- How expense checks work

- Importance of expense reimbursements

- How Ramp automates fair and compliant expense reimbursements

Expense checks, also known as expense reimbursements, are a key aspect of employee compensation strategies. They ensure that employees are promptly and fairly compensated for any business-related expenses they incur, including travel, accommodation, meals, and other essential costs.

How expense checks work

When completing an expense check in a business setting, the following steps are typically followed:

1. The employee incurs the expense while conducting business on behalf of the organization.

2. They then gather all necessary receipts and documentation to support the expense.

3. They submit expenses along with the required documentation to their supervisor or to the appropriate person in their department responsible for approving expenses.

4. The supervisor meticulously evaluates the expense to ensure alignment with stringent company policies and budget mandates.

5. If the expense is approved, your employee will receive a reimbursement check.

Importance of expense reimbursements

Expense reimbursements are a critical component of the employer-employee relationship. For the employee, it means they won’t be out of pocket for work-related expenses. For the employer, it means they won’t take an unjust financial advantage of their employees.

Promoting fairness and equity

The importance of expense checks in maintaining a fair and equitable workplace is acknowledged. Without this structure, staff members might find themselves personally covering business expenses, creating undue financial burdens, especially for those on more modest salaries. This could lead to discontent and inequity among the team, potentially affecting morale and productivity.

Accurate financial planning

In addition, expense checks help employers maintain accurate records of their company's expenses. This is crucial for budgeting and financial planning purposes. When employees are required to submit an expense report along with their receipts, it allows employers to have a full picture of their spending. This enables them to identify any areas where costs can be reduced, leading to better financial management.

Preventing fraud and misuse of funds

Expense checks also play a crucial role in preventing fraud and misuse of company funds. By requiring employees to provide detailed expense reports and receipts, you can verify that the expenses claimed are legitimate and within your policies. This can help prevent employees from submitting false or inflated claims, which can have a significant impact on your bottom line.

Legal implications and employee retention

In a commitment to fairness and transparency, the legal significance of expense checks is recognized. The Fair Labor Standards Act (FLSA) mandates that employers must reimburse employees for all work-related expenses. Beyond being a legal requirement, this practice is seen as an investment in team satisfaction and commitment. When employees know their expenses are covered, they feel valued and supported, leading to increased job satisfaction and loyalty to the company.

Clear expense policy and communication

A strong framework is crucial for efficient processing. A well-defined expense policy is the bedrock of streamlined operations. The policy should clearly specify eligible expenses, the process for report submission, and any limits or constraints in place. Proactive steps have been taken to ensure the policy is communicated effectively to all personnel. Through handbooks, training sessions, and email reminders, a culture of clarity has been cultivated, leaving no room for ambiguity concerning reimbursable expenses.

How Ramp automates fair and compliant expense reimbursements

Managing expense reimbursements manually means grappling with unclear receipts, inconsistent policy enforcement, and delayed approvals that frustrate employees while creating compliance risks. You're stuck mediating disputes over rejected expenses, chasing down missing documentation, and trying to ensure everyone follows the same rules, all while legitimate business expenses sit in limbo.

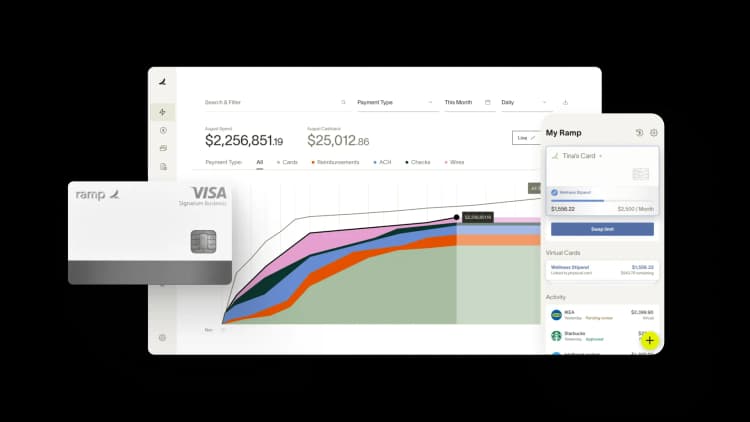

Ramp's expense management software transforms this chaotic process into a streamlined, automated system that enforces compliance from the start. The platform's customizable expense policies automatically apply your company's rules to every submission, eliminating the guesswork and favoritism that can creep into manual reviews. When an employee submits an expense, Ramp instantly checks it against your predefined limits, categories, and approval requirements. For example, if your policy caps client dinners at $100 per person, any submission exceeding this amount gets flagged for additional review before it reaches your approval queue.

Real-time receipt matching technology ensures every reimbursement request has proper documentation. Employees simply photograph receipts through Ramp's mobile app, and OCR technology extracts vendor details, amounts, and dates automatically. The system compares this data against the submitted expense amount, catching discrepancies that might indicate errors or policy violations. If someone claims $150 for a receipt showing $100, Ramp blocks the reimbursement until they provide clarification.

The platform also creates transparent audit trails for every transaction, showing who submitted what, when it was approved, and by whom. This documentation proves invaluable during audits and helps identify patterns of non-compliance across your organization. Automated approval workflows route expenses to the right managers based on amount thresholds or expense types, ensuring consistent oversight while speeding up reimbursements for employees who follow the rules. This combination of automation and transparency doesn't just enforce compliance—it makes fair treatment the default.

Build stronger team relationships with efficient expense management

Fair reimbursement policies build trust between you and your employees. When your team knows they'll be compensated promptly for legitimate business expenses, they're more likely to invest in activities that drive growth—whether that's traveling to meet clients or purchasing tools that boost productivity.

Ramp removes the friction from reimbursements while maintaining the controls you need. Your employees get their money faster, you get complete visibility into spending, and everyone operates within clear, consistent guidelines. Learn more about how Ramp can improve your reimbursement process with an interactive demo.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits