How to use AI safely in accounting

- What safe AI use in accounting means

- 5 steps to use AI safely in accounting

- Common risks of using AI in accounting

- Steps to take before implementing AI

- Benefits of safe AI use in accounting

- How Ramp enables safe AI adoption

What does it really mean to use AI safely in accounting? Data security may be the first thing that comes to mind, but it’s more than that. It's about maintaining oversight, ensuring compliance, and holding individuals accountable for business decisions they make based on AI insights.

Research from Stanford’s Graduate School of Business suggests AI is already changing how accounting teams work. Accountants who use generative AI save an average of 7.5 days on month-end close, freeing them up for high-value tasks like business communication and QA. It automates manual processes, surfaces insights faster, and improves GL accuracy.

But these benefits come with risks. The use of AI in accounting involves sensitive financial data, which can be a target for cyberattacks. Ensuring the security of AI systems and the privacy of the data they handle is vital. There's also the danger of over-reliance on AI outputs and compliance gaps that can lead to costly errors.

This guide covers the principles, risks, and practical steps for using AI safely in accounting, and how solutions like Ramp support responsible adoption.

What safe AI use in accounting means

Safe AI in accounting goes beyond secure data storage and access. It means implementing AI tools that enhance your workflows without compromising the integrity of your financial processes or exposing restricted information.

Why does this matter? Accounting deals with sensitive financial data and strict regulatory obligations. A single misuse of AI can trigger costly errors or compliance violations that damage both your finances and reputation.

But when it’s adopted responsibly, AI reduces manual work, surfaces insights faster, and strengthens decision-making. AI accounting software can automate time-consuming, repetitive tasks such as data entry, invoice processing, and bank reconciliations. The key is balancing automation with accountability.

5 steps to use AI safely in accounting

Adopting AI responsibly requires a clear plan. Follow these five steps to integrate AI into your accounting workflows while minimizing risk and maximizing efficiency:

1. Understand what AI can (and can't) do

Not all accounting tasks should be handled by AI. Foundational, day-to-day bookkeeping tasks are a great starting point. Use AI for processes like:

- Invoice matching

- Expense categorization

- Transaction classification

- Anomaly detection

- Bank reconciliations

Know where to draw the line. AI assists decision-making but shouldn't replace human review for judgment-based calls like interpreting tax law, approving audits, or handling complex transactions. In these cases, it’s better to rely on human expertise and judgment.

2. Start with the right training and policies

Educate your accounting and finance teams on how AI tools work, what data they’re allowed to input, and where errors can occur. Training ensures all team members understand the risks, fostering a culture of healthy skepticism and compliance.

Build clear AI usage policies that define:

- Approved tools and platforms

- Data access permissions

- Validation and review steps

- Escalation procedures for errors

Treat training as ongoing. AI evolves quickly, and best practices do, too. Train your employees to use AI tools effectively, including how to write better prompts and work with large language models (LLMs) for accurate outputs. Preparing your team with the right skills ensures a smoother and more secure integration of AI.

3. Choose secure, integrated tools

Pick AI solutions designed for enterprise finance, with end-to-end encryption, audit logs, role-based access controls (RBAC), and data-handling transparency. The right solution can boost productivity and improve efficiency, but it must also follow strict security and compliance standards.

Avoid siloed or third-party tools that move financial data outside your secure systems. Every data transfer creates a potential vulnerability. Instead, choose solutions that allow you to set up a sandboxed environment that limits AI access to sensitive systems and keeps everything centralized.

4. Validate AI outputs and maintain human oversight

Always double-check AI-generated classifications, summaries, or recommendations. Even the most sophisticated AI makes mistakes, especially with edge cases or unusual transactions.

Implement review checkpoints and clear ownership:

- Who verifies results?

- Who signs off on final decisions?

- How are errors corrected and documented?

- What triggers escalation to senior review?

Regular corrections and feedback improve the AI’s performance and decision-making over time. Each adjustment helps the system learn and adapt to your specific needs. Remember: Safe AI means accountability remains with people, not algorithms.

5. Continuous monitoring and improvement

Review model performance regularly. Accuracy, bias, and data drift can change over time.

Run internal audits to ensure compliance with accounting standards and privacy regulations like SOC 2 or GDPR. Data protection can include encryption, authentication, authorization, redundancy, recovery, and audit.

Create a feedback loop where team members can report when AI produces poor results. These reports help you refine your policies and identify areas for additional training. They also help you recognize when a tool isn't reliable enough for certain use cases.

Common risks of using AI in accounting

AI tools process confidential financial data, making them attractive targets for breaches. Understanding these risks is the first step toward preventing them.

| Risk | What it means for accounting | How to mitigate it |

|---|---|---|

| Data privacy and security | A single vulnerability could expose sensitive company, employee, or client financial information | Use tools with end-to-end encryption, conduct thorough vendor due diligence, and enforce RBAC |

| Bias and inaccurate insights | Models trained on skewed or incomplete data can misclassify transactions, creating cascading errors in financial records | Require AI to provide source citations and rationale for recommendations, regularly test outputs against real-world data, and look for patterns in errors |

| Regulatory compliance | AI use in financial reporting operates under evolving regulations; lack of transparency can lead to audit failures | Build in compliance rules for SOX, GDPR, and internal policies; keep auditable documentation of how AI makes decisions, what data it uses, and how results are validated |

| Over-reliance on automation | Even accurate AI can fail on edge cases like unusual transactions or new vendor relationships, leading to errors | Maintain human review for critical processes, especially for high-value transactions or regulatory filings |

Steps to take before implementing AI

Before introducing any AI tools into your accounting processes, you’ll need to do some prep work to set yourself up for success:

Assess your risks and readiness

Identify which workflows involve sensitive data and how you’re currently managing them. Ask yourself:

- What financial data will AI access?

- Where does that data currently reside?

- Who has access to it today?

Conduct a risk assessment covering cybersecurity, data residency, and compliance exposure. The security and privacy risks of AI can have major consequences for accounting organizations and their clients.

Update internal processes

AI shouldn't operate in a vacuum. Integrate it into the control structures you already have.

Build AI usage into your existing processes by defining exactly when and how your team can use it. For example, AI might assist with categorizing transactions, but a staff accountant must review flagged items before they're finalized.

Set clear thresholds for human oversight. For example, consider requiring manual review for:

- Any transaction over a certain dollar amount

- Entries that involve related parties or unusual accounts

- Month-end and year-end adjustments

- Any output you plan to share externally

Update your privacy and compliance documentation to reflect AI use. If your engagement letters or data processing agreements don't mention AI, revise them.

Educate and empower your team

According to a 2024 Karbon Magazine survey, 82% of accountants are excited by AI, but only 25% are actively investing in training. Don't let your team fall into this gap.

Make sure your team understands the risks and boundaries of AI in accounting. Use practical training methods like:

- Case studies showing safe vs. unsafe AI use

- Hands-on exercises with your chosen tools

- Regular refresher sessions as tools evolve

Designate a specific team member to maintain your training documentation, and ensure it lives somewhere accessible.

Benefits of safe AI use in accounting

When implemented with proper guardrails, AI can deliver advantages that go beyond simple automation:

- Greater efficiency and accuracy: Automating time-consuming tasks like expense categorization and reconciliation frees your team for higher-value analysis. AI also spots inconsistencies faster than human review alone, improving speed and reliability.

- Improved trust and stakeholder confidence: Safe AI builds confidence with clients, auditors, and leadership. Transparent documentation demonstrates responsible data handling and strengthens your credibility.

- Higher team morale and job satisfaction: Automation reduces the workload that builds up at month-end. This shift helps reduce burnout and makes the profession more attractive: According to the Karbon Magazine survey, 46% of accountants agree that AI can help attract and retain talent in the field.

- Smarter, data-driven decision-making: With responsible AI, teams gain timely and reliable insights into spending trends, budgets, and forecasting. You can identify patterns and anomalies that might take hours to spot manually, and make decisions based on a complete, current picture of your financial position.

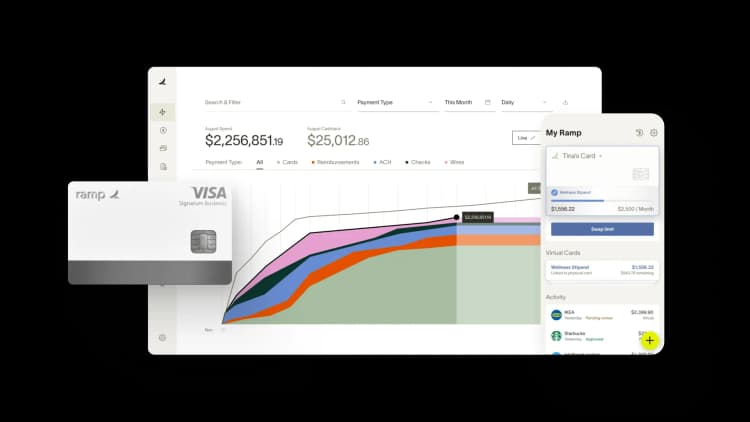

How Ramp enables safe AI adoption

Implementing AI in accounting raises valid concerns. You need AI that protects sensitive financial data while maintaining the transparency and control required for regulatory compliance, external audits, and internal governance.

Ramp's AI-powered accounting software is built with enterprise-grade security and full auditability, so you can automate with confidence. Every AI decision is logged, traceable, and reviewable, giving you complete visibility into how transactions are coded, synced, and reconciled.

Here's how Ramp helps your finance team use AI safely and responsibly:

- Human oversight built in: Ramp’s suggested actions surface the 20–30% of transactions that most need human judgment, helping you prioritize the tasks that need your attention

- SOC 2 Type II certified: Ramp meets rigorous security standards and undergoes regular third-party audits, so your financial data stays protected and compliant with industry regulations

- Role-based access controls: You can configure permissions at the user and team level, ensuring only authorized personnel can review, approve, or override AI decisions

- Encrypted data handling: All financial data is encrypted in transit and at rest, protecting sensitive information throughout the automation process

Learn more about how Ramp's secure AI helps finance teams clear their accounting queue 3x faster without compromising compliance or control.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits