Multi-entity accounting: A guide for growing businesses

- What is multi-entity accounting?

- Why multi-entity accounting matters

- Challenges of multi-entity accounting

- Benefits of multi-entity accounting

- How to implement effective multi-entity accounting

- Who needs multi-entity accounting?

- The hidden costs of ignoring multi-entity accounting

- Scenarios showcasing multi-entity accounting benefits

- Multi-entity accounting software

- Centralize multi-entity accounting with Ramp's unified platform

For businesses with multiple subsidiaries or divisions, multi-entity accounting helps financial records remain accurate and well-organized.

Centralizing financial data across locations simplifies compliance with tax codes, regulatory requirements, and reporting standards. It also enables consolidated financial management, helping businesses oversee transactions and interactions between their entities.

In this guide, we'll cover multi-entity accounting, its challenges and benefits, how to implement it, and what tools to use to help manage it.

What is multi-entity accounting?

Multi-entity accounting is a financial management approach designed for businesses that operate across multiple subsidiaries, regions, or industries. It centralizes financial data and automates complex processes, such as intercompany transactions, multi-currency accounting, and compliance with diverse tax regulations.

Consolidated financial statements show the overall financial results of a parent company along with its subsidiaries. To create these statements, you must remove the effects of transactions between the companies. For example, if a subsidiary sells inventory to the parent company, you need to eliminate any gains or losses from that sale in the consolidated financials. This method guarantees the accuracy and consolidation of financial records.

This system also helps with regional tax rules, such as handling VAT in Europe or GST in Asia, and it allows for accurate currency conversions. This is especially useful for industries such as technology, retail, e-commerce, healthcare, and consulting, where complex operations need careful financial management.

Why multi-entity accounting matters

When your business operates across multiple entities, managing finances can quickly become overwhelming. Each entity may use different processes, software, or reporting standards, creating a patchwork of financial data that's difficult to piece together.

Centralizing and standardizing your financial processes changes everything. Instead of wrestling with inconsistent data from various sources, you create a unified system where all entities follow the same procedures and use compatible tools. This approach dramatically reduces the manual work your team spends reconciling differences between entities and chasing down missing information.

The compliance benefits are equally compelling. Standardized processes help each entity meet regulatory requirements, reducing the risk of costly violations or audit findings. Meanwhile, consolidated multi-entity reporting becomes more accurate and reliable, giving you confidence in the numbers that drive major business decisions.

This foundation enables better budgeting across all entities and supports data-driven decision-making with real-time visibility into your entire operation. You can spot trends, identify opportunities, and address issues before they escalate.

The result? Streamlined operations where your finance team focuses on analysis and strategy rather than data cleanup. Errors decrease, compliance is more manageable, and you gain the clear financial picture every growing business needs to thrive.

Challenges of multi-entity accounting

Managing finances across multiple entities is complex enough to strain even experienced finance teams. Each additional entity introduces new variables, from different currencies and regulations to varying reporting requirements. These challenges compound quickly, turning what should be straightforward financial management into a time-consuming puzzle.

Here are the main hurdles businesses encounter:

- Intercompany reconciliations: Transactions between entities often don't match up perfectly, creating discrepancies that call for manual investigation. Standardized transaction codes and regular reconciliation schedules will help you catch mismatches early.

- Currency conversions and multi-currency accounting: Fluctuating exchange rates complicate reporting and can distort financial performance. Use automated currency conversion tools and establish consistent rate-setting policies across all entities.

- Compliance with different regional regulations: Each jurisdiction has unique reporting requirements, tax rules, and deadlines. Maintain a compliance calendar and work with local experts to stay current on regulatory changes.

- Data silos and lack of real-time visibility: Information gets locked in separate systems, making it difficult to see the complete financial picture. Invest in integrated accounting platforms that connect all entities and provide consolidated dashboards.

While these challenges may seem daunting, they're entirely manageable with the right combination of tools, processes, and planning.

Benefits of multi-entity accounting

When implemented properly, multi-entity accounting offers advantages you can feel in every aspect of your financial operations and planning.

The key benefits include:

- Faster close cycles: Standardized processes and integrated systems eliminate the delays caused by manual reconciliations and data gathering across entities. Your team can close the books weeks faster than before.

- Increased data accuracy: Centralized systems reduce human error and inconsistencies. Automated validations catch discrepancies early, giving you confidence in your financial reports.

- Better compliance with local and international regulations: Consistent processes help you meet varying regulatory requirements across jurisdictions while maintaining audit trails and documentation standards

- Improved ability to spot cost savings: Real-time visibility into all entities reveals spending patterns, redundancies, and opportunities to optimize resource allocation across your organization

- Support for strategic financial planning and growth: Consolidated data enables better forecasting, scenario planning, and informed decision-making as you expand into new markets or business lines

These benefits compound over time, creating a foundation that supports sustainable growth and operational efficiency across your entire organization.

How to implement effective multi-entity accounting

Implementing an accounting workflow for a multi-entity company requires collaboration across finance, IT, and leadership. The process includes automating invoice processing, reconciliations, and financial reporting while addressing compliance challenges and integrating systems across diverse entities.

Here’s how to set up an efficient multi-entity accounting framework:

Standardize charts of accounts

Make sure each entity’s financial system complies with its operational needs and local regulations. Standardize charts of accounts across entities to make consolidated financial data accurate and comparable. Use uniform reporting templates to reduce discrepancies and simplify analysis.

You should also clearly define policies for intercompany transactions, approvals, and financial reporting. For instance, a standardized approach to inter-entity reconciliations and chains of approval maintains transparency and consistency in multi-entity reporting.

Automate intercompany transactions

Multi-entity accounting software reduces manual tasks such as reconciliations, invoice processing, and financial reporting. These tools help automate intercompany transactions and maintain compliance, saving time and resources while improving accuracy. For example, automated workflows can accelerate month-end close, giving finance teams more bandwidth for strategic initiatives.

Build scalable processes

Design future-proof accounting workflows that can grow with your business. Scalable processes let you integrate new entities or markets without disrupting financial operations. This adaptability enables you to expand into new regions or industries, ensuring financial management keeps pace with growth.

Implement real-time reporting and controls

Access to current financial data is essential when managing multiple entities. Dashboards that display key metrics from all entities help leadership make informed decisions quickly.

Internal controls should include automated approval workflows and audit trails that track transactions across entities. Real-time reporting tools also enable finance teams to spot discrepancies early and address compliance issues before they escalate into larger problems.

Train cross-functional teams

Ongoing education for finance and accounting staff helps everyone stay current with evolving regulations and software capabilities. Regular training sessions should cover entity-specific requirements alongside company-wide policies and procedures.

Encourage collaboration between entities by creating knowledge-sharing sessions where teams can discuss best practices and common challenges. Cross-entity mentoring programs help build relationships and encourage consistent application of accounting standards across your business's operations.

Who needs multi-entity accounting?

Businesses with complex financial structures or operational needs often benefit from multi-entity accounting. These companies typically face challenges such as managing multiple subsidiaries, handling cross-border operations, or scaling into new markets. Examples include:

- Companies with subsidiaries, branches, or franchises

- Multinational organizations operating across regions

- Startups expanding into new markets or navigating complex funding structures

Here’s how multi-entity accounting can meet the needs of specific types of businesses:

Companies requiring increased visibility

Financial visibility goes beyond identifying cash flow trends or spotting expense anomalies; it’s about acting on opportunities in real time. Multi-entity accounting provides a centralized view of spending across categories, vendors, and teams.

For example, a technology company operating across multiple countries could use a centralized system to track category spending in real time. This level of detail allows the company to renegotiate supplier contracts, shift budgets to high-performing regions, or identify opportunities to cut certain expenses. With this kind of oversight, decision-making becomes more strategic and impactful.

Companies that want to improve operational efficiency

Handling financial tasks manually can quickly become a bottleneck for growing businesses. Multi-entity accounting systems automate these processes, saving time and reducing the risk of human error.

Consider a retail chain managing hundreds of vendor relationships across multiple states. By automating accounts payable and reconciliation tasks, the chain can reduce invoice processing times while eliminating many of the errors common in manual data entry.

These systems also scale with the business, making it easier to integrate new locations or vendors without overhauling workflows. The result is a more streamlined operation that frees up time for higher-value activities such as analyzing growth opportunities or refining strategies.

Companies that need to mitigate risks

Business enterprises dealing with several entities are exposed to various risks of errors, fraud, and compliance challenges. Centralized multi-entity accounting reduces such risks by providing comprehensive and audit-ready information.

For example, a health organization handling billing across subsidiaries could use a centralized system to flag irregularities, ensuring compliance with stringent regulations. Automated approvals and real-time transaction monitoring add layers of protection, while detailed audit trails simplify the process of preparing for audits or regulatory reviews.

These features both reduce the likelihood of fraud and provide peace of mind that financial data is accurate and compliant.

The hidden costs of ignoring multi-entity accounting

Ignoring multi-entity accounting can expose your businesses to costly risks, from compliance penalties to operational inefficiencies. Without a centralized system, errors in tax filings or missed regulatory deadlines can result in fines and reputational damage. Poor financial visibility delays decision-making, causing missed opportunities for growth investments.

According to a 2023 study of 91 CFOs conducted by SoftLedger:

- Only 16% of multi-entity companies can consolidate their entities in 1–2 days

- Roughly 40% of companies said they need 3–6 days

- 24% said they need at least a week

- 10% said it takes them 11–15 days

Other CFOs said it takes their company anywhere from 16–26 days or more for financial consolidation. The amount of time lost by not using multi-entity accounting is staggering.

Relying on manual processes also overburdens employees, increasing errors and leading to burnout. Addressing these issues with a proper multi-entity accounting system maintains compliance, enhances operations, and provides the clarity needed to drive sustainable growth.

Scenarios showcasing multi-entity accounting benefits

Managing finances across multiple entities can become overwhelming without the right systems in place. Here are a few example scenarios of how businesses can navigate these challenges using this approach.

Scenario 1: A startup expanding internationally

A tech startup recently expanded its operations into Europe and Asia, establishing five subsidiaries that operate in different currencies under varying tax regulations.

For compliance purposes, businesses must issue consolidated financial statements using a single currency—typically the currency where the parent company is headquartered. If subsidiaries use other currencies, they’re required to convert the amounts into the parent company's currency.

Managing VAT compliance in Europe and GST filings in Asia quickly became overwhelming for the tech startup, and manual currency conversions caused errors in financial reports.

With multi-entity accounting, the team consolidated financial reports across all subsidiaries, automated currency conversions, and complied with local tax codes. The system allowed for clear visibility into their global finances, reducing errors and saving significant time during month-end reporting.

This centralized approach also gave leadership the insights they needed to allocate resources effectively across regions, making for smooth expansion into new markets.

Scenario 2: A holding company managing multiple subsidiaries

A fast-growing holding company owns over 200 retail franchises across 15 states. Each location has unique performance metrics, tax obligations, and payroll needs, creating significant complexity in financial reporting and resource allocation.

By adopting a multi-entity accounting system, the parent company centralized payroll for 3,000 employees, coordinated tax filings for all 15 states, and consolidated financial data to provide a unified view of the organization’s performance.

The system also enabled the identification of underperforming locations, leading to strategic resource reallocation and optimization of operating costs. With these insights, the company successfully planned for the launch of 50 new franchise locations, backed by accurate projections and comprehensive financial data.

Scenario 3: A SaaS company handling funding allocations

A multinational SaaS company with subsidiaries in the U.S., U.K., and India faced challenges in managing funding allocations and tax compliance. Each region had to adhere to local tax laws, such as Corporation Tax in the U.K. and GST in India, while also needing accurate transaction tracking in multiple currencies.

Using multi-entity accounting, the company automated tax calculations and streamlined multi-currency transactions, achieving compliance with local regulations. The system reduced manual work and cut tax filing errors.

With these efficiencies, the company redirected resources to high-growth markets and improved funding allocations for product development and customer acquisition, fueling global expansion.

Multi-entity accounting software

Multi-entity accounting software is often used to automate tedious tasks and maintain compliance across jurisdictions.

Key features to look for in multi-entity accounting software depend on your business's specific needs. If you need a comprehensive view of your operations, consolidated multi-entity reporting is invaluable. This feature brings together data from various entities into a single dashboard, making it easier to identify trends, compare performance, and prepare accurate reports for stakeholders.

If you frequently move inventory, funds, or services between entities, you'd likely benefit from intercompany transaction automation. This eliminates manual reconciliations by matching transactions, adjusting for currency conversions, and handling tax requirements across jurisdictions.

If your business operates internationally, multi-currency support and compliance tools are non-negotiable. These features automate exchange rate adjustments and ensure accurate reporting for different tax jurisdictions, such as VAT in the EU or GST in India. This is particularly useful for multinational organizations navigating complex regulatory landscapes.

5 accounting software tools for multi-entity organizations

Most accounting software built for enterprises should offer multi-entity support, but some of the most popular options include:

- NetSuite by Oracle: Comprehensive cloud-based ERP with multi-entity accounting features for global operations

- Sage Intacct: Cloud financial management software that supports consolidations, intercompany transactions, and compliance

- QuickBooks Online Advanced: Scalable accounting solution with basic multi-entity support for growing businesses

- Xero: Cloud-based accounting software with add-ons for managing multiple entities

- Microsoft Dynamics 365 Business Central: ERP and accounting software with robust features for multi-entity management and reporting

Choosing the right multi-entity accounting software depends on your business's size, complexity, and unique requirements. These platforms can significantly reduce manual work while improving accuracy and compliance across all your business entities.

Centralize multi-entity accounting with Ramp's unified platform

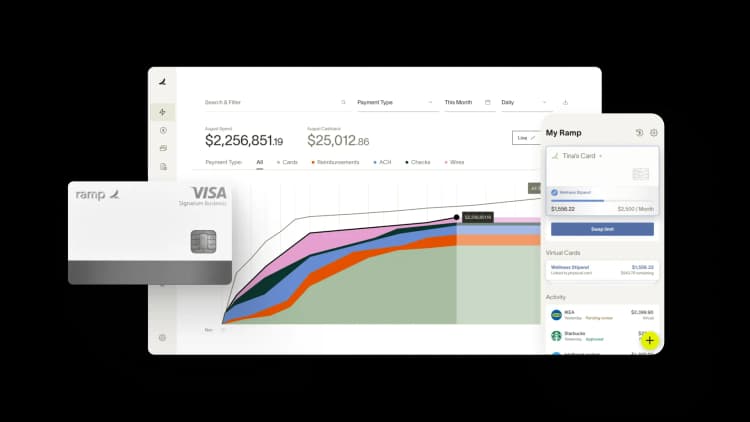

Managing accounting across multiple entities means juggling separate books, reconciling intercompany transactions, and ensuring each entity's spend is coded correctly—all while trying to close on time. Ramp's accounting automation software eliminates this complexity by centralizing all entity data in one platform and automating the workflows that typically slow teams down.

Ramp's multi-entity support lets you manage unlimited entities from a single dashboard while maintaining complete separation at the accounting level. You can set entity-specific coding rules, approval workflows, and GL mappings so transactions automatically route to the right books. When employees submit expenses or make purchases, Ramp applies the correct entity context and codes transactions accordingly—no manual sorting required.

Here's how Ramp streamlines multi-entity accounting:

- Centralized visibility: View spend across all entities in one place while maintaining separate books and reporting for each

- Entity-specific automation: Configure unique coding rules, approval chains, and GL mappings per entity so transactions land in the right place automatically

- Intercompany tracking: Tag and track intercompany transactions with custom fields so reconciliation is straightforward and audit-ready

- Unified close process: Close all entities from one platform with AI coding that learns each entity's patterns and applies them consistently

Try a demo to see how teams that Ramp close their books 3x faster every month by eliminating the manual work that comes with managing multiple entities.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits