6 ways to build a better budget in 2021

- The economy in 2021

- The world has changed…and so have budgets

- How to build a better budget in 2021

- Ready for success in 2021? We can help

It’s a brave new post-COVID world. For today’s businesses, uncertainty is the only thing that’s certain—and that makes budgeting even more challenging than usual for CFOs. Today’s finance teams must consider a bevy of new expenses, from wellness and home office stipends to digital marketing tools and remote employee reimbursements, while keeping costs low in order to safeguard against potential trouble.

In a macroeconomic environment characterized by both promise and risk, CFOs need to build a budget that protects against uncertainty while allowing for a cautious return to normal.

The economy in 2021

Prior to the COVID-19 pandemic, the U.S. economy was booming like never before—but COVID and its associated lockdowns drove a proverbial train through all that progress. Shocks in demand, supply, and finance wiped out a significant portion of gains made in the last decade of job growth and economic expansion. Businesses around the world were forced into survival mode.

Nearly a year later, we’re beginning to see promising hints of an eventual return to normalcy. Multiple vaccine candidates have been approved in the U.S., and an aggressive vaccination campaign has slowed transmission across the nation. Stimulus dollars provide financial relief to the individuals and businesses that have struggled most.

Amid these hopeful happenings, CFOs are cautiously optimistic for their companies’ futures. Indeed, according to Deloitte's CFO Signals Report, own-company optimism has increased significantly among American CFOs, from -54 to +42, thanks to promising numbers (unemployment, GDP, decreasing mortality and hospitalization rates, etc.) that exceeded earlier dour forecasts. Moreover, CFO respondents have increasingly high expectations for the future. More than half of CFOs believe economic conditions in the U.S. will continue to improve, and 25% of CFOs say their company is already at or above its pre-crisis operating level.

The world has changed…and so have budgets

Even as we collectively hope for a return to “normal,” it’s become clear that our world has changed. While we hope to avoid future lockdowns and extensive social distancing, we know that vestiges of the COVID era will remain well into the future.

Remote work, for example, is here to stay thanks to SaaS applications and collaboration tools like Slack and Zoom. As a result, approximately 74% of companies plan to permanently shift to more remote work post-COVID. To accommodate and empower an increasingly distributed workforce, companies will need to continue the digital adoption that COVID catalyzed.

And while CFOs are optimistic about their companies’ futures, they collectively agree that cost-cutting will continue to be a major priority in 2021. For the first time in a decade of Deloitte’s CFO Signal Surveys, companies have shifted their focus toward cost reduction rather than revenue growth. Additionally, a growing number of CFOs are focused on ensuring liquidity. According to Deloitte, two-thirds of CFOS say they have raised or accessed additional cash in order to navigate uncertainty, fund ongoing operations, and pay down debt, among other initiatives.

CFOs are increasingly adopting more streamlined budgeting processes to further protect against risk. According to McKinsey, “43 percent of the 127 CFO respondents we recently surveyed cite the need to streamline their overall budgeting processes to react more quickly and efficiently. Meanwhile, 65 percent anticipate more use of rolling forecasts in 2021 and beyond.” Today’s CFOs know that they need real budgets that combine current resources with COVID-era strategy. Put simply, “the business-as-usual budgeting process, with its traditional inputs and standard approaches, is no longer fit for the task.”

How to build a better budget in 2021

Building a perfect budget is impossible—especially with so much in flux. But CFOs can create a budgeting process better-geared toward our current climate by implementing the following six steps.

1. Stress-test scenarios and assumptions

2020 was characterized by worst-case scenarios and dire assumptions. The first step in building a better 2021 budget is to assess what actually happened in 2020.

Start by reviewing your 2020 budget scenarios, assumptions, and decisions and compare them to what actually played out over the past year. Did any of the test scenarios you projected materialize? How did initiatives enacted during the crisis impact company performance?

It’s critical that all teams—including sales, marketing, and finance—perform independent stress tests and create strategic plans. This can help you determine which steps the business should take in pursuit of financial success as you build and refine your 2021 budget.

2. Build from a zero base

COVID has forced many businesses to utilize a zero-based budgeting principle in order to justify spend and ensure business continuity. In 2021, consider continuing to build your budget from a zero base.

In the wake of the COVID crisis, businesses have needed to be agile, to shift spending on a dime, and to re-allocate large portions of their overarching budgets in order to keep the business afloat. A happy realization from this tumultuous year was that the areas of the budget that had once been permanent may not have been as critical as they might have seemed.

This year, assess where you can build from a zero budget. For instance, you may not plan to spend any money on travel or real estate in the coming year. By performing rigorous reviews of key spending areas, you may be able to identify key business drivers while also finding other areas where you can reset the budget’s base to zero.

3. Gather low-hanging fruit

In increasingly remote teams, more employees have and/or need the ability to make purchasing decisions. While empowering employees can ease business operations, it also comes with its fair share of risk. Too-easy spend access can lead to unnecessary or duplicate purchases, unintentionally renewed subscriptions, and unapproved spend. By reducing these instances, companies gather low-hanging fruit when it comes to cost-cutting.

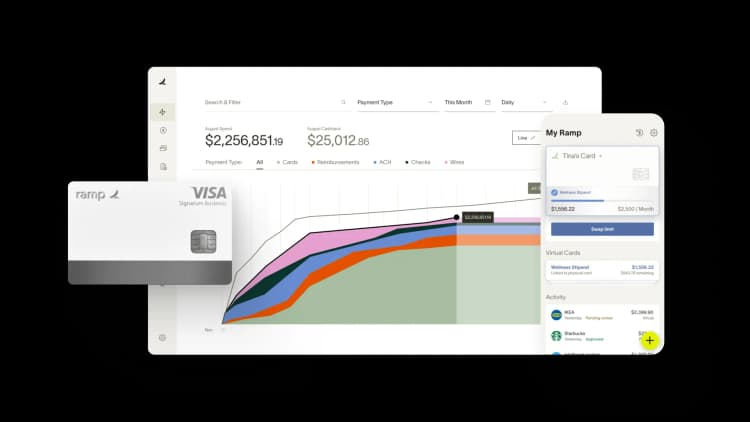

With Ramp, for example, companies can issue smart credit cards that automatically control spend. This ensures that employees don’t overspend their budgets or make unapproved purchases. Companies that use Ramp can save thousands of dollars over the course of the year thanks to cost-cutting features and time saved on tasks.

4. Reserve some spending as contingent resources

In an uncertain environment, it’s important to build reserves into your budget. This gives you both flexibility and optionality should further disaster—a new wave of COVID, for example, or the emergence of a particularly virulent strain—strike.

In a normal year, your budget would be mostly fixed. For now, though, you should consider building a more agile budget, like a rolling budget, that allows you to shift resources as needed. This is also known as a modular approach to budgeting, and it increases your company’s survivability by adding options and contingencies into the budget and creating centrally-controlled fund pools.

To apply this budgeting method, break each project into distinct phases. Review each phase periodically, then decide whether to allocate further funding to the project. If you determine that those funds could be better utilized elsewhere, you can postpone or discontinue the project.

5. Gain better visibility over spend (and make budget tweaks in real time)

In order to create a truly agile budget, you need comprehensive real-time spend visibility across the entire company. With a spend management platform like Ramp, you can leverage powerful search functionality to pinpoint any transaction made by anyone at any time, receive instant alerts regarding price increases or wasteful spend, and review real-time reports on spend across the company.

Armed with these insights, you can make immediate tweaks to your budget that reduce operational costs and protect the financial health of the company.

6. Leverage technology to alleviate stress on finance teams

Few corporate departments have been forced to adapt to the COVID pandemic as rapidly as finance teams. These employees have had to make significant budgeting and planning decisions, all while dealing with shorter reporting cycles and a decentralized work environment. Unless they receive support, burnout—and costly human error—is a very real possibility.

Automation and digital tools like Ramp can help alleviate some of the pressure. When supported by financial software that automates administrative tasks, or budgeting software that helps you track and monitor operating budgets, finance teams can focus on high-priority areas. This prevents them from wasting time and resources on frustrating manual processes.

By embracing technology, you can not only reduce the time your team spends on burdensome, inaccurate processes like expense reconciliation—you can also make these processes more accurate and cost-effective.

Ready for success in 2021? We can help

As we dive deeper into a post-COVID world, we’re ready to embrace cautious optimism about your company’s financial prospects. The vast majority of CFOs are entering 2021 with some reservations but an overwhelmingly positive outlook on the year ahead.

As you prep for a successful, cost-controlled year ahead, we can help. Our corporate card and spend management platform help CFOs gain greater control and visibility over their spend. Reach out today to learn more about how we can help you cut costs, streamline processes, and strengthen your business.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group