The 6 best receipt scanners apps for businesses in 2025

- What are receipt scanner apps?

- The 6 best receipt scanner apps for business expenses

- Features to look for in a receipt scanner app

- Benefits of using receipt scanning software

- How to use a receipt scanner app

- Alternatives to receipt scanners apps

- Why Ramp is the best receipt scanner for businesses

- Get more from your receipt scanner

Key takeaways

- Receipt scanner apps use technology to automate the process of capturing, storing, and organizing expense data electronically.

- By digitizing receipts, you can save significant time on manual data entry, reduce errors, and ensure you have accessible records for tax compliance.

- When choosing an app, look for key features like optical character recognition (OCR), automatic expense categorization, and integrations with your accounting software.

- The best app for your business will depend on specific needs, such as pricing, the volume of receipts you process, and whether you want a full expense management platform or a point solution.

- Ramp is a comprehensive finance operations platform that combines OCR-powered receipt scanning with corporate cards and expense automation to give you real-time control over company spending.

Successful businesses are always on the lookout for ways to optimize workflows, ensure compliance, and reduce tax burdens. Receipt scanning apps can help with all three.

These applications streamline the process of collecting, storing, and analyzing expense receipts, turning a pile of paper slips into organized, actionable data.

But which app is the best choice for your business? Here are our picks for the best receipt scanner apps on the market today:

- Ramp: The best overall receipt scanning software

- Expensify: Best for business travelers with simple needs

- Zoho Expense: Best for multilingual support

- QuickBooks: Best for integrations with other apps

- Dext Prepare (formerly Receipt Bank): Best for accounting firms

- Shoeboxed: Best for businesses with lots of existing paper receipts

In this article, we review all five, including the pros and cons of each, to help you make the right choice for your business expenses.

What are receipt scanner apps?

The best receipt scanning apps use technology to capture, store, organize, and simplify receipt data electronically. Unlike traditional receipt management methods, which typically require you to sort, staple, and file paper receipts manually, these apps automate the entire process.

By automating data entry and leveraging cloud storage, receipt management apps transform expense tracking into an efficient and virtually error-free process. These apps can help your company save time, improve accuracy, and provide greater insight into your business finances.

The 6 best receipt scanner apps for business expenses

Here’s our list of the best receipt management apps available today, based on factors like feature set, pricing, real user reviews, and more:

Ramp: The best overall receipt scanning software

G2: 4.8 out of 5 | Capterra: 4.9 out of 5

Ramp is more than just a receipt scanner app. It’s an industry-leading finance operations platform with OCR-powered receipt scanning built in. Your team can use Ramp’s mobile app to capture and upload receipts with their smartphone cameras, and Ramp handles the rest, automatically categorizing expenses and securely storing receipts in the cloud.

With Ramp, you get a complete expense management platform that includes expense reporting automation, T&E policy enforcement, mileage tracking, spend analytics, and more. Ramp can even generate receipts for common business transactions automatically thanks to integrations with vendors like Amazon and Lyft.

Pros:

- Modern finance platform for expense tracking, reporting, and strategic planning

- OCR-powered receipt scanning software with document management included

- Integrated corporate cards with customizable spending limits

- Automated expense approval workflows

- Integrates with major accounting systems like NetSuite, Xero, and QuickBooks

- Robust security measures protect your financial information

- Unlimited free tier with access to receipt scanning, travel booking, expense management, and more

Cons:

- Need to use Ramp’s corporate cards

- Must have $25,000 in a U.S. business bank account to qualify

- Auto-enforced spending limits can leave employees with a card that doesn’t work

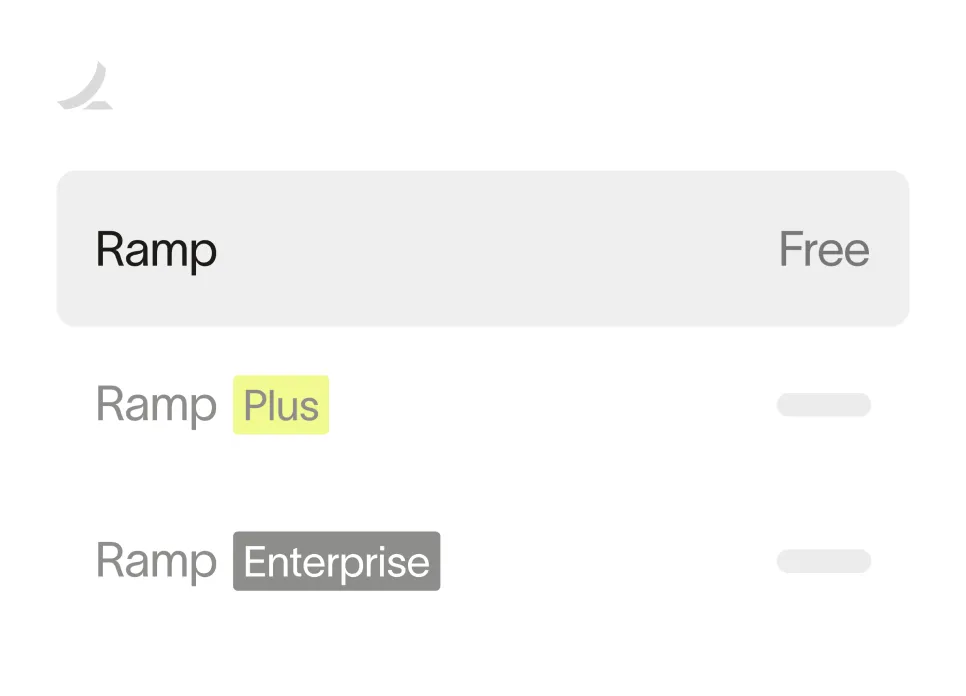

Pricing: Ramp offers the majority of its expense management features for free—including its receipt scanner app. If you want additional controls and customization, you can upgrade to Ramp Plus for $15 per user per month. If you’re interested in Enterprise pricing, just reach out.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Expensify: Best for business travelers with simple needs

G2: 4.5 out of 5 | Capterra: 4.4 out of 5

Expensify is a popular choice for businesses of all sizes thanks to its user-friendly interface and convenient mobile app. Expensify’s SmartScan receipt scanning software captures receipt details and prepares expense reports automatically to help streamline your company’s expense reimbursement process.

Pros:

- One-click receipt scanning with SmartScan technology

- Integrations with popular HR and accounting software

- Intuitive mobile app for on-the-go expense reporting

- AI-powered receipt auditing

- Easily scales with you as your business grows

Cons:

- No document management

- Per-user pricing can add up quickly, with some plans up to $36 per user per month

- Charges a monthly fee for some of its more advanced features

- Expensify’s free tier is aimed at individuals rather than small businesses

Pricing: Expensify’s Collect plan starts at $5 per user per month. Its Control plan is a step up in functionality and costs $9 per user per month.

Zoho Expense: Best for multilingual support

G2: 4.5 out of 5 | Capterra: 4.6 out of 5

Zoho Expense is another good option for business receipt scanning, particularly for companies that already use other Zoho products. Zoho Expense offers multiple methods for uploading expense receipts, including integrated receipt scanning. Its advanced autoscan can process receipts in 14 different languages.

Pros:

- Multiple methods for uploading expense receipts

- Multi-currency and multilingual support

- Integrates with popular accounting software

- Broad app support across web, mobile, and desktop platforms

Cons:

- No document management

- Free-tier usage limits may push small businesses into a paid plan

- Multi-entity management only available on Enterprise plans

- iPhone and Android apps lack many features available on web

Pricing: Zoho Expense offers a limited free tier for up to three users and 20 scans a month. Its Standard plan starts at $4 per user per month, and its Premium plan will run you $7 per user per month (both billed annually).

Quickbooks: Best for integration with existing apps

G2: 4.4 out of 5 | Capterra: 4.3 out of 5

QuickBooks is owned by Intuit, so it easily integrates with tools you might already be using like TurboTax and Mailchimp. It’s a powerful tool that scans receipts, and can track mileage and expenses. It’s an easy to use tool, but can get very expensive.

Pros:

- User interface is fairly straightforward

- Automatically backs up your data

- Integrates with other accounting software you might already be using

- Reporting is robust

Cons:

- One of the more expensive tools out there

- Not as much customization as you may need for your business

- Limited users, depending on your plan

- The app doesn’t have lacks features found on the full desktop version

Pricing: Quickbooks offers multiple tiers of pricing, depending on the number of users you need and the level of sophistication you’re looking for. Packages range from $35 per month for one user to $235 for 25.

Dext Prepare (formerly Receipt Bank): Best for accounting firms

G2: 4.5 out of 5 | Capterra: 4.2 out of 5

Dext Prepare, formerly known as Receipt Bank, offers pre-accounting software for businesses and accounting firms. Dext’s document scanner extracts relevant financial data from receipts and invoices, and it can automatically pull bills from your suppliers directly into the platform. Dext offers multiple ways to submit receipts, including mobile app, email, and more.

Pros:

- Competitive receipt scanning features

- Extensive bank integrations

- Document management system with file storage integrations

- Automatic expense categorization

Cons:

- Pricing structure can be confusing

- Seat and usage limits across plans can be restrictive and costly

- No free plan available

- Users report lengthy processing times for document scans

- Geared more towards accounting firms than small businesses

Pricing: Dext’s pricing model varies by business type, seat number, and usage, making this one of the more confusing receipt scanner apps to purchase:

- Business plans start at $24 per month for up to 5 users and 250 documents, billed annually. As you add users and documents, the price increases commensurately—up to $450 per month for 500 users, billed annually.

- For accounting firms, Dext Essentials starts at $199.99 per month for up to 10 clients, and Dext Advanced starts at $214.99 for up to 10 clients, both billed annually.

Shoeboxed: Best for businesses with lots of existing paper receipts

G2: 4.4 out of 5 | Capterra: 4.4 out of 5

Shoeboxed is a unique option for freelancers, entrepreneurs, and small businesses. Its key feature is the ability to turn a stack of business receipts into digitized, categorized, IRS-compliant data. Simply ship your paper receipts to Shoeboxed via post, and they’ll digitize them all for you. Shoeboxed also offers a traditional receipt scanner app for iOS, iPad, and Android.

Pros:

- Convert paper receipts into digital records in bulk

- Offers the option to shred and recycle submitted paper documents

- Unlimited file storage even on lowest-tier paid plan

- Integrates with popular accounting software

- Mobile app that double as a mileage tracker

Cons:

- Can’t scan anything other than receipts and business cards

- Not great for businesses with more complicated accounting needs

- Lacks modern expense management features

- No expense reporting automation

- Pricing model based on the number of physical and digital receipt scans

Pricing: If you choose annual billing, Shoeboxed starts at $23 per month for its Startup tier. Its Professional plan costs $47 per month, and its Business plan will run you $71 per month.

Features to look for in a receipt scanner app

So what exactly makes a business receipt app the best? Here are some essential features to look for when choosing business receipt scanning software:

- Optical character recognition (OCR) technology

- Automatic expense categorization

- Accurate extraction of individual expenses from itemized receipts

- Unlimited document storage for business receipts

- Multi-currency support

- Automation features for expense reporting and approvals

- Integrations with accounting software

- Spend analytics and reporting capabilities

- Strong security and user privacy

Benefits of using receipt scanning software

Receipt scanners are an essential tool for finance teams and small business owners alike because they save time, reduce errors, and improve compliance. Here are the full benefits you can expect from using receipt scanning software for your business expenses:

- Time and cost savings: Based on Ramp’s own research, the average 200-person company spends 330 hours per year processing expense reports—including the time it takes to track down, attach, and review receipts. A receipt scanner with integrated expense management features can save your company weeks of wasted time every year.

- Improved accuracy and compliance: Business receipt apps minimize human error and improve compliance with company policies, accounting standards, and tax filing regulations. For example, you’re required to keep records of your tax-deductible business expenses for at least three years. Digitizing your receipts keeps these essential tax documents safe in the cloud, where they’re easily accessible and searchable during tax season.

- Real-time visibility into spending: Automating receipt tracking helps provide real-time insights into business expenses. Manual expense reporting processes can take months from start to finish. Receipt scanning gets you closer to real-time expense tracking, and access to current data helps you make more informed financial decisions.

How to use a receipt scanner app

Following these steps will help you get the most out of your receipt scanning app’s features:

- Download and install the app: Find the mobile app of your choice on your device’s app store and install it. Sign up or log in to create an account.

- Set up account preferences: Configure the app to match your business needs and workflows. This might include setting currency preferences, approval guidelines, or defining expense categories.

- Capture receipts: Use the app’s camera function to take a photo of each receipt. Ensuring the receipt is flat, clear, and well-lit helps the app accurately capture all necessary information.

- Receive and edit details: After the app processes the receipt, review the captured details to ensure the vendor name, date, amount, and category are correct

- Submit for approval (if applicable): If your organization requires expense approval, submit itemized receipts through the app’s built-in workflow

- Sync with your accounting software: If the app integrates with your accounting software, this automation updates your records and frees you from manual data entry

Alternatives to receipt scanners apps

You may not be ready to commit to a receipt scanner app, or maybe you don’t have the budget lined up yet to add to your growing tech stack. Here are a couple of options for keeping track of your receipts:

- Your smartphone camera: You can use the camera on your smartphone to take a photo of your receipt and store it on your device or in the cloud

- Spreadsheets: Using Excel or Google Sheets formats are a very manual way to track your receipts, but gets the job done, so long as you’re up for staying on top of the updates

- Free apps: There are a handful of free apps out there, like Clearscan or Wave, that provide the minimum you need for receipt scanning.

For any of these options, you miss out on the obvious benefits you’d get with a dedicated receipt scanning app—especially the massive time savings you get with OCR technology—but with an organized system, you’ll be able to satisfy IRS requirements for digital receipt copies. It’s not a real expense tracker app, but it’s certainly better than nothing.

Why Ramp is the best receipt scanner for businesses

For finance teams, keeping track of business expense receipts is a time-consuming process. Manually collecting, organizing, and reconciling paper receipts takes valuable time away from strategic work like financial planning and analysis. And storing physical receipts introduces the risk of lost or damaged records, which can lead to incomplete expense reporting and potential compliance issues.

Ramp's expense management software solves these challenges by automating and digitizing receipt collection and management. With Ramp's receipt matching functionality, digital receipts are automatically collected from user inboxes and matched to the corresponding transactions in real-time. This intelligent pairing streamlines reconciliation and ensures that every expense has a valid receipt.

For times when a digital receipt isn't available, Ramp makes it easy to upload photos of paper receipts via mobile app. Simply take a picture of the receipt and Ramp's OCR technology will scan the relevant data and match it to the right transaction. This saves time on manual data entry and filing while providing a secure digital record of all receipt scans.

By centralizing receipts and transaction data in one platform, Ramp gives you real-time visibility into company spend. Powerful search capabilities make it easy to find any receipt or expense, eliminating the need to dig through paper files. And with all records stored securely in the cloud, there's no risk of losing critical documentation.

Ramp's digital receipt management capabilities not only save time and reduce risk, but also help ensure compliance with expense policies and accounting standards. Required receipt collection becomes automatic, and you can feel confident that expense reports are complete and audit-ready. With Ramp, scanning and storing receipts becomes an effortless part of the expense management workflow, empowering you to focus on growth.

Get more from your receipt scanner

Ramp’s modern finance platform gives you everything you need from a receipt scanning and tracking app and then some. Our integrated corporate cards help you curb overspending with custom controls at the card, vendor, department, or employee level.

Ramp seamlessly integrates with your accounting software, automatically logging and categorizing every transaction. With real-time reporting and analytics, you can optimize your spending and set more accurate budgets based on historical trends.

Ready to say goodbye to that file cabinet full of paper receipts? Try Ramp’s interactive demo and see why our customers save an average of 5% a year.

FAQs

There are many benefits to automating your processes. You can be more efficient with your time, reduce paperwork, and improve your tracking capabilities—ultimately saving your company money.

When exploring the best options for your business, be sure to ask questions about security and encryption of your data. But, yes, most subscription-based apps will securely protect your data.

Receipt scanner apps can help you enforce your reimbursement policies and identify any receipts that are not compliant with your stated policy. They will flag for you when this happens, so you can work with your team accordingly.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits