Purchase order automation: What it is and how it works

- What is purchase order automation?

- What makes purchase order automation work: Key components

- Purchase order automation vs. traditional procurement

- How to use purchase order automation: Step-by-step process

- Integration with existing systems

- Benefits of purchase order automation

- Purchase order automation software: Key features

- 3 purchase order automation best practices

- Use Ramp for seamless purchase order automation

Manual purchase order processes slow teams down and introduce avoidable errors, approval delays, and blind spots in spend visibility. Purchase order automation replaces these manual steps with software that creates, routes, tracks, and matches POs without relying on email threads or spreadsheets.

Well-implemented PO automation shortens cycle times, reduces errors, strengthens compliance, and gives finance teams clearer control over purchasing from request through payment.

What is purchase order automation?

Purchase order automation is the use of software to replace the manual steps involved in generating, approving, sending, and tracking purchase orders. Instead of copying data between systems, printing forms, or chasing approvals over email, an automated purchase order system handles the entire flow digitally using predefined rules, validations, and alerts.

Industry data shows that automation can reduce purchase order cycle time significantly, with many organizations reporting 70–80% faster PO processing after moving away from manual workflows. But speed is only part of the value. Automation also reduces data-entry errors, routes approvals to the right stakeholders automatically, and gives finance teams real-time visibility into where every order stands.

Together, these capabilities shift procurement away from reactive paperwork and toward a more controlled, predictable process that supports better spend management across the business.

What makes purchase order automation work: Key components

What makes purchase order automation effective isn’t a single feature, but a set of connected components that work together to remove manual handoffs and enforce consistency throughout the procurement process.

Digital purchase requisitions

Digital requisitions replace paper forms and spreadsheets with structured online requests that require complete, accurate information from the start. Instead of relying on free-text fields, the system enforces correct supplier details, item descriptions, and pricing by pulling from catalogs or master records.

By standardizing intake upfront, automation reduces errors before they reach the approval stage and eliminates the need to rework incomplete or inaccurate requests later in the process.

Automated approval workflows

Automated PO and invoice approval workflows route requests to the right approvers based on rules you define, such as spend thresholds, departments, or categories. Once configured, those rules are applied consistently without manual intervention.

Approvers can review and act on requests from any device, while the system logs decisions and timestamps automatically. This shortens approval cycles and creates a built-in audit trail without requiring extra documentation.

Vendor management integration

Effective automation connects directly to your vendor management system so purchase orders are created using accurate supplier data, negotiated pricing, and approved terms. This removes the need to copy information across systems and helps prevent off-contract purchases.

Tying POs to approved vendors also strengthens compliance by limiting requests to suppliers that meet internal policies and contractual requirements.

Real-time tracking and visibility

Automated purchase order systems provide real-time visibility into every stage of the process, from pending approvals to delivered goods and outstanding invoices. Instead of chasing updates over email, stakeholders can see current status in a centralized dashboard.

This visibility makes it easier to forecast commitments, resolve issues quickly, and keep procurement and finance aligned as orders move through the system.

2-way and 3-way automated matching

Automated 2-way and 3-way matching compare purchase orders against invoices and, when applicable, receiving documents. These checks ensure that invoices match what was ordered and received before payment is issued.

By handling matching digitally, automation reduces overpayments, duplicate invoices, and disputes that often arise when teams compare documents manually.

Purchase order automation vs. traditional procurement

Before investing in automation, it helps to understand how it compares to traditional procurement. Manual processes depend heavily on email, spreadsheets, and individual follow-ups, while purchase order automation standardizes each step and enforces controls consistently as volume increases.

| Metric | Traditional procurement | Purchase order automation |

|---|---|---|

| Processing cost | Higher due to manual entry, rework, and paper handling | Lower as repetitive tasks are handled automatically |

| Processing time | Slower, often delayed by inbox backlogs and manual routing | Faster with instant routing and system-driven approvals |

| Error rate | Higher risk from manual data entry and inconsistent formats | Lower risk due to validation rules and standardized data |

| Visibility | Limited, requiring manual status checks | Real-time visibility through centralized dashboards |

| Compliance | Relies on individuals remembering policies | Enforced automatically through system rules |

| Scalability | Requires additional staff as volume grows | Scales without increasing headcount |

| Audit readiness | Time-consuming document collection | Built-in audit trails available instantly |

The pain points PO automation solves include:

- Manual errors and rework: Manual entry leads to typos, incorrect pricing, and duplicate orders, errors that cause rework, disputes, and delayed payments. Automated validation checks ensure data is correct before you create a PO, so you spend less time fixing mistakes.

- Approval bottlenecks: In manual systems, approvals pile up while managers hunt for emails or paper forms. Automation routes requests instantly and notifies stakeholders, so approvals actually move rather than stagnate.

- Lack of visibility: In spreadsheets or inboxes, you never know where a PO stands. Automation dashboards give you real-time insights so you can track orders, budgets, and vendor performance without chasing answers.

How to use purchase order automation: Step-by-step process

Purchase order automation follows a consistent flow from request to payment, with controls built into each stage to reduce errors and keep spending aligned with policy.

Step 1: Create a purchase requisition

The process starts with a digital purchase requisition. Instead of paper forms or free-text emails, requesters submit standardized forms with required fields and dropdowns that enforce accuracy. Supplier details, pricing, and item descriptions can be pulled automatically from existing records, reducing manual entry.

Before the request moves forward, validation rules check for missing information or out-of-policy selections. Issues are flagged early, which prevents incomplete or noncompliant requests from reaching approvers.

Step 2: Get approvals through automatic routing

Once submitted, the system routes the requisition to the appropriate approvers based on predefined rules. These rules can account for factors like department, spend category, or dollar amount, ensuring requests reach the right stakeholders without manual coordination.

For example, low-dollar purchases might auto-approve, mid-range requests may require a manager’s signoff, and higher-value POs can route to finance for additional review. This logic keeps approvals moving while still enforcing controls where they matter most.

Approvers receive notifications and can act from any device, and every decision is logged automatically for audit purposes.

Step 3: Generate the purchase order and send it to the vendor

After approval, the system generates a digital purchase order using a standardized template. The PO includes pricing, delivery terms, and approval history, all pulled directly from the approved requisition. Purchase orders can be sent electronically to vendors through email, portals, or integrations, eliminating the need to create and track PDFs manually.

Step 4: Track receipt of goods and invoices

As goods or services are delivered, the system updates order status in real time. Finance and procurement teams can see which POs are fulfilled, which invoices are outstanding, and where action is needed without chasing updates across inboxes. This shared visibility helps teams stay aligned and reduces delays caused by missing or unclear information.

Step 5: Match invoices and issue payment

When an invoice arrives, automated matching compares it against the purchase order and, when applicable, the receiving record. If everything aligns, the invoice is cleared for payment. Discrepancies are flagged immediately for review, which reduces back-and-forth with vendors and prevents incorrect payments before funds go out the door.

Integration with existing systems

Purchase order automation works best when it connects cleanly with the systems you already rely on. These integrations ensure data stays consistent across procurement, accounting, and vendor workflows without requiring duplicate entry or manual reconciliation.

- Enterprise resource planning (ERP) integration: Syncing vendor data, cost centers, and budgets between your PO system and ERP keeps purchasing aligned with financial controls. This prevents duplicate records and ensures downstream reporting reflects committed spend accurately.

- Accounting software connections: Integrations with accounts payable and the general ledger automate financial posting and help ensure invoices are paid against approved purchase orders. This also simplifies audit preparation by keeping records aligned across systems.

- Vendor portal integration: Allowing vendors to view PO status, confirm deliveries, and submit invoices through a portal reduces email back-and-forth and shortens fulfillment cycles

Benefits of purchase order automation

Purchase order automation reshapes how procurement supports the business by embedding controls directly into everyday workflows. Instead of reacting to issues after the fact, finance teams gain earlier visibility into spend and fewer surprises as purchasing volume grows.

Time and cost savings

Automation reduces the time and effort required to process purchase orders by eliminating manual steps like re-entering data, routing paper forms, and reconciling mismatched documents. As a result, teams spend less time correcting errors and more time focusing on higher-value work.

Consider a team that regularly orders from the same suppliers. In a manual process, pricing is often copied from emails or spreadsheets, increasing the risk of small mistakes that turn into billing disputes. With purchase order automation, pricing and terms are pulled directly from approved records, and invoices are matched automatically before payment, cutting down on rework and delays.

Improved compliance and control

With automated workflows, compliance no longer depends on individuals remembering policies or approval rules. Purchasing guidelines are built into the system, so requests that fall outside policy are flagged before they move forward. Because every action is logged with timestamps and approvals, audit trails are created automatically. This makes it easier to review transactions, demonstrate compliance, and prevent unauthorized spending before it occurs.

Enhanced vendor relationships

Automation also improves how teams work with vendors. Faster approvals and clearer purchase orders reduce confusion, while consistent invoice matching helps ensure vendors are paid accurately and on time.

Over time, this reliability strengthens relationships, supports better payment terms, and reduces friction on both sides of the transaction.

Purchase order automation software: Key features

Not all purchase order automation tools are built the same. The right software should remove manual work without sacrificing visibility or control, and it should adapt to how your team actually buys rather than forcing rigid processes.

PO automation must-have features

A strong purchase order automation platform should include:

- Customizable approval workflows: Route requests based on department, spend level, or category so approvals follow policy without manual intervention

- Mobile accessibility: Allow approvers to review and act on requests from anywhere, keeping purchasing moving even when stakeholders are out of the office

- Real-time reporting and analytics: Provide visibility into procurement spend analysis, bottlenecks, and outstanding commitments to support better decision-making

- Vendor self-service capabilities: Reduce back-and-forth by allowing suppliers to view purchase orders, confirm details, and submit invoices directly

PO automation advanced features

As procurement operations mature, advanced capabilities can help teams move beyond efficiency toward optimization and forecasting:

- AI-powered insights: Identify anomalies and opportunities for improvement that go beyond basic rule-based checks

- Predictive analytics: Use historical data to forecast purchasing trends and staffing needs more accurately

- Smart contract management: Help ensure purchase order terms align with negotiated contracts to reduce compliance issues and overpayments

3 purchase order automation best practices

Successful purchase order automation depends as much on execution as it does on software. Teams that see the most value treat automation as a process change, not a one-time system rollout.

1. Standardize processes before automating

Before introducing automation, take time to document how purchase requests, approvals, and orders currently move through the organization. Look for points where approvals stall, exceptions are common, or errors occur frequently.

Automation reflects the process you put into it. Standardizing workflows first ensures you are not locking inefficiencies into software and makes adoption easier once automation is live.

2. Align automation rules with purchasing policy

Automation works best when approval logic mirrors your existing purchasing policies. Configure spend thresholds, vendor restrictions, and budget controls so compliance happens automatically instead of through reminders or manual reviews.

When the system guides users toward compliant choices upfront, teams spend less time rejecting requests after the fact and more time moving purchases forward smoothly.

3. Roll out in phases and measure success

A phased rollout helps teams adapt without disrupting daily operations. Starting with a single department or spend category allows you to refine workflows and address issues before expanding more broadly.

Define success metrics early, such as approval turnaround time or error reduction, and review them regularly. Measuring results makes it easier to demonstrate ROI and improve the process as needs evolve.

Use Ramp for seamless purchase order automation

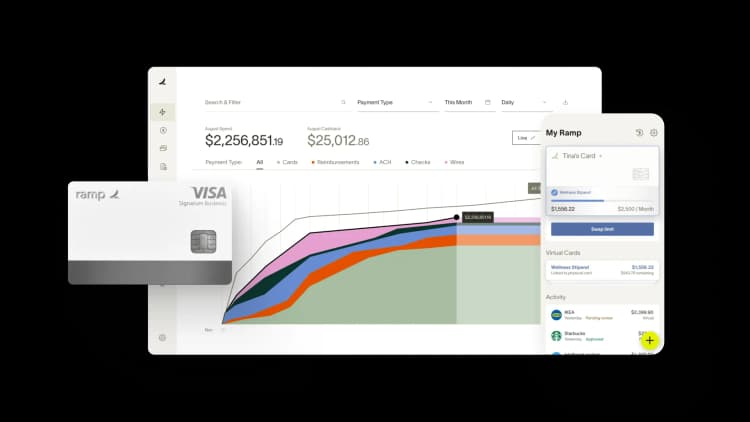

Transform how you manage purchase orders with Ramp’s procurement software. Ramp gives finance teams clear control over purchasing by automating the full procure-to-pay process from request through payment.

- Centralized spend requests: Capture every type of purchase request in one place so required details are collected upfront

- Connected procurement conversations: Keep approvals, questions, and context tied directly to each request instead of scattered across email or chat tools

- Custom approval workflows: Build approval paths that reflect your purchasing policies and scale as your organization grows

- Automated purchase order creation: Generate POs automatically to maintain visibility into upcoming invoices and committed spend

Use Ramp’s savings calculator to estimate how much time and money your team could save by automating purchase orders and streamlining procurement workflows.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits