Expense reconciliation: What it is and how automation helps

- What is expense reconciliation?

- Common blockers and quick fixes

- How to reconcile expenses

- Manual vs. automated: What changes in practice

- Best practices for smooth reconciliation

- Benefits of automated expense reconciliation

- Choosing the right expense reconciliation software

- How Ramp eliminates manual expense reconciliation headaches

Accurate expense reconciliation keeps your books clean, helps you close the books on time, and makes audits uneventful. It means every expense is properly documented, every discrepancy resolved, and every report backed by reliable data. Strong reconciliation practices give you confidence in your numbers and more time to focus on running the business.

What is expense reconciliation?

Expense reconciliation is the process of comparing and matching expense records from different sources, such as expense receipts, credit card statements, and accounting records, to ensure they are accurate and consistent.

Beyond keeping the books aligned, reconciliation also helps protect cash flow, support accurate reporting, and keep companies audit-ready. Small startups benefit from fewer surprises, while larger companies depend on it for cleaner closes and more reliable budget decisions.

Who is responsible for expense reconciliation?

The responsibility for expense reconciliation typically falls to your finance team members. In smaller businesses, owners often handle it themselves. Establishing clear ownership helps keep your financial records accurate and your business running smoothly.

Related reconciliations you’ll touch include:

- Corporate cards and expense reimbursements (transaction feeds plus receipts)

- Bank feeds/credit card statements (period alignment)

- GL entries and adjustments (document any journal entries and lock the period)

Related processes like budget reconciliation compare planned spending against actual results to keep financial plans on track.

Common blockers and quick fixes

Finance teams deal with recurring obstacles that can turn expense reconciliation into a time-consuming headache. These challenges don’t just affect travel or card spend—operating expense reconciliation also suffers when receipts are missing or data is inconsistent.

Here are the most common challenges and how to fix them:

Blocker | Problem | Solution |

|---|---|---|

Missing receipts | Lost or unsubmitted receipts leave gaps in records and make audits difficult | Use mobile receipt scanning, set automated reminders, and enforce a 30-day cutoff policy |

Poor data formatting | Inconsistent categories, dates, or vendor names cause delays and rework | Use dropdown menus, publish formatting guidelines, and rely on expense management software that auto-formats data fields |

Delayed entries | Late submissions disrupt month-end close and skew reporting periods | Tie submission deadlines to payroll cycles, implement automated approvals, and use real-time expense tracking tools |

Policy compliance issues | Out-of-policy expenses (e.g., upgraded flights or overspending on meals) slow reviews and create friction | Publish clear policies, train employees regularly, and embed policy checks in your expense system |

How to reconcile expenses

Getting your expenses properly reconciled doesn't have to be overwhelming. Follow these steps to reconcile expenses efficiently, whether you're handling your own business expenses or managing them for an entire team.

Step 1: Gather documentation

Collect all receipts, bank and card statements, expense reports, and invoices in one place, organized by date, category, or employee. A simple filing system works, but digital tools such as cloud storage or expense management apps make it easier to keep everything accessible and backed up automatically.

Step 2: Match transactions and receipts

Match each transaction to its receipt, checking amounts, dates, and vendor details. Spreadsheets or expense software can streamline the process, and simple tools like checklists or color-coded tabs help you stay organized.

Step 3: Identify discrepancies

Watch for mismatches, missing receipts, duplicate entries, or unclear business purposes. Catching issues early with regular spot checks saves time and prevents small discrepancies from piling up.

Step 4: Take corrective actions

When you find discrepancies, reach out for missing information or clarification — most issues resolve quickly. Escalate significant amounts or policy violations to managers, and always document how they were handled to maintain a clear audit trail.

Step 5: Finalize and document adjustments

Post any correcting journal entries, attach receipts and approvals to the transaction record, and clearly note who made each change and when. Export or save a reconciliation report, then lock the period so entries can’t be backdated. This creates a clean audit trail and gives finance leaders confidence the books are accurate and ready to close.

Manual vs. automated: What changes in practice

You can reconcile business expenses using several methods, but they all fall into two broad categories: manual and automated.

Manual and automated reconciliation both aim for accurate records, but the approach and effort involved are very different:

Method | How it works | Pros | Cons |

|---|---|---|---|

Manual reconciliation | Collect and record expenses manually in spreadsheets or ledgers. Transactions are checked line by line against receipts and statements. | Low cost; straightforward for very small teams | Time-consuming, error-prone, and difficult to scale as volume grows |

Automated reconciliation | Software digitizes receipts, auto-matches transactions in real time, and applies policy rules. Employees submit expenses electronically. | Fast, accurate, audit-ready, and gives real-time visibility | Up-front software costs; employee learning curve; still requires human oversight for exceptions |

The bottom line: Automation removes most of the grunt work and speeds up reconciliation, but finance teams are still essential for judgment calls and edge cases.

Best practices for smooth reconciliation

Effective reconciliation processes help keep your financial records accurate while reducing stress during closing periods and audits. Here are some best practices to follow:

- Establish regular reconciliation schedules: Set monthly, weekly, or daily reconciliation timelines based on transaction volume and account importance to prevent backlogs from accumulating

- Maintain complete audit trails: Document every reconciliation step, including who performed the work, when it was completed, and what adjustments were made for future reference

- Create clear documentation standards: Develop templates and guidelines that specify exactly what supporting evidence is required for different types of reconciling items

- Use standardized reconciliation formats: Apply consistent templates across all accounts to make reviews faster and reduce the chance of missing important items

- Implement proper review controls: Require independent review of all reconciliations before final approval, with clear sign-off procedures for accountability

- Automate where possible: Leverage accounting software features such as bank feeds and automated matching to reduce manual data entry and speed up the process

Following these practices will help you build reliable reconciliation processes that support accurate financial reporting and satisfy audit requirements. Clear reconciliation guidelines ensure consistency across teams and make it easier to train new employees on the process.

Is expense reconciliation easy?

The complexity of expense reconciliation largely depends on your business's systems and processes. Companies with automated expense reporting tools, integrated accounting software, and consolidated data sources find the process much more manageable than those relying on manual spreadsheets and paper receipts.

Expense management platforms that capture receipts digitally, apply consistent coding rules, and integrate directly with your general ledger eliminate much of the manual work. These systems can automatically match credit card transactions with submitted receipts, flag policy violations, and provide real-time visibility into spending patterns.

While expense reconciliation will never be completely effortless, the right combination of technology, clear processes, and regular monitoring can make it significantly more manageable. If you invest in proper expense management systems, you may see dramatic reductions in reconciliation time and improved accuracy in your financial reporting.

Benefits of automated expense reconciliation

Expense management software simplifies what used to be a tedious, manual process by connecting directly to your financial systems and matching transactions in real time. The software handles the heavy lifting of data collection, comparison, and initial variance identification, freeing up valuable time for more strategic financial activities.

The specific advantages include:

- Reduced errors: Eliminates human mistakes that naturally occur during manual data entry and comparison

- Faster month-end close: Accelerates the entire closing process by completing reconciliations in minutes rather than days

- Improved compliance: Maintains detailed audit trails and documentation that satisfy regulatory requirements

- Better visibility: Provides real-time dashboards and reporting that give finance teams immediate insight into account status and outstanding items

In 2025, more finance teams are adopting AI-powered tools that speed up approvals, flag anomalies automatically, and further reduce manual effort. Ramp's own research has shown that companies that adopt automated systems can see a 95% decrease in the time it takes to review and approve expenses.

Ramp customers report similar gains: Bratjen Construction cut reconciliation from 2 weeks to just 1–2 days. This also means less time is needed for reconciliation as the software's accuracy makes the process easier and faster.

Simplify your expense management with Ramp

Choosing the right expense reconciliation software

The longer reconciliation takes, the higher your reconciliation costs, from staff hours to delayed reporting. The right software helps minimize that overhead.

Key features to look for include:

- Digitization: Mobile apps let employees snap receipts instantly, while automatic capture of e-receipts keeps records organized and reduces manual entry

- Automation: Advanced tools categorize expenses, detect duplicates, and apply policy rules automatically to save time and prevent costly mistakes

- Integration: Seamless connections with accounting systems like QuickBooks, Xero, or NetSuite ensure expenses flow straight into your books without rekeying

- Ease of use: Intuitive design helps employees submit expenses quickly and gives finance teams visibility without heavy training

- Reporting: Real-time dashboards and customizable reports highlight spending trends, track budgets, and flag issues before they snowball

- Security: Strong encryption, role-based access, and detailed audit trails protect sensitive data and keep your team compliant

When evaluating potential solutions, start by identifying your specific pain points and involving key stakeholders from both finance and operations teams. Request demos that simulate your actual workflows, and ask vendors about implementation timelines, training resources, and ongoing support. Consider starting with a pilot program to test functionality before committing to a full rollout.

The right expense management software supports best practices by creating clear approval workflows and maintaining detailed records for compliance purposes. Built-in policy enforcement helps prevent unauthorized spending while automated alerts keep managers informed about budget variances.

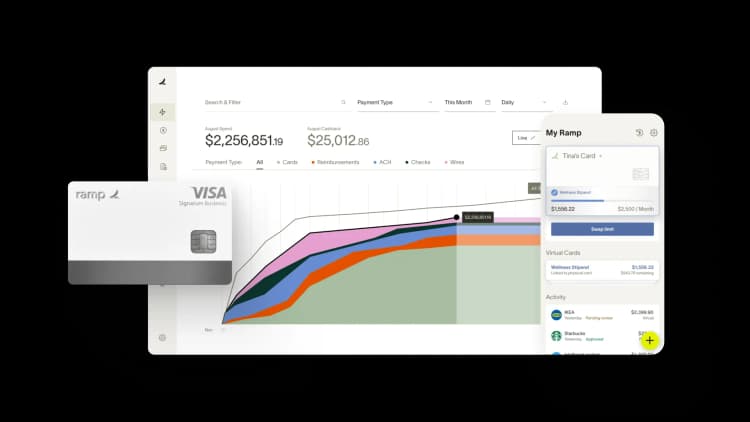

How Ramp eliminates manual expense reconciliation headaches

Manual expense reconciliation eats up countless hours each month, forcing finance teams to chase down receipts, match transactions line by line, and hunt for coding errors across multiple spreadsheets. The process becomes even more painful when you're dealing with hundreds of employee expenses, missing documentation, and transactions that don't quite match up.

Ramp's automated expense management platform transforms this tedious process into something that practically runs itself. When employees make purchases with Ramp cards, transactions flow directly into your accounting system with all the necessary details already attached.

Real-time transaction feeds mean you're not waiting until month-end to see what's been spent; you can monitor and categorize expenses as they happen. This immediate visibility lets you catch issues early rather than discovering problems weeks later during reconciliation.

Intelligent receipt matching

The platform's receipt matching technology takes automation even further. Instead of manually pairing receipts with transactions, Ramp automatically captures and matches receipt data to the corresponding purchase.

Employees simply snap a photo of their receipt and submit it via text, mobile app, or email. Ramp's OCR technology extracts the relevant information, verifies it against the transaction, and files everything away for you. No more chasing down missing receipts or deciphering crumpled paper weeks after the fact.

Automated expense categorization and approvals

Perhaps most powerful is Ramp's intelligent categorization engine, which learns from your past coding decisions to automatically assign expenses to the right accounts. The system recognizes patterns in your spending and applies consistent categorization rules across all transactions.

When combined with customizable approval workflows that route expenses to the right managers based on amount, category, or merchant, you're looking at a reconciliation process that's not just faster—it's more accurate and compliant by design.

Set expense reconciliation on autopilot

Expense reconciliation is time-consuming and often challenging, especially if you do it manually. Ramp’s expense management software, paired with our corporate cards, can save time and improve accuracy. Try an interactive demo and learn why more than 50,000 businesses have saved $10 billion and 27.5 million hours with Ramp.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits