.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°